Download California Llc 1 Form

Common Questions

What is the California LLC-1 form?

The California LLC-1 form is the Articles of Organization for a Limited Liability Company (LLC) in California. This form must be filed with the Secretary of State to officially create an LLC in the state.

What is the filing fee for the LLC-1 form?

The filing fee for submitting the LLC-1 form is $70. An optional certification fee of $5 may also be included if desired.

How long does it take to process the LLC-1 form?

Standard processing time for the LLC-1 form is approximately 5 business days from the date of receipt. Online submissions are given priority over paper submissions.

Are there any additional fees associated with filing?

Yes, if you are submitting the form in person, there is a $15 handling fee. However, this fee does not apply to submissions made by mail. Additionally, LLCs may be subject to a minimum $800 tax each year, payable to the California Franchise Tax Board.

What information is required on the LLC-1 form?

The LLC-1 form requires the following information:

- Name of the LLC

- Business addresses, including the initial street address and mailing address

- Service of process details, including the name and address of an individual or corporation designated as the agent

- Management structure of the LLC

- Purpose statement for the LLC

Can I submit the LLC-1 form online?

Yes, the LLC-1 form can be submitted online for faster processing. It is recommended to use the online filing system available at bizfileOnline.sos.ca.gov.

What should I do if I need to make changes after filing the LLC-1 form?

If changes are needed after filing, an amendment may be required. It is advisable to consult the Secretary of State’s office or a legal professional for guidance on how to proceed with amendments.

What is the purpose statement required on the LLC-1 form?

The purpose statement must indicate that the LLC is organized to engage in any lawful act or activity permitted under the California Revised Uniform Limited Liability Company Act. This statement should not be altered.

Who can sign the LLC-1 form?

The form must be signed by an organizer who is authorized under California law to do so. This individual affirms the accuracy of the information provided under penalty of perjury.

Where do I send the LLC-1 form after completion?

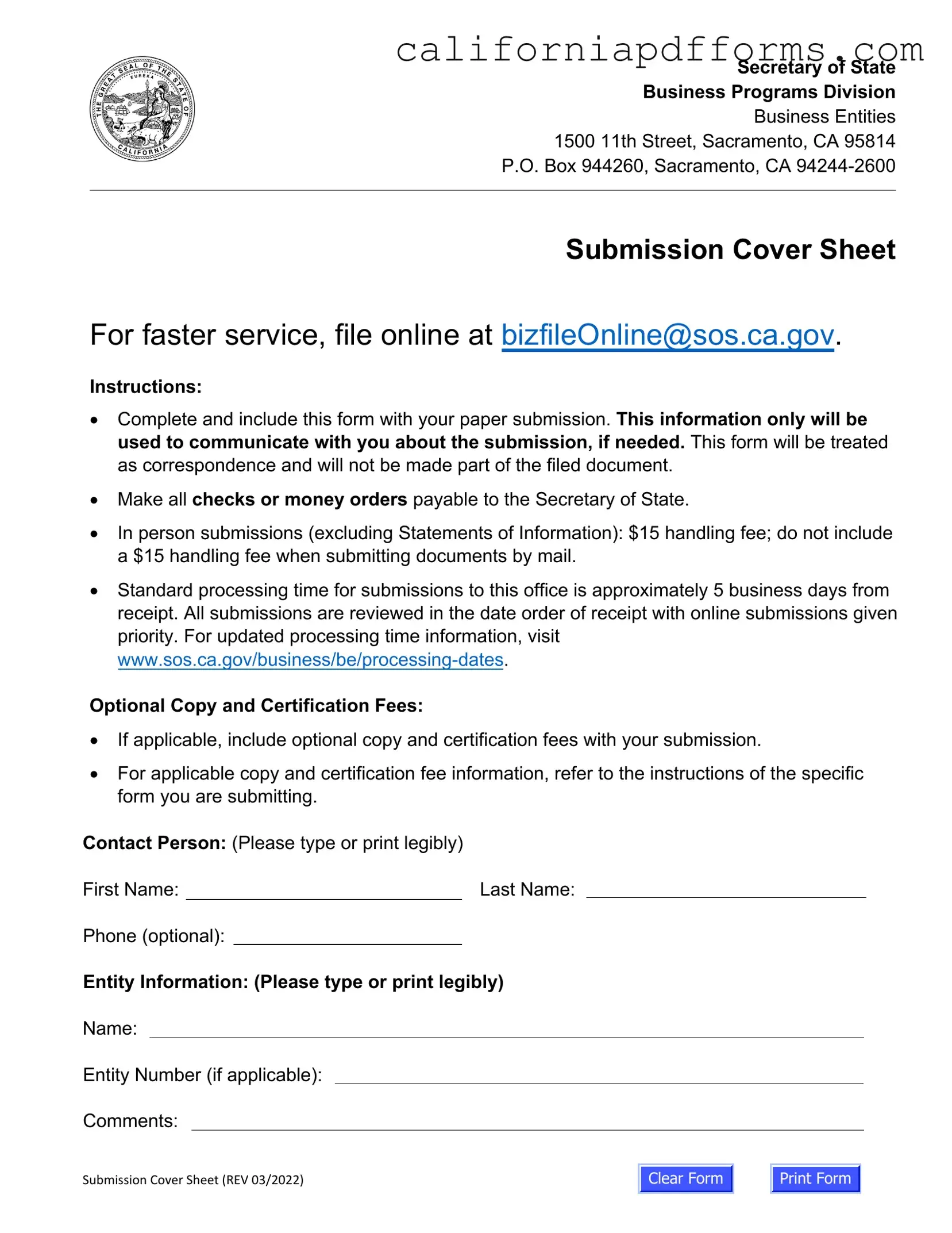

The completed LLC-1 form should be mailed to the Secretary of State, Business Programs Division, Business Entities, at 1500 11th Street, Sacramento, CA 95814. Alternatively, online submissions can be made through the provided website.

Document Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The California LLC-1 form is governed by the California Revised Uniform Limited Liability Company Act. |

| Filing Fee | The standard filing fee for submitting the LLC-1 form is $70.00. |

| Optional Certification Fee | An optional certification fee of $5.00 can be included with the submission. |

| Minimum Franchise Tax | LLCs in California may be required to pay a minimum annual tax of $800 to the Franchise Tax Board. |

| Processing Time | Standard processing time for submissions is approximately 5 business days from the date of receipt. |

| In-Person Submission Fee | A $15 handling fee applies to in-person submissions, but this fee is not required for mail submissions. |

| Agent Requirement | The form requires the designation of an agent for service of process, which can be either an individual or a corporation. |

| Purpose Statement | The purpose statement must remain unchanged and indicates that the LLC may engage in any lawful activity. |

| Submission Instructions | Complete the form and include it with your paper submission; it will not be part of the filed document. |

Dos and Don'ts

When filling out the California LLC-1 form, it's important to follow specific guidelines to ensure a smooth submission process. Here are four things you should do and four things you should avoid.

- Do: Complete the form legibly, using either printed text or typed information.

- Do: Include the correct LLC name with the required identifier, such as "LLC" or "L.L.C."

- Do: Provide a valid California street address for the designated office and service of process; do not use a P.O. Box.

- Do: Sign the form and affirm that the information is true and correct.

- Don't: Forget to include the filing fee of $70; ensure payment is made to the Secretary of State.

- Don't: Alter the purpose statement; it must remain as provided in the form.

- Don't: Submit documents by mail with a handling fee; this fee only applies to in-person submissions.

- Don't: Leave any required fields blank; incomplete forms may delay processing.

Misconceptions

Understanding the California LLC-1 form is essential for anyone looking to establish a limited liability company in the state. However, several misconceptions can lead to confusion during the filing process. Below are some common misunderstandings regarding the California LLC-1 form.

- All LLC names must include "LLC": While it is true that the name must contain an LLC identifier, if it is omitted, the state will automatically add "LLC" to the name upon filing.

- You can use a P.O. Box for the business address: The form specifically requires a physical street address for the designated office in California. P.O. Boxes are not acceptable.

- The filing fee is the only cost involved: In addition to the $70 filing fee, LLCs may also incur an annual minimum tax of $800 to the California Franchise Tax Board, which is separate from the initial filing costs.

- Submitting online is not necessary: Online submissions receive priority processing over paper submissions. For faster service, filing online is recommended.

- Any individual can serve as the agent for service of process: The agent must have a physical address in California. If the agent is a corporation, only the name of the registered corporate agent should be provided.

- The purpose statement can be altered: The purpose statement on the form must remain unchanged. It is designed to comply with the California Revised Uniform Limited Liability Company Act.

- Additional signatures are not needed: If there are multiple organizers, additional signatures can be attached to the form. These signatures must be incorporated into the filing.

- Filing the form guarantees immediate approval: Processing times can take approximately five business days. Approval is not instant, and submissions are reviewed in the order they are received.

By addressing these misconceptions, individuals can better navigate the process of filing the California LLC-1 form and ensure a smoother experience in establishing their business.

Documents used along the form

When forming a Limited Liability Company (LLC) in California, the LLC-1 form is just the beginning. Several other documents and forms are often required or recommended to ensure compliance with state regulations. Below is a list of some key forms that can accompany the LLC-1.

- LLC-12: Statement of Information - This form must be filed within 90 days of filing the LLC-1. It provides updated information about the LLC, including its address, management, and agent for service of process. This keeps the state informed about the company's structure and operations.

- LLC-4/7: Certificate of Cancellation - If an LLC decides to cease its operations, this form is necessary to formally dissolve the company. It ensures that the state recognizes the LLC's termination and releases it from ongoing obligations.

- LLC-2: Application to Register a Foreign LLC - If an LLC formed in another state wishes to do business in California, it must file this application. This allows the foreign LLC to operate legally within California's jurisdiction.

- Operating Agreement - While not submitted to the state, this internal document outlines how the LLC will be managed. It details the rights and responsibilities of members and managers, and can help prevent disputes in the future.

- Form 568: Limited Liability Company Return of Income - This tax form is required for LLCs to report their income to the California Franchise Tax Board. It ensures compliance with state tax obligations and helps maintain good standing.

These documents play a crucial role in the formation and ongoing management of an LLC in California. Understanding their purpose can help new business owners navigate the regulatory landscape more effectively.

Different PDF Templates

Rent a Room Lease Agreement - The property provider’s obligations are clearly stated to avoid ambiguity.

California Tourism Tax - State agencies are responsible for paying the charges incurred during stays.

Permanent Housing Search Document - This form is part of the protocol for maintaining eligibility for shelter assistance in California.