Official Deed Template for the State of California

Common Questions

What is a California Deed form?

A California Deed form is a legal document used to transfer ownership of real property in California. It serves as proof of the transfer and outlines the details of the transaction, including the parties involved and the property description.

What types of Deeds are available in California?

California recognizes several types of Deeds, including:

- Grant Deed: This is the most common type, which guarantees that the seller has not sold the property to anyone else.

- Quitclaim Deed: This transfers whatever interest the seller has in the property without any guarantees.

- Warranty Deed: This provides the highest level of protection for the buyer, ensuring that the seller has clear title to the property.

- Trustee's Deed: Used in the context of a foreclosure or when a property is held in a trust.

Do I need to have the Deed notarized?

Yes, in California, a Deed must be notarized to be legally valid. This process ensures that the identities of the parties involved are verified, and it helps prevent fraud.

How do I complete a California Deed form?

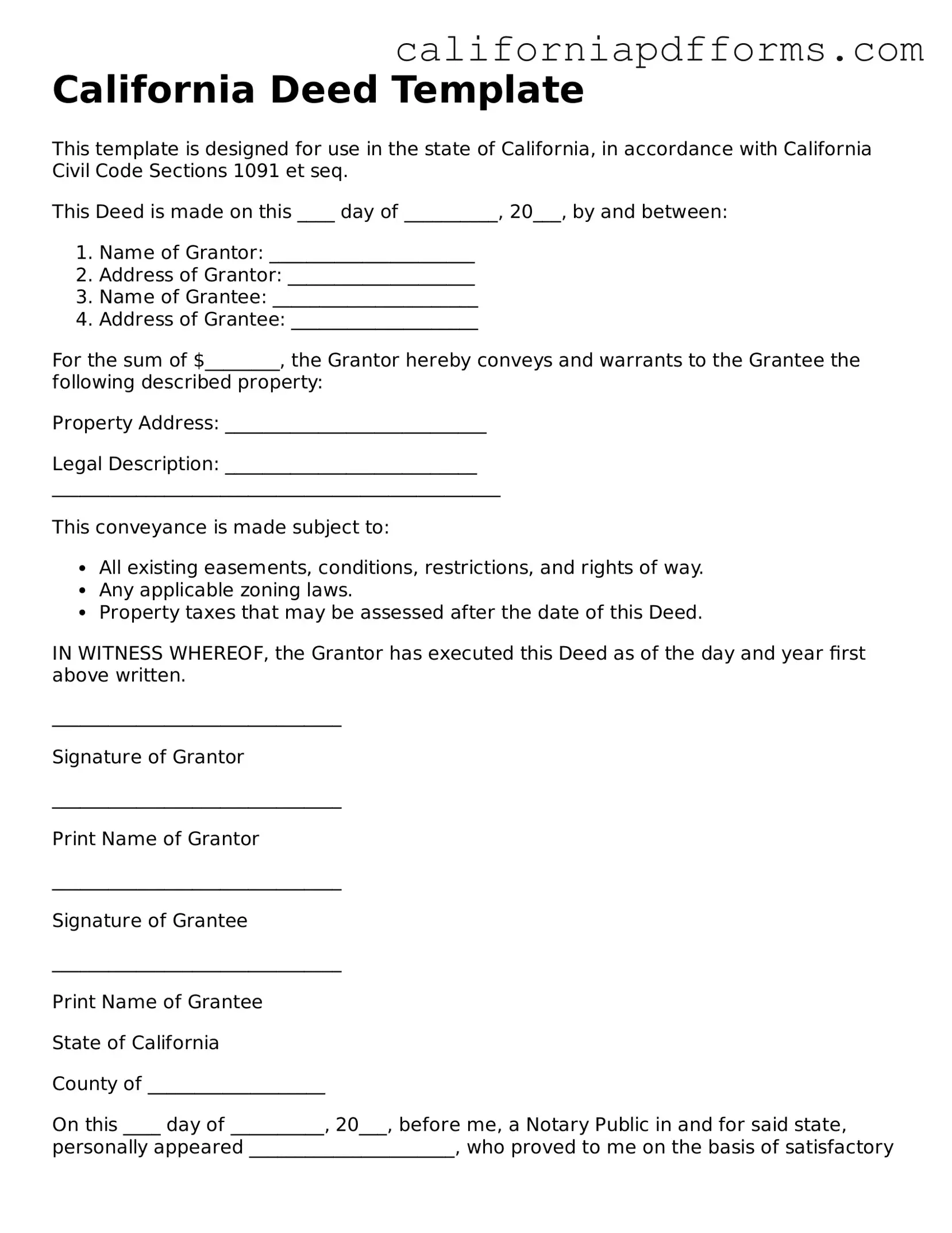

To complete a California Deed form, follow these steps:

- Identify the type of Deed you need.

- Fill in the names of the grantor (seller) and grantee (buyer).

- Provide a legal description of the property.

- Include the date of the transaction.

- Sign the Deed in front of a notary public.

Where do I file the Deed after completion?

After completing and notarizing the Deed, it must be filed with the county recorder's office in the county where the property is located. This step is crucial for making the transfer of ownership public and official.

Are there any fees associated with filing a Deed?

Yes, there are typically fees associated with filing a Deed. These fees vary by county and may include recording fees, transfer taxes, and additional charges. It’s advisable to check with your local county recorder's office for specific fee amounts.

Can I transfer property to myself using a Deed?

Yes, you can transfer property to yourself using a Deed. This is often done for estate planning purposes or to change the way the property is held. However, it’s important to consider potential tax implications and consult with a professional if needed.

What happens if I make a mistake on the Deed?

If a mistake is made on the Deed, it may lead to complications in the property transfer. Depending on the error, you might need to create a new Deed or execute a correction deed to amend the mistake. Consulting with a legal professional is recommended to address any issues properly.

Form Information

| Fact Name | Description |

|---|---|

| Purpose | The California Deed form is used to transfer ownership of real property from one party to another. |

| Types of Deeds | Common types include Grant Deed, Quitclaim Deed, and Warranty Deed, each serving different purposes. |

| Governing Laws | The transfer of property in California is governed by the California Civil Code, specifically Sections 1050-1095. |

| Notarization | A California Deed must be notarized to be legally valid and enforceable. |

| Recording | To protect ownership rights, the deed should be recorded with the county recorder's office where the property is located. |

| Consideration | The deed may require a statement of consideration, indicating the value exchanged for the property. |

| Legal Description | A precise legal description of the property must be included to avoid ambiguity in ownership. |

| Grantor and Grantee | The form must clearly identify the grantor (seller) and the grantee (buyer) involved in the transaction. |

| Tax Implications | Property transfers may have tax implications, including potential reassessment of property taxes under Proposition 13. |

Dos and Don'ts

When filling out a California Deed form, it is essential to approach the task with care. Below is a list of things to do and avoid, ensuring that the process is smooth and compliant.

- Do ensure that all names are spelled correctly. Accuracy is crucial for legal documents.

- Do provide a clear and complete description of the property. This helps prevent any confusion in the future.

- Do sign the deed in the presence of a notary public. This step adds an important layer of authenticity.

- Do check local recording requirements. Different counties may have specific rules regarding the submission of deeds.

- Don't leave any sections blank. Each part of the form must be filled out to avoid delays or rejections.

- Don't use white-out or erasers on the form. Corrections should be made by crossing out and initialing the changes to maintain integrity.

By adhering to these guidelines, you can help ensure that your California Deed form is completed accurately and efficiently.

Misconceptions

Understanding the California Deed form is essential for anyone involved in real estate transactions. However, several misconceptions can lead to confusion. Here are eight common misconceptions explained:

-

All deeds are the same.

Not all deeds serve the same purpose. There are various types of deeds, such as grant deeds, quitclaim deeds, and warranty deeds, each with different implications and protections.

-

Signing a deed is enough to transfer property.

While signing a deed is a crucial step, the deed must also be recorded with the county to legally transfer ownership.

-

Deeds can be verbal.

Property transfers must be documented in writing. Verbal agreements regarding deeds are not legally binding in California.

-

Only a lawyer can prepare a deed.

While legal assistance can be beneficial, individuals can prepare a deed themselves, provided they understand the necessary requirements and legal language.

-

All property transfers require a notary.

Not all deeds need notarization, but having a notary can help ensure the document is valid and can prevent future disputes.

-

Once a deed is recorded, it cannot be changed.

A deed can be amended or revoked, but doing so requires following specific legal procedures to ensure validity.

-

Deeds are only for selling property.

Deeds can also be used for gifting property, transferring property between family members, or placing property into a trust.

-

Property taxes are unaffected by a deed transfer.

Transferring property can trigger reassessment for property taxes, which may lead to increased tax liabilities.

Clarifying these misconceptions can help individuals navigate the complexities of property transactions in California more effectively.

Documents used along the form

When dealing with property transactions in California, several important documents often accompany the California Deed form. Each of these forms serves a unique purpose and plays a vital role in ensuring that the transfer of property is smooth and legally sound. Below is a list of commonly used forms and documents that you may encounter.

- Grant Deed: This document is used to transfer ownership of real property from one party to another. It provides a guarantee that the property is free from any encumbrances, except those disclosed in the deed.

- Quitclaim Deed: A quitclaim deed transfers whatever interest the grantor has in the property without making any promises about the quality of that interest. It’s often used between family members or in divorce settlements.

- Title Report: This report outlines the current ownership of the property and any liens or claims against it. It’s essential for buyers to ensure they are acquiring a clear title.

- Preliminary Change of Ownership Report: This form is required by the county assessor when property changes hands. It helps in assessing property taxes based on the new ownership.

- Property Transfer Disclosure Statement: Sellers must provide this statement to inform buyers of any known issues with the property, such as structural problems or pest infestations.

- Affidavit of Death: If a property owner passes away, this document can help clarify the transfer of property rights to heirs or beneficiaries without going through probate.

- Notice of Default: This document is filed when a borrower has failed to make mortgage payments. It serves as a warning that foreclosure proceedings may begin if the debt remains unpaid.

- Escrow Instructions: These are written instructions given to an escrow agent detailing how to handle the funds and documents involved in the property transaction, ensuring that all parties fulfill their obligations.

Understanding these documents can help streamline the property transfer process and ensure that all parties are informed and protected. Whether you are buying, selling, or transferring property, being aware of these forms is crucial for a successful transaction.

Other Popular California Forms

Bill of Sale Template for Car - Use this form to document the transfer of ownership for a dirt bike.

Mobile Home Title California - A clear Mobile Home Bill of Sale can streamline the process for all parties involved.