Download California Llc 12 Form

Common Questions

What is the California LLC 12 Form?

The California LLC 12 Form, also known as the Statement of Information, is a document that every California limited liability company (LLC) must file with the Secretary of State. This form provides important information about the LLC, including its address, management, and agent for service of process. It must be filed within 90 days of registering the LLC and then every two years thereafter.

When is the LLC 12 Form due?

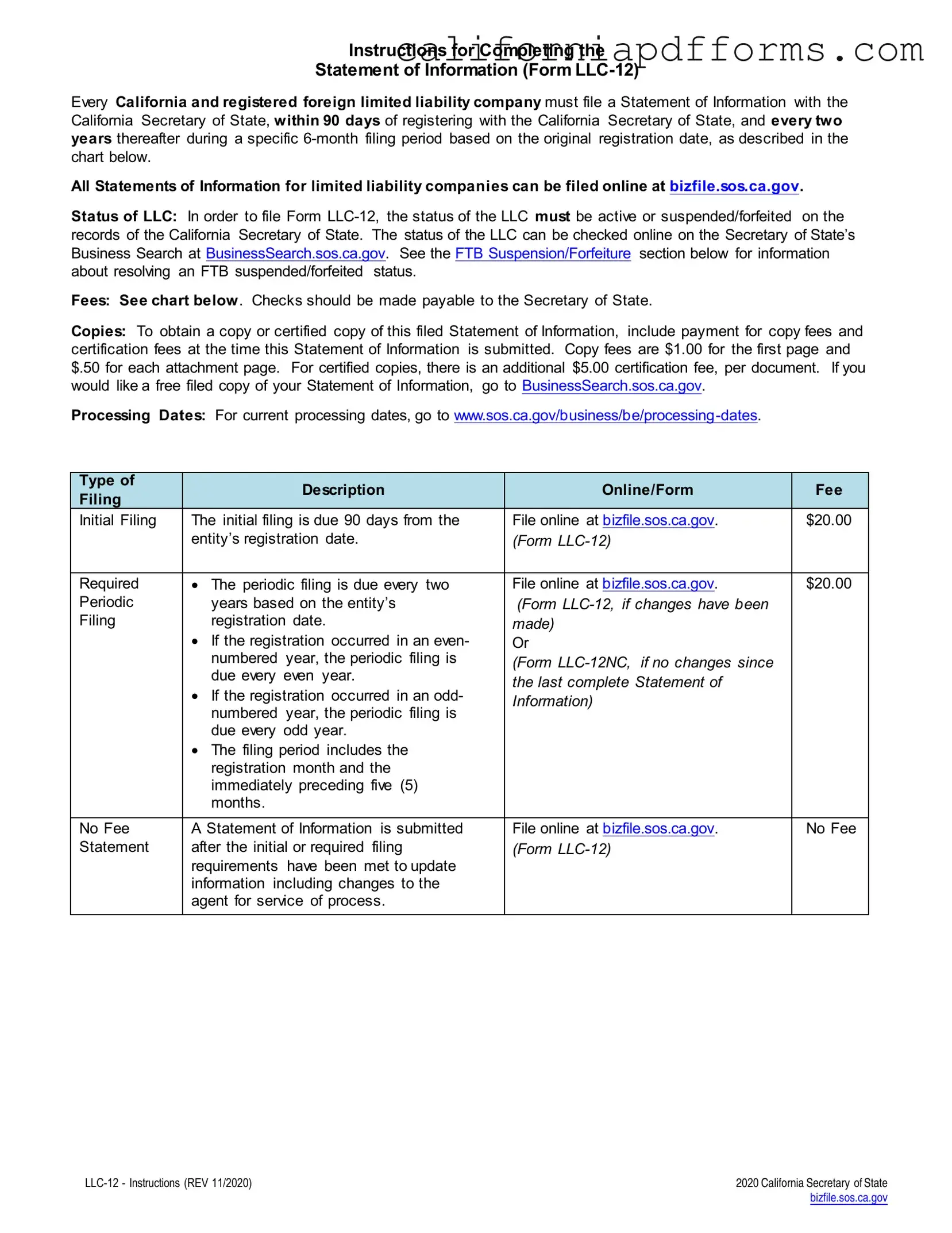

The initial filing of the LLC 12 Form is due within 90 days of the LLC's registration date. After that, the form must be filed every two years during a specific six-month period based on the original registration date. The exact filing period can be determined using a chart provided by the Secretary of State.

How can I file the LLC 12 Form?

The LLC 12 Form can be filed online at bizfile.sos.ca.gov . It can also be submitted by mail or in person at the Secretary of State's office in Sacramento. For online submissions, simply follow the prompts on the website. If filing by mail, send the completed form along with the applicable fees to the address provided in the instructions.

What are the fees associated with filing the LLC 12 Form?

The fee for filing the LLC 12 Form is $20.00 for both the initial and periodic filings. If you need a copy or certified copy of the filed Statement of Information, there are additional fees: $1.00 for the first page and $0.50 for each attachment page, plus a $5.00 certification fee per document if applicable.

What if my LLC's status is suspended or forfeited?

If the status of your LLC is suspended or forfeited, you must resolve this issue with the California Franchise Tax Board (FTB) before you can file the LLC 12 Form. This may involve taking specific steps to reinstate your LLC's active status. For more information, visit the FTB's website or contact them directly.

What information is required on the LLC 12 Form?

The LLC 12 Form requires several pieces of information, including:

- The exact name of the LLC as it appears on file.

- The 12-digit Entity (File) Number issued by the Secretary of State.

- The principal office address of the LLC.

- The name and address of the LLC's agent for service of process.

- A description of the LLC's principal business activity.

- Information about the LLC's management.

Can I update information on the LLC 12 Form?

How long does it take to process the LLC 12 Form?

The standard processing time for submissions to the Secretary of State is approximately five business days from the date of receipt. However, this time may vary, so it is advisable to check the current processing dates on the Secretary of State's website for the most accurate information.

Where can I find more information about the LLC 12 Form?

For more details about the LLC 12 Form, you can visit the California Secretary of State's website. There, you will find instructions, filing options, and additional resources to assist you with the filing process.

Document Specifications

| Fact Name | Details |

|---|---|

| Filing Requirement | All California and registered foreign LLCs must file Form LLC-12 within 90 days of registration and every two years thereafter. |

| Filing Period | The filing period is a specific 6-month window based on the original registration date. |

| Active Status | The LLC must be active or in a suspended/forfeited status to file Form LLC-12. |

| Filing Fees | The fee for filing Form LLC-12 is $20.00, payable to the Secretary of State. |

| Copy Fees | Copy fees are $1.00 for the first page and $0.50 for each additional page. A $5.00 certification fee applies for certified copies. |

| Online Filing | Form LLC-12 can be filed online at bizfile.sos.ca.gov for faster processing. |

| Legal Authority | The governing law for Form LLC-12 is found in Section 17702.09 of the California Corporations Code. |

Dos and Don'ts

When filling out the California LLC 12 form, it’s essential to ensure accuracy and compliance. Here’s a handy list of things to do and avoid:

- Do enter the LLC name exactly as it appears on file.

- Do provide the correct 12-digit Entity (File) Number issued by the Secretary of State.

- Do use a physical address for the LLC’s principal office.

- Do check the status of your LLC before filing to ensure it’s active.

- Don't abbreviate city names or use P.O. Box addresses.

- Don't forget to include the mailing address if it differs from the principal office address.

- Don't submit the form without checking for any required fees.

- Don't leave any sections blank; provide all necessary information.

By following these guidelines, you can help ensure a smooth filing process for your LLC in California.

Misconceptions

- Form LLC-12 is only for new LLCs. This form is actually required for both new and existing LLCs. Every LLC must file it within 90 days of registration and every two years thereafter.

- Filing Form LLC-12 is optional. In reality, filing is mandatory. Failing to submit it on time can lead to penalties, including a $250 fine.

- All LLCs can file Form LLC-12 regardless of status. Only LLCs that are active or suspended/forfeited can submit this form. If the status is inactive, filing is not permitted.

- Filing can be done anytime. There is a specific 6-month filing period based on the LLC's original registration date. Missing this window can result in penalties.

- There are no fees associated with filing. A fee of $20 is required for both initial and periodic filings. Additional fees apply for copies and certified copies.

- You can use a P.O. Box for the principal address. The principal office address must be a physical location. P.O. Boxes are not acceptable.

- Changes to the LLC do not need to be reported until the next filing period. Any changes, such as updates to the agent for service of process, can be reported at any time using a Statement of Information.

- Only one member or manager can be listed. While every LLC must have at least one, you can list multiple managers or members on the form.

- Submitting the form online is complicated. The online filing process is designed to be user-friendly. It simplifies the submission and ensures faster processing.

Documents used along the form

When forming a limited liability company (LLC) in California, several documents and forms accompany the filing of the California LLC 12 form. Each of these documents serves a specific purpose and is crucial for compliance with state regulations. Below is a list of commonly used forms that are often associated with the LLC 12 form.

- Form LLC-1: This is the Articles of Organization, the foundational document required to officially create an LLC. It includes essential details like the LLC’s name, address, and the name of the registered agent.

- Form LLC-12A: This form is used to provide additional information about the managers or members of the LLC. It is particularly important if there are multiple managers or members that need to be listed.

- Form LLC-12NC: If no changes have occurred since the last Statement of Information, this form can be filed instead of the standard LLC-12. It simplifies the process for those who have not made any updates.

- Form LLC-4/7: This form is for the Certificate of Dissolution. If the LLC needs to be dissolved, this document must be filed to officially terminate the business entity.

- Form LLC-4/8: This is the Certificate of Cancellation. It is used to cancel an LLC that has not yet commenced business or has not filed any tax returns.

- Form LLC-2: Known as the Statement of Information for Domestic Limited Liability Companies, this form provides detailed information about the LLC’s business activities and management structure.

- Form LLC-3: This form is the Certificate of Amendment, which is necessary when changes are made to the Articles of Organization, such as a change in the LLC’s name or address.

- Form LLC-5: The Statement of Information for Foreign Limited Liability Companies, this form is required for LLCs formed outside of California that wish to operate within the state.

Understanding these forms and their purposes is essential for maintaining compliance with California’s business regulations. Properly filing these documents not only ensures the legal standing of your LLC but also helps in the smooth operation of your business.

Different PDF Templates

Ftb 3803 - Submission of the form indicates that parents are making a choice in how their child's income is reported for tax purposes.

What Is the Tax Credit for 2023 - Converted claims may relate to unresolved tax disputes from previous years.

Is Workers Comp Required in California - Identify the type of employer in the provided section.