Download California Sales Tax Certificate Form

Common Questions

To whom do I give this certificate?

If you are purchasing goods for resale, you will give this certificate to your vendor. This ensures that your vendor does not charge you sales tax. If you are selling goods for resale and have received this certificate from your buyer, you will keep the certificate on file for your records.

Can I register for multiple states simultaneously?

Yes, you can register for multiple states at the same time. For detailed instructions, visit www.sstregister.org .

I have received this certificate from my customer. What do I do with it?

After examining the certificate, if you accept it in good faith, keep it on file as required by your state laws. The relevant state is typically where you are located or where the sales transaction occurred.

Am I the Buyer or the Seller?

If you are purchasing goods for resale, you are the Buyer. Conversely, if you are selling goods to a buyer who intends to resell them, you are the Seller.

What is the purpose of this certificate?

This certificate serves as documentation that the Seller should not collect sales tax. It confirms that either the good or service sold, or the Buyer, is exempt from the tax.

How do I fill out the certificate?

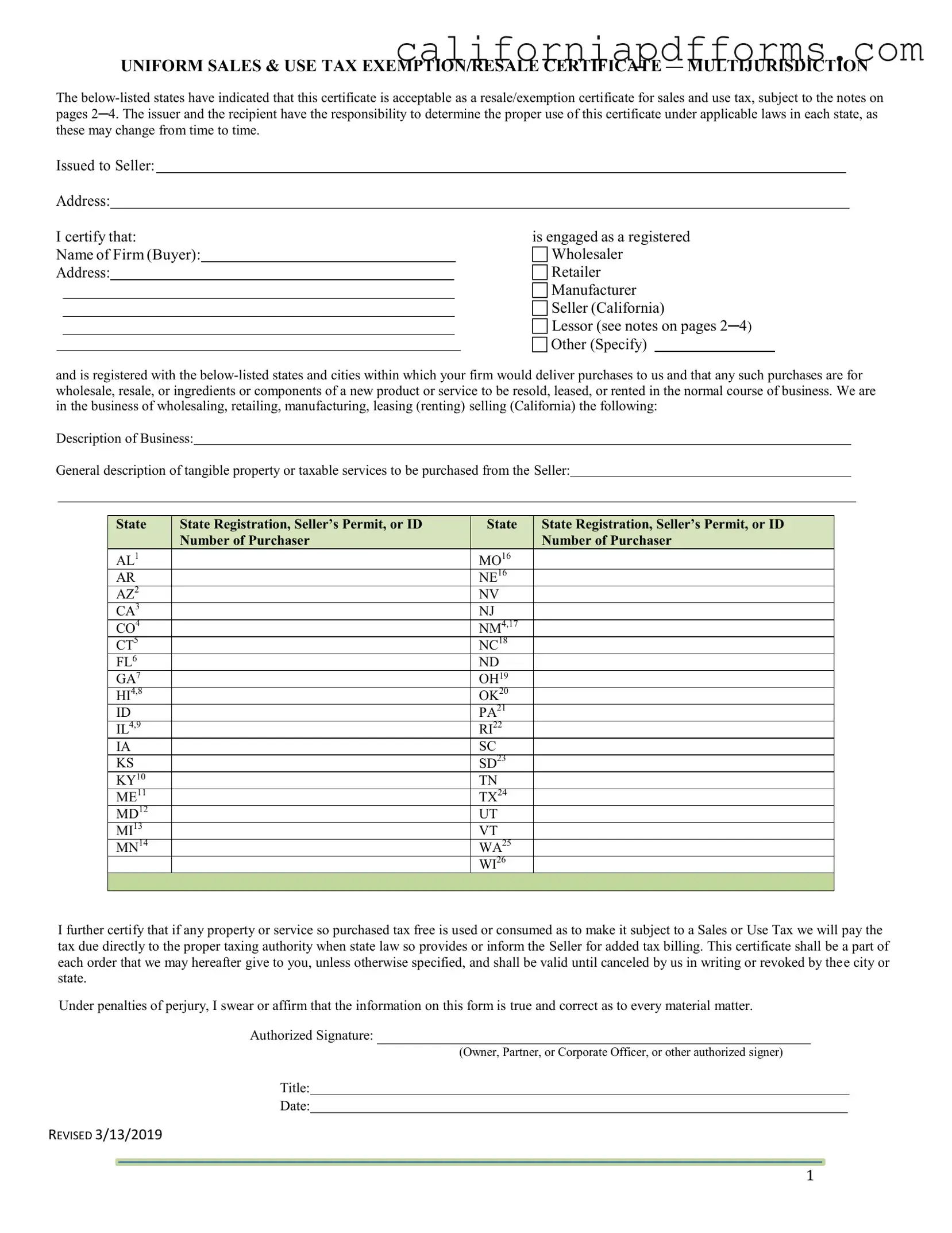

The Buyer is responsible for filling out the certificate. Start with the “Issued to Seller” section, providing the necessary details about the transaction and the parties involved.

What information goes on the line next to each state abbreviation?

You should enter your state registration, seller's permit, or ID number next to each applicable state abbreviation. This information verifies your eligibility for tax exemption in those states.

What if I don’t have an ID number for any (or some) state(s)?

If you do not have an ID number for certain states, you may not be able to use this certificate for those states. It is important to provide valid identification numbers where required to ensure compliance with tax laws.

Who should use this certificate?

This certificate should be used by buyers who are purchasing goods for resale. Sellers should also use it to document transactions where the buyer claims a tax exemption.

Document Specifications

| Fact Name | Description |

|---|---|

| Purpose | The California Sales Tax Certificate is primarily used to certify that a purchase is for resale, thereby exempting the buyer from sales tax on that transaction. |

| Governing Law | This certificate is governed by Title 18, California Code of Regulations, Section 1668. |

| Validity | The certificate remains valid until it is revoked in writing by the issuer or by the state. |

| Who Uses It? | Buyers, including wholesalers, retailers, manufacturers, and lessors, can use this certificate to claim tax exemption for resale purchases. |

| Seller's Responsibility | Sellers must keep a properly executed certificate on file to avoid liability for sales tax. |

| Not an Exemption Certificate | This certificate is not valid for claiming tax exemptions on purchases other than for resale. |

| Signature Requirement | The certificate must be signed by an authorized person, such as an owner, partner, or corporate officer. |

| Multiple States | The certificate can be used in multiple jurisdictions, but each state may have specific rules regarding its acceptance. |

| Penalties for Misuse | Misuse of the certificate may lead to penalties, including fines or imprisonment, depending on the state. |

| Filing Instructions | Buyers should provide the certificate to the seller at the time of purchase to avoid being charged sales tax. |

Dos and Don'ts

When filling out the California Sales Tax Certificate form, there are several important guidelines to follow. Here’s a list of what you should and shouldn't do:

- Do: Ensure that all sections of the form are filled out completely and accurately.

- Do: Provide your business name and address clearly to avoid any confusion.

- Do: Confirm that you are registered in the appropriate states before submitting the form.

- Do: Keep a copy of the completed form for your records.

- Do: Sign and date the form to validate your certification.

- Don't: Leave any sections blank; incomplete forms may lead to issues later.

- Don't: Use this form for purchases that do not qualify for resale; it could result in penalties.

- Don't: Assume that the seller will know how to process the form without your guidance.

- Don't: Forget to check the specific requirements for your state, as they can vary.

- Don't: Submit the form without reviewing it for errors or omissions.

Misconceptions

- Misconception 1: The certificate can be used as a general tax exemption.

- Misconception 2: Any business can use this certificate without restrictions.

- Misconception 3: The seller is responsible for verifying the validity of the certificate.

- Misconception 4: The certificate is valid indefinitely.

- Misconception 5: The certificate can be used for all types of purchases.

- Misconception 6: A verbal agreement is sufficient to validate the use of the certificate.

This is incorrect. The California Sales Tax Certificate is specifically a resale certificate. It does not grant a blanket exemption from sales tax for all purchases.

Not true. Only businesses engaged in wholesaling, retailing, manufacturing, or leasing can use this certificate for purchases intended for resale. Each state has specific rules regarding its use.

While sellers should exercise care, the responsibility primarily lies with the buyer to ensure they are eligible for the exemption. Sellers can be held liable if they do not accept the certificate in good faith.

This is misleading. The certificate remains valid until it is canceled in writing by the buyer or revoked by the state. Regular updates are recommended to ensure compliance.

This is false. The certificate is only valid for tangible personal property or services that are intended for resale. It cannot be used for taxable services in certain states.

This is incorrect. A properly filled-out certificate must be presented to the seller. Verbal agreements do not satisfy the legal requirements for tax exemption.

Documents used along the form

The California Sales Tax Certificate form is often accompanied by various other forms and documents that facilitate tax exemption claims or provide necessary information for sales transactions. Below is a list of these documents, each serving a specific purpose.

- Seller's Permit: This document is issued by the state to businesses allowing them to collect sales tax from customers. It is essential for any business selling tangible goods in California.

- Resale Certificate: This certificate allows buyers to purchase goods without paying sales tax if they intend to resell the items. It must be provided to the seller at the time of purchase.

- Exemption Certificate: Used by buyers who qualify for tax exemptions due to specific reasons, such as being a nonprofit organization. This certificate must be presented to the seller to avoid tax charges.

- Tax Exempt Letter: A formal letter from a tax-exempt organization stating its status. This letter can be used to support claims for tax exemption on purchases.

- Business License: This document proves that a business is legally allowed to operate in California. It is often required to establish credibility with suppliers.

- IRS Form W-9: This form provides the taxpayer identification number of a business. It is commonly requested by vendors to ensure accurate tax reporting.

- Sales Tax Return: A periodic report submitted to the state detailing sales tax collected and owed. This form is crucial for compliance and accurate tax reporting.

- Purchase Order: A document issued by a buyer to a seller indicating the details of a purchase. It serves as a formal agreement and helps in tracking orders.

- Invoice: A detailed bill from the seller to the buyer outlining the products or services provided, along with the total amount due. It is essential for record-keeping and tax purposes.

- Certificate of Good Standing: This document verifies that a business is legally registered and compliant with state regulations. It may be required for certain transactions or partnerships.

Understanding these documents and their purposes is vital for businesses operating in California. Proper documentation ensures compliance with state tax laws and can prevent unnecessary tax liabilities. Always consult a professional if you have questions about specific requirements or processes.

Different PDF Templates

California Re 214 - Information collected on the RE 214 form is regulated by California privacy laws.

Judicial Council Forms California - The L 206 form can streamline the process of regaining full ownership of the property.

Form 3523 - Credits can be reduced by various percentages depending on the entity type.