Download California Std 236 Form

Common Questions

What is the purpose of the California Std 236 form?

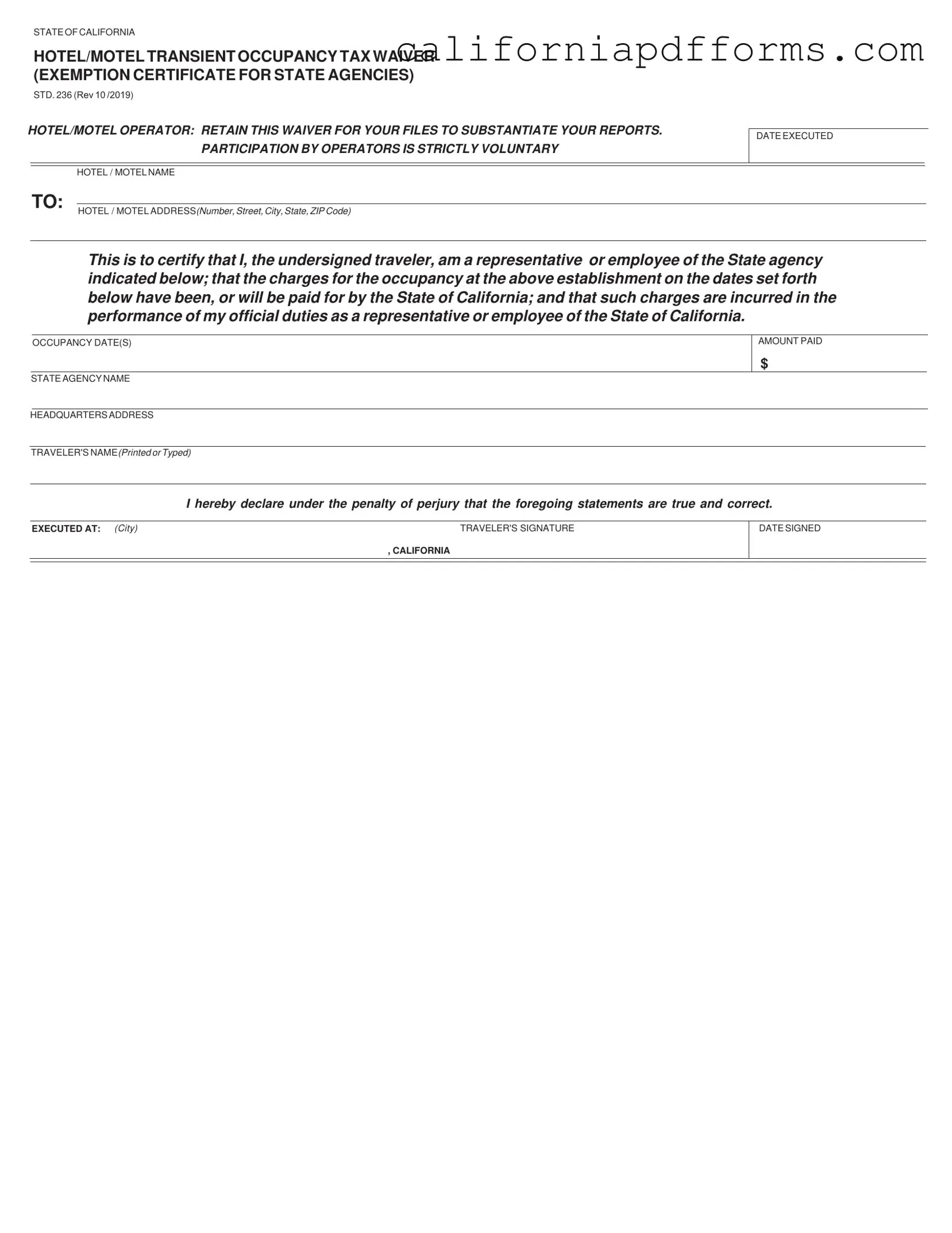

The California Std 236 form serves as a waiver for the transient occupancy tax for state agencies. When a state employee or representative stays at a hotel or motel for official duties, this form certifies that the charges will be covered by the State of California. It is essential for hotel operators to retain this waiver to substantiate their tax reports.

Who is eligible to use the California Std 236 form?

Eligibility to use the California Std 236 form is limited to employees or representatives of state agencies. These individuals must be engaged in official duties that require them to stay at a hotel or motel. The form must be completed and signed by the traveler, indicating that the expenses incurred are for state business and will be paid by the state agency.

What information is required on the California Std 236 form?

The form requires several key pieces of information:

- The name and address of the hotel or motel.

- The dates of occupancy.

- The name of the state agency the traveler represents.

- The amount paid for the stay.

- The traveler's name, printed or typed.

- The traveler's signature and date signed.

Providing accurate information is crucial, as it helps ensure compliance with tax regulations.

What should hotel operators do with the California Std 236 form?

Hotel operators should retain the completed California Std 236 form for their records. Keeping this documentation is important for substantiating their reports regarding transient occupancy tax. Operators must ensure that they have a clear understanding of the voluntary nature of participation in this waiver process and the requirements for proper documentation.

Document Specifications

| Fact Name | Details |

|---|---|

| Form Purpose | The California Std 236 form serves as a waiver for transient occupancy tax for state agencies. |

| Governing Law | This form is governed by California Revenue and Taxation Code Section 7280. |

| Voluntary Participation | Participation by hotel/motel operators in using this waiver is strictly voluntary. |

| Form Revision Date | The current version of the form was revised in October 2019. |

| Retention Requirement | Hotel/motel operators must retain this waiver for their records to substantiate tax reports. |

| Traveler's Declaration | The traveler must declare under penalty of perjury that the information provided is true and correct. |

| State Agency Identification | The form requires the name of the state agency responsible for payment of the occupancy charges. |

| Occupancy Dates | The form must specify the dates of occupancy for which the waiver is being claimed. |

| Signature Requirement | The traveler must sign and date the form to validate the waiver. |

| Tax Exemption Scope | This waiver only applies to state employees and representatives conducting official state business. |

Dos and Don'ts

When filling out the California Std 236 form, it is important to follow specific guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do.

- Do ensure all information is accurate and complete.

- Do use clear and legible handwriting or type the information.

- Do include the correct hotel/motel name and address.

- Do sign and date the form before submission.

- Don't leave any required fields blank.

- Don't use abbreviations that may cause confusion.

- Don't submit the form without verifying the amounts and dates.

- Don't forget to keep a copy of the completed form for your records.

Misconceptions

Misconceptions about the California Std 236 form can lead to confusion. Here are five common misunderstandings:

- It's mandatory for all hotel/motel stays. Participation in using the Std 236 form is strictly voluntary for hotel and motel operators.

- Only certain state agencies can use it. Any representative or employee of a state agency can utilize the form, not just select agencies.

- It exempts travelers from all taxes. The form specifically waives transient occupancy tax but does not exempt travelers from other applicable taxes or fees.

- It must be submitted to the state. The hotel/motel operator retains the form for their records; it does not need to be submitted to any state agency.

- Only the traveler needs to sign it. The hotel/motel operator must also keep a copy for their files to substantiate their reports.

Understanding these points can help ensure proper use of the Std 236 form and compliance with regulations.

Documents used along the form

When dealing with the California Std 236 form, several other documents often accompany it to ensure a smooth process for state agency travel and related expenses. Each of these documents serves a specific purpose, contributing to the overall clarity and compliance required in financial and travel reporting. Below is a list of related forms and documents commonly used alongside the California Std 236.

- California Std 261: This form is a travel expense claim for state employees. It details the expenses incurred during official travel, including transportation, lodging, and meals. It is essential for employees seeking reimbursement for their travel-related costs.

- California Std 262: The travel request form is necessary for obtaining prior approval for travel. It outlines the purpose of the trip, estimated costs, and travel dates. Approval is typically required before any travel arrangements can be made.

- California Std 263: This is the travel itinerary form, which provides a detailed schedule of the traveler's plans, including departure and arrival times, locations, and accommodations. It helps in tracking the traveler's movements and ensuring that all arrangements are in order.

- Travel Authorization Form: This internal document is used by agencies to formally authorize travel for their employees. It typically includes budget codes and other financial details, ensuring that the trip aligns with the agency's budgetary constraints.

- Hotel/Motel Invoice: This document is provided by the hotel or motel and outlines the charges incurred during the stay. It serves as proof of payment and is often required for reimbursement claims.

- Expense Report: After travel is completed, employees submit an expense report summarizing all costs incurred. This report usually includes receipts and documentation for each expense, ensuring transparency and accountability in state spending.

Each of these forms plays a crucial role in the travel process for state employees in California. Properly completing and maintaining these documents not only ensures compliance with state regulations but also facilitates efficient reimbursement and record-keeping. Understanding the purpose of each form can help streamline the travel experience for state agency representatives.

Different PDF Templates

Inactive Real Estate License California - Applicants must read the instructions carefully before completing the form.

Lic 9182 Form - Each field on the form is designed to gather specific information needed for the background clearance process.