Download California Fl140 Form

Common Questions

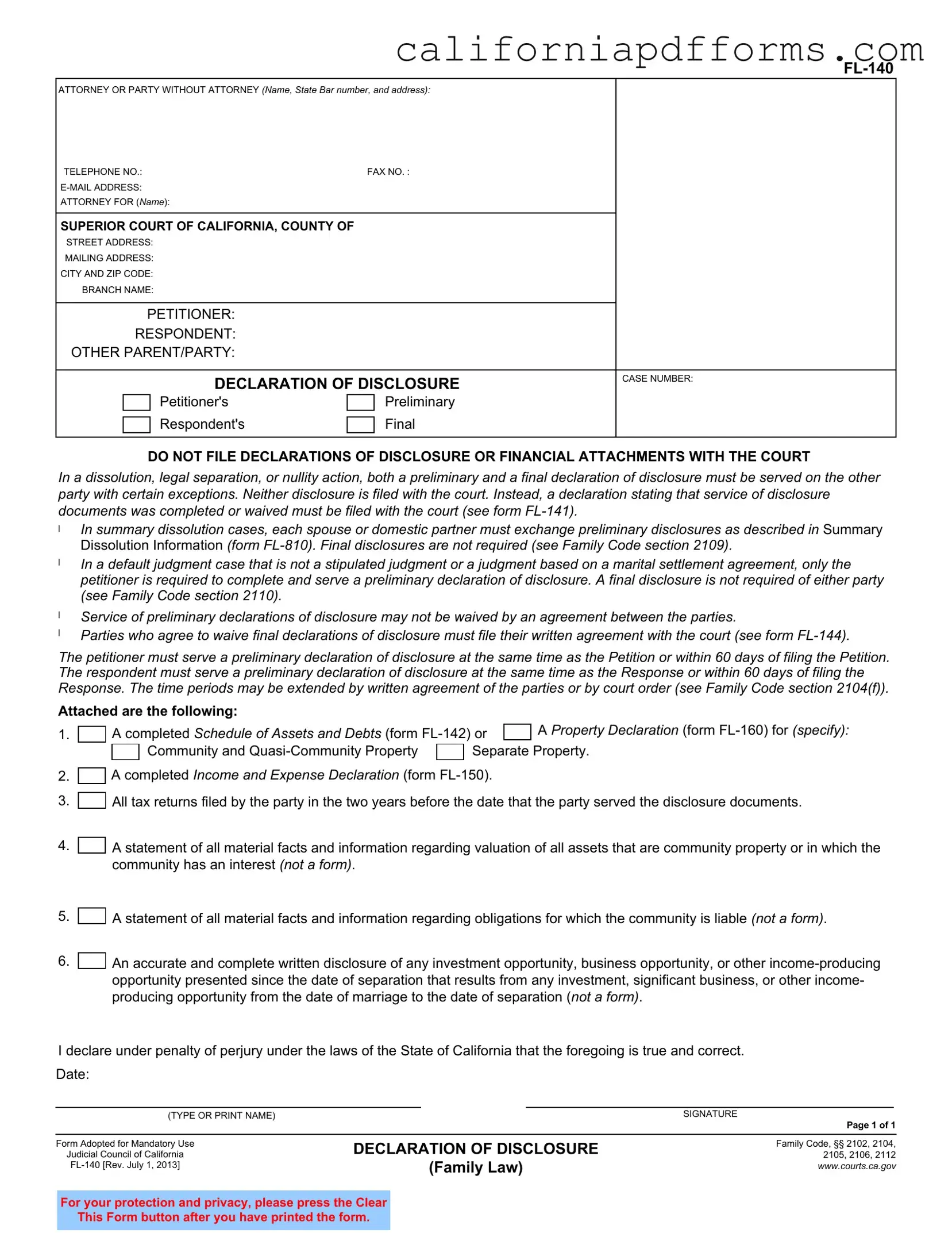

What is the purpose of the California FL-140 form?

The FL-140 form, also known as the Declaration of Disclosure, is used in family law cases in California. It serves to ensure that both parties in a dissolution, legal separation, or nullity action provide full financial disclosure to one another. This form helps facilitate transparency regarding assets, debts, and income, which is essential for fair resolution during legal proceedings.

When do I need to file the FL-140 form?

You do not file the FL-140 form with the court. Instead, it must be served to the other party involved in the case. The petitioner must serve their preliminary declaration of disclosure at the same time as the Petition or within 60 days of filing. The respondent must serve theirs at the same time as the Response or within 60 days of filing the Response. Always check for any extensions that may apply through written agreement or court order.

What documents must be included with the FL-140 form?

When completing the FL-140, you must attach several important documents, including:

- A completed Schedule of Assets and Debts (form FL-142) or a Property Declaration (form FL-160).

- A completed Income and Expense Declaration (form FL-150).

- All tax returns filed in the two years prior to serving the disclosure documents.

- A statement detailing all material facts regarding the valuation of community property assets.

- A statement of all obligations for which the community is liable.

- A written disclosure of any income-producing opportunities presented since the date of separation.

Can the disclosure requirements be waived?

No, the preliminary declaration of disclosure cannot be waived by agreement between the parties. However, parties may agree to waive the final declaration of disclosure, but they must file this agreement with the court using form FL-144.

What happens if I fail to serve the FL-140 form?

If you do not serve the FL-140 form and the required disclosures, it could negatively impact your case. The court may impose sanctions or limit your ability to present certain evidence. It is crucial to comply with these requirements to protect your rights and interests in the proceedings.

What is the penalty for providing false information on the FL-140 form?

Providing false information on the FL-140 form can lead to serious consequences. You declare under penalty of perjury that the information you provide is true and correct. If you are found to have intentionally misrepresented information, you may face legal penalties, including fines or other sanctions imposed by the court.

Document Specifications

| Fact Name | Description |

|---|---|

| Form Purpose | The FL-140 form is used to declare financial disclosures in family law cases such as divorce, legal separation, or nullity actions. |

| Governing Laws | This form is governed by California Family Code sections 2102, 2104, 2105, 2106, and 2112. |

| Disclosure Requirement | Both parties must serve a preliminary and final declaration of disclosure, with certain exceptions. |

| Filing with Court | Neither the preliminary nor the final declarations are filed with the court; instead, a declaration of service must be filed. |

| Preliminary Disclosure Timing | The petitioner must serve their preliminary disclosure with the Petition or within 60 days of filing it. |

| Respondent's Timeline | The respondent is required to serve their preliminary disclosure at the same time as their Response or within 60 days of filing. |

| Waiving Disclosures | Service of preliminary disclosures cannot be waived by agreement, but final disclosures can be waived if filed with the court. |

| Summary Dissolution | In summary dissolution cases, each spouse must exchange preliminary disclosures, but final disclosures are not required. |

| Default Judgment | In default judgment cases, only the petitioner must complete and serve a preliminary declaration of disclosure. |

| Attachments Required | The form requires attachments such as a Schedule of Assets and Debts, Income and Expense Declaration, and tax returns from the past two years. |

Dos and Don'ts

Things to Do When Filling Out the California FL-140 Form:

- Ensure all personal information is accurate and complete, including names, addresses, and contact details.

- Attach the necessary financial documents, such as the Income and Expense Declaration (form FL-150).

- Serve the preliminary declaration of disclosure to the other party within the required time frame.

- File the declaration stating that the service of disclosure documents was completed or waived (form FL-141).

Things Not to Do When Filling Out the California FL-140 Form:

- Do not file the declarations of disclosure with the court.

- Avoid leaving any sections blank; incomplete forms may lead to delays.

- Do not forget to sign and date the form to validate your declaration.

- Refrain from waiving the preliminary declaration of disclosure through an agreement; it is mandatory to serve it.

Misconceptions

Understanding the California FL-140 form can be challenging, and several misconceptions often arise. Here are eight common misunderstandings about this important document:

- Misconception 1: The FL-140 must be filed with the court.

- Misconception 2: Only one party needs to complete a preliminary declaration of disclosure.

- Misconception 3: Final disclosures are always necessary.

- Misconception 4: Agreements can waive the requirement for preliminary disclosures.

- Misconception 5: There are no time limits for serving disclosures.

- Misconception 6: The FL-140 is the only document required for financial disclosure.

- Misconception 7: You can skip providing tax returns.

- Misconception 8: The disclosure process is optional.

Many people believe that the FL-140 form, which is the Declaration of Disclosure, needs to be filed with the court. In reality, this form is not filed. Instead, a declaration stating that the disclosure documents were served must be filed using form FL-141.

In a dissolution or legal separation case, both parties are typically required to serve a preliminary declaration of disclosure. However, in a default judgment case, only the petitioner is required to complete this step.

Some individuals think that final declarations of disclosure are mandatory in every case. This is not true. In summary dissolution cases, final disclosures are not required, as specified in Family Code section 2109.

It is a common belief that parties can agree to waive the service of preliminary declarations of disclosure. However, this is not permitted. Both parties must serve their preliminary disclosures regardless of any agreement.

Some people think that there are no deadlines associated with serving disclosures. In fact, the petitioner must serve their preliminary declaration of disclosure when filing the Petition or within 60 days afterward. The respondent has the same timeline following the Response.

Many assume that the FL-140 is the sole document needed for financial disclosure. In addition to this form, parties must also provide other documents, such as the Income and Expense Declaration (form FL-150) and a completed Schedule of Assets and Debts (form FL-142).

Some individuals believe they can omit tax returns when serving disclosures. However, all tax returns filed in the two years preceding the disclosure must be included to ensure transparency.

Lastly, some people think that the disclosure process can be bypassed entirely. This is incorrect. The disclosure of financial information is a critical step in family law cases, ensuring both parties have access to necessary information for fair proceedings.

Documents used along the form

The California FL-140 form is a crucial document in family law cases, particularly in matters of divorce, legal separation, or nullity. It is often accompanied by several other forms that help ensure both parties provide necessary financial disclosures. Below is a list of common forms and documents that are typically used alongside the FL-140.

- FL-141: Declaration of Disclosure - This form is used to declare that the preliminary and final disclosures have been served or waived. It is essential for maintaining transparency between parties.

- FL-150: Income and Expense Declaration - This document provides a detailed account of a party's income, expenses, and financial situation. It is critical for determining support obligations.

- FL-142: Schedule of Assets and Debts - This form lists all assets and debts of the parties, helping to clarify the financial landscape during the dissolution process.

- FL-160: Property Declaration - Similar to the Schedule of Assets and Debts, this form provides a detailed account of property ownership, including community and separate property.

- FL-144: Stipulation to Waive Final Declaration of Disclosure - If both parties agree to waive the final disclosure, this form must be filed with the court to document that agreement.

- FL-810: Summary Dissolution Information - For couples opting for a summary dissolution, this form outlines the requirements for preliminary disclosures, which both parties must exchange.

- Tax Returns - Copies of tax returns filed in the two years prior to serving disclosure documents are often required to provide a full picture of financial status.

- Statements of Material Facts - These statements detail any material facts related to the valuation of community property and liabilities, ensuring both parties have a clear understanding of their financial obligations.

- Disclosure of Investment Opportunities - This document outlines any investment or business opportunities that have arisen since separation, which could impact financial disclosures.

Understanding these forms and their purposes can significantly ease the process of financial disclosure in family law cases. Each document plays a vital role in ensuring transparency and fairness, helping both parties navigate their legal obligations effectively.

Different PDF Templates

Whats Form 540 - Notary signatures may be required for certain entities completing the form.

How to Check Gun Registration Online - The inclusion of comments allows for additional information pertinent to the transaction.