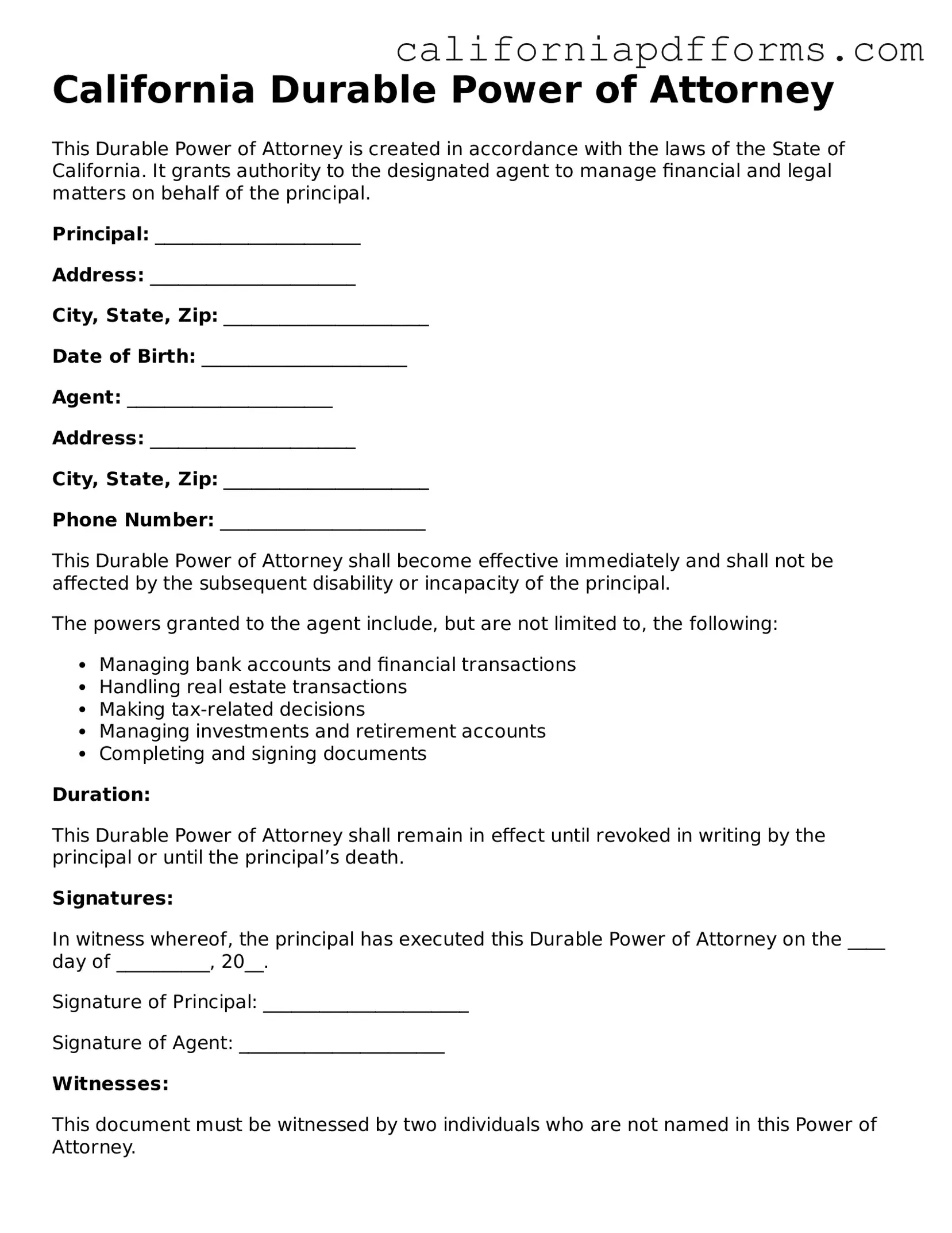

Official Durable Power of Attorney Template for the State of California

Common Questions

What is a California Durable Power of Attorney?

A California Durable Power of Attorney is a legal document that allows you to appoint someone to manage your financial and legal affairs if you become unable to do so yourself. The term "durable" means that the authority granted continues even if you become incapacitated.

Who can be appointed as an agent?

You can appoint any competent adult as your agent, including a family member, friend, or professional. However, it’s essential to choose someone you trust, as they will have significant control over your financial matters.

What powers can I grant to my agent?

You can grant a wide range of powers, including:

- Managing bank accounts

- Paying bills

- Buying or selling property

- Making investment decisions

- Handling tax matters

You can specify the powers you want to grant or limit them as necessary.

How do I create a Durable Power of Attorney in California?

To create a Durable Power of Attorney, follow these steps:

- Obtain a California Durable Power of Attorney form.

- Fill out the form, specifying the powers you wish to grant.

- Sign the document in front of a notary public or two witnesses, as required by California law.

Do I need to notarize the document?

Yes, the Durable Power of Attorney must be notarized or signed by two witnesses to be valid in California. This helps to ensure that the document is executed properly and reduces the risk of disputes later on.

Can I revoke a Durable Power of Attorney?

Yes, you can revoke a Durable Power of Attorney at any time as long as you are mentally competent. To do so, you should create a written revocation document and notify your agent and any relevant institutions of the change.

What happens if I become incapacitated and have not created a Durable Power of Attorney?

If you become incapacitated without a Durable Power of Attorney, the court may appoint a conservator to manage your affairs. This process can be lengthy and costly, making it essential to have a Durable Power of Attorney in place if you wish to avoid this situation.

Is a Durable Power of Attorney effective immediately?

It can be effective immediately or only upon your incapacity, depending on how you choose to set it up. If you want it to take effect right away, you need to specify that in the document. If you prefer it to activate only when you become incapacitated, make sure to indicate that clearly.

Can I use a Durable Power of Attorney for healthcare decisions?

No, a Durable Power of Attorney is specifically for financial and legal matters. For healthcare decisions, you need a separate document called an Advance Health Care Directive. This document allows you to appoint someone to make medical decisions on your behalf if you are unable to do so.

Form Information

| Fact Name | Details |

|---|---|

| Definition | A California Durable Power of Attorney allows an individual (the principal) to designate someone (the agent) to manage their financial affairs in case they become incapacitated. |

| Governing Law | This form is governed by the California Probate Code, specifically Sections 4000-4545. |

| Durability | The "durable" aspect means that the power of attorney remains in effect even if the principal becomes incapacitated. |

| Agent's Powers | The agent can perform a variety of tasks, including managing bank accounts, paying bills, and making investment decisions. |

| Revocation | The principal can revoke the power of attorney at any time, as long as they are mentally competent. |

| Notarization Requirement | While notarization is not mandatory, having the document notarized can help prevent disputes about its validity. |

| Health Care Decisions | This form does not cover health care decisions. For that, a separate Advance Health Care Directive is needed. |

| Limitations | Some powers, like making changes to a will or trust, cannot be granted through a durable power of attorney. |

Dos and Don'ts

When filling out the California Durable Power of Attorney form, there are important guidelines to follow. Here are six things you should and shouldn't do:

- Do: Read the instructions carefully before starting.

- Do: Clearly identify the person you are appointing as your agent.

- Do: Specify the powers you wish to grant to your agent.

- Don't: Leave any sections blank; fill in all required fields.

- Don't: Use outdated forms; ensure you have the latest version.

- Don't: Forget to sign and date the form in the appropriate places.

Misconceptions

Understanding the California Durable Power of Attorney form is crucial for anyone considering this important legal document. However, several misconceptions can lead to confusion and misinformed decisions. Here are nine common misconceptions:

- It only applies to financial matters. Many believe that a Durable Power of Attorney is limited to financial decisions. In reality, it can also cover health care decisions if specified in the document.

- It becomes invalid if I become incapacitated. This is false. The purpose of a Durable Power of Attorney is to remain effective even if you become incapacitated, unlike a regular Power of Attorney.

- Anyone can serve as my agent. While you can choose almost anyone, it's important to select someone you trust deeply. Not all individuals are qualified to act in your best interest.

- It is a one-size-fits-all document. Each Durable Power of Attorney can be tailored to fit your specific needs and preferences. Customizing the document ensures it aligns with your wishes.

- Once signed, it cannot be changed. This is not true. You can revoke or amend your Durable Power of Attorney at any time, as long as you are mentally competent.

- It automatically grants my agent access to my medical records. Access to medical records is not automatically included. You must specify this authority in the document if you wish for your agent to have it.

- It is only necessary for the elderly. Many people think that only older adults need a Durable Power of Attorney. In truth, anyone over the age of 18 can benefit from having one.

- My spouse automatically has power over my decisions. While spouses have certain rights, a Durable Power of Attorney explicitly designates who can make decisions on your behalf. Without this document, your spouse may not have full authority.

- I don’t need it if I have a will. A will only takes effect after your death. A Durable Power of Attorney is essential for managing your affairs while you are still alive, especially if you become unable to do so.

Clarifying these misconceptions is essential for making informed decisions about your legal and financial future. Take the time to understand the implications and benefits of having a Durable Power of Attorney in place.

Documents used along the form

The California Durable Power of Attorney form is a crucial document that allows an individual to designate someone else to make financial and legal decisions on their behalf. However, it is often used in conjunction with several other important forms and documents that can help ensure comprehensive planning for various circumstances. Below is a list of five such documents commonly associated with the Durable Power of Attorney.

- Advance Healthcare Directive: This document allows individuals to outline their healthcare preferences in case they become unable to communicate those wishes. It typically includes instructions on medical treatment and appoints a healthcare agent to make decisions on the individual's behalf.

- Living Will: A living will is a type of advance directive that specifically addresses end-of-life care. It provides guidance on the types of medical treatments an individual wishes to receive or refuse if they are terminally ill or in a persistent vegetative state.

- HIPAA Authorization: The Health Insurance Portability and Accountability Act (HIPAA) authorization allows individuals to grant permission for designated persons to access their medical records and information. This is particularly important when a healthcare agent needs to make informed decisions about medical care.

- Revocable Living Trust: A revocable living trust is an estate planning tool that allows individuals to manage their assets during their lifetime and specify how those assets should be distributed after death. It can help avoid probate and streamline the transfer of assets to beneficiaries.

- Will: A will is a legal document that outlines how an individual's assets should be distributed upon their death. It also allows for the appointment of guardians for minor children and can specify funeral arrangements.

These documents collectively enhance the effectiveness of a Durable Power of Attorney by addressing various aspects of an individual's personal and financial affairs. Utilizing these forms can help ensure that an individual's wishes are respected and that their interests are protected in different situations.

Other Popular California Forms

How to Sell a Gun in Ca - Installed to secure both buyer and seller's interests in the deal.

What Is an Operating Agreement Llc California - An Operating Agreement outlines the management structure of a business entity.