Download California Std 830 Form

Common Questions

What is the California Std 830 form and who should use it?

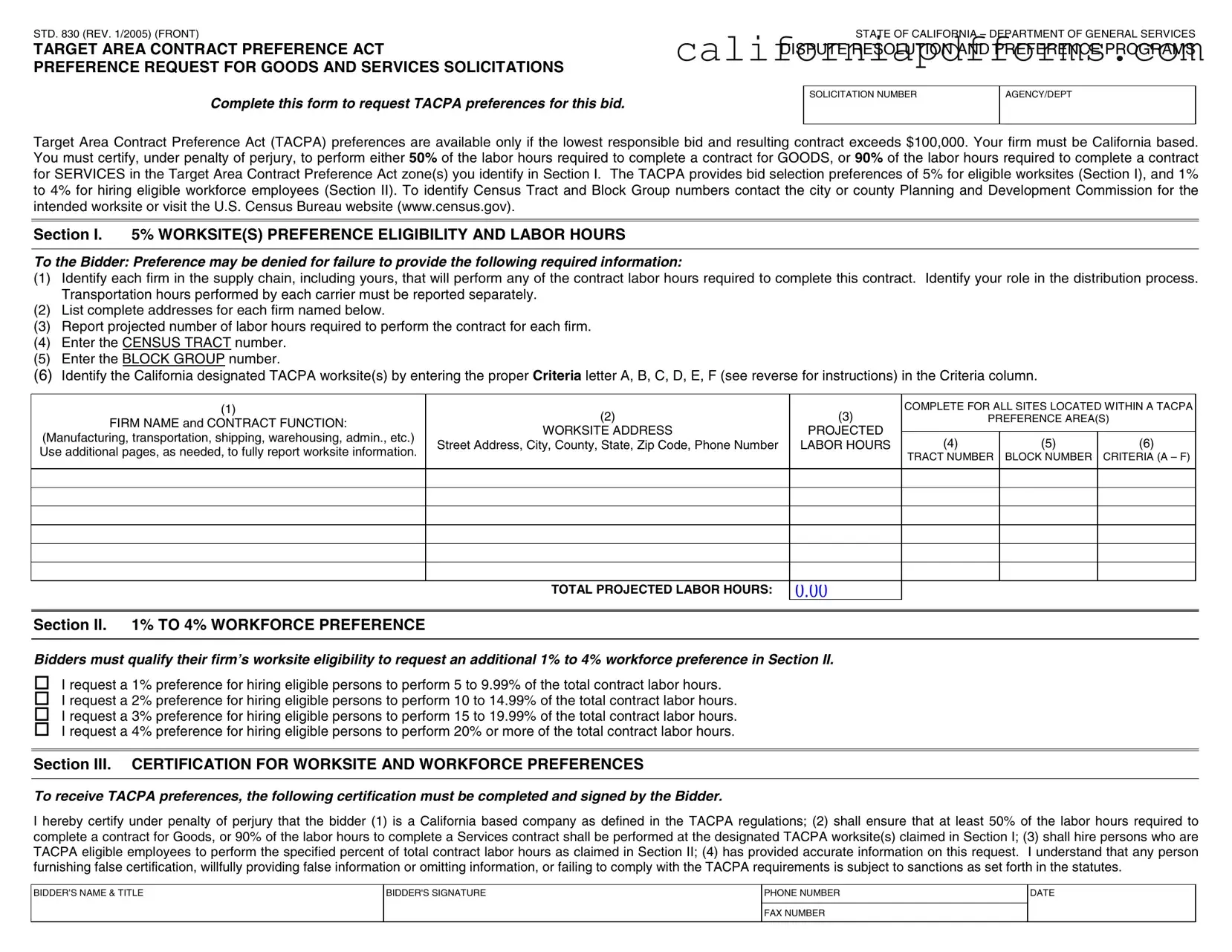

The California Std 830 form is a request form for the Target Area Contract Preference Act (TACPA) preferences. It is designed for California-based businesses that wish to apply for bidding preferences when submitting proposals for state contracts. Specifically, this form is applicable when the lowest responsible bid and resulting contract exceed $100,000. Eligible businesses must certify their commitment to perform a significant portion of the contract labor hours in designated distressed areas, as defined by TACPA regulations.

What are the eligibility requirements for TACPA preferences?

To qualify for TACPA preferences, a bidder must meet several criteria:

- The firm must be based in California.

- The total contract amount must exceed $100,000.

- For contracts involving goods, at least 50% of the labor hours must be performed at designated TACPA worksites. For services, this requirement increases to 90%.

- The bidder must accurately identify and report all firms involved in the contract labor, including their respective labor hours and worksite information.

Failure to comply with these requirements may result in the denial of the preference request.

What types of preferences can be requested through the Std 830 form?

The Std 830 form allows bidders to request two types of preferences:

- Worksite Preference: A 5% preference is available for firms that perform labor in eligible TACPA worksite areas.

- Workforce Preference: Additional preferences ranging from 1% to 4% can be requested based on the percentage of total contract labor hours performed by eligible employees. This is contingent upon first qualifying for the worksite preference.

The maximum total preference that can be claimed is 9%, or up to $50,000 per bid, with a combined maximum limit of 15% of the lowest responsible bid.

What are the consequences of providing false information on the Std 830 form?

Providing false information or omitting required details on the Std 830 form can have serious repercussions. Under the law, if a business is awarded a contract based on false certification, it may face several penalties:

- The business must repay any difference between the awarded contract amount and the actual cost that the state would have incurred if the contract had been awarded correctly.

- A penalty of up to 10% of the contract amount may be assessed.

- The business may be barred from conducting any transactions with the state for a period ranging from six months to three years.

These penalties underscore the importance of accuracy and integrity when completing the Std 830 form.

Document Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The Target Area Contract Preference Act (TACPA) is governed by GC §4530 et seq. and 2 CCR §1896.30 et seq. |

| Eligibility Criteria | To qualify for TACPA preferences, bidders must be California-based firms and the contract must exceed $100,000. |

| Labor Hour Requirements | Bidders must perform at least 50% of labor hours for goods contracts or 90% for services contracts at designated TACPA worksites. |

| Preference Percentages | Eligible bidders can receive a 5% worksite preference and an additional 1% to 4% workforce preference based on hiring criteria. |

Dos and Don'ts

When filling out the California Std 830 form, it's crucial to be thorough and accurate. Here are five important dos and don'ts to keep in mind:

- Do ensure that your firm is California-based and meets the eligibility requirements for TACPA preferences.

- Do provide complete addresses for all firms involved in the contract labor hours.

- Do accurately report the projected number of labor hours for each firm.

- Do enter the correct Census Tract and Block Group numbers for your worksite.

- Do sign the certification under penalty of perjury, confirming all information is accurate.

- Don't underestimate the labor hours required for the contract; this may lead to a denial of your preference request.

- Don't combine transportation hours with other labor hours; report them separately.

- Don't omit any firms or sites that will perform contract labor hours.

- Don't provide false information or omit necessary details, as this can result in serious penalties.

- Don't forget to check the eligibility of your worksite according to the TACPA criteria.

Misconceptions

Understanding the California Std 830 form is essential for businesses looking to benefit from the Target Area Contract Preference Act (TACPA). Here are eight common misconceptions about this form:

- Only large companies can apply for TACPA preferences. Many believe that only large corporations qualify, but small California-based firms can also benefit as long as they meet the requirements.

- All contracts are eligible for TACPA preferences. In reality, TACPA preferences apply only to contracts exceeding $100,000. Contracts below this amount do not qualify.

- Only the lowest bidder can receive preferences. While the lowest responsible bid is necessary, TACPA preferences can still be granted to eligible bidders who meet the criteria, even if they are not the lowest.

- Labor hours can be estimated without specifics. It is a misconception that bidders can provide vague estimates. Detailed reporting of labor hours for each firm involved is mandatory.

- All types of work are eligible for the same percentage of preferences. The preferences vary based on the type of contract. For goods, a 5% worksite preference is available, while for workforce hiring, preferences range from 1% to 4% depending on the percentage of labor hours.

- Certification is a formality that does not require accuracy. This is incorrect. Providing false information or failing to meet the certification requirements can lead to severe penalties, including contract disqualification.

- Transportation hours are included in the total labor hours. This is a misunderstanding. Transportation hours must be reported separately and cannot be combined with other labor hours.

- Once preferences are granted, there are no further obligations. After receiving TACPA preferences, bidders must continue to report on contract performance and compliance, ensuring that they adhere to the requirements throughout the contract duration.

Clarifying these misconceptions can help businesses navigate the TACPA process more effectively and maximize their opportunities for contract preferences.

Documents used along the form

The California Std 830 form is a key document for businesses seeking preferences under the Target Area Contract Preference Act (TACPA). However, several other forms and documents often accompany this form to ensure compliance and facilitate the bidding process. Below is a list of these documents, each serving a unique purpose.

- Bidder’s Summary Form: This form provides a detailed breakdown of the projected labor hours necessary to complete the contract. It helps verify the labor hours claimed in the Std 830 form.

- Manufacturer’s Summary Form: Required for bidders supplying goods, this form outlines the number of labor hours needed for manufacturing the products. It ensures transparency in labor allocation.

- Eligibility Certification: This document certifies that the bidder meets the eligibility criteria for TACPA preferences. It is essential for validating the information provided in the Std 830 form.

- Dispute Resolution Form: This form outlines the procedures for resolving disputes related to the TACPA preferences. It is crucial for bidders to understand their rights and obligations.

- Contract Compliance Report: Once a contract is awarded, this report tracks the contractor's performance, including labor hours and compliance with TACPA requirements.

- Tax Identification Form: This document is necessary for tax purposes and verifies the bidder's legal status. It is often required for any state contract.

- Subcontractor Disclosure Form: If subcontractors will be involved, this form discloses their roles and responsibilities. It ensures that all parties are compliant with TACPA guidelines.

Understanding and preparing these accompanying documents can significantly enhance your chances of successfully obtaining contract preferences under TACPA. Ensure that all information is accurate and complete to avoid any potential issues during the bidding process.

Different PDF Templates

Can Parents Agree to No Child Support in California - It outlines the details of support payments, including amounts and obligations.

What to Bring to Child Custody Pre-trial - Timelines for both service and response are crucial for fair proceedings.

Fw 002 - If more space is needed for additional facts, forms may be attached.