Download California Note Secured Form

Common Questions

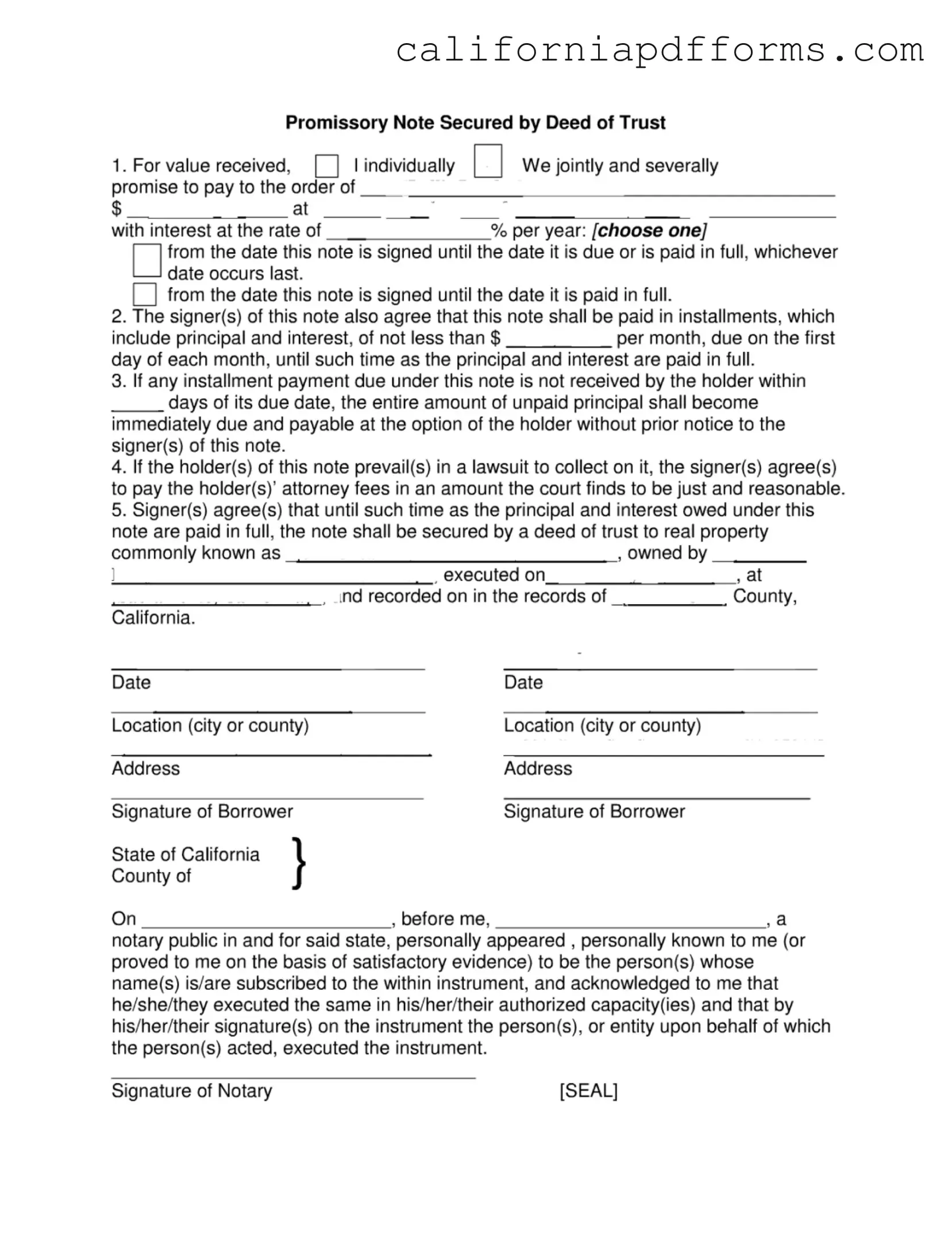

What is the California Note Secured form?

The California Note Secured form is a legal document that outlines a promissory note secured by a deed of trust. This document is used when a borrower agrees to pay back a loan, with the loan being secured by real property. It details the terms of repayment, including the amount borrowed, interest rates, and payment schedule.

Who can sign the California Note Secured form?

Both individuals and entities can sign the California Note Secured form. If multiple parties are involved, they can be jointly and severally liable, meaning each party is responsible for the entire amount of the loan. This allows the lender to seek repayment from any one of the borrowers if the others default.

What information is required on the form?

The form requires specific details, including:

- The names of the borrower(s).

- The amount of money being borrowed.

- The interest rate.

- The payment schedule, including the amount of each installment.

- The property being used as collateral.

Accurate information is crucial to ensure the enforceability of the note.

What happens if a payment is missed?

If a borrower fails to make a payment within the specified grace period, the lender has the option to declare the entire unpaid principal amount due immediately. This means that all outstanding amounts become payable without prior notice to the borrower, which can lead to serious financial consequences.

Can the terms of the note be modified?

Yes, the terms of the note can be modified, but such changes typically require mutual consent from both the borrower and the lender. It is advisable to document any modifications in writing to avoid disputes later on.

What is a deed of trust?

A deed of trust is a legal document that secures a loan by using real property as collateral. In the event of default, the lender can initiate foreclosure proceedings to recover the loan amount by selling the property. This provides the lender with a level of security for the loan.

Are attorney fees recoverable under this note?

Yes, if the lender prevails in a lawsuit to collect on the note, the borrower agrees to pay the lender's attorney fees. The amount awarded will be determined by the court based on what it finds to be just and reasonable.

Is notarization required for the California Note Secured form?

Yes, notarization is required for the California Note Secured form. A notary public must witness the signing of the document to verify the identities of the signers and ensure that they are signing voluntarily. This adds a layer of authenticity to the document.

What should I do if I need help filling out the form?

If you need assistance with the California Note Secured form, consider consulting with a legal professional. They can provide guidance on how to accurately complete the document and ensure that it meets all legal requirements.

Where should I keep the completed form?

Once the California Note Secured form is completed and signed, it is important to keep it in a safe place. Both the borrower and the lender should retain copies for their records. This ensures that both parties have access to the terms and conditions agreed upon.

Document Specifications

| Fact Name | Description |

|---|---|

| Promissory Note | This document serves as a promise to pay a specified amount of money, with interest, to a designated party. |

| Installment Payments | Payments are made monthly, including both principal and interest, until the debt is fully paid. |

| Default Clause | If a payment is late, the entire unpaid balance may become due immediately, at the holder's discretion. |

| Attorney Fees | If a lawsuit is necessary to collect the debt, the signer may be responsible for the holder's attorney fees. |

| Secured by Deed of Trust | The note is secured by a deed of trust on real property, ensuring the lender has a claim to the property until the debt is settled. |

Dos and Don'ts

When filling out the California Note Secured form, consider the following guidelines to ensure accuracy and compliance.

- Do: Clearly state the amount being borrowed, including the dollar amount and the interest rate.

- Do: Specify the payment schedule, including the amount of each installment and the due date.

- Do: Ensure all signers provide their signatures and that the document is notarized.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any blank spaces in the form; all fields should be filled out completely.

- Don't: Forget to review the terms carefully before signing to avoid misunderstandings.

- Don't: Use vague language; be precise about the terms of the loan and obligations.

- Don't: Ignore the importance of having the document notarized, as this adds legal validity.

Misconceptions

Understanding the California Note Secured form is crucial for both borrowers and lenders. However, several misconceptions often arise. Here are five common misunderstandings:

- Misconception 1: The note does not require monthly payments.

- Misconception 2: There is no penalty for late payments.

- Misconception 3: The holder cannot recover attorney fees.

- Misconception 4: The deed of trust does not secure the note.

- Misconception 5: The notary's role is unimportant.

Many believe that they can make payments at their convenience. In reality, the form specifies that payments must be made in installments, including both principal and interest, on the first day of each month.

Some assume that late payments will not have immediate consequences. However, if a payment is not received within a specified number of days, the entire unpaid principal may become due immediately at the holder's discretion.

It is a common belief that the holder cannot recover legal fees. In fact, if the holder prevails in a lawsuit, the signer agrees to pay reasonable attorney fees as determined by the court.

Some people think that the note is unsecured. However, the form clearly states that the note is secured by a deed of trust to real property until the principal and interest are fully paid.

Many underestimate the importance of the notary. The notary public verifies the identities of the signers and ensures that the document is executed properly, which is essential for the note's enforceability.

Documents used along the form

When dealing with a California Note Secured form, several other documents may be necessary to ensure a comprehensive understanding and legal standing of the agreement. Below is a list of forms and documents commonly used alongside the California Note Secured form. Each entry provides a brief description of its purpose.

- Deed of Trust: This document secures the promissory note by placing a lien on the property. It outlines the rights and responsibilities of both the borrower and the lender, ensuring that the lender can reclaim the property if the borrower defaults.

- Loan Agreement: A detailed contract between the lender and borrower that specifies the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any fees associated with the loan.

- Disclosure Statement: This document provides the borrower with important information regarding the loan, including the total cost of the loan, payment schedule, and any potential penalties for late payments.

- Promissory Note: A written promise by the borrower to pay back the loan amount to the lender, detailing the terms of repayment and any interest that may accrue.

- Borrower's Affidavit: A sworn statement by the borrower affirming their identity and the accuracy of the information provided in the loan application and related documents.

- Credit Report Authorization: This form allows the lender to obtain the borrower’s credit report, which helps assess the borrower’s creditworthiness and ability to repay the loan.

- Title Report: A document that verifies the ownership of the property and ensures there are no liens or claims against it, providing peace of mind to the lender.

- Insurance Policy: Proof of insurance on the property being used as collateral, protecting both the borrower and lender in case of damage or loss.

- Payment Schedule: A detailed outline of when payments are due, how much is owed each time, and the total duration of the loan, aiding in financial planning for the borrower.

- Notice of Default: A formal notification sent to the borrower if they fail to make payments as agreed, outlining the consequences and potential actions the lender may take.

These documents work together to create a clear framework for the loan agreement, ensuring that both parties understand their rights and obligations. Having all necessary forms in order can help prevent misunderstandings and protect the interests of both the borrower and the lender.

Different PDF Templates

California 501c3 - The exemption begins on the date specified by the fleet owner.

Current Inactive Real Estate License - Signatures must be authentic; countersigned or photocopied signatures are not accepted.

Fppc - All income received during the reporting period must be reported on the 700-U form.