Download California De 4 Form

Common Questions

-

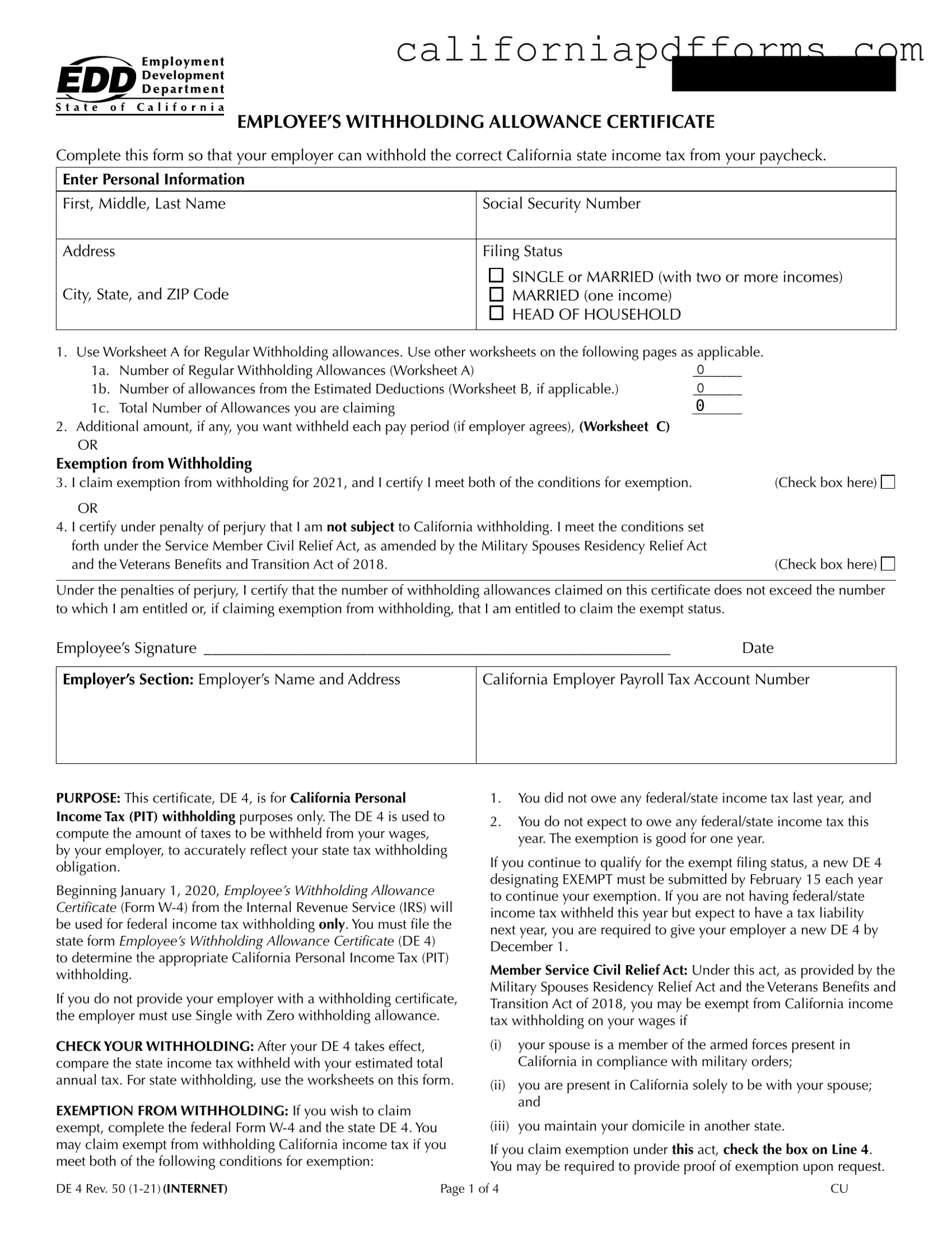

What is the California DE 4 form?

The California DE 4 form, officially known as the Employee’s Withholding Allowance Certificate, is a document that helps your employer determine how much state income tax to withhold from your paycheck. By completing this form, you can claim withholding allowances based on your personal tax situation, which can ultimately affect your take-home pay.

-

Who needs to fill out the DE 4 form?

Any employee in California who wants to ensure the correct amount of state income tax is withheld from their wages should complete the DE 4 form. This includes individuals who are starting a new job, those who have had a change in their financial situation, or anyone who wants to adjust their withholding allowances. If you do not submit this form, your employer will automatically withhold taxes as if you are single with zero allowances, which may not reflect your actual tax obligation.

-

How do I determine the number of allowances to claim?

To figure out the number of allowances you can claim, you should consider several factors:

- Your filing status (single, married, head of household).

- Whether you have dependents or qualify for additional allowances, such as for blindness.

- If you expect to itemize deductions on your tax return.

Use Worksheet A provided with the DE 4 form to calculate your regular withholding allowances. If you plan to itemize deductions, you may also need to complete Worksheet B to determine any additional allowances.

-

What if I qualify for exemption from withholding?

If you believe you qualify for exemption from California income tax withholding, you must meet two conditions: you did not owe any federal or state income tax last year, and you do not expect to owe any this year. To claim this exemption, check the appropriate box on the DE 4 form. Remember, this exemption is valid for one year, so you’ll need to submit a new DE 4 each year by February 15 if you still qualify.

-

What happens if I don’t submit the DE 4 form?

If you fail to submit the DE 4 form, your employer is required to withhold taxes as if you are single with zero allowances. This may result in a higher amount of tax being withheld from your paycheck than necessary. If too much tax is withheld, you might receive a refund when you file your tax return, but this means less take-home pay throughout the year. To avoid this situation, it’s best to complete and submit the DE 4 form as soon as possible.

Document Specifications

| Fact Name | Description |

|---|---|

| Purpose | The DE 4 form is used to determine the correct amount of California state income tax to withhold from an employee's paycheck. |

| Governing Law | This form is governed by California Revenue and Taxation Code and Title 22 of the California Code of Regulations. |

| Filing Requirement | Employees must file the DE 4 to ensure accurate withholding; otherwise, employers will default to using Single with Zero allowances. |

| Exemption Criteria | Employees may claim exemption from withholding if they did not owe taxes last year and do not expect to owe taxes this year. |

| Worksheets | The form includes multiple worksheets (A, B, and C) to help employees calculate their withholding allowances and additional amounts. |

| Signature Requirement | Employees must sign the form under penalty of perjury, certifying the accuracy of the information provided. |

| Additional Withholding | Employees can request additional amounts to be withheld from their paychecks, subject to employer agreement. |

| Annual Renewal | Employees claiming exemption must renew their status by submitting a new DE 4 by February 15 each year. |

| Penalties | Filing a DE 4 with no reasonable basis for the claimed allowances may result in a $500 fine and possible criminal penalties. |

Dos and Don'ts

Things You Should Do:

- Complete all personal information accurately, including your name, Social Security number, and address.

- Use Worksheet A to determine your regular withholding allowances.

- Claim only the allowances you are entitled to, based on your situation.

- Check the appropriate filing status box: SINGLE, MARRIED, or HEAD OF HOUSEHOLD.

- Sign and date the form before submitting it to your employer.

Things You Shouldn't Do:

- Do not claim allowances for dependents if you are not eligible.

- Avoid submitting multiple DE 4 forms to different employers for the same allowances.

- Do not leave any required fields blank; this may delay processing.

- Do not forget to review your withholding after the form takes effect.

- Never provide false information, as this can lead to penalties.

Misconceptions

Misconceptions About the California DE 4 Form

- 1. The DE 4 form is optional. Many believe that submitting the DE 4 is optional. In reality, if you do not submit it, your employer will withhold taxes at the highest rate, which may not reflect your actual tax obligation.

- 2. The DE 4 is only for employees with multiple jobs. This form is necessary for all employees, regardless of the number of jobs. It ensures the correct amount of state income tax is withheld from your paycheck.

- 3. You can only claim allowances for dependents. While dependents are a factor, you can also claim allowances for yourself, your spouse, and other qualifying conditions such as blindness.

- 4. Filing the DE 4 guarantees a tax refund. Completing the DE 4 does not guarantee a refund. It merely adjusts withholding to match your estimated tax liability.

- 5. Once filed, the DE 4 never needs to be updated. This is false. You should update your DE 4 whenever your financial situation changes, such as a new job, marriage, or the birth of a child.

- 6. Exemptions from withholding last indefinitely. Exemptions must be renewed annually. If you qualify for exemption, you must submit a new DE 4 by February 15 each year.

- 7. The DE 4 form is the same as the federal W-4. These forms serve different purposes. The DE 4 is specifically for California state tax withholding, while the W-4 is for federal tax withholding.

- 8. You cannot claim additional withholding allowances. You can request additional amounts to be withheld if you anticipate owing more taxes. Use Worksheet C to determine this amount.

Documents used along the form

The California DE 4 form, known as the Employee’s Withholding Allowance Certificate, is essential for determining the correct amount of state income tax withholding from an employee's paycheck. In addition to this form, several other documents and forms are commonly used in conjunction with the DE 4 to ensure compliance with California tax laws. Below is a list of these forms, along with a brief description of each.

- Form W-4 (Federal): This form is used for federal income tax withholding. Employees must complete it to inform their employer of their tax situation, including marital status and number of allowances claimed. The DE 4 complements the W-4 by addressing state-specific withholding requirements.

- Form 540 (California Resident Income Tax Return): This is the primary form used by California residents to report their income and calculate their state tax liability. It is essential for employees to review this form to understand their overall tax obligations and ensure that their withholding aligns with their expected tax liability.

- Form 540-ES (Estimated Tax for Individuals): This form is used by individuals who expect to owe tax of $500 or more when they file their return. It allows taxpayers to make estimated tax payments throughout the year, which can help avoid penalties for underpayment of taxes.

- Form DE 44 (California Employer’s Guide): This guide provides employers with information on California payroll tax requirements, including how to calculate withholding amounts. It is a valuable resource for both employers and employees to understand the withholding process.

- Worksheet A, B, and C (included with DE 4): These worksheets assist employees in calculating the number of allowances they can claim based on their personal situation, estimated deductions, and additional withholding needs. Completing these worksheets accurately is crucial for determining the correct withholding amounts.

Understanding these forms and how they interact with the California DE 4 is vital for both employees and employers. Proper completion and submission of these documents can lead to more accurate tax withholding, potentially reducing the risk of underpayment or overpayment of state income taxes. Awareness of these requirements is essential for effective tax planning and compliance in California.

Different PDF Templates

Reply Brief Deadline California - This form is essential for attorneys looking to formally exit a case while complying with legal regulations.

California Dpr - The application fee for most amendments is $100.00.

Child Custody Forms California - Petitioners must object within ten court days if they disagree with a recommended order from the commissioner.