Download California Earthquake Authority Form

Common Questions

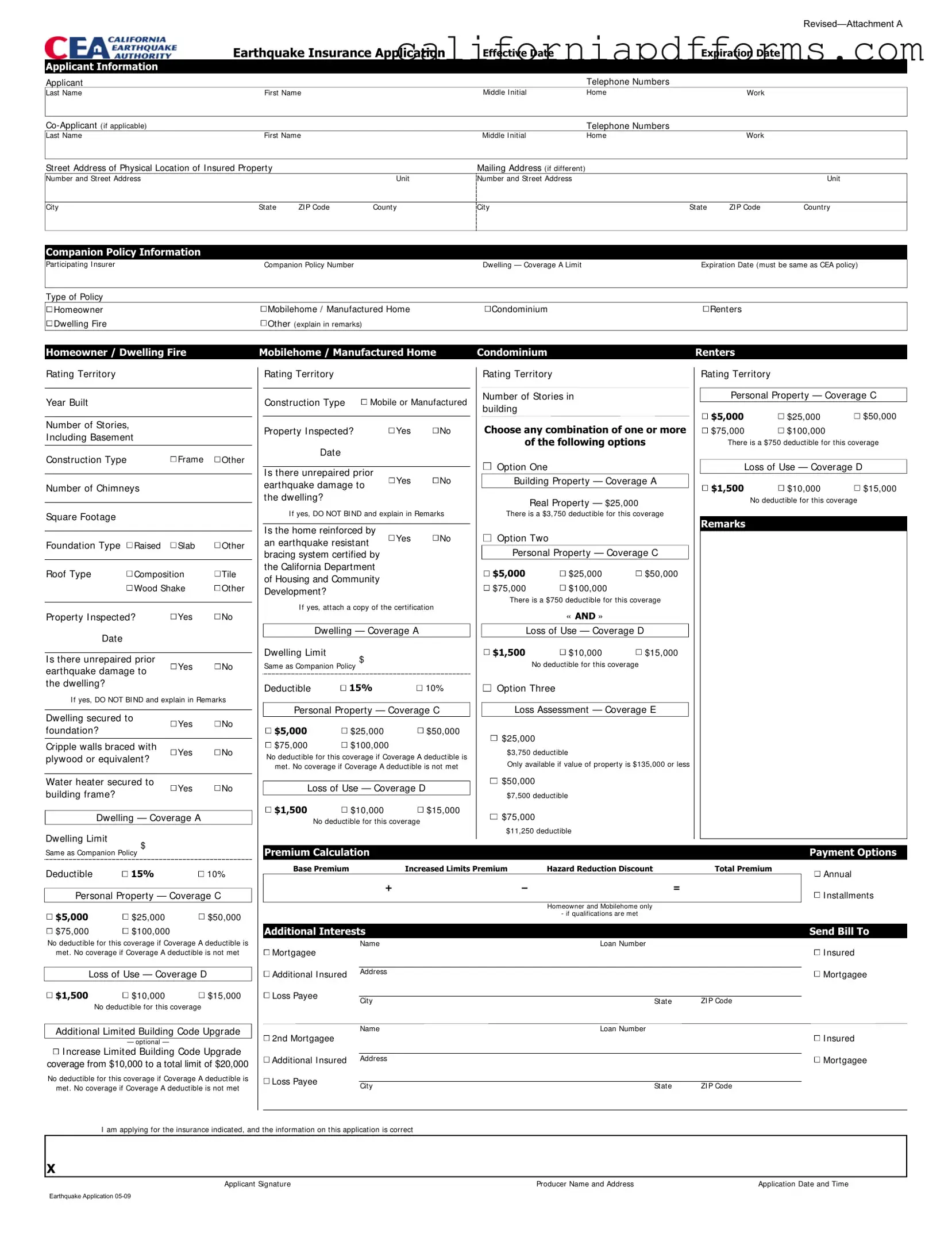

What is the California Earthquake Authority (CEA) form used for?

The CEA form is an application for earthquake insurance coverage in California. This insurance helps protect homeowners and renters against financial losses due to earthquake damage. By filling out this form, applicants can secure coverage that complements their existing home insurance policies.

Who needs to fill out the CEA form?

Anyone who owns a home, mobile home, or condominium in California and wants earthquake insurance should complete this form. Renters can also apply for coverage to protect their personal belongings. It's essential for anyone living in an earthquake-prone area to consider this insurance.

What information do I need to provide on the form?

You will need to provide several key pieces of information, including:

- Your name and contact details.

- The address of the property you want to insure.

- Details about any existing insurance policies, known as companion policies.

- Information about the construction type, age, and condition of your property.

- Coverage limits and deductibles you wish to select.

What is a companion policy?

A companion policy is your existing homeowners, renters, or fire insurance policy that the CEA policy will complement. The CEA requires this information to determine the appropriate coverage and limits for your earthquake insurance. It’s important that the companion policy is active and meets specific criteria set by the CEA.

How do I calculate the premium for the earthquake insurance?

The premium calculation involves several factors, including:

- Your base premium, which is determined by the type of coverage you select.

- Any increased limits you may choose.

- Discounts for hazard reduction measures you have taken.

- Your total premium will be the sum of these components.

Make sure to review all options carefully to understand how they affect your premium.

What should I do if my property has unrepaired earthquake damage?

If your property has unrepaired earthquake damage, you should not bind the insurance. Instead, you need to explain the situation in the remarks section of the application. The CEA may require you to address these issues before coverage can be approved.

Can I choose my payment option for the insurance premium?

Yes, you can choose how you want to pay your premium. The options typically include an annual payment or installment payments. Selecting the option that best fits your budget is important, as it can impact your overall financial planning.

How do I submit the completed CEA form?

Once you have completed the form, ensure that all required fields are filled out, and you have signed it. You can then submit it to your insurance agent or the California Earthquake Authority directly, depending on the process outlined by your insurance provider. Keep a copy for your records.

Document Specifications

| Fact Name | Description |

|---|---|

| Effective Date | The policy effective date must be provided, and it should match the expiration date of the companion policy. |

| Applicant Information | Applicants must complete their full names, telephone numbers, and physical address of the insured property. |

| Companion Policy Details | Information about the participating insurer and the policy number of the companion policy is required. |

| Coverage Types | The application identifies different types of coverage, such as homeowner, mobilehome, condominium, and renters. |

| Premium Calculation | Applicants must calculate the total premium, including base premium, increased limits, and any discounts. |

| Payment Options | Applicants can choose between annual payment or installment options for the insurance premium. |

| Signature Requirement | The application must be signed by the applicant, and the producer's name and address should also be included. |

Dos and Don'ts

When filling out the California Earthquake Authority form, it’s important to follow certain guidelines to ensure accuracy and completeness. Here’s a list of things you should and shouldn’t do:

- Do provide the correct effective and expiration dates for your policy.

- Do complete all requested information for both the applicant and co-applicant, if applicable.

- Do ensure that the expiration date matches the companion policy’s expiration date.

- Do accurately identify the type of policy you are applying for based on your companion policy.

- Do answer all questions truthfully and provide any necessary explanations in the remarks section.

- Don't leave any fields blank; every section needs to be filled out to avoid delays.

- Don't forget to secure the applicant's signature at the end of the application.

Misconceptions

-

Misconception 1: The California Earthquake Authority (CEA) form is only for homeowners.

This is incorrect. The CEA form is applicable to various types of properties, including mobile homes, condominiums, and rental units. Each property type has specific sections that must be completed to ensure accurate coverage.

-

Misconception 2: Completing the form is optional if I already have earthquake insurance.

This is not true. If you wish to obtain or renew coverage through the CEA, completing the form is mandatory. The information provided is essential for determining eligibility and calculating premiums.

-

Misconception 3: The CEA form does not require details about prior earthquake damage.

This misconception is misleading. The form specifically asks about any unrepaired prior earthquake damage. Failing to disclose this information can result in denial of coverage.

-

Misconception 4: I can submit the form without providing a signature.

This is incorrect. The applicant's signature is a crucial part of the application process. It confirms that the information provided is accurate and that the applicant agrees to the terms of the policy.

-

Misconception 5: The CEA form is the same for all insurance providers.

This is not accurate. While the CEA form has standard sections, specific requirements may vary depending on the participating insurer. It is important to follow the instructions provided for each insurer to ensure proper processing.

Documents used along the form

The California Earthquake Authority (CEA) form is a critical document for homeowners seeking earthquake insurance. Along with this form, several other documents and forms are often utilized to ensure comprehensive coverage and compliance with insurance requirements. Below is a list of related forms that may be required during the application process.

- Homeowners Insurance Policy: This document outlines the coverage provided for a home, including protection against various risks such as fire, theft, and liability. It serves as a companion policy to the CEA form, as earthquake insurance is typically offered as an endorsement to standard homeowners insurance.

- Dwelling Fire Policy: This policy covers specific risks associated with a dwelling that is not occupied by the owner. It is essential for landlords or those renting out property, providing coverage for damages to the building itself.

- Condominium Unit Owners Policy: This form is tailored for condo owners, covering personal property and the interior of the unit. It complements the CEA application by addressing specific needs related to condominium ownership.

- Renters Insurance Policy: This policy protects tenants' personal belongings and provides liability coverage. It is relevant for those who do not own the property but wish to secure earthquake coverage through the CEA.

- Earthquake Insurance Endorsement: This document is an add-on to a standard homeowners or renters policy that specifically addresses earthquake-related damages. It details the terms and conditions under which earthquake coverage is provided.

- Property Inspection Report: An inspection report may be required to assess the condition of the property before issuing an earthquake insurance policy. This report can highlight any existing vulnerabilities or necessary upgrades.

- Loss Payee Agreement: This agreement is crucial for mortgage lenders, outlining how insurance proceeds will be distributed in the event of a claim. It ensures that the lender's financial interest is protected.

- Additional Insured Endorsement: This document allows other parties, such as contractors or co-owners, to be covered under the policy. It is particularly useful in shared ownership situations or when work is being done on the property.

Understanding these forms can help homeowners navigate the insurance landscape more effectively. Each document plays a vital role in ensuring that property owners are adequately protected against the risks associated with earthquakes and other potential hazards.

Different PDF Templates

What States Have Bar Reciprocity - Be aware that your employment with the qualifying institution must meet specific criteria.

California Tourism Tax - The California Std 236 form is used for tax waivers by state agency employees.

Dcss - Summons / Complaint - This form plays a pivotal role in legally binding agreements between parents regarding support.