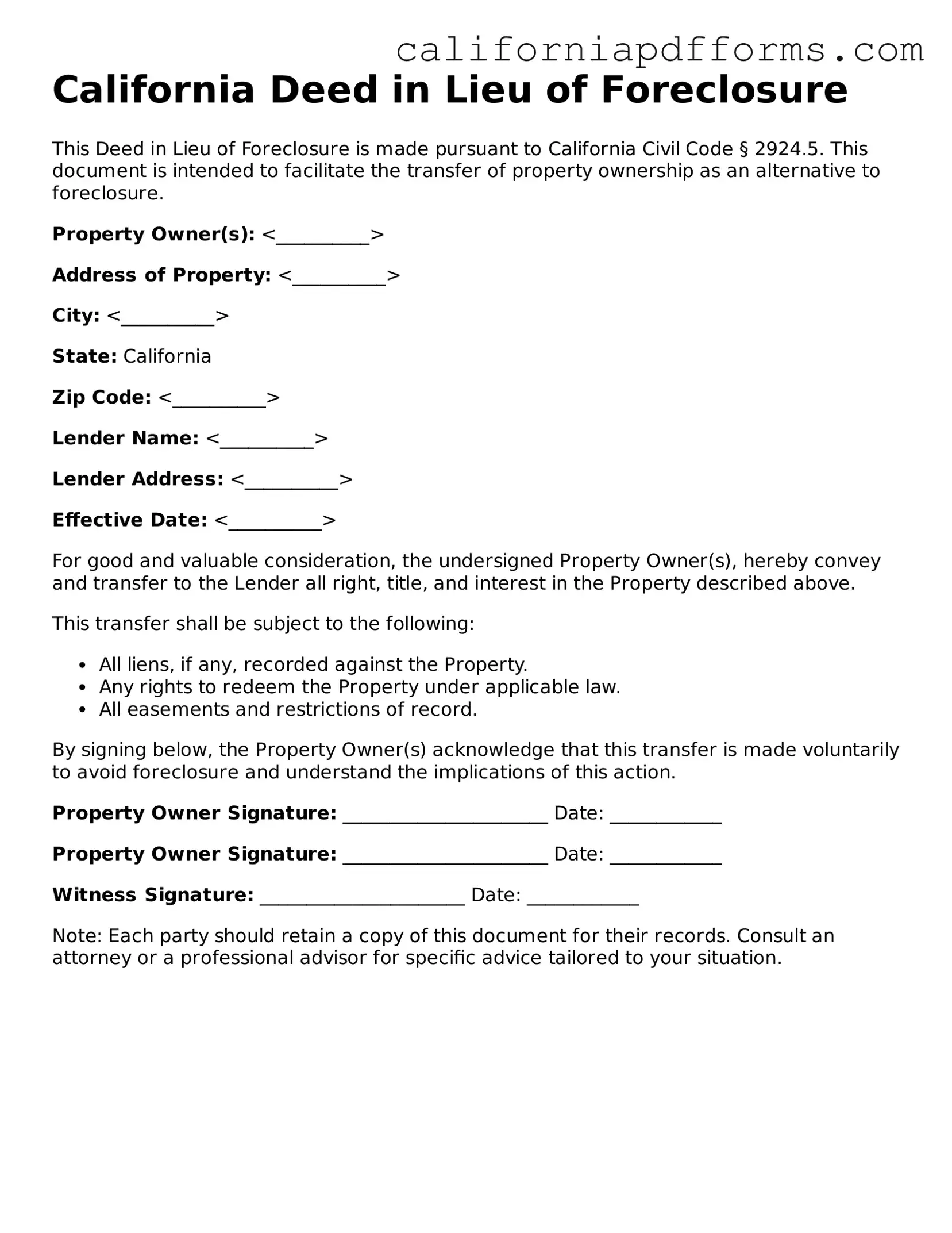

Official Deed in Lieu of Foreclosure Template for the State of California

Common Questions

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal agreement where a homeowner voluntarily transfers the title of their property to the lender in exchange for relief from the mortgage debt. This process allows the homeowner to avoid the lengthy and often costly foreclosure process. It can be a beneficial option for those facing financial difficulties and seeking a quicker resolution.

What are the benefits of choosing a Deed in Lieu of Foreclosure?

Several advantages come with opting for a Deed in Lieu of Foreclosure:

- Quick resolution: The process is generally faster than foreclosure, allowing homeowners to move on sooner.

- Less damage to credit: While it still impacts credit scores, the effect is often less severe than a foreclosure.

- Potential for debt forgiveness: Homeowners may be relieved of their mortgage obligations, depending on the lender's terms.

- Control over the process: Homeowners have more control compared to a foreclosure, where the lender dictates the timeline and process.

Are there any drawbacks to a Deed in Lieu of Foreclosure?

While there are benefits, it is important to consider potential drawbacks:

- Impact on credit: Although less severe than foreclosure, a Deed in Lieu will still negatively affect credit scores.

- Tax implications: Homeowners may face tax liabilities if the lender forgives any portion of the debt.

- Eligibility requirements: Not all lenders accept Deeds in Lieu, and some may have specific criteria that must be met.

- Loss of property: Homeowners will lose their property, which can be emotionally and financially challenging.

How does one initiate a Deed in Lieu of Foreclosure?

The process typically involves several steps:

- Contact the lender: The homeowner should reach out to their lender to discuss their financial situation and express interest in a Deed in Lieu.

- Provide documentation: Lenders may require financial documents to assess the homeowner's situation, including income statements and details about the property.

- Negotiate terms: Homeowners should negotiate the terms of the agreement, including any potential debt forgiveness and the timeline for the transfer.

- Complete the paperwork: Once terms are agreed upon, the necessary legal documents must be signed and recorded to finalize the transfer.

Form Information

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to transfer the title of their property to the lender to avoid foreclosure. |

| Governing Law | In California, the process is governed by the California Civil Code, particularly sections related to mortgages and deeds. |

| Eligibility | Homeowners facing financial difficulties and unable to keep up with mortgage payments may qualify for this option. |

| Process | The homeowner must negotiate with the lender to agree on the deed transfer, often requiring a formal agreement. |

| Benefits | This option can be less damaging to a homeowner's credit score compared to a foreclosure and may provide a faster resolution. |

| Risks | Homeowners may still be liable for any deficiency balance if the property sells for less than the mortgage amount unless otherwise agreed upon. |

| Alternatives | Other options include loan modification, short sale, or bankruptcy, which may also help avoid foreclosure. |

Dos and Don'ts

When filling out the California Deed in Lieu of Foreclosure form, it is essential to approach the process with care and attention. Here are some important do's and don'ts to consider:

- Do ensure that all information is accurate and complete. Double-check names, addresses, and property details.

- Do consult with a legal professional if you have questions or uncertainties about the process.

- Do keep copies of all documents for your records after submission.

- Do communicate openly with your lender about your intentions and any challenges you are facing.

- Do understand the implications of signing the deed and how it may affect your credit and future borrowing.

- Don't rush through the form. Take your time to fill it out thoughtfully.

- Don't leave any fields blank unless instructed. Incomplete forms may be rejected.

- Don't ignore any additional documentation that may be required by your lender.

- Don't sign the form without fully understanding its contents and consequences.

- Don't hesitate to seek assistance if you feel overwhelmed by the process.

Misconceptions

Understanding the California Deed in Lieu of Foreclosure can be challenging, especially with the many misconceptions that surround it. Here are eight common misconceptions and clarifications to help you navigate this process more effectively.

-

Misconception 1: A deed in lieu of foreclosure eliminates all debts.

This is not true. While the property is transferred to the lender, any remaining debts not secured by the property may still be owed.

-

Misconception 2: You can only use a deed in lieu if your mortgage is current.

In reality, many lenders will accept a deed in lieu even if you are behind on your mortgage payments. However, being current may improve your chances.

-

Misconception 3: The process is quick and simple.

Although it may seem straightforward, the deed in lieu process can take time. Lenders will conduct their own evaluations and may require extensive documentation.

-

Misconception 4: A deed in lieu will not affect your credit score.

This is misleading. A deed in lieu of foreclosure can impact your credit score, often negatively, similar to a foreclosure.

-

Misconception 5: You will not need to vacate the property immediately.

Once the deed is signed, you may be required to vacate the property within a specified timeframe. It is important to clarify this with your lender.

-

Misconception 6: A deed in lieu is the same as a short sale.

These are different processes. A short sale involves selling the property for less than what is owed, while a deed in lieu transfers ownership directly to the lender.

-

Misconception 7: You can negotiate the terms of a deed in lieu.

While some terms may be negotiable, lenders often have standard policies. It’s essential to understand what you can realistically negotiate.

-

Misconception 8: A deed in lieu guarantees you will not face foreclosure.

Accepting a deed in lieu does not guarantee that you will avoid foreclosure proceedings. It’s crucial to communicate openly with your lender throughout the process.

By addressing these misconceptions, individuals facing financial difficulties can make more informed decisions about their options in California.

Documents used along the form

When dealing with a Deed in Lieu of Foreclosure in California, several other forms and documents may be necessary to ensure a smooth process. Each of these documents serves a specific purpose and helps protect the interests of both the borrower and the lender. Here’s a list of commonly used forms that complement the Deed in Lieu of Foreclosure.

- Notice of Default: This document notifies the borrower that they have defaulted on their mortgage payments. It serves as a formal warning before further actions, such as foreclosure, are taken.

- Loan Modification Agreement: If the borrower and lender agree to modify the terms of the loan, this document outlines the new terms, including interest rates and payment schedules.

- Release of Liability: This form releases the borrower from any further obligations related to the mortgage after the Deed in Lieu is executed, providing peace of mind to the borrower.

- Property Condition Disclosure: This document provides information about the condition of the property being transferred. It ensures that the lender is aware of any existing issues with the property.

- Affidavit of Title: The borrower signs this document to affirm that they own the property and that there are no undisclosed liens or claims against it.

- Title Insurance Policy: This insurance protects the lender against any potential claims or disputes regarding the ownership of the property after the transfer.

- Quitclaim Deed: This document transfers any interest the borrower has in the property to the lender. It is often used in conjunction with the Deed in Lieu of Foreclosure.

- Settlement Statement: This statement outlines all financial aspects of the transaction, including any fees, credits, or debits associated with the Deed in Lieu process.

- Consent to Foreclosure Alternative: This form indicates that the borrower agrees to consider alternatives to foreclosure, such as the Deed in Lieu of Foreclosure.

Understanding these documents can help streamline the process and ensure that all parties are protected. Always consider consulting with a legal professional to navigate these forms effectively.

Other Popular California Forms

Power of Attorney to Transfer Motor Vehicle - Designate an agent to handle the sale or purchase of a motor vehicle with this Power of Attorney.

Dmv Bill of Sale California - The form may also include the purchase price and date of sale for clarity.