Download California Ftb 626 Form

Common Questions

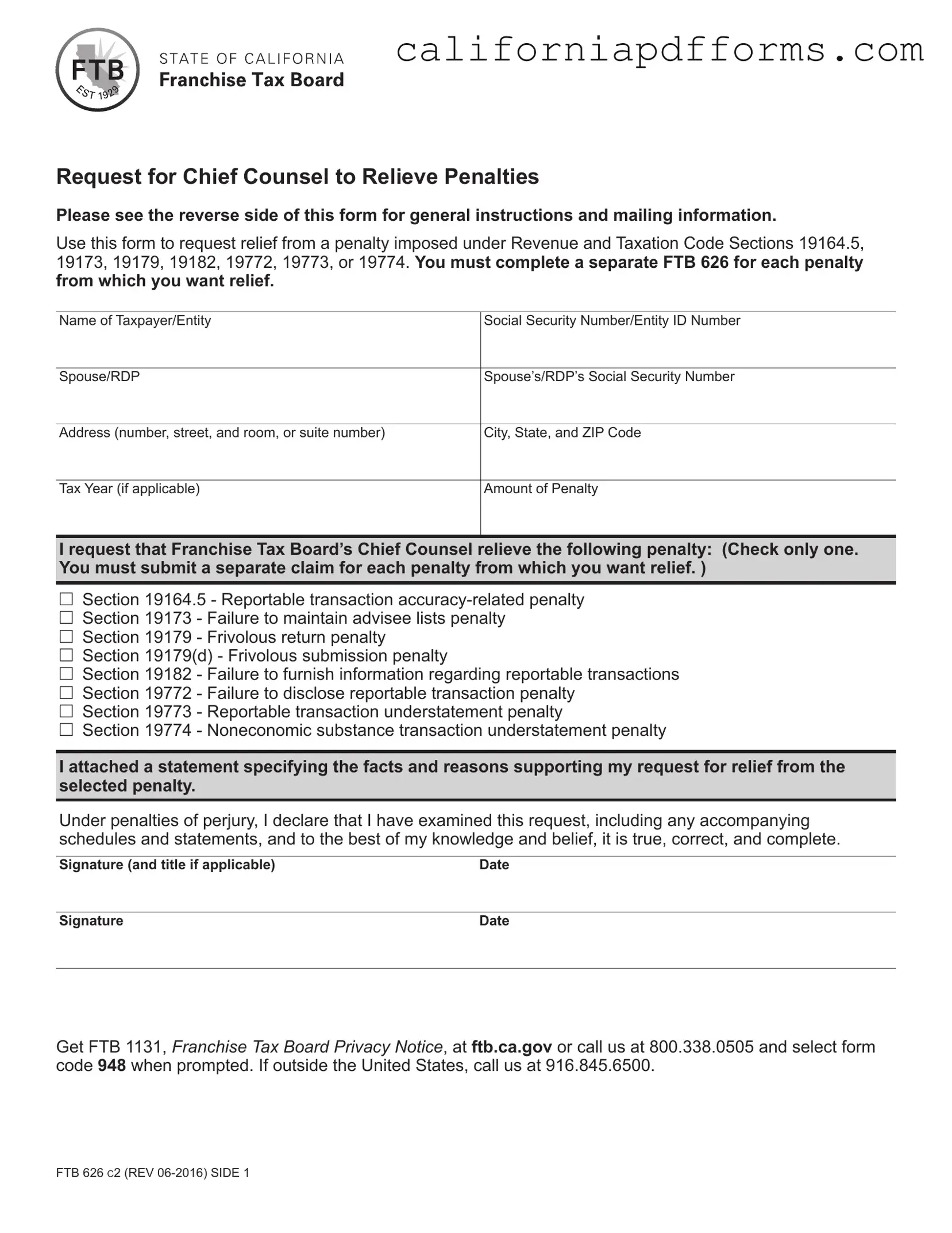

What is the purpose of the California FTB 626 form?

The California FTB 626 form is used to request relief from specific penalties imposed by the Franchise Tax Board (FTB) under certain sections of the Revenue and Taxation Code. This form allows taxpayers to ask the Chief Counsel of the FTB to consider relieving all or part of these penalties.

Which penalties can I request relief from using the FTB 626 form?

You can request relief from the following penalties using the FTB 626 form:

- Section 19164.5 - Reportable transaction accuracy-related penalty

- Section 19173 - Failure to maintain advisee lists penalty

- Section 19179 - Frivolous return penalty

- Section 19179(d) - Frivolous submission penalty

- Section 19182 - Failure to furnish information regarding reportable transactions

- Section 19772 - Failure to disclose reportable transaction penalty

- Section 19773 - Reportable transaction understatement penalty

- Section 19774 - Noneconomic substance transaction understatement penalty

Do I need to submit a separate FTB 626 form for each penalty?

Yes, you must complete a separate FTB 626 form for each penalty from which you seek relief. This means if you are requesting relief from multiple penalties, you will need to fill out and submit multiple forms.

What information do I need to provide on the FTB 626 form?

The form requires the following information:

- Name of the taxpayer or entity

- Social Security Number or Entity Identification Number

- Spouse or Registered Domestic Partner (RDP) information, if applicable

- Address, including city, state, and ZIP code

- Tax year, if applicable

- Amount of the penalty

- Selection of the specific penalty for which relief is requested

What should I include with my FTB 626 form submission?

Along with the completed FTB 626 form, you must attach a statement that specifies the facts and reasons supporting your request for relief from the selected penalty. Additionally, if applicable, include a copy of the notice that imposed the penalty.

Who needs to sign the FTB 626 form?

If you filed a joint return, both you and your spouse or RDP must sign the form. For business entities, an authorized individual must sign, and their title should be included. If someone is filing on your behalf, a Power of Attorney must be attached.

Where do I send my completed FTB 626 form?

Mail your completed FTB 626 form and any supporting statements to the following address:

CHIEF COUNSEL

LEGAL DIVISION MS A 260

FRANCHISE TAX BOARD

PO BOX 1720

RANCHO CORDOVA CA 95741-1720

How can I get additional information about penalties?

For more information about penalties, you can visit the FTB website at ftb.ca.gov and search for penalty information. Alternatively, you can contact the FTB at 800.852.5711 during weekdays from 7 a.m. to 5 p.m., excluding state holidays.

What if I have questions while completing the FTB 626 form?

If you have questions while filling out the FTB 626 form, you can call the FTB at 800.852.5711 for assistance. If you are outside the United States, you can reach them at 916.845.6500.

Document Specifications

| Fact Name | Description |

|---|---|

| Purpose of FTB 626 | This form is used to request relief from specific penalties imposed by the Franchise Tax Board. |

| Governing Laws | Relief is requested under Revenue and Taxation Code Sections 19164.5, 19173, 19179, 19182, 19772, 19773, or 19774. |

| Separate Requests | A separate FTB 626 form must be completed for each penalty from which relief is sought. |

| Required Information | The form requires personal information such as the taxpayer's name, Social Security Number, and address. |

| Signature Requirement | Both spouses or registered domestic partners must sign if the request pertains to a joint return. |

| Authorized Signatures | For business entities, an authorized individual must sign the request, including their title. |

| Supporting Statement | A statement detailing the facts and reasons for the relief request must accompany the form. |

| Mailing Instructions | Completed forms should be mailed to the Chief Counsel, Legal Division, at the specified address in Rancho Cordova, CA. |

| Contact Information | For assistance, individuals can call the Franchise Tax Board at 800.852.5711 or visit their website. |

Dos and Don'ts

When filling out the California FTB 626 form, it’s important to follow certain guidelines to ensure your request is processed smoothly. Below are some key dos and don’ts to keep in mind.

- Do complete a separate FTB 626 form for each penalty you are requesting relief from.

- Do provide accurate information for both your Social Security Number and your spouse’s or registered domestic partner’s (RDP) number if applicable.

- Do include the entity identification number if you are filing on behalf of a business entity.

- Do attach a clear statement explaining the facts and reasons for your request.

- Do ensure that both spouses or RDPs sign the form if you filed a joint return.

- Don’t forget to mail your completed form to the correct address provided in the instructions.

- Don’t leave any sections blank; provide all required information to avoid delays.

- Don’t submit your request without the necessary supporting documents, such as a copy of the notice imposing the penalty.

- Don’t assume that your request will be automatically approved; the Chief Counsel has discretion over penalty relief.

By adhering to these guidelines, you can improve the chances of your request being processed efficiently. Always double-check your form before sending it to ensure everything is complete and accurate.

Misconceptions

Misconceptions about the California FTB 626 form can lead to confusion regarding the process of requesting penalty relief. Below are ten common misconceptions, along with clarifications for each.

- One form suffices for multiple penalties. Many believe that a single FTB 626 can cover multiple penalties. In reality, a separate form is required for each penalty from which relief is sought.

- Anyone can request penalty relief. It is a common misconception that anyone can file for relief. Only taxpayers subject to specific penalties under designated sections of the Revenue and Taxation Code can use this form.

- Relief is guaranteed. Some individuals assume that submitting the FTB 626 guarantees relief from penalties. The Chief Counsel has discretion and may deny requests based on the circumstances presented.

- Supporting statements are optional. There is a belief that attaching a supporting statement is not necessary. However, the form explicitly requires a statement outlining the facts and reasons for the request.

- Only individuals can file. Many think that only individual taxpayers can use this form. In fact, business entities, such as corporations and partnerships, can also request relief using the FTB 626.

- Signature requirements are flexible. Some may believe that signatures are not strictly enforced. In reality, signatures from both spouses or an authorized representative are necessary when applicable.

- Filing deadlines are not strict. A misconception exists that deadlines for filing the FTB 626 are flexible. Timely submission is crucial, as requests must adhere to specific timeframes set by the Franchise Tax Board.

- All penalties are eligible for relief. It is often assumed that any penalty can be addressed with this form. However, only penalties listed on the front of the FTB 626 are eligible for relief requests.

- Submitting the form is the final step. Some believe that submitting the FTB 626 concludes the process. In fact, taxpayers should expect potential follow-up communications from the Franchise Tax Board regarding their requests.

- Relief can be requested without prior notice. There is a common misunderstanding that one can request relief without having received a notice of penalty. A notice is necessary as it serves as the basis for the relief request.

Documents used along the form

When navigating the process of requesting penalty relief in California, it’s important to be aware of other forms and documents that may accompany the California FTB 626 form. These documents can help clarify your situation and strengthen your request. Below are some commonly used forms that may be relevant.

- FTB 1131 - Franchise Tax Board Privacy Notice: This document informs taxpayers about how their personal information is collected, used, and protected by the Franchise Tax Board. It is essential to understand your privacy rights when submitting any tax-related forms.

- Power of Attorney (Form FTB 3520): If you wish to authorize someone else to act on your behalf, this form is necessary. It allows your representative to communicate with the Franchise Tax Board regarding your penalty relief request and other tax matters.

- FTB 540 - California Resident Income Tax Return: If your penalty relief request is related to a specific tax year, you may need to submit your income tax return for that year. This form provides context regarding your financial situation and the basis for your penalty request.

- Supporting Statement: While not a formal form, a detailed statement outlining the facts and reasons for your request is crucial. This document should clearly explain the circumstances surrounding the penalties and why you believe relief should be granted.

Being prepared with these additional documents can streamline the process and improve your chances of receiving the relief you seek. Always ensure that you complete each form accurately and attach any necessary supporting information. This diligence can make a significant difference in how your request is evaluated.

Different PDF Templates

Lic 9182 Form - The TLR 3 form is an integral part of California’s effort to protect those in community care environments.

California Motion for Reconsideration - Individuals must provide the case name and number at the top of the form.

540nr Instructions - Refunds are possible for overpayments reported on the form.