Download California Sc 223 Form

Common Questions

-

What is the purpose of the California SC-223 form?

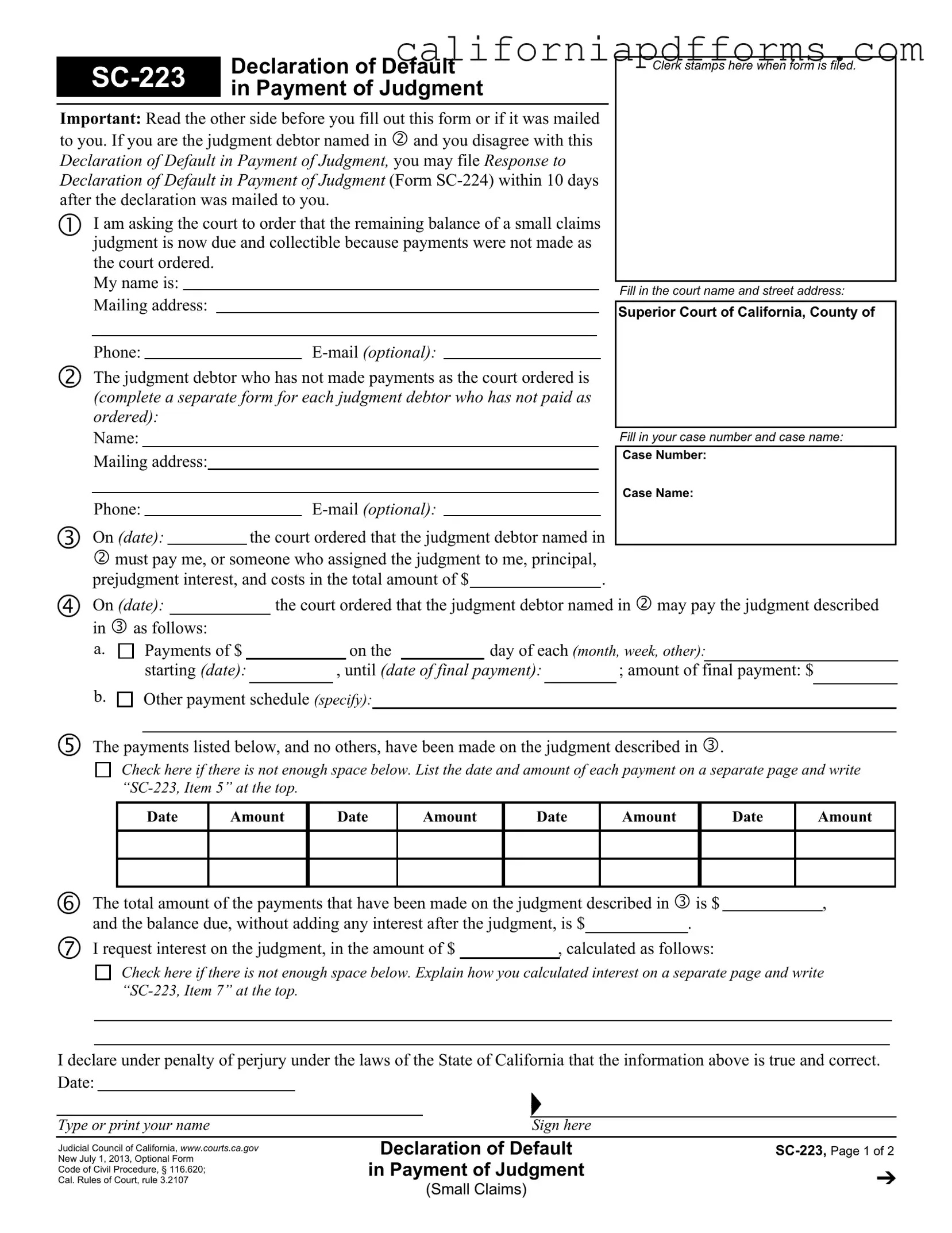

The California SC-223 form, known as the Declaration of Default in Payment of Judgment, is used to inform the court that a judgment debtor has failed to make the payments as ordered by the court. This form allows the judgment creditor to request that the full balance of the judgment become due and collectible due to the missed payments.

-

Who should fill out the SC-223 form?

The SC-223 form should be filled out by the judgment creditor, the person or entity to whom the money is owed. If there are multiple judgment debtors who have not made payments as ordered, a separate form must be completed for each debtor.

-

What information is required on the SC-223 form?

Key information needed includes:

- Your name and contact information.

- The name and contact information of the judgment debtor.

- The case number and case name.

- The total amount of the judgment and the payment schedule.

- A detailed account of any payments made and the remaining balance.

- Any interest being requested on the unpaid judgment.

-

What happens after I file the SC-223 form?

Once the form is filed with the small claims court clerk, the court will notify all parties involved. They will receive a copy of the declaration along with a blank Response form (SC-224). The judgment debtor has 10 days to respond to the declaration.

-

What if the judgment debtor disagrees with the SC-223 declaration?

If the judgment debtor disagrees with the declaration, they can file a Response to Declaration of Default in Payment of Judgment (Form SC-224) within 10 days of receiving the declaration. This response must be served to all parties involved in the case.

-

When is the judgment due?

Generally, small claims judgments are due immediately unless the court specifies otherwise. If the judgment is not paid in full within 30 days, the judgment creditor can take legal actions to collect the unpaid amount.

-

Can a judgment debtor request to make payments?

Yes, a judgment debtor can request the court's permission to make payments on the judgment. If granted, the judgment creditor cannot take further collection actions as long as payments are made on time. However, if payments are missed, the creditor can request that the full balance become due.

-

Is interest charged on the unpaid judgment?

Yes, interest at a rate of 10 percent per year is typically added to the unpaid amount from the date the judgment is entered until it is fully paid. However, if the court allows a payment plan and all payments are made on time, interest may not be charged.

-

How do I calculate interest on the judgment?

To calculate interest, you need to determine the unpaid principal balance and the number of days interest should apply. Interest is calculated at a rate of 10 percent per year. If payments have been made, separate calculations must be done for the reduced principal balance after each payment.

-

Where can I get help with the SC-223 form?

For assistance, you can contact your county's small claims advisor or visit the California courts website at www.courts.ca.gov/smallclaims/advisor for resources and guidance.

Document Specifications

| Fact Name | Description |

|---|---|

| Purpose | The SC-223 form is used to request the court to declare that the remaining balance of a small claims judgment is due because the judgment debtor has failed to make payments as ordered. |

| Response Time | If a judgment debtor disagrees with the declaration, they have 10 days from the date the declaration was mailed to file a Response using Form SC-224. |

| Governing Laws | This form is governed by the California Code of Civil Procedure, § 116.620 and the California Rules of Court, rule 3.2107. |

| Filing Process | The completed SC-223 form must be filed with the small claims court clerk, who will then notify all parties involved in the case. |

Dos and Don'ts

When filling out the California SC-223 form, it's important to follow specific guidelines to ensure your submission is correct and effective. Here are ten things to do and not do:

- Do read the entire form carefully before filling it out.

- Do fill out page 1 completely, including all required information.

- Do provide a separate form for each judgment debtor who has not made payments.

- Do file your completed form(s) with the small claims court clerk.

- Do keep a copy of the form for your records.

- Don't leave any required fields blank; ensure all information is provided.

- Don't submit the form without double-checking for accuracy.

- Don't forget to list the date and amount of each payment made, if applicable.

- Don't ignore the deadline for filing a response if you disagree with the declaration.

- Don't hesitate to seek help from a small claims advisor if you have questions.

Misconceptions

There are several misconceptions about the California SC-223 form, which can lead to confusion for those involved in small claims judgments. Here are four common misunderstandings:

- Misconception 1: The SC-223 form can be filed without any prior payments being made.

- Misconception 2: Filing the SC-223 form guarantees immediate collection of the full judgment amount.

- Misconception 3: Interest is automatically added to the judgment amount after filing the SC-223 form.

- Misconception 4: The SC-223 form can be used for multiple judgment debtors on one form.

This is incorrect. The SC-223 form is intended for situations where a judgment debtor has failed to make the payments as ordered by the court. If no payments have been made, the judgment creditor must first seek a court order allowing payments before filing this form.

Filing the SC-223 does not automatically mean the full amount is collectible. After the form is filed, the court will notify all parties involved, and the judgment debtor has the right to respond within 10 days. A hearing may be scheduled to determine the next steps.

This is misleading. Interest may be added to the unpaid judgment amount, but it depends on the court's order. If the court allows payments and they are made on time, interest may not be included. If payments are missed, interest could then become due.

This is not true. A separate SC-223 form must be filled out for each judgment debtor who has not made payments as ordered. This ensures that the court has clear and accurate information regarding each debtor's payment status.

Documents used along the form

The California SC-223 form is a critical document for individuals seeking to enforce a small claims judgment when payments have not been made as ordered by the court. In addition to this form, there are several other documents that may be necessary or useful in the process of managing small claims judgments. Here’s a list of related forms and documents often used alongside the SC-223.

- SC-224 Response to Declaration of Default in Payment of Judgment: This form allows the judgment debtor to respond if they disagree with the declaration filed using SC-223. It must be submitted within 10 days of receiving the declaration.

- SC-112A Proof of Service by Mail: This document is used to confirm that the Response to Declaration of Default has been properly served to all relevant parties. It serves as evidence that the judgment creditor has been notified.

- SC-130 Request to Cancel Judgment: If circumstances change, a party may wish to cancel the judgment. This form is used to formally request the court to vacate the judgment under specific conditions.

- SC-101 Small Claims Complaint: This is the initial form used to file a small claims case. It details the claim being made against the defendant and sets the process in motion.

- SC-200 Request for Court Order: This form can be used to request various court orders related to the small claims case, including adjustments to payment schedules or other modifications.

- SC-300 Small Claims Judgment: This document outlines the court's decision regarding the small claims case, including the amount awarded to the plaintiff and the payment terms.

- SC-300A Notice of Entry of Judgment: This notice informs all parties involved that a judgment has been entered in the case. It is essential for keeping everyone updated on the status of the judgment.

- SC-120 Request to Set Aside Default Judgment: If a party believes a default judgment was entered incorrectly, they can use this form to request the court to set it aside and allow for a new hearing.

Understanding these documents can help ensure that you navigate the small claims process more effectively. Each form serves a specific purpose and can significantly impact the outcome of your case. It’s essential to fill out and submit the correct forms in a timely manner to protect your rights and interests.

Different PDF Templates

Fw-003 - Overall, the FW-010 is integral for individuals managing their financial responsibilities in court.

Writ of Mandate Meaning - Adhering to all submission procedures can significantly affect the petition's success.

Form 541 - If unable to pay the full amount by the deadline, pay as much as you can to reduce penalties.