Download California Sr 10 Form

Common Questions

What is the purpose of the California SR 10 form?

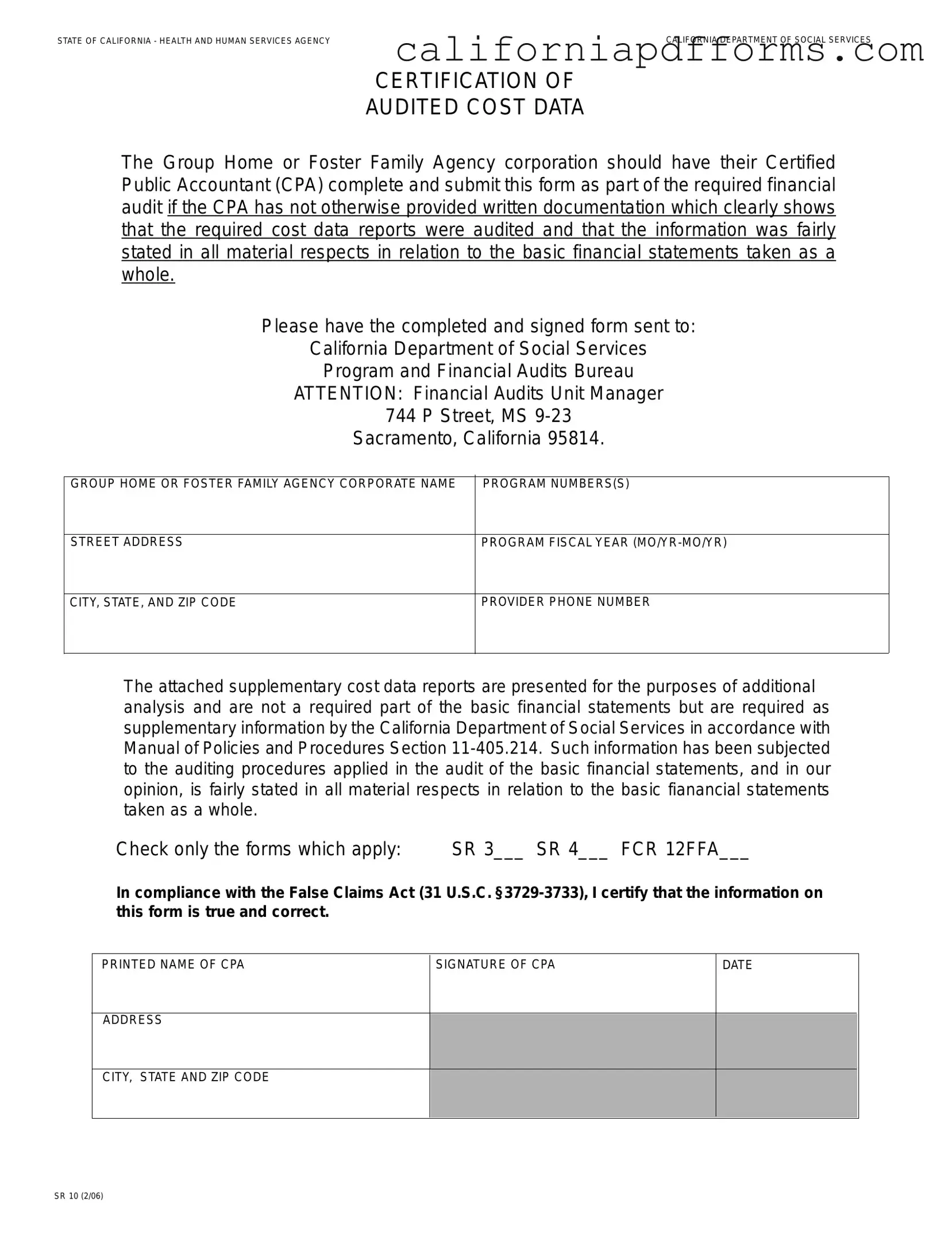

The California SR 10 form serves as a certification of audited cost data for Group Homes and Foster Family Agencies. This form must be completed by a Certified Public Accountant (CPA) as part of the financial audit process. It ensures that the cost data reports have been thoroughly audited and that the information presented is accurate and fairly stated. This certification is crucial for compliance with the regulations set forth by the California Department of Social Services.

Who is responsible for submitting the SR 10 form?

The responsibility for submitting the SR 10 form lies with the Group Home or Foster Family Agency. Specifically, the CPA who conducts the audit must complete and sign the form. After completion, it should be sent to the California Department of Social Services, specifically to the Program and Financial Audits Bureau. It is important to ensure that the form is filled out correctly and submitted in a timely manner to avoid any compliance issues.

What information is required on the SR 10 form?

The SR 10 form requires several pieces of information to be accurately filled out. This includes:

- The corporate name of the Group Home or Foster Family Agency.

- The program number(s) associated with the agency.

- The street address and city, state, and zip code of the agency.

- The fiscal year for which the audit is being conducted.

- The provider's phone number for contact purposes.

Additionally, the CPA must provide their printed name, signature, and the date of certification. This information is essential for the Department of Social Services to verify the authenticity and accuracy of the audit.

What are the consequences of not submitting the SR 10 form?

Failure to submit the SR 10 form can lead to several negative consequences for a Group Home or Foster Family Agency. Without this certification, the agency may face compliance issues with the California Department of Social Services. This could result in financial penalties or jeopardize the agency's funding and ability to operate. Moreover, it could affect the agency's reputation and trustworthiness within the community. Therefore, it is vital to ensure that this form is completed and submitted as required.

Document Specifications

| Fact Name | Description |

|---|---|

| Purpose | The SR 10 form is used to certify audited cost data for group homes and foster family agencies in California. |

| Governing Law | This form is governed by the California Department of Social Services policies, specifically the Manual of Policies and Procedures Section 11-405.214. |

| Submission Requirement | A Certified Public Accountant (CPA) must complete and submit the form as part of the financial audit process. |

| Supplementary Information | Attached cost data reports are supplementary and are not required as part of the basic financial statements. |

| False Claims Act Compliance | The form includes a certification that the information provided is true and correct, in compliance with the False Claims Act. |

| Contact Information | Completed forms should be sent to the California Department of Social Services, specifically to the Program and Financial Audits Bureau. |

Dos and Don'ts

When filling out the California SR 10 form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are four things you should and shouldn't do:

- Do: Ensure that your Certified Public Accountant (CPA) completes the form accurately.

- Do: Submit the form along with any required supplementary cost data reports.

- Don't: Forget to include your corporate name and program numbers on the form.

- Don't: Leave any sections blank; fill in all necessary information to avoid delays.

Misconceptions

Understanding the California SR 10 form can be challenging, and several misconceptions often arise. Here are six common misunderstandings about this important document:

- Misconception 1: The SR 10 form is optional for Group Homes and Foster Family Agencies.

- Misconception 2: Only the basic financial statements need to be audited.

- Misconception 3: The SR 10 form can be submitted without a CPA's signature.

- Misconception 4: The supplementary cost data reports are not important.

- Misconception 5: The SR 10 form is only for new programs.

- Misconception 6: The SR 10 form is only for state agencies.

Many believe that submitting the SR 10 form is optional. In reality, it is a required part of the financial audit process, ensuring that the cost data is accurately reported and verified by a Certified Public Accountant (CPA).

Some think that only the basic financial statements require auditing. However, the SR 10 form includes supplementary cost data reports, which must also be audited to provide a complete financial picture.

It's a common belief that the form can be submitted without a CPA's signature. This is incorrect; the form must be signed by a CPA to validate the information provided and ensure compliance with regulations.

Some may think that the supplementary cost data reports are insignificant. In fact, they play a crucial role in the financial audit process, as they provide additional context and analysis of the organization’s finances.

There is a misconception that the SR 10 form is only necessary for new programs. In truth, all programs must complete this form annually, regardless of their age or history.

Some people believe that only state agencies need to worry about the SR 10 form. However, it is essential for all Group Homes and Foster Family Agencies operating in California, regardless of their affiliation with state agencies.

Documents used along the form

The California SR 10 form is an essential document for Group Homes and Foster Family Agencies, particularly in the context of financial audits. Alongside this form, several other documents are commonly used to ensure compliance and thorough reporting. Here are five important forms that often accompany the SR 10:

- SR 3 Form: This form is used to report the costs associated with providing care in a group home or foster family agency. It outlines various expenses and helps establish the financial framework for the services rendered.

- SR 4 Form: The SR 4 form focuses on the revenue generated by the agency. It details the funding sources and income received, which is crucial for a comprehensive financial audit.

- FCR 12FFA Form: This form is specifically designed for Foster Family Agencies. It provides additional financial data and ensures that the agency meets state requirements for funding and reporting.

- Financial Statements: These are comprehensive documents that summarize the financial position of the agency. They include the balance sheet, income statement, and cash flow statement, giving a clear picture of the agency's financial health.

- Supplementary Cost Data Reports: While not required, these reports offer additional insights into the costs incurred by the agency. They provide context and detail that can be beneficial during the audit process.

Using these documents in conjunction with the California SR 10 form helps ensure that agencies meet regulatory requirements and maintain transparency in their financial practices. Proper documentation fosters accountability and supports the mission of providing quality care to those in need.

Different PDF Templates

California Fl 145 - This form operates as a necessary tool in family law cases, streamlining the discovery of pertinent information.

Frivolous Return Irs - Both spouses or registered domestic partners must sign the form if they filed jointly.