Download California Mc 012 Form

Common Questions

-

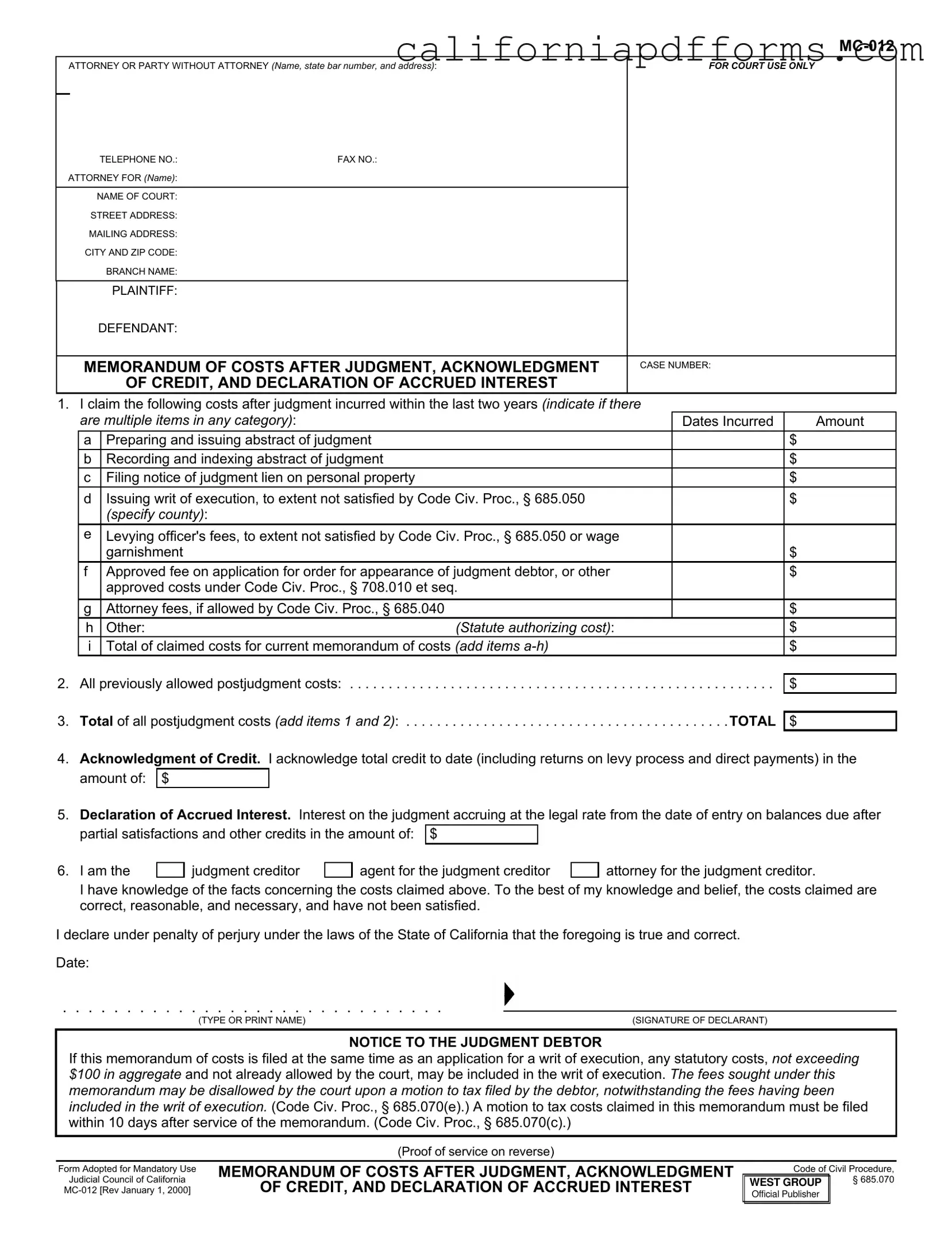

What is the purpose of the California MC-012 form?

The California MC-012 form, known as the Memorandum of Costs After Judgment, Acknowledgment of Credit, and Declaration of Accrued Interest, serves multiple purposes. It allows a judgment creditor to claim costs incurred after a judgment has been entered. This includes costs related to the enforcement of the judgment, such as filing fees and attorney fees. Additionally, it provides a way to acknowledge any credits that have been applied to the judgment and declare any accrued interest on the judgment amount.

-

Who should file the MC-012 form?

The MC-012 form should be filed by the judgment creditor or their representative. This can include an attorney acting on behalf of the creditor or an agent authorized to manage the collection of the judgment. It is important that the individual filing the form has knowledge of the costs being claimed and can verify their accuracy.

-

What types of costs can be claimed on the MC-012 form?

The form allows for various types of costs to be claimed, including:

- Preparing and issuing an abstract of judgment

- Recording and indexing the abstract of judgment

- Filing notice of judgment lien on personal property

- Issuing a writ of execution

- Levying officer's fees

- Approved fees for the appearance of the judgment debtor

- Attorney fees, if permitted by law

- Other costs as authorized by statute

Each claimed cost must be itemized with the corresponding amounts and dates incurred.

-

How is interest on the judgment calculated on the MC-012 form?

Interest on the judgment is calculated at the legal rate from the date of entry of the judgment. The form requires the judgment creditor to declare the total amount of accrued interest on any balances due after accounting for partial satisfactions and credits. This declaration must be accurate and reflect the correct legal rate applicable to the judgment.

-

What happens if the MC-012 form is filed with a writ of execution?

If the MC-012 form is filed alongside an application for a writ of execution, certain statutory costs can be included in the writ. However, these costs must not exceed $100 in total and should not have already been allowed by the court. It's crucial to note that the debtor has the right to challenge these fees through a motion to tax costs, which must be filed within ten days of service of the memorandum.

-

What are the consequences of filing inaccurate costs on the MC-012 form?

Filing inaccurate costs can lead to disallowance of the claimed fees by the court. If a debtor files a motion to tax costs, the court will review the claimed amounts. If the court finds that the costs are unreasonable or incorrect, it may deny the request for those costs. Therefore, it is essential to ensure that all claims are correct, reasonable, and necessary.

-

How should the MC-012 form be served?

The MC-012 form must be served to the judgment debtor either by mail or personal delivery. If mailing, the individual serving the document must be at least 18 years old and not a party to the case. The form requires details about the service, including the name of the person served, their address, and the date of service. Proper proof of service must be completed and included with the filing.

Document Specifications

| Fact Name | Description |

|---|---|

| Purpose | The MC-012 form is used to claim costs incurred after a judgment has been issued in a civil case in California. |

| Governing Law | This form is governed by the California Code of Civil Procedure, specifically sections 685.040 and 685.070. |

| Filing Requirement | The form must be filed with the court to recover post-judgment costs, and it may be included in an application for a writ of execution. |

| Cost Categories | Costs that can be claimed include fees for preparing abstracts, recording judgments, and attorney fees, among others. |

| Deadline for Motion to Tax | A debtor has 10 days to file a motion to tax costs claimed in the MC-012 after being served with the memorandum. |

| Declaration of Accuracy | The person completing the form must declare under penalty of perjury that the claimed costs are accurate and reasonable. |

Dos and Don'ts

When filling out the California MC-012 form, there are important guidelines to keep in mind. Here are four things to do and not do:

- Do: Make sure to accurately list all costs incurred after judgment within the last two years.

- Do: Double-check that all amounts are correctly added up in the total section.

- Don't: Leave any sections blank; provide information for each required field.

- Don't: Forget to sign and date the form before submitting it to the court.

Misconceptions

- Misconception 1: The MC-012 form is only for attorneys.

- Misconception 2: The form is only necessary if the judgment debtor has not paid anything.

- Misconception 3: Once filed, the costs cannot be challenged.

- Misconception 4: All costs listed must be automatically approved by the court.

- Misconception 5: The MC-012 form does not require supporting documentation.

- Misconception 6: Filing the MC-012 guarantees immediate payment.

- Misconception 7: The form is only relevant for certain types of judgments.

- Misconception 8: The MC-012 must be filed in person.

This form can be used by both attorneys and individuals representing themselves in court. Anyone who is a judgment creditor can file it.

The MC-012 is important even if the debtor has made partial payments. It helps document all costs and accrued interest related to the judgment.

The judgment debtor has the right to challenge the costs claimed in the MC-012. They can file a motion to tax costs within a specified timeframe.

Not all costs will be approved. The court can disallow certain fees if they do not meet legal requirements or if they are deemed unreasonable.

While the form itself does not require attachments, it is advisable to keep records of all costs claimed in case they need to be justified later.

Filing the form does not guarantee payment. It is simply a step in the process of enforcing a judgment.

The MC-012 can be used for various types of judgments, including monetary judgments and those involving specific performance.

This form can be filed by mail or electronically in many jurisdictions, making it more accessible for those unable to visit the courthouse.

Documents used along the form

The California MC-012 form is often used in conjunction with several other documents to ensure that all necessary information is submitted to the court. Below is a list of common forms and documents that may accompany the MC-012, each serving a specific purpose in the post-judgment process.

- MC-013: Notice of Motion for Writ of Execution - This form is used to request the court to issue a writ of execution, allowing the creditor to collect on the judgment through various means, such as wage garnishment or property seizure.

- MC-014: Writ of Execution - This document is the court's order that authorizes the enforcement of a judgment. It provides the legal basis for the creditor to take action against the debtor's assets.

- MC-015: Application for Order for Appearance of Judgment Debtor - This form is filed to request a court order requiring the judgment debtor to appear in court to answer questions about their finances and ability to pay the judgment.

- MC-016: Declaration of Accrued Interest - This document outlines the interest that has accrued on the judgment amount since it was entered, providing a clear record of what is owed.

- MC-017: Request for Hearing on Motion to Tax Costs - If the debtor contests the costs claimed in the MC-012, this form is used to request a hearing to resolve the dispute.

- MC-018: Proof of Service - This form provides evidence that the MC-012 and any related documents were properly served to the debtor or other parties involved in the case.

- MC-019: Judgment Lien on Personal Property - This document is filed to create a lien against the debtor's personal property, ensuring that the creditor has a claim to the property until the judgment is satisfied.

- MC-020: Notice of Entry of Judgment - This form serves to inform the debtor and other interested parties that a judgment has been entered, detailing the specifics of the case and the amount owed.

- MC-021: Application for Order for Examination of Judgment Debtor - Similar to the MC-015, this form requests a court order for a debtor's examination to determine their financial situation.

- MC-022: Statement of Costs - This document itemizes the costs incurred by the creditor in the collection process, providing transparency and justification for the amounts claimed.

Using these forms effectively can streamline the post-judgment collection process. Each document plays a vital role in ensuring that creditors can enforce their rights while maintaining compliance with court procedures.

Different PDF Templates

Tro California - Use the CH-115 to ask for a new court date after receiving a Notice of Court Hearing.

State of California Health and Human Services Agency Forms - A contact phone number for the primary care physician allows for smoother coordination of care.