Download California Stop Payment Form

Common Questions

-

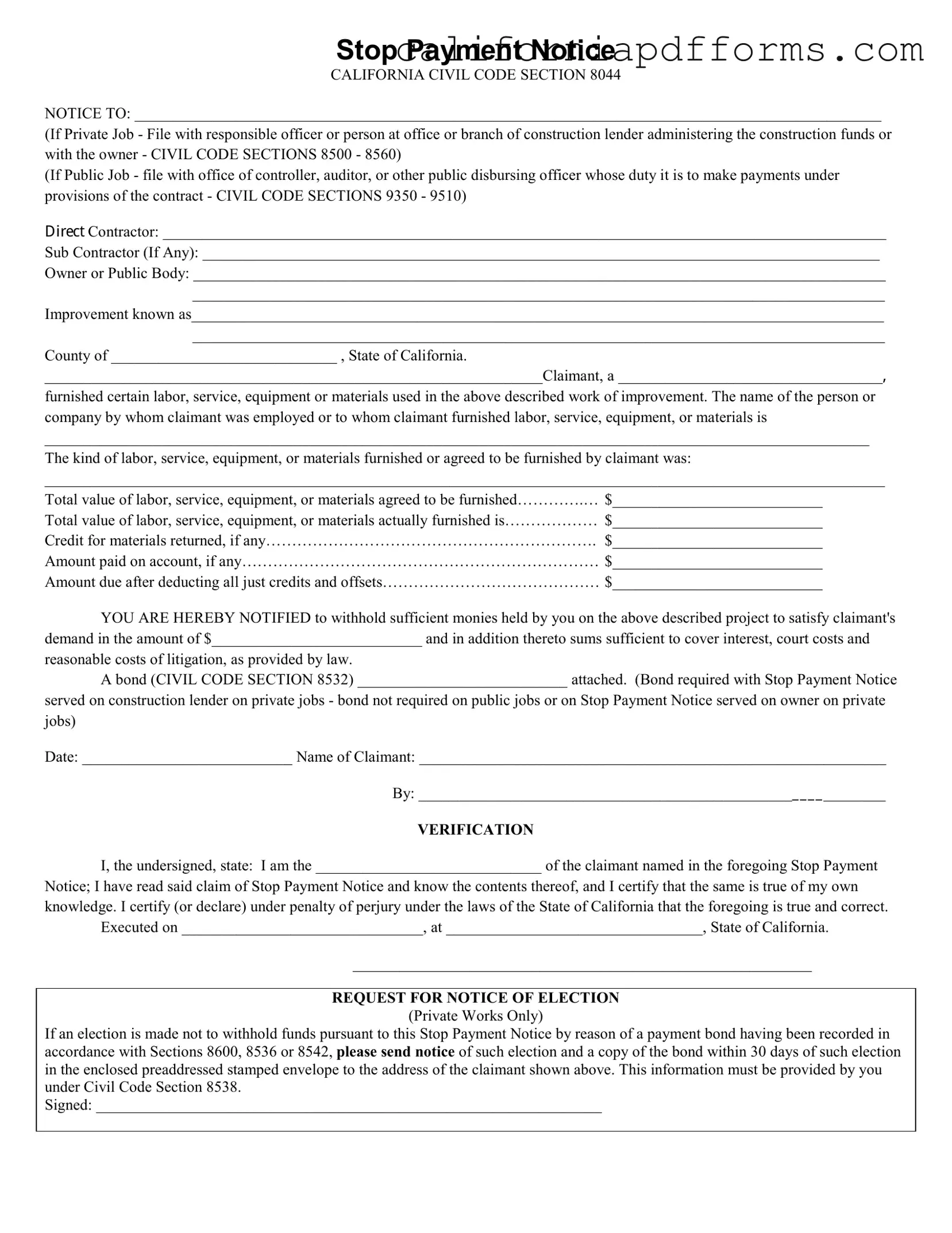

What is a California Stop Payment form?

The California Stop Payment form is a legal document used to notify a construction lender or property owner that a claimant has not been paid for labor, services, equipment, or materials provided for a construction project. It serves to protect the claimant's right to payment by requesting that the recipient withhold sufficient funds to cover the outstanding amount owed.

-

Who can file a Stop Payment Notice?

Any claimant who has provided labor, services, equipment, or materials for a construction project can file a Stop Payment Notice. This includes contractors, subcontractors, and suppliers. It's essential to ensure that you meet the requirements outlined in the California Civil Code before filing.

-

Where should I file the Stop Payment Notice?

The filing location depends on whether the project is private or public. For private projects, file with the construction lender or the owner. For public projects, submit the notice to the office of the controller or auditor responsible for making payments under the contract.

-

What information is required on the form?

The form requires several key details, including:

- The names of the contractor, subcontractor, owner, and public body (if applicable).

- A description of the improvement and the county where the project is located.

- The total value of labor, services, equipment, or materials provided.

- The amount due after accounting for any credits or payments made.

-

Is a bond required when filing a Stop Payment Notice?

A bond is required when filing a Stop Payment Notice on private jobs if served on the construction lender. However, no bond is necessary for public jobs or when the notice is served directly to the owner on private jobs.

-

What happens after I file the Stop Payment Notice?

Once the notice is filed, the recipient must withhold sufficient funds to satisfy the claimant's demand. They are also required to provide notice if they choose not to withhold funds due to an existing payment bond. This notice must be sent within 30 days.

-

What are the consequences of not filing a Stop Payment Notice?

If you do not file a Stop Payment Notice, you may lose your right to claim payment from the construction lender or property owner. Filing the notice is crucial for protecting your financial interests and ensuring you receive compensation for your work.

Document Specifications

| Fact Name | Details |

|---|---|

| Governing Law | The Stop Payment Notice is governed by California Civil Code Section 8044. |

| Filing Requirements for Private Jobs | For private jobs, the notice must be filed with the responsible officer or person at the construction lender's office or with the owner. |

| Filing Requirements for Public Jobs | In the case of public jobs, the notice must be filed with the office of the controller, auditor, or other public disbursing officer. |

| Bond Requirement | A bond is required when serving a Stop Payment Notice on a construction lender for private jobs, as outlined in Civil Code Section 8532. |

| Notice to Withhold Funds | The notice instructs the recipient to withhold sufficient funds to cover the claimant's demand and related costs. |

| Verification Requirement | The claimant must verify the accuracy of the Stop Payment Notice under penalty of perjury. |

| Request for Notice of Election | If an election is made not to withhold funds due to a payment bond, notice must be sent to the claimant within 30 days, as per Civil Code Section 8538. |

Dos and Don'ts

When filling out the California Stop Payment form, it's essential to follow certain guidelines to ensure your submission is correct and effective. Here’s a helpful list of things you should and shouldn't do:

- Do: Fill out the form completely and accurately, including all required information about the project and the claimant.

- Do: Sign and date the form to validate your claim. An unsigned form may be considered incomplete.

- Do: Keep a copy of the completed form for your records. This will be useful for future reference.

- Do: File the notice with the appropriate party, whether it's a private or public job, as specified in the instructions.

- Don't: Leave any sections blank. Incomplete forms can lead to delays or rejection of your claim.

- Don't: Forget to check for any required attachments, such as a bond for private jobs, if applicable.

- Don't: Provide false information. This could result in legal repercussions under California law.

- Don't: Ignore deadlines for filing the notice. Timeliness is crucial in these matters.

Misconceptions

Here are ten common misconceptions about the California Stop Payment form, along with clarifications for each:

- Only contractors can file a Stop Payment Notice. Anyone providing labor, services, equipment, or materials can file this notice, including subcontractors and suppliers.

- A Stop Payment Notice guarantees payment. While it alerts the responsible party to withhold funds, it does not guarantee that the claimant will receive payment.

- The form is only for private jobs. The Stop Payment Notice can be used for both private and public jobs, but the filing process differs for each.

- A bond is always required. A bond is necessary only for private jobs when serving the construction lender, not for public jobs or when serving the owner directly.

- Filing the notice is a complicated process. While it requires specific information, the process is straightforward and can be completed with attention to detail.

- All claims must be paid immediately after filing. The notice serves to withhold funds but does not require immediate payment; it depends on the resolution of the claim.

- There is a strict deadline for filing. While timely filing is important, the exact deadline can vary based on the project type and contract terms.

- Once filed, the Stop Payment Notice cannot be withdrawn. A claimant can withdraw the notice, but they must follow specific procedures to do so.

- The notice must be filed in person. While it can be filed in person, it can also be sent via certified mail, depending on the requirements.

- Only the owner of the property can respond to the notice. Other parties, such as lenders or general contractors, can also respond or take action based on the notice.

Understanding these misconceptions can help ensure that all parties involved in a construction project are aware of their rights and responsibilities regarding payment and claims.

Documents used along the form

The California Stop Payment form is an essential document for those involved in construction projects, particularly when there are disputes regarding payments for labor or materials. However, it is often used in conjunction with other forms and documents that help clarify and support the claims being made. Below are some common documents that may accompany the Stop Payment form.

- Preliminary Notice: This document is typically sent at the beginning of a construction project to inform the property owner and other parties about the involvement of subcontractors and suppliers. It serves to protect the rights of those who may later file a claim for unpaid work or materials.

- Claim of Lien: A Claim of Lien is filed when a contractor, subcontractor, or supplier has not been paid for their work. This document creates a legal claim against the property, ensuring that the unpaid party has a right to seek payment through the property itself.

- Notice of Completion: This form is filed by the property owner or general contractor once the construction project is completed. It serves to officially mark the end of the project and can affect the timeline for filing liens or claims, as it may trigger deadlines for unpaid parties to act.

- Payment Bond: A Payment Bond is often required on private construction projects to guarantee that all subcontractors and suppliers will be paid. This document provides financial security and can be crucial in ensuring that funds are available to cover any claims made under the Stop Payment form.

Understanding these documents can significantly enhance your ability to navigate payment disputes in construction projects. Each plays a vital role in protecting the rights of those who contribute labor and materials, ensuring that everyone involved is fairly compensated for their efforts.

Different PDF Templates

540nr Instructions - Filed forms may be subject to further review by the Franchise Tax Board.

Ds 260 Sample - The DV 260 is an essential step towards securing safety for individuals involved in domestic violence situations.