Download California Heirship Form

Common Questions

-

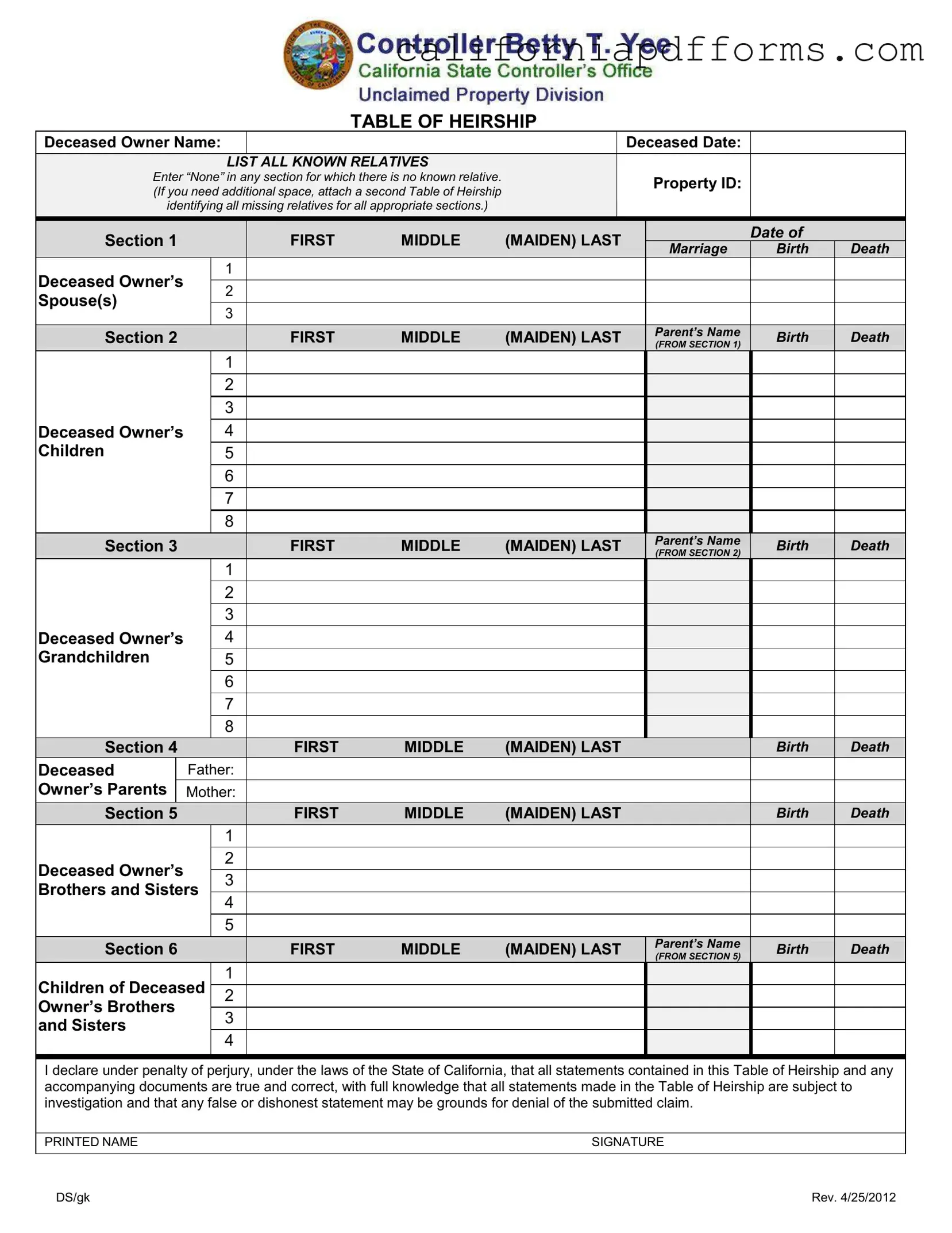

What is the California Heirship form?

The California Heirship form is a document used to identify the heirs of a deceased property owner. It lists all known relatives of the deceased, including spouses, children, grandchildren, parents, and siblings. This form is essential for claiming property that belonged to someone who has passed away.

-

Who needs to fill out this form?

Anyone who is claiming property from a deceased owner should fill out this form. This includes heirs like children, spouses, and sometimes siblings or parents. If you believe you have a right to the property, you will need to provide the necessary information about yourself and the deceased's relatives.

-

What information do I need to provide?

You will need to provide several details, including:

- The deceased owner's name and date of death.

- Your own information and that of all known relatives.

- Dates of birth and death for each relative, if applicable.

- Details about marriages, if the deceased had a spouse.

Make sure to include a certified death certificate for each deceased relative listed.

-

What if the deceased owner had no children or siblings?

If the deceased owner had no children or siblings, simply write "None" in the respective sections of the form. It's important to fill out all sections accurately, even if some do not apply.

-

How do I submit the California Heirship form?

You can submit the form along with your claim to the relevant authority or agency handling the property. Make sure to keep a copy for your records. Check with the specific agency for any additional submission guidelines they may have.

-

What happens if I provide false information?

Providing false information on the form can lead to serious consequences, including denial of your claim. The form includes a declaration stating that all information is true and correct. It's crucial to be honest and accurate when filling it out.

-

Can I attach additional pages if needed?

Yes, if you need more space to list all known relatives, you can attach additional pages. Just make sure to clearly identify these pages as part of your Table of Heirship.

-

Is there a deadline for submitting the form?

There may be deadlines depending on the specific circumstances of the property claim. It’s best to check with the relevant agency to ensure you submit your form on time. Delays could affect your ability to claim the property.

Document Specifications

| Fact Name | Details |

|---|---|

| Purpose | The California Heirship form is used to identify the heirs of a deceased property owner. |

| Governing Law | This form is governed by California Probate Code Sections 6400-6414. |

| Required Information | Users must provide names, dates of birth, and dates of death for all known relatives. |

| Spouse Information | All current and former spouses of the deceased must be listed, even if they are deceased. |

| Children Details | Each child of the deceased must be listed individually. If none exist, enter "None." |

| Grandchildren Section | Grandchildren must also be listed. If there are no grandchildren, enter "None." |

| Parent Details | Both parents of the deceased should be included, regardless of their living status. |

| Siblings Information | All siblings must be recorded. If there are no siblings, indicate "None." |

| Verification Statement | The form includes a declaration stating that all information is true under penalty of perjury. |

| Submission Requirements | A certified death certificate for each deceased relative listed must accompany the form. |

Dos and Don'ts

When filling out the California Heirship form, there are several important practices to keep in mind. Below is a list of things you should and shouldn't do to ensure the process goes smoothly.

- Do enter the full name of the deceased property owner accurately.

- Do provide the date of death for the deceased property owner.

- Do list all known relatives, including spouses, children, and parents.

- Do include a copy of the certified death certificates for all deceased relatives mentioned.

- Do write “None” in sections where there are no known relatives.

- Don't leave any sections blank if you have relevant information to provide.

- Don't provide inaccurate or misleading information, as this can lead to denial of the claim.

By following these guidelines, you can help ensure that your submission is complete and accurate, which is essential for a successful claim process.

Misconceptions

Misconceptions about the California Heirship form can lead to confusion and errors in the claims process. Here are six common misunderstandings:

- Only living relatives need to be listed. Many believe that only living relatives should be included on the form. However, it is essential to list all known relatives, both living and deceased. This ensures a comprehensive overview of the family tree.

- The form is optional. Some think that completing the Heirship form is not mandatory. In reality, it is a crucial step in claiming property and must be accurately filled out to avoid delays or denials.

- Providing a death certificate is unnecessary. A common myth is that death certificates for deceased relatives are not required. In fact, the form requires copies of death certificates for all deceased relatives listed, ensuring proper verification of claims.

- There is no need to include former spouses. Many people overlook the importance of including former spouses. The form requires you to enter all current and former spouses to provide a complete picture of the deceased's family relationships.

- Filling out the form is straightforward and doesn't require attention to detail. Some may think that the form can be filled out quickly without careful consideration. However, inaccuracies or omissions can lead to complications. Take time to ensure all information is correct.

- It doesn't matter how many relatives are listed. Some individuals believe that the number of relatives listed is irrelevant. In truth, a complete list of known relatives is vital for establishing rightful heirs and ensuring that the claims process proceeds smoothly.

Documents used along the form

When dealing with the California Heirship form, it's important to understand that several other documents may accompany it to ensure a smooth process. Each of these documents plays a crucial role in establishing the rightful heirs and supporting claims to the deceased's property. Below is a list of commonly used forms and documents that often accompany the California Heirship form.

- Death Certificate: This official document confirms the date and cause of death of the deceased. It is essential for proving the death and is often required when filing claims for property or assets.

- Will: If the deceased left behind a will, this document outlines their wishes regarding the distribution of their assets. It can provide clarity on the intended heirs and may simplify the heirship process.

- Trust Documents: If the deceased established a trust, these documents detail the assets held in the trust and the beneficiaries. They are vital for understanding how the deceased's assets are managed and distributed.

- Affidavit of Heirship: This sworn statement can help establish the identity of heirs when there is no will. It typically includes information about the deceased's family and can be a useful tool in the absence of formal estate planning.

- Inventory of Assets: This document lists all of the deceased’s assets, including property, bank accounts, and personal belongings. It provides a comprehensive overview of what is to be distributed among the heirs.

- Petition for Probate: If the deceased had a will, this petition is filed with the court to initiate the probate process. It formally requests the court to recognize the will and appoint an executor to manage the estate.

Understanding these documents can help heirs navigate the often complex landscape of estate management. Each piece of paperwork serves a specific purpose and can significantly impact the distribution of assets. By gathering these documents, you can ensure a smoother process and protect your rights as an heir.

Different PDF Templates

Relative Information - The form includes instructions for law enforcement on enforcing the orders.

How to Collect a Judgement From a Person - The form requires a certification of mailing, ensuring all parties are notified.