Download California L 206 Form

Common Questions

What is the California L 206 form?

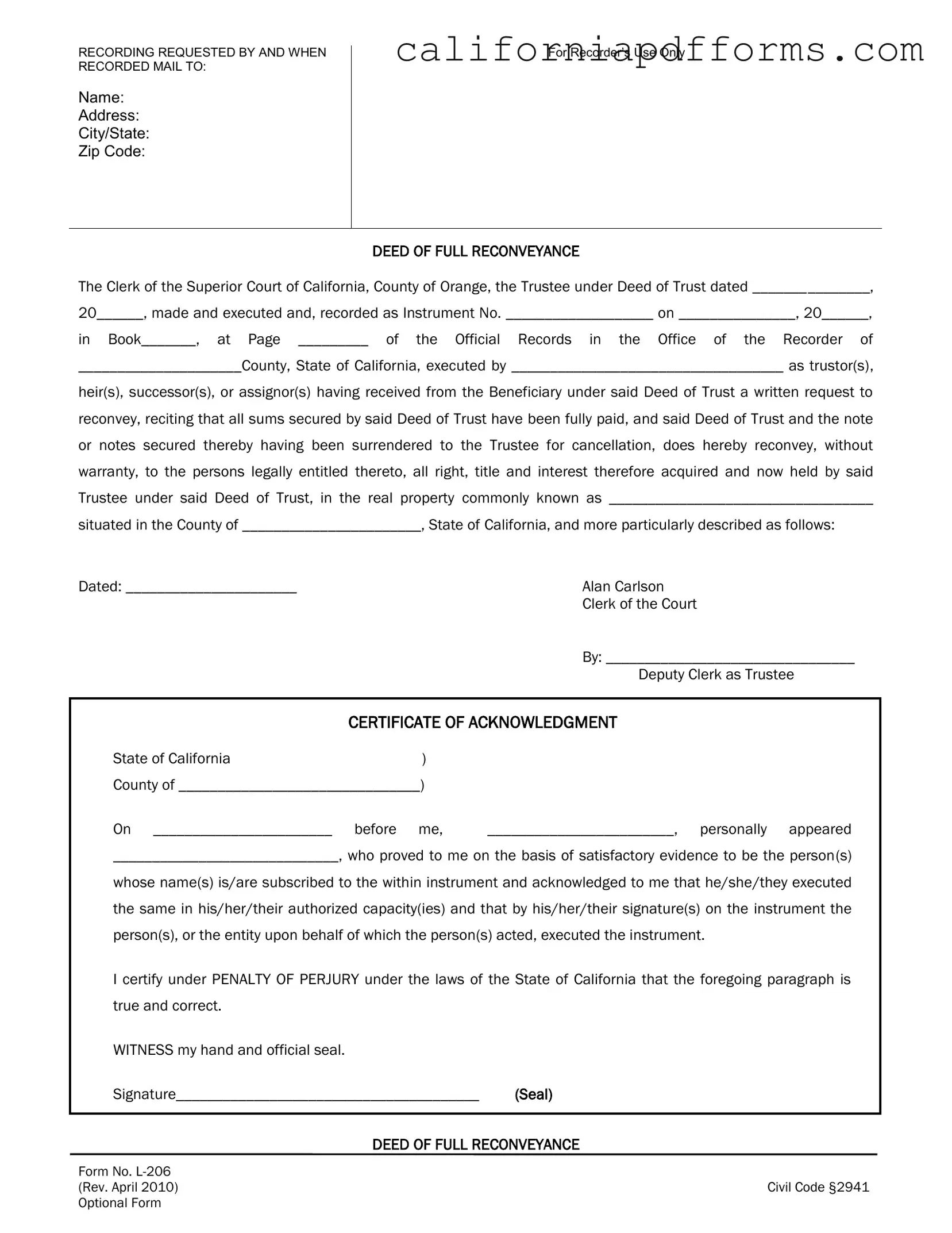

The California L 206 form is a legal document known as the Deed of Full Reconveyance. It is used to officially confirm that a borrower has paid off their mortgage or deed of trust in full. By completing this form, the trustee relinquishes their interest in the property, effectively returning full ownership to the borrower.

Who needs to use the L 206 form?

This form is typically used by borrowers who have fully paid off their mortgage or deed of trust. It is also relevant for trustees who need to acknowledge that the debt has been satisfied and that they no longer hold any interest in the property.

What information is required on the L 206 form?

The L 206 form requires several key pieces of information, including:

- The names and addresses of the parties involved.

- The date the original deed of trust was executed.

- The recording information of the deed of trust, such as the instrument number and the book and page number.

- A description of the property being reconveyed.

- The date of the reconveyance.

How is the L 206 form filed?

To file the L 206 form, it should be completed and signed by the trustee. After that, it must be recorded with the county recorder's office where the property is located. This step ensures that the reconveyance is officially recognized and becomes part of the public record.

What happens if the L 206 form is not filed?

If the L 206 form is not filed, the borrower may still technically own the property, but the trustee's interest may remain on record. This can create complications in future transactions involving the property, such as selling or refinancing, as the existing lien may still appear on title reports.

Is there a fee associated with filing the L 206 form?

Yes, there is typically a fee for recording the L 206 form with the county recorder's office. The amount can vary by county, so it’s advisable to check with the local recorder’s office for the exact fee structure.

Can the L 206 form be used for any type of property?

The L 206 form can be used for various types of real property, including residential, commercial, and agricultural properties, as long as the property is located in California and is subject to a deed of trust that has been paid off.

What is the significance of the Certificate of Acknowledgment?

The Certificate of Acknowledgment is an important part of the L 206 form. It verifies that the signatures on the document were made in the presence of a notary public, ensuring the authenticity of the signatures. This step adds an extra layer of protection against fraud.

Can I fill out the L 206 form myself?

While it is possible to fill out the L 206 form yourself, it is often beneficial to seek assistance from a legal professional. They can help ensure that all necessary information is accurately completed and that the form is filed correctly, minimizing the risk of issues down the line.

Document Specifications

| Fact Name | Details |

|---|---|

| Form Purpose | The California L 206 form is used to document the full reconveyance of a deed of trust. |

| Governing Law | This form is governed by California Civil Code §2941. |

| Form Revision Date | The current version of the form was last revised in April 2010. |

| Recording Information | It must be recorded with the county recorder's office where the property is located. |

| Trustee's Role | The trustee executes the reconveyance once all sums secured by the deed of trust are paid. |

| Acknowledgment Requirement | A notary public must acknowledge the signatures on the form for it to be valid. |

| Property Description | The form requires a detailed description of the property being reconveyed. |

Dos and Don'ts

When filling out the California L 206 form, consider the following guidelines:

- Do ensure all required fields are completed accurately.

- Do use clear and legible handwriting or type the information.

- Don't leave any sections blank unless specifically instructed.

- Don't forget to include the date and signatures where necessary.

Misconceptions

Understanding the California L 206 form, also known as the Deed of Full Reconveyance, is essential for those involved in real estate transactions. However, several misconceptions can lead to confusion. Here are nine common misconceptions:

- The form is only for homeowners. This form can be used by any party involved in a Deed of Trust, including trustees and beneficiaries.

- It is mandatory to use the L 206 form. The form is optional, but it is a standard method for reconveyance in California.

- All signatures must be notarized. Only the signatures of the parties involved in the reconveyance need notarization, not all signatures on the form.

- The form must be recorded immediately. While it is advisable to record the form promptly, there is no strict timeline for recording.

- Using the L 206 form guarantees the title is clear. The form only confirms that the Deed of Trust has been satisfied; it does not guarantee a clear title.

- Once filed, the form cannot be amended. The form can be amended or corrected if errors are found, but this requires proper procedures.

- The L 206 form is the same in all counties. While the form is standardized, some counties may have specific requirements or additional forms.

- Filing the form is the only step in the reconveyance process. Other steps, such as notifying the borrower and ensuring all payments are complete, are also crucial.

- The L 206 form is only relevant for traditional mortgages. It applies to any Deed of Trust, including those for commercial properties and other secured loans.

Awareness of these misconceptions can help individuals navigate the reconveyance process more effectively. Understanding the purpose and requirements of the California L 206 form is vital for ensuring compliance and protecting interests in real estate transactions.

Documents used along the form

The California L 206 form, also known as the Deed of Full Reconveyance, is an essential document used in real estate transactions, particularly when a loan secured by a deed of trust has been fully paid off. Alongside this form, there are several other documents that are commonly utilized to ensure a smooth and legally compliant process. Below is a list of these forms, each with a brief description to provide clarity on their purpose and importance.

- Grant Deed: This document transfers ownership of real property from one party to another. It guarantees that the seller has not transferred the title to anyone else and that the property is free from any liens, except those disclosed in the deed.

- Quitclaim Deed: A quitclaim deed is used to transfer any interest the grantor may have in a property without making any guarantees about the title. It is often used between family members or to clear up title issues.

- Notice of Default: This form is filed when a borrower has failed to make mortgage payments. It serves as a public notice that the borrower is in default and may lead to foreclosure proceedings if the debt remains unpaid.

- Trustee's Deed: This document is executed by a trustee to convey property following a foreclosure sale. It provides the new owner with legal title to the property, transferring it from the trustee to the purchaser.

- Title Insurance Policy: This policy protects the buyer and lender from any future claims against the title of the property. It ensures that the title is clear and provides coverage for legal fees in case of disputes.

- Preliminary Title Report: This report outlines the current status of a property's title, including any liens, easements, or restrictions. It is typically ordered before closing a real estate transaction to ensure all issues are addressed.

- Property Transfer Tax Declaration: This form is used to report the sale of real property to the local tax authority. It provides details about the transaction and helps determine any applicable transfer taxes.

Each of these documents plays a crucial role in the real estate transaction process. Understanding their functions can help ensure that all legal requirements are met and that the interests of all parties involved are protected. Proper documentation is vital in maintaining clear titles and avoiding potential disputes in the future.

Different PDF Templates

Permanent Housing Search Document - The CW 74 form is a critical piece of paperwork in the broader support system for individuals seeking housing.

How Is an Eviction Notice Served - This notice is instrumental in maintaining legal clarity in landlord-tenant relationships.