Download California Rs 3 Form

Common Questions

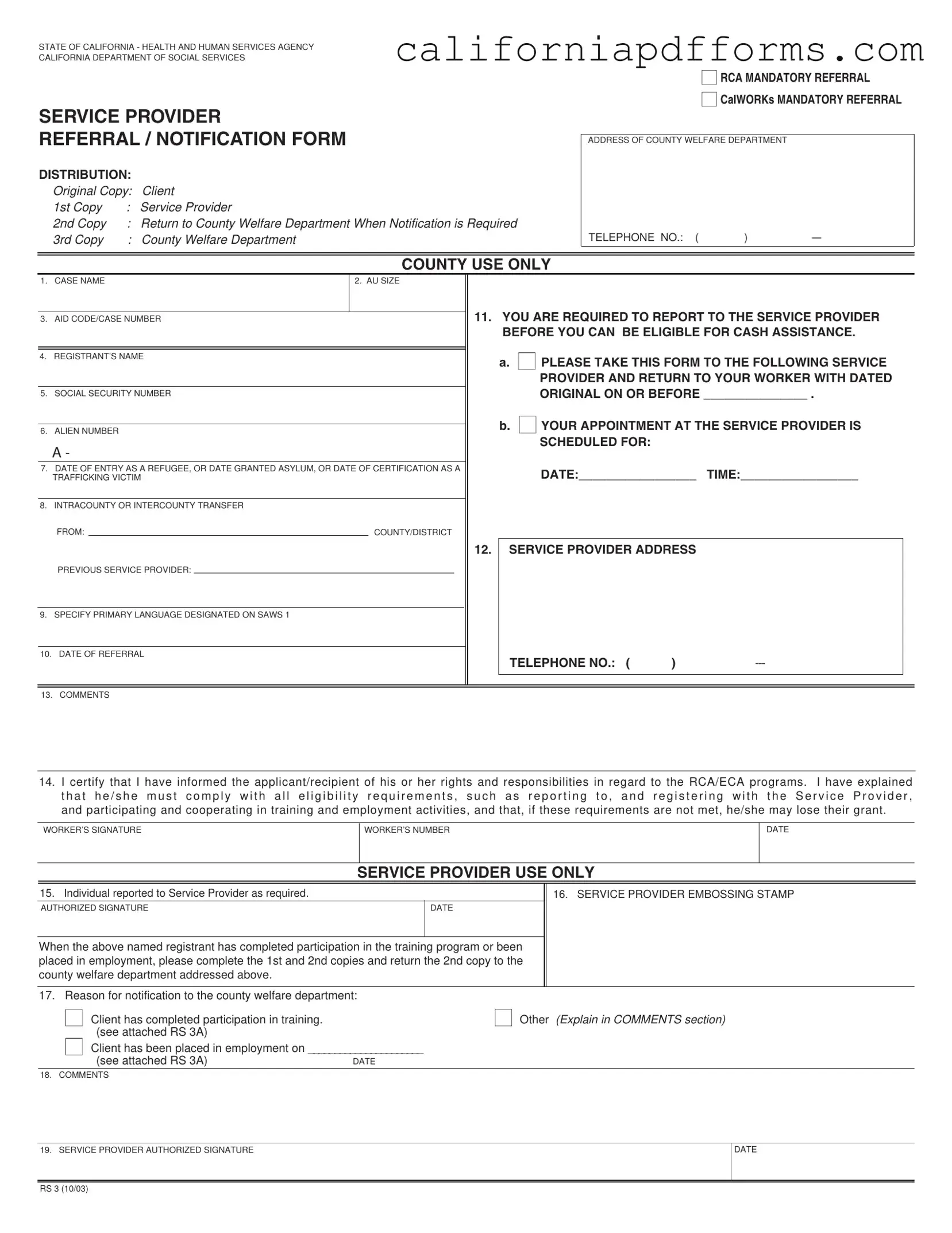

What is the California Rs 3 form?

The California Rs 3 form is a notification and referral form used by the Department of Social Services. It is primarily for individuals who are receiving cash assistance through programs like CalWORKs or Refugee Cash Assistance (RCA). The form ensures that clients are referred to necessary service providers and helps track their participation in required training or employment activities.

Who needs to fill out the Rs 3 form?

The Rs 3 form must be filled out for individuals who are part of an assistance unit (AU) and are required to report to a service provider. This typically includes refugees or those receiving public assistance. The form is completed by a county worker and must include specific information about the client, such as their name, social security number, and details about their appointment with the service provider.

What happens after the Rs 3 form is completed?

Once the Rs 3 form is completed, the client must take it to the designated service provider. They are required to return the form with a dated original copy to their county worker by a specified date. If the client completes their training or finds employment, the service provider will notify the county welfare department using the form. This helps ensure that clients remain eligible for their cash assistance.

What are the consequences of not complying with the Rs 3 form requirements?

If a client does not comply with the requirements outlined in the Rs 3 form, they may risk losing their cash assistance. It is essential for clients to attend their appointments and participate in the necessary training or employment activities. Failure to do so can lead to a loss of benefits, which can significantly impact their financial stability.

Document Specifications

| Fact Name | Details |

|---|---|

| Governing Law | The California Rs 3 form is governed by the California Welfare and Institutions Code, particularly sections related to public assistance programs. |

| Purpose | This form is used for mandatory referrals to service providers for individuals receiving cash assistance through programs like RCA and CalWORKs. |

| Distribution | The original copy goes to the client, the first copy is for the service provider, and the second copy is returned to the County Welfare Department. |

| Required Information | Key details such as case name, aid code, registrant’s name, and social security number must be filled out for proper processing. |

| Appointment Scheduling | The form allows for scheduling appointments with service providers, ensuring clients receive necessary assistance in a timely manner. |

| Compliance | Clients must comply with eligibility requirements, including registration with service providers, to maintain their cash assistance benefits. |

Dos and Don'ts

When filling out the California Rs 3 form, it’s important to follow specific guidelines to ensure accuracy and compliance. Here are some dos and don’ts:

- Do enter the registrant’s name clearly, including last name, first name, and middle initial.

- Do provide the correct social security number for the registrant.

- Do check the box indicating the date the registrant is to return the validated original form.

- Do ensure that the service provider’s address is complete, including street, city, and zip code.

- Don't leave any fields blank; all required information must be filled out.

- Don't use abbreviations or shorthand that may confuse the reader.

- Don't forget to sign the form where required, as an unsigned form may be rejected.

- Don't submit the form without verifying all entries for accuracy.

Misconceptions

Understanding the California Rs 3 form can be challenging due to various misconceptions. Here are five common misunderstandings about this important document:

- The Rs 3 form is optional for clients. Many people believe that completing the Rs 3 form is not mandatory. In reality, this form is a required step for individuals seeking cash assistance through programs like RCA or CalWORKs. Clients must report to the designated service provider as instructed.

- Only refugees need to fill out the Rs 3 form. While the form is specifically designed for refugees and certain eligible individuals, it is not exclusive to them. Any applicant who falls under the specified assistance programs must complete the form to ensure compliance with eligibility requirements.

- Submitting the Rs 3 form guarantees cash assistance. Some individuals mistakenly think that merely submitting the Rs 3 form will automatically result in cash assistance. However, eligibility for benefits depends on meeting all requirements, including attending scheduled appointments and participating in necessary training or employment activities.

- The information on the Rs 3 form is not confidential. There is a concern that the details provided on the Rs 3 form can be shared freely. In fact, the information is treated with strict confidentiality and is used solely for the purpose of determining eligibility for assistance programs.

- Once the Rs 3 form is submitted, no further action is required. Some believe that submitting the form concludes their responsibilities. On the contrary, clients must remain engaged with their service provider and fulfill ongoing obligations, such as attending appointments and participating in programs, to maintain their eligibility.

By clearing up these misconceptions, individuals can better navigate the requirements associated with the California Rs 3 form and ensure they receive the assistance they need.

Documents used along the form

The California RS 3 form is used for mandatory referrals to service providers for individuals receiving cash assistance. Several other documents often accompany this form to ensure proper processing and compliance with requirements. Below is a list of these related forms and documents.

- RS 3A Form: This form is used to provide additional details about the client's participation in training programs or employment. It is typically attached to the RS 3 form when a client has completed their training or been placed in a job.

- SAWS 1 Form: The Statewide Automated Welfare System (SAWS) 1 form captures essential information about the assistance unit, including details about the primary language spoken by the client. This information is crucial for service providers to offer appropriate support.

- Employment Verification Form: This document is used to confirm a client's employment status. It may include details such as the employer's name, job title, and duration of employment. This verification is often required for eligibility assessments.

- Client Rights and Responsibilities Document: This document outlines the rights and responsibilities of clients participating in assistance programs. It ensures that clients are aware of their obligations, including compliance with training and employment requirements.

- County Welfare Department Notification Form: This form is used to inform the County Welfare Department of any changes in a client's status, such as completion of training or changes in employment. Timely notifications are essential for maintaining accurate records and ensuring continued eligibility.

These forms and documents work together with the RS 3 form to facilitate effective communication and compliance within the assistance program. Proper completion and submission of these documents help ensure that clients receive the support they need.

Different PDF Templates

Gpa Verification Form Cal Grant - Double-check your information on the G 8 form to ensure accuracy and completeness.

Fl334 - It ensures that both parties are kept informed of each other's financial actions.

Where to File California Tax Return - The form requires the reporting of an organization’s accounting method, such as cash or accrual accounting.