Download California Fl 348 Form

Common Questions

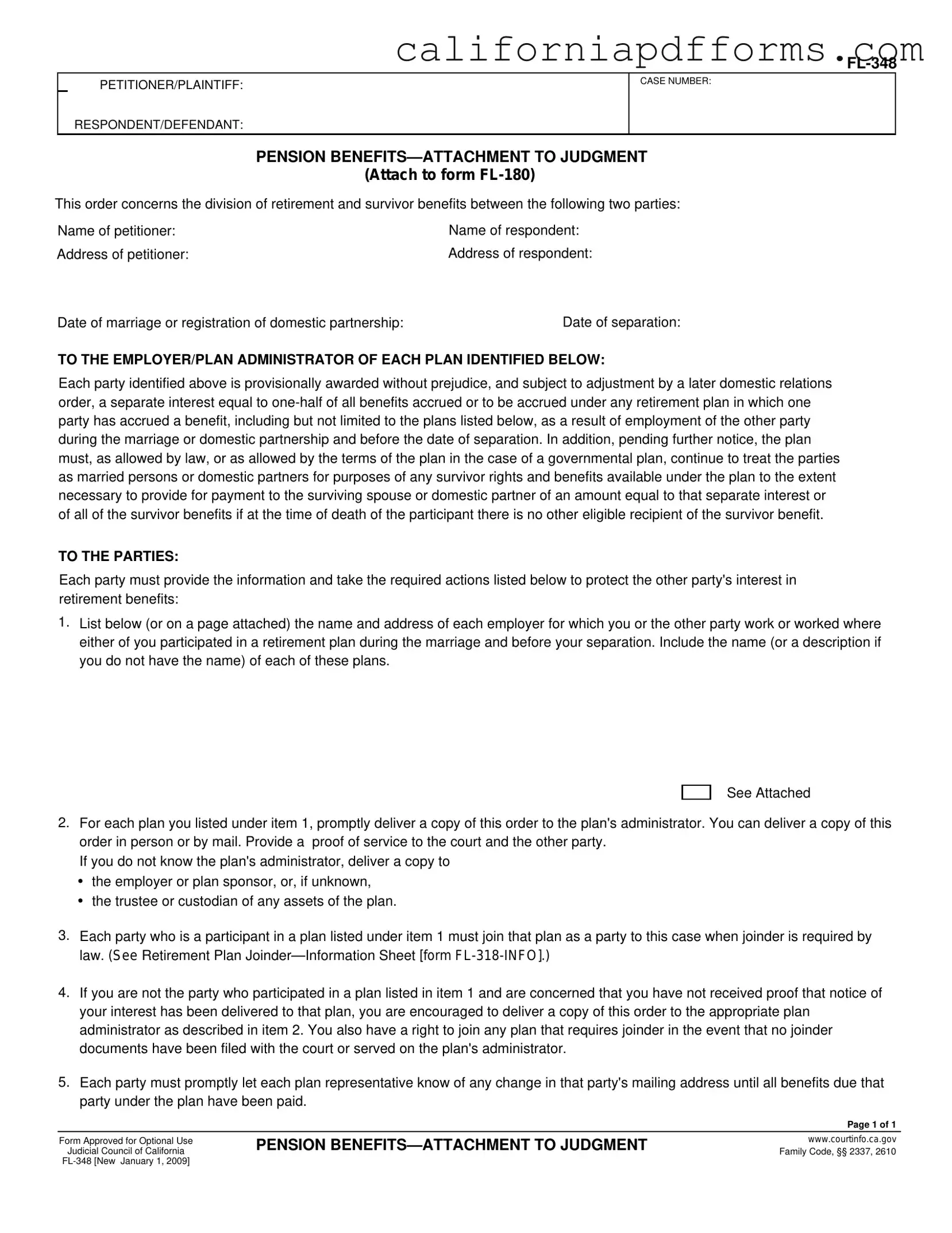

What is the purpose of the California FL-348 form?

The California FL-348 form, also known as the Pension Benefits—Attachment to Judgment, is used to outline how retirement and survivor benefits will be divided between two parties during a divorce or separation. It ensures that each party receives their fair share of any retirement benefits accrued during the marriage or domestic partnership.

Who needs to fill out the FL-348 form?

Both parties involved in a divorce or separation need to complete the FL-348 form. This includes the petitioner (the one who filed for divorce) and the respondent (the other party). It is important for both parties to provide accurate information about their respective retirement plans to protect their interests.

What information is required on the FL-348 form?

The form requires the following information:

- Names and addresses of both parties.

- The date of marriage or registration of domestic partnership.

- The date of separation.

- A list of employers where either party participated in a retirement plan during the marriage.

- The names or descriptions of those retirement plans.

How do I submit the FL-348 form?

You can submit the FL-348 form by filing it with the court where your divorce case is being heard. Additionally, you must provide copies of the order to the plan administrators of any retirement plans listed on the form. This can be done in person or by mail.

What happens after submitting the FL-348 form?

Once the FL-348 form is submitted, the retirement plans identified must recognize the parties as married or in a domestic partnership for survivor benefits. Each party is also required to inform the plan representatives of any changes in their mailing addresses until all benefits due have been paid.

What if I am unsure about the plan administrator?

If you do not know who the plan administrator is, you can send a copy of the FL-348 form to the employer or plan sponsor. If that information is also unknown, you can deliver it to the trustee or custodian of any assets of the plan.

Do I need to join the retirement plan as a party to the case?

Yes, if you are a participant in any of the retirement plans listed, you must join that plan as a party to the case when required by law. This ensures that your rights and interests in the plan are properly represented.

What if I have concerns about my interest in the retirement plan?

If you are not the party who participated in the retirement plan and are worried that you have not received proof of notice regarding your interest, you should consider delivering a copy of the FL-348 form to the appropriate plan administrator. You also have the right to join any plan that requires joinder if no documents have been filed with the court.

Document Specifications

| Fact Name | Details |

|---|---|

| Form Purpose | The FL-348 form is used to attach a pension benefits order to a judgment in family law cases. |

| Governing Laws | This form is governed by California Family Code sections 2337 and 2610. |

| Parties Involved | The form requires information from both the petitioner/plaintiff and the respondent/defendant. |

| Retirement Benefits Division | It provisionally awards each party a separate interest in retirement benefits accrued during the marriage. |

| Employer Notification | Each party must notify the employer or plan administrator about the order to protect their interests. |

| Change of Address | Parties must inform plan representatives of any address changes until all benefits are paid. |

Dos and Don'ts

When filling out the California FL-348 form, it is important to follow specific guidelines to ensure accuracy and compliance. Below is a list of actions to take and avoid:

- Do: Provide complete and accurate names and addresses for both parties involved.

- Do: List all employers where either party participated in a retirement plan during the marriage.

- Do: Deliver a copy of the order to the plan's administrator promptly.

- Do: Keep track of any changes in mailing addresses and inform plan representatives accordingly.

- Don't: Leave out any retirement plans that were accrued during the marriage.

- Don't: Ignore the requirement to join any necessary plans as parties to the case.

Misconceptions

Misconception 1: The FL-348 form is only for couples who are getting divorced.

This form is relevant not only for divorce but also for domestic partnerships. It addresses the division of retirement benefits for both types of relationships, ensuring that all parties have a fair claim to accrued benefits.

Misconception 2: Completing the FL-348 form guarantees immediate access to retirement benefits.

While the form helps establish rights to benefits, it does not provide immediate access. The benefits are subject to further orders and adjustments, which may take time to finalize.

Misconception 3: Only the person who contributed to the retirement plan receives benefits.

The FL-348 form ensures that both parties are entitled to a share of the retirement benefits accrued during the marriage or partnership. This means that even if one party did not directly contribute, they may still be entitled to half of the benefits.

Misconception 4: You do not need to inform your employer about the FL-348 form.

It is crucial to notify the plan administrator or employer about the FL-348 order. This ensures that both parties' rights are recognized and protected in the retirement plan.

Misconception 5: The FL-348 form is a one-time submission and does not require follow-up.

After submitting the FL-348 form, both parties must remain proactive. They need to keep the plan representatives informed of any address changes and ensure that all required actions are taken to protect their interests.

Misconception 6: The FL-348 form is only necessary if there is a dispute over benefits.

Even in amicable separations, completing the FL-348 form is important. It clarifies each party's rights to retirement benefits and helps prevent future disputes, ensuring that everyone understands their entitlements.

Documents used along the form

The California FL-348 form is a crucial document used in family law cases concerning the division of pension benefits during divorce or separation. Several other forms and documents are often used alongside FL-348 to ensure that all legal requirements are met and that both parties' interests are protected. Below is a list of commonly associated documents.

- FL-180: Judgment - This form is used to finalize the divorce or separation. It outlines the terms of the divorce, including property division, child custody, and support obligations.

- FL-318-INFO: Retirement Plan Joinder—Information Sheet - This document provides information about the requirement for joining retirement plans in divorce proceedings. It explains the process and implications of joinder for both parties.

- FL-350: Notice of Motion to Modify Judgment - This form is used when a party seeks to modify the terms of the existing judgment, including changes related to pension benefits or support orders.

- FL-320: Request for Order - This document allows a party to request a court order regarding various issues, including the enforcement or modification of pension benefits as outlined in the judgment.

- FL-300: Notice of Motion - This form is necessary to notify the other party of a motion being filed in court. It ensures that both parties are aware of upcoming hearings and motions regarding pension benefits.

- FL-310: Declaration Under Uniform Child Custody Jurisdiction and Enforcement Act - While primarily focused on child custody, this declaration may be relevant in cases where pension benefits impact child support obligations.

- FL-335: Proof of Service - This document serves as evidence that a party has properly served the required documents to the other party or relevant entities, ensuring compliance with legal notification requirements.

- FL-315: Stipulation and Order - This form is used when both parties agree on specific terms related to the division of pension benefits. It formalizes their agreement and submits it for court approval.

Using these forms in conjunction with the California FL-348 can help streamline the process of dividing pension benefits and ensure that both parties' rights are safeguarded. It is advisable to carefully follow the instructions for each form and seek legal guidance if needed.

Different PDF Templates

California Fnp 004 - The Medical Board assesses all submissions for compliance before granting renewals.

Cal Efile - The form reflects income earned in the prior fiscal year and applicable tax rates.