Download California Lp 102 Form

Common Questions

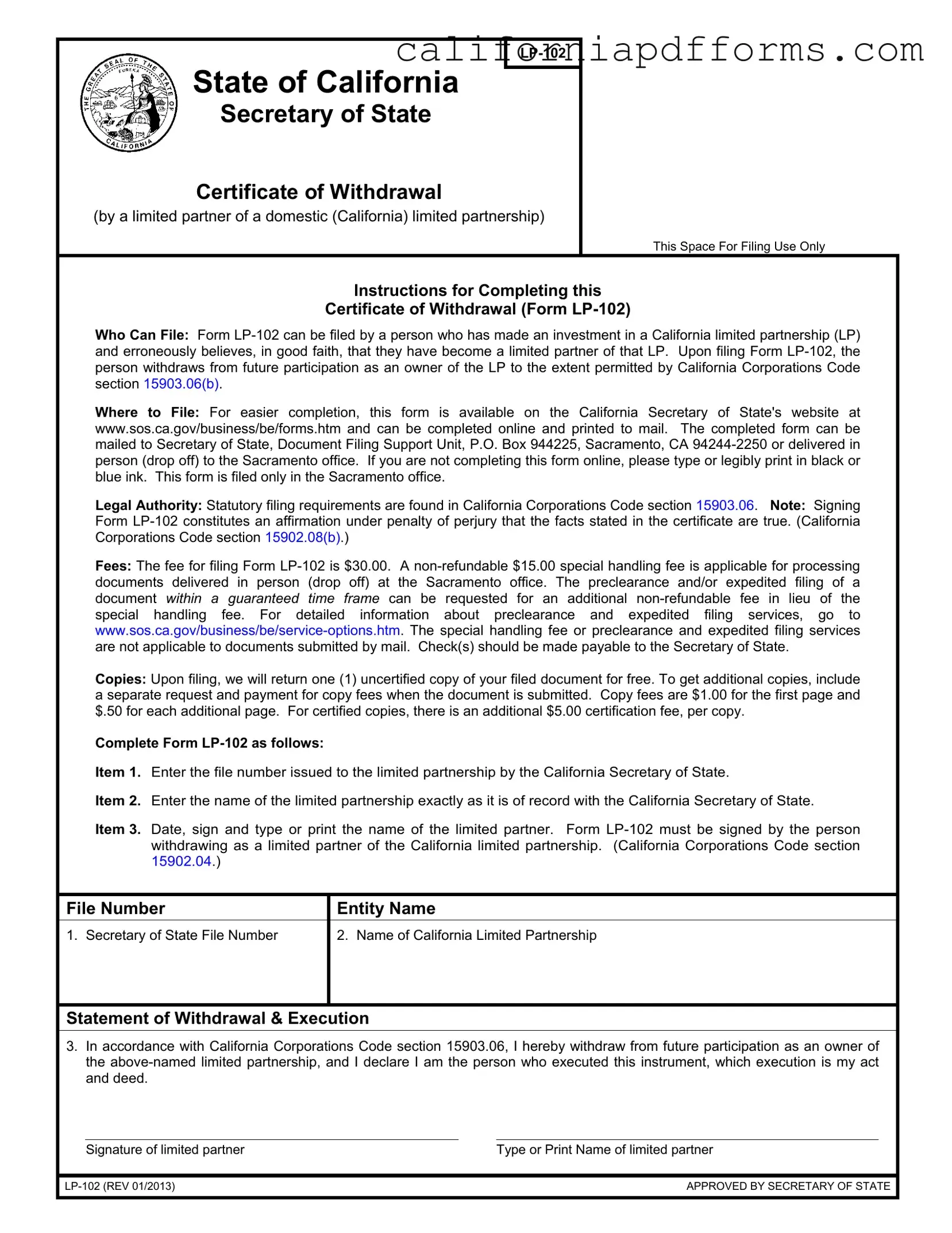

What is the purpose of the California LP-102 form?

The California LP-102 form is used by individuals who believe they have mistakenly become limited partners in a California limited partnership. By filing this form, they officially withdraw from any future participation as owners of that partnership.

Who is eligible to file the LP-102 form?

Any person who has made an investment in a California limited partnership and believes, in good faith, that they have become a limited partner can file this form. It is important that the individual genuinely feels they are withdrawing from their limited partner status.

Where should I file the LP-102 form?

You can file the LP-102 form by mailing it to the Secretary of State, Document Filing Support Unit, P.O. Box 944225, Sacramento, CA 94244-2250. Alternatively, you may deliver it in person to the Sacramento office. The form is also available online for easier completion.

What is the filing fee for the LP-102 form?

The standard fee for filing the LP-102 form is $30. If you choose to deliver the document in person, a non-refundable special handling fee of $15 will apply. Additional fees may be incurred for expedited services.

What happens after I file the LP-102 form?

Once the LP-102 form is filed, you will receive one free uncertified copy of the document. If you need additional copies, you must request them and include payment for copy fees at that time.

What information is required to complete the LP-102 form?

To complete the LP-102 form, you will need to provide:

- The file number assigned to the limited partnership by the California Secretary of State.

- The exact name of the limited partnership as recorded.

- Your signature, along with the date and your printed name as the limited partner withdrawing.

Is there a penalty for providing false information on the LP-102 form?

Yes, signing the LP-102 form is an affirmation under penalty of perjury. This means that if the information provided is found to be false, you could face legal consequences.

Can I get a certified copy of the LP-102 form?

Yes, you can request certified copies of the LP-102 form. There is an additional certification fee of $5 for each certified copy, along with the standard copy fees.

What should I do if I have more questions about the LP-102 form?

If you have further questions, you can visit the California Secretary of State's website or contact their office directly for assistance. They provide resources and guidance for completing and filing the LP-102 form.

Document Specifications

| Fact Name | Detail |

|---|---|

| Form Purpose | The LP-102 form is used by a limited partner to withdraw from a California limited partnership. |

| Who Can File | Any person who has invested in a California limited partnership and believes they are a limited partner can file this form. |

| Filing Location | This form must be filed at the Sacramento office of the Secretary of State, either by mail or in person. |

| Legal Authority | The filing requirements are governed by California Corporations Code section 15903.06. |

| Filing Fees | The fee for filing Form LP-102 is $30. A $15 special handling fee applies for in-person submissions. |

| Copy Fees | One uncertified copy is returned for free. Additional copies cost $1.00 for the first page and $0.50 for each additional page. |

| Signature Requirement | The form must be signed by the withdrawing limited partner, affirming the truth of the information provided. |

Dos and Don'ts

When filling out the California LP-102 form, it is essential to follow specific guidelines to ensure proper submission. Here are five things to do and five things to avoid:

- Do: Complete the form online for ease of use and accuracy.

- Do: Enter the limited partnership name exactly as it appears in official records.

- Do: Sign the form, as it is required to validate your withdrawal.

- Do: Use black or blue ink if you are filling out the form by hand.

- Do: Include the correct fee when submitting the form to avoid delays.

- Don't: Forget to include your file number; it is crucial for processing.

- Don't: Use any other color ink besides black or blue if completing by hand.

- Don't: Leave any fields blank; all required information must be filled out.

- Don't: Submit the form without signing it, as this will invalidate your request.

- Don't: Ignore the instructions for filing; ensure you follow the guidelines to the letter.

Misconceptions

- Anyone can file Form LP-102. Only individuals who have made an investment in a California limited partnership and mistakenly believe they are a limited partner can file this form.

- Filing Form LP-102 is optional. It is a necessary step for those who wish to withdraw from their mistaken status as a limited partner.

- Form LP-102 can be filed anywhere. This form must be filed specifically in the Sacramento office of the Secretary of State.

- There are no fees associated with filing Form LP-102. A fee of $30.00 is required, along with a possible $15.00 special handling fee for in-person submissions.

- Filing online is not allowed. In fact, the form can be completed online for convenience before printing and mailing it.

- Submitting the form guarantees withdrawal from the partnership. While it initiates the withdrawal process, the actual withdrawal is subject to compliance with California Corporations Code.

- One copy of the filed document is the only copy provided. You will receive one free uncertified copy, but additional copies can be requested for a fee.

- All fields on Form LP-102 are optional. Certain fields, such as the file number and partnership name, are mandatory and must be completed accurately.

- Signing the form is a mere formality. Signing the form affirms under penalty of perjury that the information provided is true and accurate.

Documents used along the form

The California LP-102 form is a crucial document for individuals seeking to withdraw from a limited partnership. However, several other forms and documents may also be necessary or useful in conjunction with this withdrawal process. Below is a list of commonly associated forms and documents, each described briefly for clarity.

- LP-1: Certificate of Limited Partnership - This document establishes the existence of a limited partnership in California. It includes details such as the partnership's name, its principal office address, and the names of the general partners.

- LP-3: Certificate of Amendment - This form is used to amend the existing Certificate of Limited Partnership. Changes could include modifications to the partnership name, address, or the roles of partners.

- LP-4: Certificate of Cancellation - This document is filed to officially dissolve a limited partnership. It indicates that the partnership has ceased operations and outlines the distribution of remaining assets.

- LP-5: Statement of Information - This form provides updated information about the limited partnership, including changes in the partners' details or the business address. It must be filed periodically to keep the state informed.

- LP-6: Certificate of Conversion - This document is filed when a limited partnership wishes to convert to a different business structure, such as a corporation or limited liability company (LLC).

- LP-7: Statement of Withdrawal of General Partner - Similar to the LP-102, this form is specifically for general partners wishing to withdraw from a limited partnership. It details their exit and the implications for the partnership.

- LP-8: Statement of Resignation - This document allows a partner to formally resign from their position within the partnership, outlining the effective date and any remaining obligations.

- Form 5500: Annual Return/Report of Employee Benefit Plan - If the limited partnership has employee benefit plans, this form may be required to report on the financial condition and operations of the plan.

- Form 990: Return of Organization Exempt from Income Tax - Nonprofit limited partnerships may need to file this form to report their income, expenses, and activities to the IRS.

Understanding these forms and their purposes is essential for anyone involved in a limited partnership in California. Properly managing documentation can ensure compliance with state regulations and facilitate smoother transitions for partners withdrawing from the partnership.

Different PDF Templates

California Courts - This page can help streamline your court submissions.

California Tr 0106 - Applicants must understand the risks involved and agree to hold the state harmless for any injuries or damages incurred.