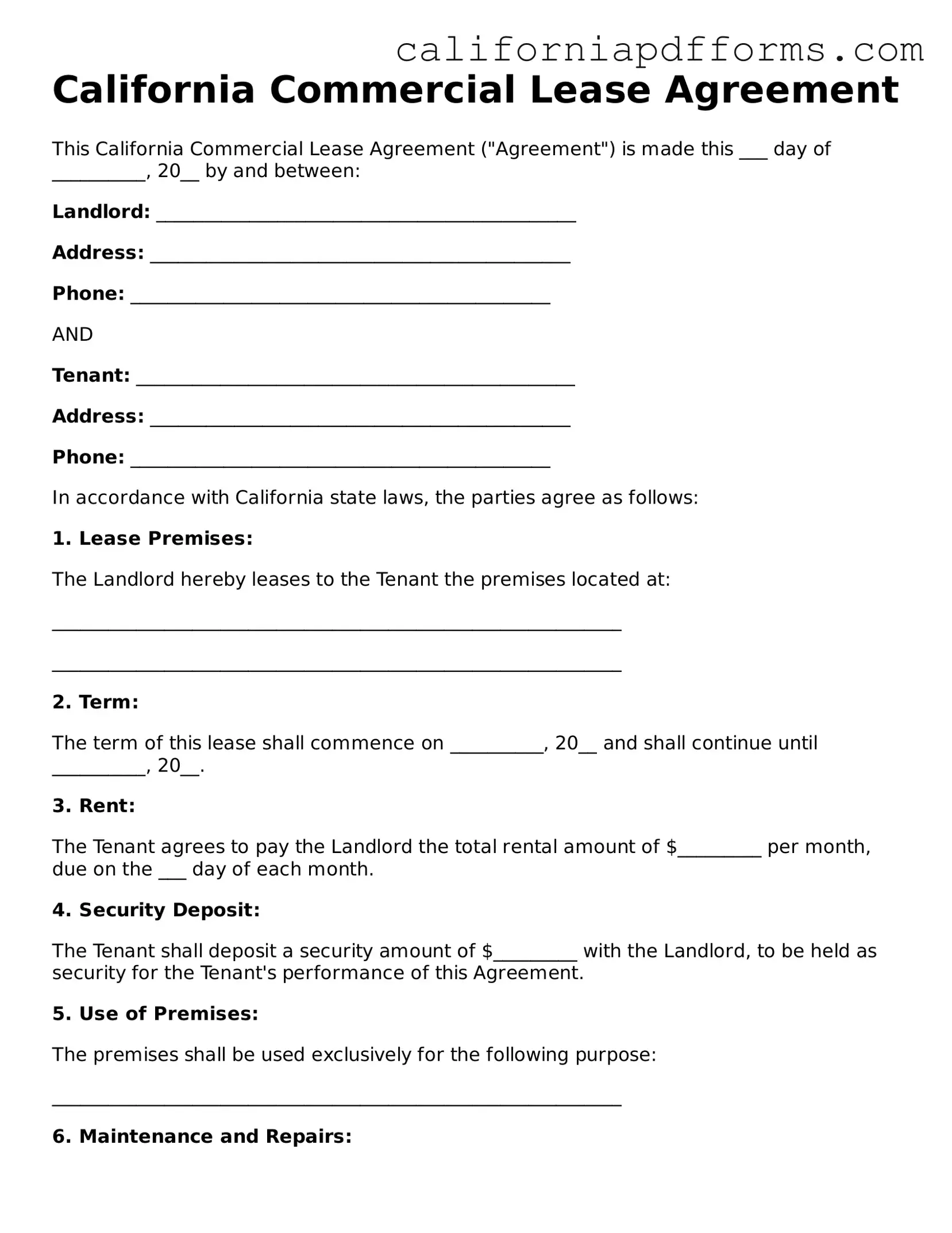

Official Commercial Lease Agreement Template for the State of California

Common Questions

What is a California Commercial Lease Agreement?

A California Commercial Lease Agreement is a legal document that outlines the terms and conditions under which a landlord rents commercial property to a tenant. This agreement covers various aspects, including rent, duration of the lease, maintenance responsibilities, and use of the property. It is essential for both parties to understand their rights and obligations.

What key elements should be included in the lease agreement?

When drafting a California Commercial Lease Agreement, ensure it includes the following key elements:

- Names of the landlord and tenant

- Description of the leased premises

- Lease term (start and end dates)

- Rent amount and payment schedule

- Security deposit details

- Maintenance and repair responsibilities

- Permitted uses of the property

- Termination conditions

How long is a typical commercial lease term?

The length of a commercial lease can vary widely. Common lease terms range from one to five years, but some leases may extend for longer periods. The duration often depends on the type of business and the specific needs of the tenant and landlord. It's important to negotiate a term that works for both parties.

Can the lease be modified after signing?

Yes, a commercial lease can be modified after it has been signed, but both parties must agree to any changes. Modifications should be documented in writing and signed by both the landlord and tenant to ensure clarity and enforceability. Verbal agreements are not recommended.

What happens if a tenant defaults on the lease?

If a tenant defaults on the lease, the landlord has several options. These may include:

- Issuing a notice to cure the default, giving the tenant time to resolve the issue.

- Terminating the lease and taking possession of the property.

- Seeking damages through legal action.

It's crucial for tenants to understand the terms of default outlined in the lease to avoid potential consequences.

Is it necessary to have a lawyer review the lease?

While it's not legally required to have a lawyer review a commercial lease, it is highly advisable. A legal professional can help identify potential issues, ensure compliance with state laws, and protect your interests. This is especially important for complex leases or if you are unfamiliar with commercial real estate transactions.

What are common types of commercial leases?

There are several common types of commercial leases, including:

- Gross Lease: The landlord covers all property expenses.

- Net Lease: The tenant pays a portion of property expenses, such as taxes and maintenance.

- Percentage Lease: The tenant pays a base rent plus a percentage of sales.

- Modified Gross Lease: A combination of gross and net leases, where some expenses are shared.

Understanding the type of lease can help tenants make informed decisions based on their business needs.

Form Information

| Fact Name | Details |

|---|---|

| Governing Law | The California Commercial Lease Agreement is governed by California state laws, particularly the California Civil Code. |

| Parties Involved | The agreement typically involves a landlord (lessor) and a tenant (lessee) who are entering into a commercial leasing arrangement. |

| Lease Duration | Lease terms can vary widely, often ranging from one year to several years, depending on the agreement between the parties. |

| Security Deposits | Landlords may require a security deposit, which is usually equivalent to one to three months' rent, to cover potential damages or unpaid rent. |

Dos and Don'ts

When filling out a California Commercial Lease Agreement form, it’s essential to approach the task with care and attention to detail. Here are some important dos and don’ts to keep in mind:

- Do read the entire lease agreement carefully before filling it out. Understanding each clause will help you avoid potential pitfalls.

- Do provide accurate information. Ensure that all names, addresses, and dates are correct to avoid confusion later.

- Do clarify any unclear terms with the landlord or a legal professional. It’s better to ask questions upfront than to make assumptions.

- Do keep a copy of the completed lease for your records. This will serve as a reference in case any disputes arise.

- Don’t rush through the form. Taking your time can prevent mistakes that could lead to legal issues down the line.

- Don’t sign the lease until you are completely satisfied with its terms. Once signed, you are legally bound to the agreement.

By following these guidelines, you can navigate the process of completing a California Commercial Lease Agreement with confidence and clarity. Remember, a well-filled lease can lead to a successful business relationship.

Misconceptions

Understanding the California Commercial Lease Agreement form is crucial for both landlords and tenants. However, several misconceptions can lead to confusion. Here are nine common misconceptions explained:

- All lease agreements are the same. Many believe that all commercial lease agreements follow the same structure and terms. In reality, each agreement can be tailored to fit the specific needs of the parties involved, including duration, payment terms, and maintenance responsibilities.

- Verbal agreements are sufficient. Some people think that verbal agreements are legally binding. However, written agreements provide clear documentation of the terms and help prevent misunderstandings.

- Only landlords can negotiate terms. Tenants often feel they have little power in negotiations. In fact, both parties can negotiate terms, including rent, lease length, and renewal options.

- Security deposits are always refundable. While many assume that security deposits will be returned at the end of the lease, this is not always the case. Deductions may occur for damages or unpaid rent, as outlined in the lease.

- Rent increases are not allowed. Some tenants believe that once rent is set, it cannot be increased. However, many leases include provisions for rent increases at specified intervals.

- All commercial leases require a lawyer. Although legal advice can be beneficial, it is not mandatory for all commercial lease agreements. Many landlords and tenants successfully navigate leases without legal representation.

- Lease terms are fixed and cannot be changed. Many assume that once a lease is signed, the terms are unchangeable. In fact, amendments can be made if both parties agree, allowing for flexibility.

- Insurance is not necessary. Some tenants overlook the importance of insurance, thinking it is optional. Most commercial leases require tenants to maintain insurance to protect against potential liabilities.

- All lease agreements are easy to understand. While some leases may be straightforward, others can be complex. It is important for both parties to thoroughly review the lease and seek clarification on any unclear terms.

By addressing these misconceptions, both landlords and tenants can approach the California Commercial Lease Agreement with greater confidence and understanding.

Documents used along the form

The California Commercial Lease Agreement is a critical document for establishing the terms of a rental arrangement between a landlord and a tenant. Alongside this agreement, several other forms and documents are commonly utilized to ensure a comprehensive understanding and legal compliance throughout the leasing process. Below is a list of these documents, each serving a distinct purpose in the commercial leasing landscape.

- Lease Addendum: This document serves to modify or add specific terms to the original lease agreement. It can address issues such as maintenance responsibilities, additional fees, or changes in lease duration.

- Guaranty Agreement: A guaranty agreement is used when a third party agrees to take on the financial obligations of the tenant if they default. This provides additional security for the landlord.

- Estoppel Certificate: This certificate is often requested by potential buyers or lenders. It verifies the terms of the lease and confirms that the tenant is in compliance with those terms, ensuring transparency in the leasing arrangement.

- Security Deposit Receipt: This document acknowledges the receipt of the security deposit from the tenant. It outlines the amount collected and the conditions under which it may be retained or returned at the end of the lease.

These documents collectively enhance the clarity and enforceability of the commercial lease agreement, ensuring that both parties understand their rights and obligations. Utilizing these forms can help mitigate potential disputes and foster a positive landlord-tenant relationship.

Other Popular California Forms

Durable Power of Attorney Paperwork - A well-drafted document can minimize confusion and disputes among family members.

Tractor Bill of Sale Word Template - Organizes all relevant information concerning the sale in one document.

California Grant Deed - This form must contain a legal description of the property being transferred.