Download California Death of a Joint Tenant Affidavit Form

Common Questions

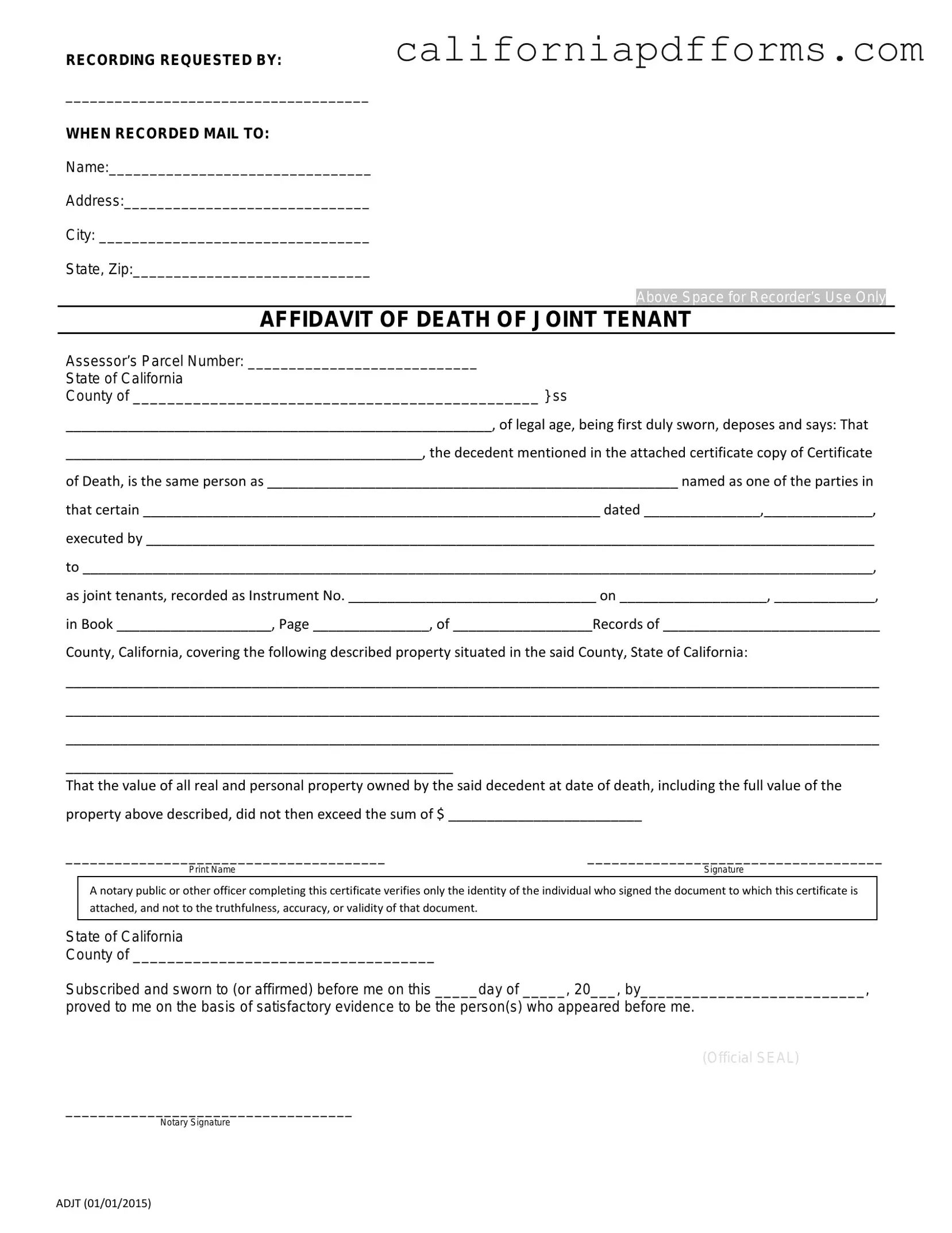

- The name and date of death of the deceased joint tenant.

- The name of the surviving joint tenant.

- A description of the property, including its address and any relevant legal descriptions.

- Any other pertinent details, such as the date the joint tenancy was created.

What is the California Death of a Joint Tenant Affidavit?

The California Death of a Joint Tenant Affidavit is a legal document used to transfer the interest in property when one of the joint tenants passes away. This affidavit helps clarify the ownership of the property and is often necessary to ensure that the surviving tenant can take full control without going through probate.

Who should file the affidavit?

The surviving joint tenant is responsible for filing the affidavit. This individual must have been a co-owner of the property with the deceased tenant. It’s important that the surviving tenant acts promptly to secure their interest in the property.

What information is required to complete the affidavit?

To complete the affidavit, you will need:

Do I need to notarize the affidavit?

Yes, the affidavit must be notarized. This step is crucial because it verifies the identity of the person signing the document and adds a layer of authenticity to the affidavit. Notarization helps prevent fraud and ensures that the document is legally binding.

Where do I file the affidavit?

The affidavit should be filed with the county recorder's office in the county where the property is located. This office will keep a public record of the affidavit, which helps establish the new ownership status of the property.

Is there a fee to file the affidavit?

Yes, there is typically a filing fee associated with submitting the affidavit to the county recorder's office. Fees can vary by county, so it’s advisable to check with your local office for the exact amount. Be prepared to pay this fee at the time of filing.

What happens if I don’t file the affidavit?

If the affidavit is not filed, the property may remain in the name of the deceased joint tenant. This could lead to complications, especially if there are other heirs or if the property needs to be sold. Filing the affidavit ensures that the surviving joint tenant's ownership is clear and legally recognized.

Document Specifications

| Fact Name | Description |

|---|---|

| Purpose | The California Death of a Joint Tenant Affidavit is used to transfer property ownership after the death of a joint tenant. |

| Governing Law | This form is governed by California Probate Code Section 5600. |

| Eligibility | Only joint tenants can utilize this affidavit to transfer property rights. |

| Required Information | The affidavit requires the name of the deceased joint tenant and the surviving joint tenant. |

| Signature Requirement | The surviving joint tenant must sign the affidavit in front of a notary public. |

| Filing Location | The completed affidavit must be filed with the county recorder's office where the property is located. |

| Effect on Title | Filing the affidavit updates the property title to reflect the surviving joint tenant as the sole owner. |

| Exemption from Probate | This process allows the property to bypass the probate process, simplifying the transfer. |

| Multiple Properties | A separate affidavit must be completed for each property owned jointly. |

| Legal Advice | It is advisable to seek legal counsel when completing this affidavit to ensure compliance with all requirements. |

Dos and Don'ts

When filling out the California Death of a Joint Tenant Affidavit form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are six do's and don'ts to keep in mind:

- Do provide accurate information about the deceased joint tenant.

- Do include the date of death clearly on the form.

- Do sign the affidavit in the presence of a notary public.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank; fill out every section.

- Don't submit the form without verifying all details are correct.

Misconceptions

The California Death of a Joint Tenant Affidavit form is often misunderstood. Here are nine common misconceptions:

- Only married couples can use the form. Many believe that this affidavit is exclusive to married couples. In reality, any joint tenants, regardless of their relationship, can utilize this form.

- The form is only for property in California. Some assume this affidavit can only be used for California properties. However, it is applicable to any property held as joint tenancy, as long as the property is located in California.

- It is not necessary if there is a will. A common myth is that if a deceased joint tenant had a will, the affidavit is unnecessary. In fact, the affidavit serves to transfer the deceased's interest in the property directly to the surviving tenant, regardless of the will's provisions.

- The affidavit must be filed with a court. Many think that the affidavit needs to be filed in court. Instead, it is typically recorded with the county recorder's office where the property is located.

- All joint tenants must sign the affidavit. Some believe that all surviving joint tenants need to sign the affidavit. In truth, only one surviving joint tenant can complete and sign the form to transfer the property.

- The form is only for real estate. There is a misconception that this affidavit applies solely to real estate. However, it can also be used for other types of property held in joint tenancy, such as bank accounts.

- There is a time limit to file the affidavit. Many think there is a strict deadline for filing the affidavit after a joint tenant's death. While it is advisable to file it promptly, there is no specific statutory time limit for submitting the affidavit.

- The affidavit guarantees clear title. Some individuals believe that filing the affidavit guarantees a clear title to the property. While it helps establish ownership, it does not eliminate potential claims or issues related to the property.

- Legal assistance is not needed. A misconception exists that individuals can easily complete the affidavit without any help. Although the form is straightforward, consulting with a legal professional can ensure all details are correct and properly handled.

Documents used along the form

The California Death of a Joint Tenant Affidavit form is a crucial document for transferring ownership of property after the death of one joint tenant. However, several other forms and documents are often used in conjunction with this affidavit to ensure a smooth transfer process and to clarify the estate's situation. Below is a list of these commonly used documents.

- Death Certificate: This official document confirms the death of the joint tenant and is typically required to initiate the transfer of property ownership.

- Grant Deed: This document is used to formally transfer the deceased joint tenant's interest in the property to the surviving joint tenant(s), ensuring that the title reflects the new ownership.

- Trust Documents: If the deceased had a trust, these documents may outline how the property should be handled and can provide guidance on the distribution of assets.

- Will: A will may specify the deceased's wishes regarding the property and can clarify any potential disputes about ownership or distribution among heirs.

- Property Tax Records: These records help establish the tax status of the property and may be necessary to update the ownership information with the local tax authority.

- Affidavit of Death: This document serves as a sworn statement confirming the death of the joint tenant and may be required by certain institutions or agencies.

- Title Insurance Policy: If applicable, this policy protects against any defects in the title and may be reviewed during the transfer process to ensure clear ownership.

These documents collectively support the legal and administrative processes involved in transferring property ownership after the death of a joint tenant. Having them prepared and organized can facilitate a smoother transition for the surviving tenant(s) and help avoid potential legal complications.

Different PDF Templates

Ftb Form 3800 - Careful record-keeping of all investment income is essential when using this form.

Form 3523 - The current year research credit appears on Line 41 after considering various adjustments.

Form 100x - It is important to clarify if the original return was filed under different corporate details or names.