Download California Mc 011 Form

Common Questions

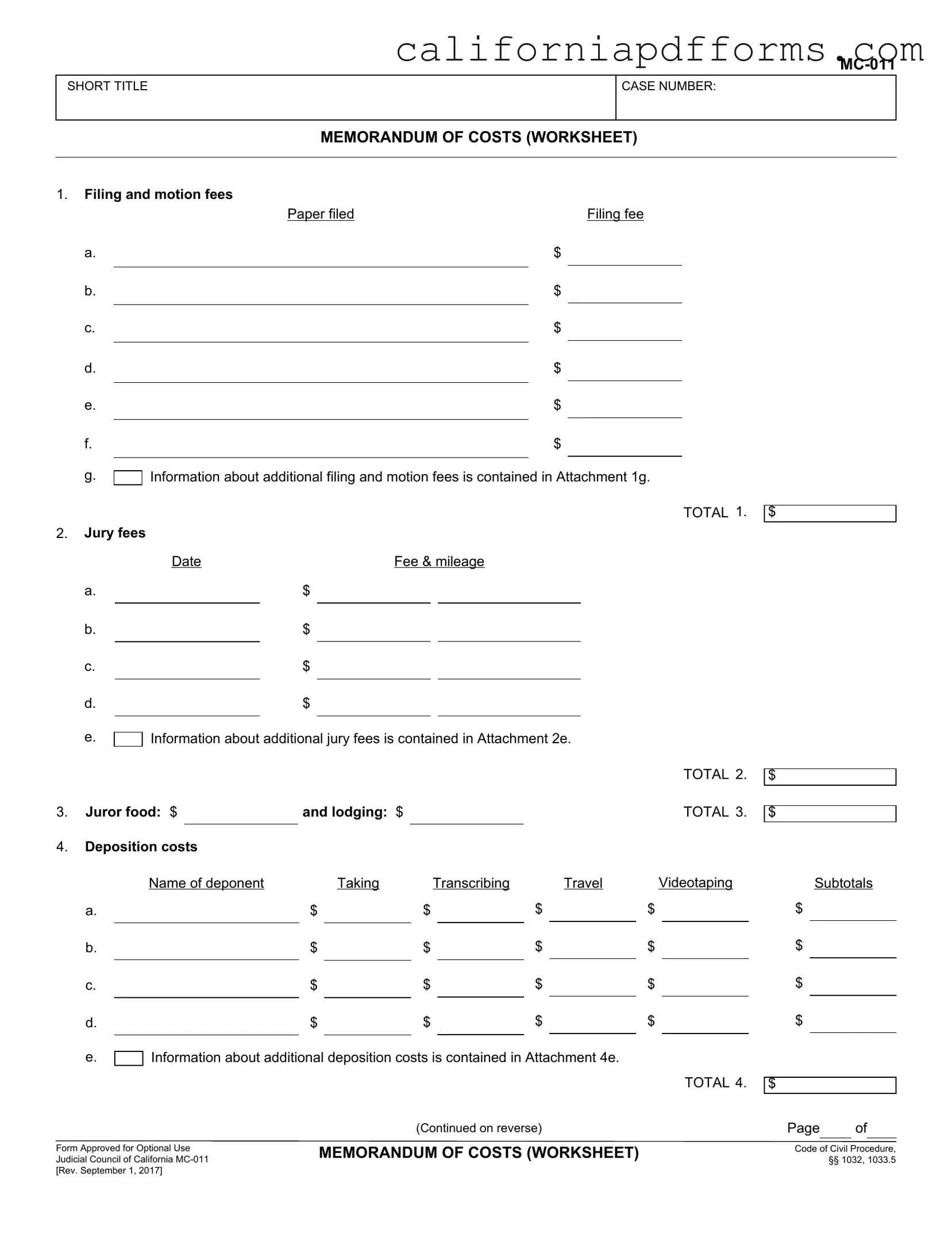

What is the California MC-011 form?

The California MC-011 form, also known as the Memorandum of Costs (Worksheet), is used to itemize and request reimbursement for costs incurred during legal proceedings. This form helps parties outline their expenses related to filing fees, jury fees, deposition costs, service of process, and other legal expenses. It is an essential document for those seeking to recover costs in civil cases.

Who should use the MC-011 form?

The MC-011 form is intended for parties involved in civil litigation in California. Both plaintiffs and defendants may use this form to document and claim costs associated with their case. It is particularly useful for those who have incurred significant expenses and wish to seek reimbursement through the court.

What types of costs can be included on the MC-011 form?

Various costs can be included on the MC-011 form, such as:

- Filing and motion fees

- Jury fees

- Deposition costs

- Service of process expenses

- Witness fees (ordinary and expert)

- Attorney fees (if fixed without a court determination)

- Costs for court transcripts

- Interpreter fees

- Electronic filing and service fees

- Other specified costs

Each category allows for detailed itemization of expenses, making it easier for the court to review and approve requests for reimbursement.

How do I fill out the MC-011 form?

To complete the MC-011 form, follow these steps:

- Provide the short title of the case and the case number at the top of the form.

- Itemize each category of costs, including specific amounts for each expense.

- Ensure that all calculations are accurate and that totals are clearly indicated.

- If necessary, attach additional documentation or explanations as referenced in the form.

Review the form for completeness before submitting it to the court.

When should the MC-011 form be submitted?

The MC-011 form should be submitted after the conclusion of the legal proceedings, typically when the party is seeking to recover costs. It is important to adhere to any deadlines set by the court for submitting cost memoranda. Failure to submit within the specified timeframe may result in the loss of the right to recover those costs.

Can I include attorney fees on the MC-011 form?

Yes, attorney fees can be included on the MC-011 form, but only if they are fixed by contract or statute without the need for a court determination. If attorney fees require a noticed motion, they should not be included on this form. It is essential to follow the specific guidelines provided in the form regarding attorney fees.

What if I have additional costs not listed on the MC-011 form?

If there are additional costs that are not specifically listed on the MC-011 form, you can specify them in the “Other” section at the end of the form. Be sure to provide a clear description and the associated costs. Supporting documentation may also be helpful to justify these additional expenses.

Where can I find more information about the MC-011 form?

Additional information about the MC-011 form can be found on the California Judicial Branch website or through local court resources. It is advisable to review any relevant guidelines or instructions provided by the court to ensure compliance with filing requirements.

Document Specifications

| Fact Name | Fact Description |

|---|---|

| Form Title | The MC-011 form is titled "Memorandum of Costs (Worksheet)" and is used to itemize costs in California civil cases. |

| Governing Law | This form is governed by the California Code of Civil Procedure, specifically sections 1032 and 1033.5. |

| Filing Fees | Filing and motion fees must be documented on the form. Additional details can be found in Attachment 1g. |

| Jury Fees | Jury fees, including fees and mileage, are recorded on the form. More information is available in Attachment 2e. |

| Deposition Costs | Costs related to depositions, such as taking, transcribing, and travel, are included. Refer to Attachment 4e for more details. |

| Service of Process | Costs for service of process must be listed. Additional information can be found in Attachment 5d. |

| Expert Fees | Expert fees can be claimed under different categories, including court-ordered fees. Details are provided in Attachments 8a, 8b, and 8c. |

Dos and Don'ts

When filling out the California MC-011 form, it is essential to follow specific guidelines to ensure accuracy and compliance. Here are ten things to keep in mind:

- Do read the instructions carefully before starting.

- Do fill out all required sections completely.

- Do double-check your calculations for accuracy.

- Do use clear and legible handwriting or type the information.

- Do keep copies of the completed form for your records.

- Don't leave any mandatory fields blank.

- Don't use abbreviations unless specified in the instructions.

- Don't submit the form without reviewing it thoroughly.

- Don't forget to sign and date the form where required.

- Don't include unnecessary attachments that are not requested.

By adhering to these guidelines, you can help ensure that your MC-011 form is processed smoothly and efficiently. Taking the time to complete the form correctly can save you from potential delays or complications in your case.

Misconceptions

Understanding the California MC-011 form can be challenging, and several misconceptions can lead to confusion. Here are four common misunderstandings:

- The MC-011 form is only for attorneys. Many believe that only legal professionals can use this form. In reality, anyone involved in a legal case can submit the MC-011 to claim costs incurred during litigation.

- All costs can be claimed without limitation. Some individuals think they can claim any expense related to their case. However, the law specifies which costs are recoverable, such as filing fees, jury fees, and certain expert witness fees. It is crucial to understand these limitations.

- The form must be filed immediately after the case concludes. There is a misconception that the MC-011 must be submitted right after a case is resolved. In fact, there is typically a specific timeframe within which costs must be claimed, often within 15 days after the judgment or dismissal.

- Providing receipts is unnecessary. Some believe they can simply list costs without supporting documentation. This is incorrect; it is essential to provide receipts or evidence for the expenses claimed to ensure they are considered valid by the court.

Documents used along the form

The California MC-011 form, known as the Memorandum of Costs (Worksheet), is a crucial document used in civil litigation to outline the costs incurred during a case. Several other forms and documents complement this form, each serving specific purposes in the litigation process. Below is a list of these documents, along with brief descriptions of their functions.

- MC-012 - This form is used to request a hearing on costs. It allows parties to contest the costs listed in the MC-011, providing an opportunity for judicial review.

- MC-013 - This document is for the declaration of costs. It supports the MC-011 by providing a detailed account of the costs incurred and justifications for each expense.

- MC-014 - The request for an award of attorney fees is documented here. This form is essential when seeking reimbursement for legal representation costs.

- MC-015 - This form is used for filing a motion to tax costs. It challenges specific costs listed in the MC-011, allowing the opposing party to argue against them.

- MC-016 - This is a notice of motion for costs. It formally notifies the court and opposing parties of the intent to seek recovery of costs associated with the litigation.

- MC-017 - This document serves as an application for a court order regarding costs. It outlines the reasons for seeking costs and the legal basis for the request.

- MC-018 - This is a proof of service form. It verifies that all parties have been properly notified of the costs being claimed, ensuring compliance with legal requirements.

- MC-019 - This form is used to submit additional evidence supporting the claimed costs. It may include invoices, receipts, or other documentation relevant to the expenses incurred.

- MC-020 - This is a stipulation regarding costs, which allows parties to agree on the costs without court intervention, streamlining the process of cost recovery.

These forms and documents play a vital role in the process of recovering costs in California civil litigation. They ensure that all parties have a clear understanding of the expenses involved and provide mechanisms for contesting or agreeing on those costs. Proper use of these forms can significantly impact the efficiency and outcome of a case.

Different PDF Templates

California Fl 455 - Extraordinary hardship due to the earnings assignment order can be cited as a reason for requesting a stay.

California Radiology License Application - Providing a telephone number is necessary for any follow-up questions by the Department.

Jurat California - The California Jurat reduces the chances of misinterpretation of signed documents.