Download California Scratchers Form

Common Questions

What is the purpose of the California Scratchers form?

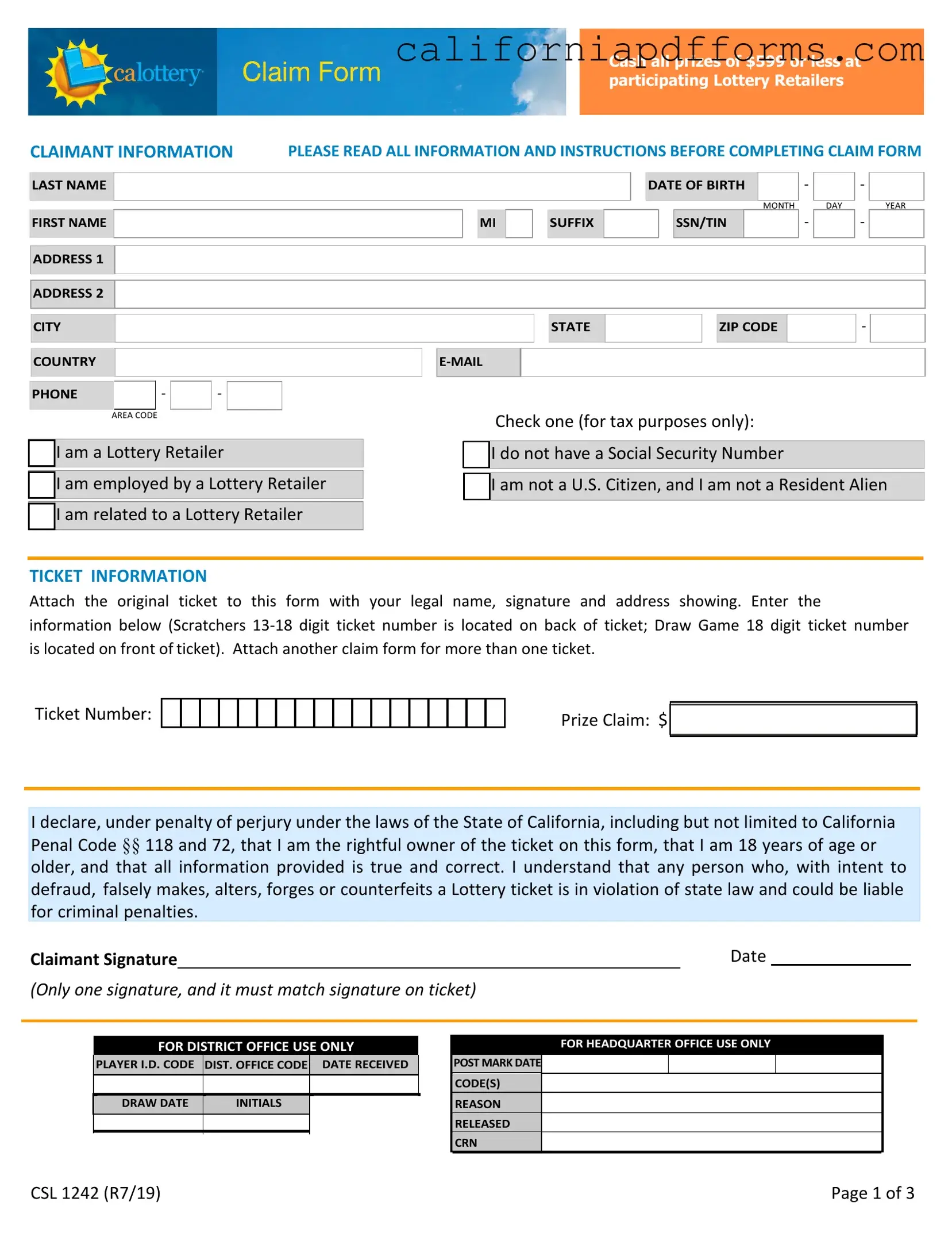

The California Scratchers form is used to claim lottery prizes from Scratchers tickets. It collects essential information from the claimant, such as their name, address, and ticket details. This information is necessary to validate the claim and ensure that the rightful owner receives their winnings.

How do I complete the form correctly?

To complete the California Scratchers form accurately, follow these steps:

- Print your legal name and address on the back of the ticket.

- Sign your name on the back of the original ticket.

- Fill out the Claimant Information and Ticket Information sections on the first page of the form.

- Sign the first page of the form in ink, ensuring only one signature is provided.

- Staple the original ticket to the front of the form.

Keep a copy of the completed form and a copy of both sides of the ticket for your records. You can then deliver the form and ticket to any Lottery District Office or mail them to the specified address.

What happens if I submit an incomplete form?

Submitting an incomplete form may delay or prevent the processing of your prize claim. Essential information includes your legal name, date of birth, complete address, email, and phone number. If any of these details are missing, the California State Lottery may not be able to verify your claim, resulting in potential complications.

Are lottery prizes subject to taxes?

Lottery prizes are not subject to California state income tax. However, federal tax laws require withholding. For U.S. citizens and resident aliens, 24% of the prize amount will be withheld. Non-U.S. citizens will have 30% withheld from their winnings. It is important to be aware of these tax implications when claiming your prize.

What should I do if I have questions about the form or the claiming process?

If you have questions regarding the California Scratchers form or the claiming process, you can contact the Lottery at 1-800-LOTTERY (568-8379). Their representatives are available Monday through Friday to assist you. Additionally, you can visit any Lottery District Office for in-person assistance.

Document Specifications

| Fact Name | Fact Detail |

|---|---|

| Prize Claim Limit | Prizes of $599 or less can be cashed at participating Lottery Retailers. |

| Processing Time | Claims submitted to Lottery Headquarters take approximately 8 weeks to process once received and verified. |

| Tax Withholding | Federal tax withholding is 24% for U.S. citizens and resident aliens, and 30% for non-U.S. citizens. |

| Governing Laws | This form is governed by the California State Lottery Act of 1984 (Gov. Code §8880 et seq.) and relevant federal tax laws. |

Dos and Don'ts

When filling out the California Scratchers form, there are important guidelines to follow to ensure your claim is processed smoothly. Here’s a list of things you should and shouldn’t do:

- Do print your legal name and address clearly on the back of the ticket.

- Do sign your name on the back of the original ticket.

- Do complete all sections of the Claimant Information and Ticket Information.

- Do staple your original ticket to the front of the claim form.

- Don’t forget to keep a copy of the claim form and the ticket for your records.

- Don’t submit your claim without the original signed ticket and all required information.

Following these steps is crucial. Missing information or errors can lead to delays or even rejection of your claim. Act promptly to ensure you receive your prize without unnecessary complications.

Misconceptions

- Misconception 1: You can cash any winning ticket at any retailer.

- Misconception 2: You don’t need to provide personal information.

- Misconception 3: All winnings are tax-free.

- Misconception 4: You can submit a claim without the original ticket.

- Misconception 5: There’s no deadline for claiming winnings.

- Misconception 6: You can sign the claim form digitally.

- Misconception 7: You can claim prizes on behalf of someone else.

- Misconception 8: All claim forms are processed immediately.

- Misconception 9: You don’t need to keep a copy of your claim form.

In reality, you can only cash prizes of $599 or less at participating Lottery Retailers. For larger prizes, you must submit a claim form.

Completing the claim form requires personal details, including your legal name, address, and Social Security Number for tax purposes.

While California does not tax lottery winnings, federal taxes apply. U.S. citizens and resident aliens face a 24% withholding, while non-citizens have 30% withheld.

The original ticket must be attached to the claim form. Without it, your claim cannot be processed.

Claims must be submitted within a specific period after the ticket is purchased. Check the California Lottery website for exact timelines.

The form requires an ink signature. A digital signature will not be accepted.

Only the ticket holder can claim the prize. If you are not the owner of the ticket, you cannot submit a claim.

Processing a claim takes time. Once received and verified, it typically takes about 8 weeks for payment to be issued.

It’s crucial to keep a copy of both the claim form and the ticket for your records. This can help in case of any issues with your claim.

Documents used along the form

When filing a claim for a California Scratchers ticket, several other forms and documents may be necessary or helpful to ensure a smooth process. Understanding these documents can aid in successfully navigating the claims process.

- Claimant's Tax Information Form: This document is essential for providing the California Lottery with the claimant's tax identification details. It ensures that the correct tax withholdings are applied to any winnings, as the Lottery is obligated to report these amounts to the IRS.

- Multiple Ownership Claim Form: If a group of players shares a winning ticket, this form is required to outline the ownership percentages and the distribution of the prize. It is crucial for claims exceeding $1,000,000 and helps to clarify how the winnings will be divided among the group.

- W-9 Form: This IRS form is used to provide the Lottery with the claimant's taxpayer identification number. It is necessary for reporting purposes, especially for those who are U.S. citizens or resident aliens, ensuring compliance with federal tax laws.

- Identity Verification Documents: These may include a government-issued ID or other forms of identification that confirm the claimant's identity. Such documents are often required to validate the claim and protect against fraud.

- Privacy Notice Acknowledgment: This document informs the claimant about how their personal information will be used and protected. Acknowledging this notice is important for understanding the privacy policies of the California Lottery.

Being aware of these additional forms can streamline the claims process and help ensure that all necessary information is provided. This preparation can significantly reduce delays and complications when claiming lottery winnings.

Different PDF Templates

Ds 260 Sample - Information provided on this form can help police respond more effectively to incidents of domestic violence.

Permanent Housing Search Document - The CW 74 form helps ensure accountability in the search for Permanent Housing.