Download California Schedule R Form

Common Questions

What is the purpose of the California Schedule R form?

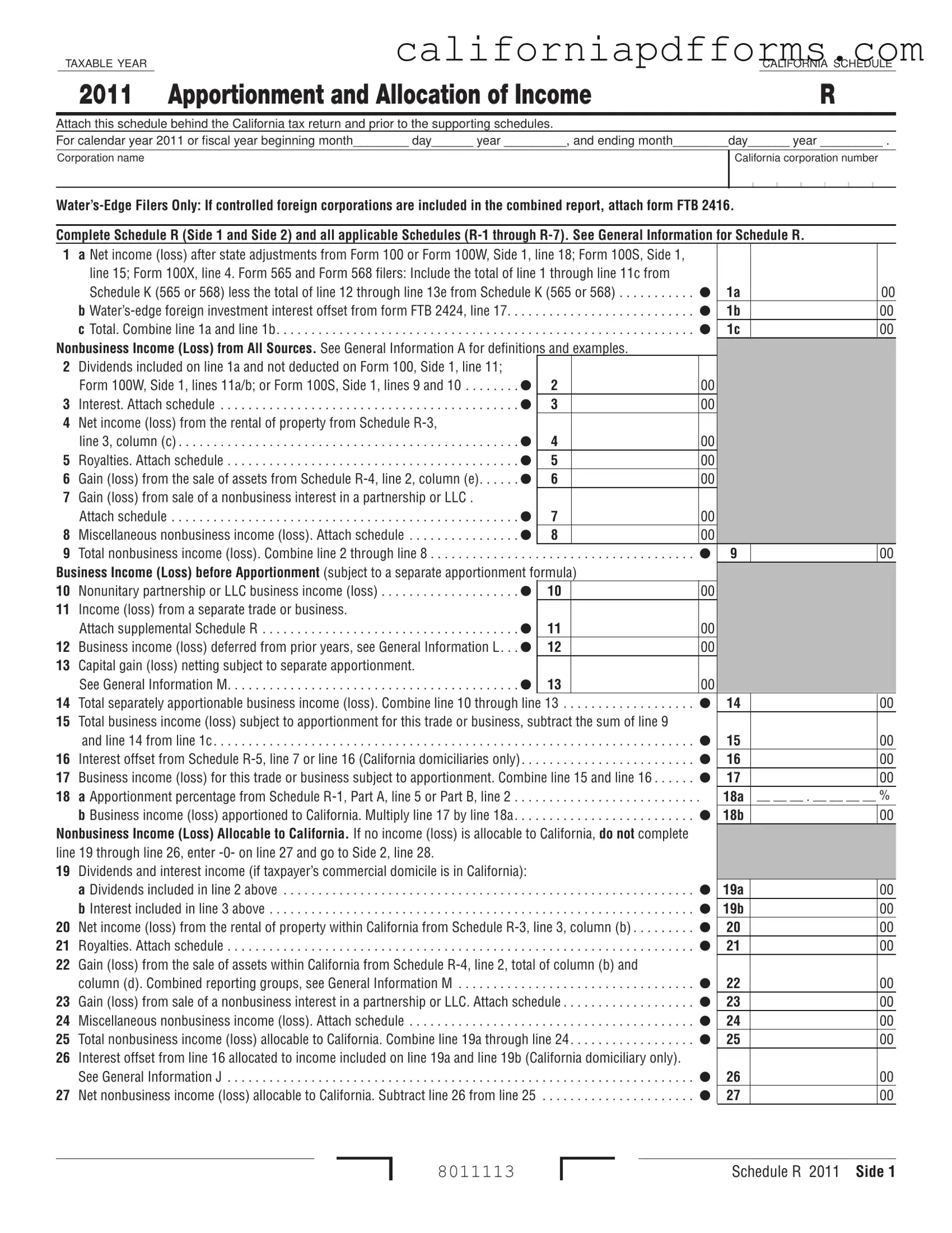

The California Schedule R form is used to report the apportionment and allocation of income for corporations doing business in California. It helps determine how much of a corporation's income is subject to California tax based on its business activities within the state.

Who needs to file Schedule R?

Corporations that have income from business activities in California must file Schedule R. This includes corporations that are part of a combined reporting group and those that elect to use the water's-edge method. If a corporation has controlled foreign corporations included in its combined report, it must also attach form FTB 2416.

What information is required to complete Schedule R?

To complete Schedule R, corporations need to provide:

- Net income or loss after state adjustments from the relevant tax form (Form 100, 100W, or 100S).

- Details on nonbusiness income and losses, including dividends, interest, rental income, and gains or losses from asset sales.

- Business income or loss before apportionment, including income from partnerships or LLCs.

- Apportionment percentage calculated using either the standard three-factor formula or the single-sales factor formula.

What is the apportionment percentage?

The apportionment percentage determines the portion of a corporation's income that is taxable in California. It is calculated based on the corporation's property, payroll, and sales within California compared to its total property, payroll, and sales. Corporations can choose between a standard three-factor formula or a single-sales factor formula for this calculation.

What types of income should be reported on Schedule R?

Schedule R requires reporting both business and nonbusiness income. Business income includes income from regular operations and activities, while nonbusiness income includes dividends, interest, rental income, and gains from the sale of nonbusiness assets. Each type of income must be detailed separately to ensure accurate apportionment.

How do I report nonbusiness income allocable to California?

To report nonbusiness income allocable to California, fill out the relevant lines on Schedule R that pertain to dividends, interest, rental income, and gains from sales of assets located in California. If no income is allocable, enter -0- on the designated line and proceed to the next section.

What happens if I do not file Schedule R?

Failure to file Schedule R when required may result in penalties and interest on any unpaid taxes. The California Franchise Tax Board may also estimate your tax liability, which could lead to a higher tax bill than if you had accurately reported your income.

Where should I attach Schedule R when filing my tax return?

Schedule R should be attached behind the main California tax return (Form 100, 100W, or 100S) and before any supporting schedules. Ensure that all relevant information is completed accurately to avoid delays in processing your return.

Document Specifications

| Fact Name | Fact Description |

|---|---|

| Purpose | The California Schedule R form is used for the apportionment and allocation of income for corporations operating in multiple states. |

| Filing Requirement | Corporations must attach Schedule R to their California tax return, specifically Form 100, Form 100W, or Form 100S. |

| Taxable Year | Schedule R can be used for both calendar and fiscal years, allowing flexibility in reporting. |

| Water’s-Edge Filers | Water’s-edge filers must include Form FTB 2416 if they have controlled foreign corporations in their combined report. |

| Nonbusiness Income | The form distinguishes between business income and nonbusiness income, with specific lines for each category. |

| Apportionment Percentage | Corporations must calculate their apportionment percentage using sales, property, and payroll factors, as detailed in Schedule R-1. |

| Interest Offset | California domiciled corporations can claim an interest offset, which reduces taxable income based on interest expenses. |

| Contribution Adjustments | Schedule R includes a section for adjusting contributions, impacting the net income for state purposes. |

| Governing Laws | Schedule R is governed by the California Revenue and Taxation Code, specifically Sections 25101-25137. |

| Attachments Required | Additional schedules (R-1 through R-7) must be completed based on the corporation's specific income sources and activities. |

Dos and Don'ts

When filling out the California Schedule R form, keep the following guidelines in mind:

- Do ensure you have the correct taxable year filled in at the top of the form.

- Don't skip any lines that apply to your situation; each line is important for accurate reporting.

- Do attach all required schedules, such as R-1 through R-7, behind the Schedule R form.

- Don't forget to double-check your calculations to avoid errors that could delay processing.

- Do clearly indicate any nonbusiness income or loss on the appropriate lines.

- Don't leave any fields blank; if a field does not apply, enter “-0-” as needed.

- Do review the General Information section for any specific instructions related to your business type.

Misconceptions

- Misconception 1: The California Schedule R is only for corporations.

- Misconception 2: You can skip Schedule R if your business has no income.

- Misconception 3: Schedule R is optional for California tax returns.

- Misconception 4: Only businesses operating in California need to file Schedule R.

- Misconception 5: Completing Schedule R is straightforward and does not require supporting documents.

- Misconception 6: The apportionment percentage is the same for all businesses.

- Misconception 7: Schedule R only addresses business income.

- Misconception 8: You can use prior year’s figures without adjustments.

- Misconception 9: Filing Schedule R guarantees lower taxes.

This form is designed for various types of entities, including limited liability companies (LLCs) and partnerships, not just corporations.

If your business has no income, you still need to complete Schedule R to report any nonbusiness income or losses that may be applicable.

Schedule R is a required form for those who need to report apportionment and allocation of income, so it cannot be skipped.

Even businesses located outside California may need to file Schedule R if they have income sourced to California.

Many entries on Schedule R require additional schedules and documentation, such as Schedules R-1 through R-7, to substantiate the figures reported.

The apportionment percentage can vary based on the business's specific activities and how income is generated, so it must be calculated individually.

Schedule R also deals with nonbusiness income, which can significantly affect tax calculations.

Each tax year is unique, and figures from previous years may need adjustments based on current tax laws and business activities.

While proper completion can optimize tax obligations, it does not guarantee a lower tax bill, as tax liability depends on various factors including income levels and deductions.

Documents used along the form

The California Schedule R form is used for the apportionment and allocation of income for corporations operating in California. When filing this form, several other documents may be required to provide additional information and support. Below is a list of commonly used forms and documents that often accompany the California Schedule R.

- Form 100: This is the California Corporation Franchise or Income Tax Return. Corporations must complete this form to report their income, deductions, and tax liability.

- Form 100W: This form is specifically for corporations that are classified as "water's-edge" filers. It is used to report income and apportion it to California.

- Form 100S: This is the California S Corporation Franchise or Income Tax Return. S Corporations must use this form to report their income and pay taxes.

- Form 565: Partnerships use this form to report their income, deductions, and credits. It includes information on each partner's share of the income.

- Form 568: This form is for Limited Liability Companies (LLCs) to report their income and pay the required fees and taxes in California.

- Schedule R-1: This schedule calculates the apportionment formula used to determine how much income is subject to California tax based on various factors, including property, payroll, and sales.

- Schedule R-2: This is a sales and general questionnaire that provides additional details about the corporation's business activities and sales figures.

- Schedule R-3: This schedule reports the net income or loss from the rental of nonbusiness property, detailing income and deductions related to rental activities.

- Schedule R-4: Used to report gains or losses from the sale of nonbusiness assets, this schedule details the transactions involving property sold in or out of California.

- Schedule R-5: This schedule computes interest offsets for California domiciliary corporations, detailing how interest expenses and income are calculated.

These forms and schedules provide critical information that supports the calculations made on the California Schedule R. Ensure that all relevant documents are completed accurately to facilitate a smooth filing process.

Different PDF Templates

California Dca - Gold Shield certification can enhance a station's reputation within the community.

Forming an Llc in California - List the name and address of any manager appointed per the Articles of Organization.