Download California Will Form

Common Questions

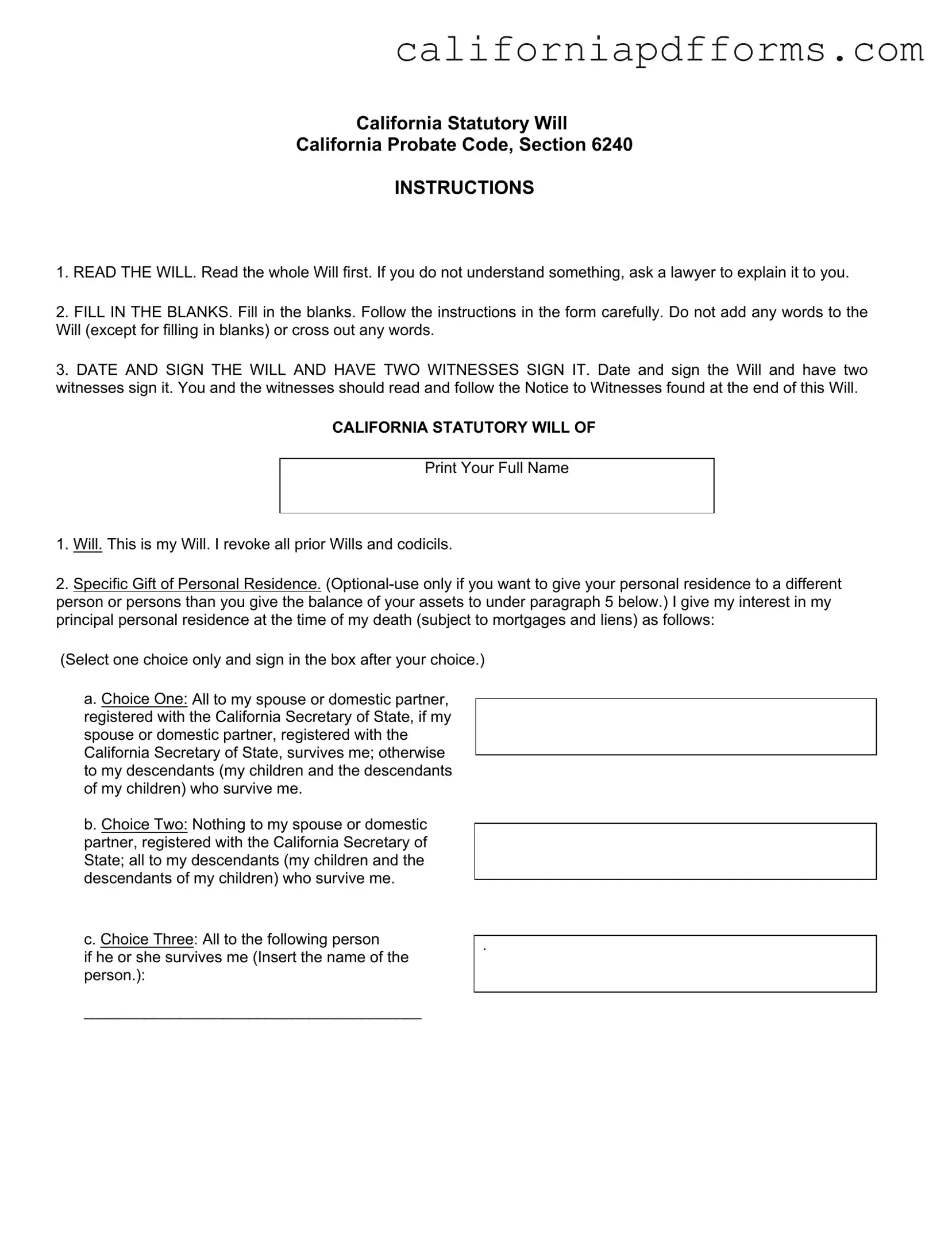

What is a California Statutory Will?

A California Statutory Will is a simple legal document that allows you to outline how your assets will be distributed after your death. It follows a specific format set by California law, making it easier for individuals to create a valid will without extensive legal knowledge.

How do I fill out the California Will form?

To fill out the form, start by reading the entire document to understand its contents. Then, fill in the blanks as instructed. Avoid adding extra words or crossing out any parts of the form. Make sure to date and sign the will, and have two witnesses sign it as well. They must also read the Notice to Witnesses included at the end of the will.

Do I need witnesses to sign my will?

Yes, California law requires that your will be signed by two adult witnesses. They must sign the document in your presence and in each other’s presence. This helps ensure the will is valid and can be enforced after your death.

Can I change my will after it is created?

Yes, you can change your will at any time. If you want to make changes, it's best to create a new will that clearly states it revokes any previous wills. Alternatively, you can use a codicil, which is an amendment to your existing will, but this can be more complicated.

What happens if I do not sign the will?

If you do not sign the will, it will not be considered valid. This means that your assets will be distributed according to California's intestacy laws, which may not reflect your wishes. Always ensure that you sign the document and have it witnessed properly.

What should I include in my will?

Your will should include:

- Your personal information, including your full name.

- Specific gifts of property, such as your residence, vehicles, or cash to individuals or charities.

- Instructions for the distribution of your remaining assets.

- Guardianship nominations for minor children.

- Executor nominations to manage your estate.

Can I choose a guardian for my children in my will?

Yes, if you have children under the age of 18, you can nominate a guardian in your will. You should list your first, second, and third choices for guardianship. This helps ensure that your children are cared for by someone you trust if both parents are unable to do so.

What is an executor, and how do I choose one?

An executor is the person responsible for managing your estate after your death. This includes paying debts, distributing assets, and handling any necessary legal matters. When choosing an executor, consider someone who is trustworthy, organized, and capable of handling financial matters. You can name an individual or a bank or trust company as your executor.

What if I have minor children and want to delay their inheritance?

You can specify a custodian for your minor children's assets until they reach a certain age, between 18 and 25. This allows you to ensure that their inheritance is managed responsibly until they are mature enough to handle it. Be sure to name your first, second, and third choices for custodians in your will.

Document Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The California Statutory Will is governed by the California Probate Code, specifically Section 6240. |

| Witness Requirement | To be valid, the Will must be signed by the maker in the presence of two witnesses, who must also sign the document. |

| Revocation Clause | The Will includes a clause that revokes all prior Wills and codicils, ensuring that only the most recent document is considered. |

| Specific Gifts | The Will allows for specific gifts of personal property, including automobiles and household effects, which can be designated to particular individuals. |

| Guardian Nomination | If the maker has a child under 18, the Will provides a section to nominate guardians for the child's care, ensuring their well-being after the maker's passing. |

Dos and Don'ts

When filling out the California Will form, keep these important do's and don'ts in mind:

- Do read the entire Will carefully before making any entries.

- Do fill in all blanks as instructed without adding or crossing out any words.

- Do date and sign the Will, ensuring two witnesses also sign it.

- Do ensure that your witnesses understand their role and the contents of the Will.

- Do choose only one option for each specific gift or asset distribution.

- Don't leave any blanks unfilled; this can lead to confusion or legal issues.

- Don't use correction fluid or make any changes after signing.

- Don't forget to specify a guardian for minor children if applicable.

- Don't assume that your Will is valid without following all the required steps.

Misconceptions

- Misconception 1: A California Will must be notarized.

- Misconception 2: You can add or change words in the Will after it is completed.

- Misconception 3: A handwritten Will is always valid in California.

- Misconception 4: If you don’t mention your spouse in the Will, they won’t inherit anything.

- Misconception 5: You can use a California Will for any type of asset distribution.

- Misconception 6: You need to have a lawyer to create a valid Will in California.

- Misconception 7: All assets must be distributed according to the Will.

- Misconception 8: You can’t change your Will once it’s created.

- Misconception 9: Your Will can be executed without witnesses.

- Misconception 10: A Will is only necessary for wealthy individuals.

This is not true. A California Will does not need to be notarized, but it must be signed by the maker and witnessed by two adults.

Once the Will is filled out, you should not add words or cross anything out. Changes can invalidate the document.

While handwritten Wills can be valid, they must meet specific requirements. It’s safer to use the California Statutory Will form.

California law provides for community property rights. Your spouse may still inherit under state law, even if not mentioned in the Will.

The California Statutory Will is designed for straightforward distributions. Complex estates may require a different approach.

While consulting a lawyer can be helpful, it is not required. You can complete the California Statutory Will form on your own.

Certain assets, like life insurance policies and retirement accounts, may pass outside of the Will based on beneficiary designations.

You can change your Will at any time by creating a new Will or adding a codicil, provided you follow the correct procedures.

California law requires that a Will be signed in the presence of two witnesses who also sign the document.

Everyone can benefit from having a Will, regardless of their financial situation. It ensures your wishes are followed regarding asset distribution.

Documents used along the form

When preparing a California Will, there are several other forms and documents that may be beneficial to consider. These documents help clarify your wishes and ensure that your estate is managed according to your preferences. Below is a list of commonly used forms that complement the California Will.

- Durable Power of Attorney: This document allows you to appoint someone to make financial decisions on your behalf if you become unable to do so. It remains in effect even if you become incapacitated.

- Advance Healthcare Directive: This form lets you specify your healthcare preferences and appoint a person to make medical decisions for you if you cannot communicate your wishes.

- Trust Document: A trust can help manage your assets during your lifetime and after your death. It allows for the distribution of your assets without going through probate, which can save time and costs.

- Beneficiary Designations: These forms are used for accounts like life insurance and retirement plans. They allow you to designate who will receive these assets upon your death, overriding your Will.

- Guardianship Designation: If you have minor children, this document allows you to name a guardian for them in case of your death. This can be included in your Will but can also be a standalone document.

- Letter of Intent: While not legally binding, this letter can provide guidance to your executor or loved ones regarding your wishes for your estate, funeral arrangements, and other personal matters.

These documents can work together with your California Will to ensure that your estate is handled according to your wishes. It’s important to review and update these documents regularly, especially after major life events. Consulting with a professional can help you navigate these choices effectively.

Different PDF Templates

Ch-800 - This document is vital for maintaining lawful firearm possession in California.

How to File Contempt of Court in California - It is crucial for maintaining accountability within family law cases pertaining to child support obligations.