Download California Id 1060 Form

Common Questions

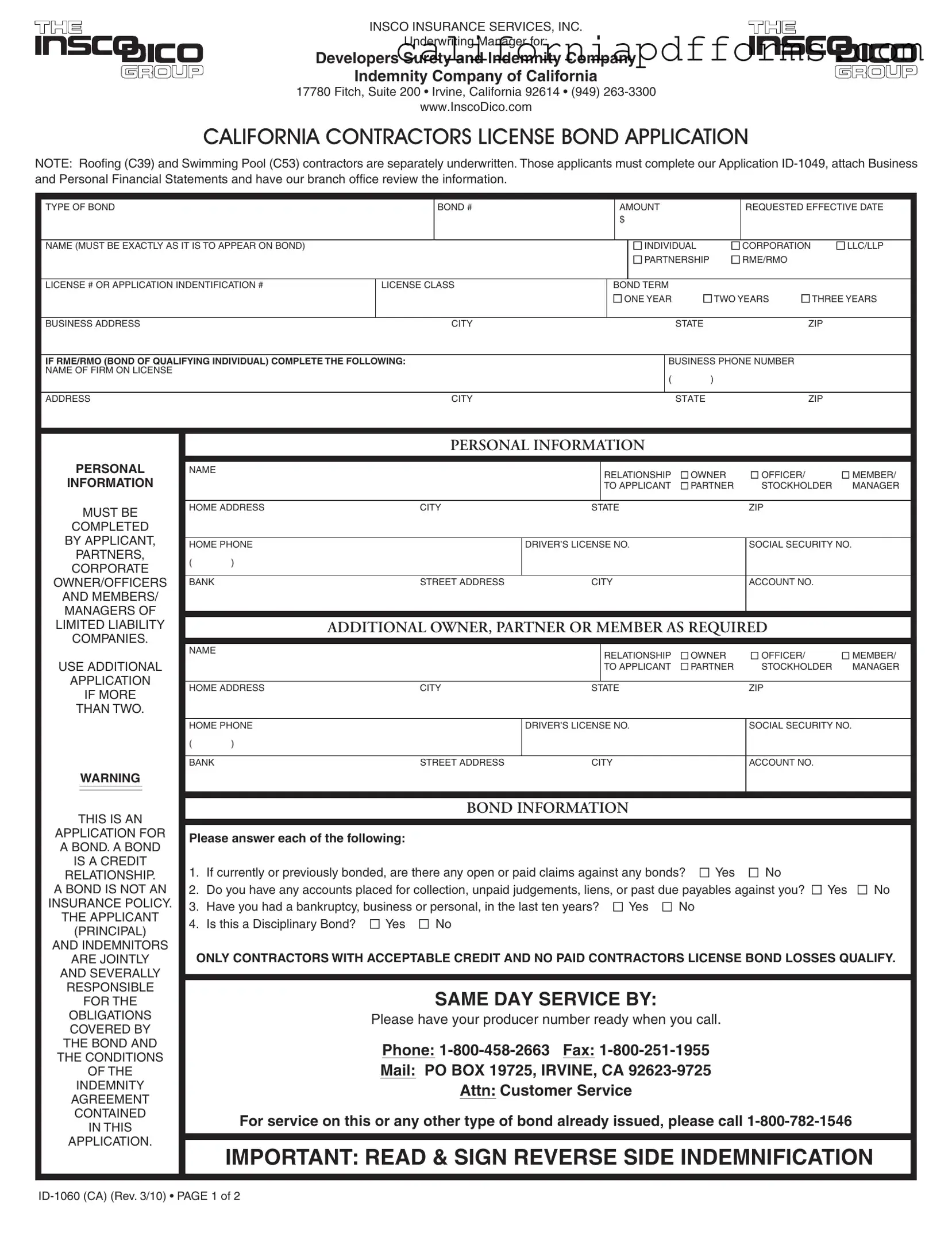

What is the purpose of the California ID 1060 form?

The California ID 1060 form is an application for a contractor's license bond. This bond serves as a credit relationship between the applicant and the surety company. It guarantees that the contractor will adhere to state regulations and fulfill contractual obligations. If the contractor fails to meet these obligations, the bond provides a financial safety net for clients who may suffer losses due to the contractor's actions.

Who needs to fill out the California ID 1060 form?

Any individual or business entity seeking a contractor's license in California must complete the California ID 1060 form. This includes various types of applicants such as individuals, corporations, limited liability companies (LLCs), partnerships, and qualifying individuals (RME/RMO). It is important to note that roofing and swimming pool contractors must complete a separate application, the ID-1049, along with additional financial documentation.

What information is required on the California ID 1060 form?

The form requires detailed personal and business information from the applicant, including:

- Name and type of business entity (individual, corporation, etc.)

- Business address and contact information

- License number or application identification number

- Personal information for all partners, corporate owners, and LLC members

- Financial history, including any past claims against bonds, unpaid judgments, or bankruptcies

This comprehensive information helps the surety company assess the creditworthiness of the applicant.

What happens if there are issues with the application?

If there are any discrepancies or issues with the information provided in the California ID 1060 form, the surety company may deny the bond application. Common issues include unpaid claims against previous bonds, significant financial liabilities, or a poor credit history. It is crucial for applicants to ensure that all information is accurate and complete before submission to avoid delays or denials in the bonding process.

Document Specifications

| Fact Name | Details |

|---|---|

| Form Purpose | The California ID 1060 form is used to apply for a contractor's license bond. |

| Governing Law | This form is governed by California Business and Professions Code Section 7071.5. |

| Types of Contractors | Specific contractor types, such as Roofing (C39) and Swimming Pool (C53), require a different application (ID-1049). |

| Bond Duration Options | Applicants can select a bond term of one, two, or three years. |

| Joint Responsibility | Both the applicant and indemnitors are jointly responsible for bond obligations. |

| Credit Relationship | A bond represents a credit relationship, not an insurance policy. |

| Claims Disclosure | Applicants must disclose any open or paid claims against previous bonds. |

| Bankruptcy History | Disclosure of any bankruptcy within the last ten years is required. |

| Indemnification Agreement | Applicants must agree to indemnify the surety against any losses incurred from issuing the bond. |

| Contact Information | For assistance, applicants can contact Insco Insurance Services at 1-800-458-2663. |

Dos and Don'ts

When filling out the California ID 1060 form, there are several important dos and don'ts to keep in mind. These tips can help ensure your application is completed accurately and efficiently.

- Do read the entire form carefully before you start filling it out.

- Do use the exact name as it should appear on the bond.

- Do provide accurate personal information for all required individuals.

- Do double-check all numbers, including your license number and Social Security number.

- Don't leave any required fields blank; incomplete forms can delay processing.

- Don't use abbreviations unless specified; clarity is essential.

- Don't forget to sign the application; an unsigned form is invalid.

By following these guidelines, you can help ensure a smoother process when applying for your bond. Accuracy and attention to detail are key components in successfully completing the California ID 1060 form.

Misconceptions

Here are some common misconceptions about the California ID 1060 form:

- It is an insurance policy. Many people think that a bond functions like an insurance policy. However, a bond is a credit relationship, meaning it guarantees payment to a third party if certain conditions are met.

- Only large companies need to fill it out. This form is required for all contractors, regardless of the size of their business. Individual contractors also need to complete it.

- Once submitted, the bond is guaranteed. Submission does not guarantee approval. The surety company will review your application and assess your creditworthiness before deciding.

- Personal information is optional. Personal details of the applicant and partners are mandatory. This information helps assess the risk associated with issuing the bond.

- All contractors qualify for a bond. Not every contractor can qualify. Acceptable credit and a clean history of bond losses are necessary for approval.

- It can be filled out quickly without preparation. Completing the form requires careful attention. Applicants should gather all necessary documents and information before starting.

- There are no ongoing responsibilities after getting the bond. Once issued, the bond comes with ongoing obligations. Indemnitors must reimburse the surety for any claims made against the bond.

- The bond lasts indefinitely. The bond is typically issued for a specific term, such as one, two, or three years. Renewal or reapplication may be necessary at the end of that term.

Documents used along the form

When applying for a bond in California, the California ID 1060 form is a crucial document. However, several other forms and documents are often required to support the application process. Each of these documents serves a specific purpose and helps ensure that the bonding company has all necessary information to assess the applicant's qualifications. Below is a list of commonly used forms and documents that may accompany the California ID 1060 form.

- Application ID-1049: This form is specifically for roofing (C39) and swimming pool (C53) contractors. It gathers detailed information necessary for underwriting these specialized types of contractors.

- Business Financial Statement: This document outlines the financial health of the business. It includes assets, liabilities, and other financial data that help the bonding company evaluate the applicant's creditworthiness.

- Personal Financial Statement: Similar to the business financial statement, this document provides a snapshot of the individual owner's financial situation. It includes personal assets, debts, and income details.

- Indemnity Agreement: This agreement outlines the responsibilities of the indemnitors (those who sign the bond) and the bonding company. It is a commitment to reimburse the bonding company for any claims made against the bond.

- Proof of Insurance: Many bonding companies require proof of general liability insurance. This document demonstrates that the contractor has coverage in place to protect against potential claims.

- Licensing Documentation: This includes copies of the contractor's license and any other relevant certifications. It verifies that the contractor is legally allowed to operate in their specified trade.

Gathering these documents can feel overwhelming, but each one plays a vital role in the bonding process. Ensuring that all paperwork is complete and accurate can help facilitate a smoother application experience. If you have questions about any of these documents, seeking guidance can be beneficial.