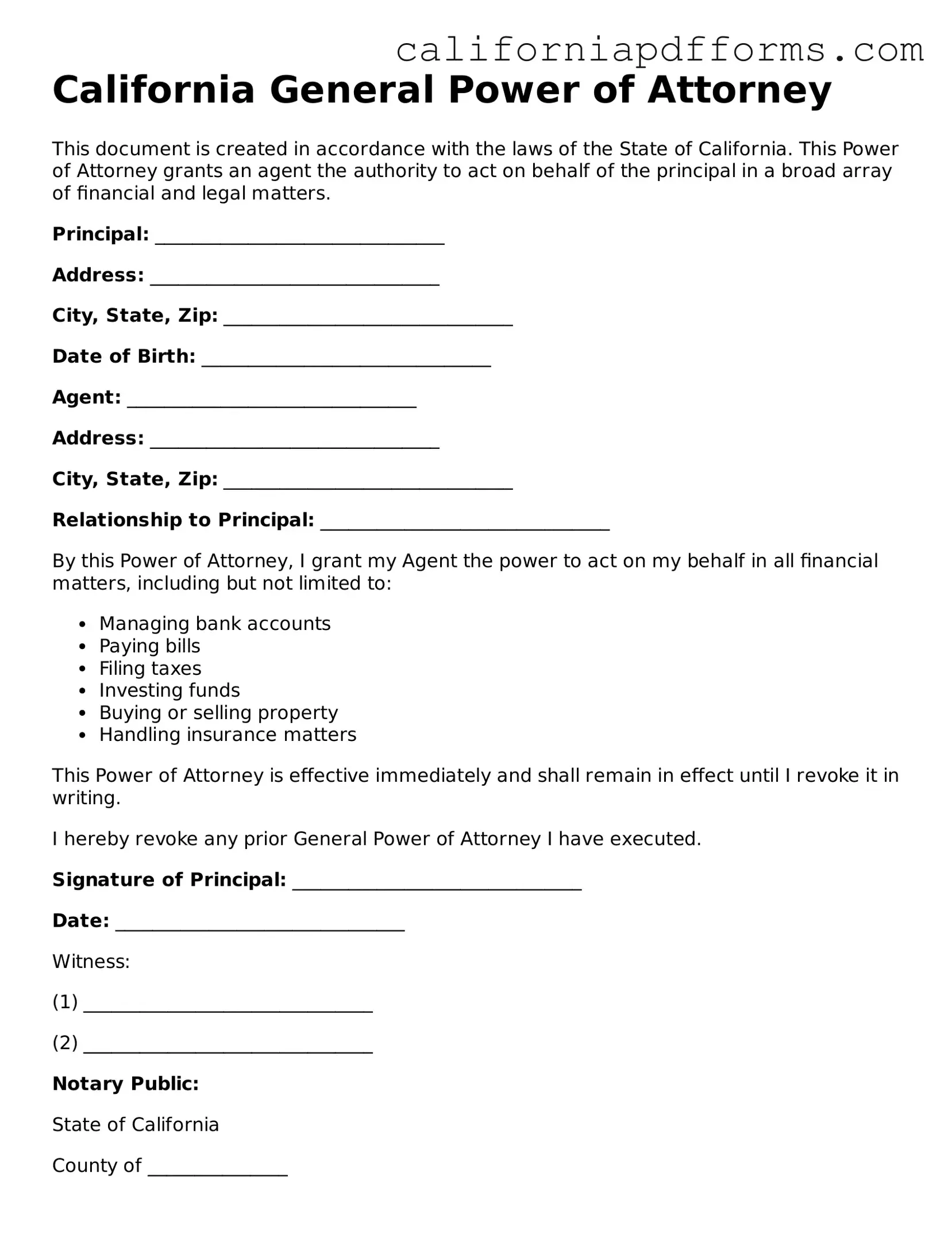

Official General Power of Attorney Template for the State of California

Common Questions

What is a California General Power of Attorney?

A California General Power of Attorney is a legal document that allows one person, known as the principal, to appoint another person, called the agent or attorney-in-fact, to act on their behalf. This authority can cover a wide range of financial and legal matters, such as managing bank accounts, signing checks, and handling real estate transactions. The principal can specify the powers granted to the agent, and this document can be tailored to meet specific needs.

When does a General Power of Attorney become effective?

A General Power of Attorney can be effective immediately upon signing, or it can be set to become effective at a future date or upon the occurrence of a specific event, such as the principal becoming incapacitated. If it is set to become effective only upon incapacitation, it is often referred to as a "springing" power of attorney. It is important for the principal to clearly outline when the powers will take effect in the document.

Can I revoke a General Power of Attorney in California?

Yes, a General Power of Attorney can be revoked at any time as long as the principal is mentally competent. To revoke the document, the principal must create a written notice of revocation and communicate it to the agent and any institutions or individuals that may rely on the power of attorney. It is advisable to formally cancel the document by filing a revocation with the county recorder's office, especially if the original power of attorney was recorded.

What happens if the principal becomes incapacitated?

If the principal becomes incapacitated and the General Power of Attorney does not have a springing clause, the agent can continue to act on behalf of the principal. However, if the principal has not designated a durable power of attorney, the authority may end upon incapacitation. In such cases, a court may need to appoint a conservator to manage the principal's affairs. It is crucial to discuss these scenarios with a legal professional to ensure that the principal's wishes are respected.

Form Information

| Fact Name | Description |

|---|---|

| Definition | A California General Power of Attorney allows an individual (the principal) to grant authority to another person (the agent) to make decisions on their behalf. |

| Governing Law | This form is governed by the California Probate Code, specifically Sections 4000-4545. |

| Durability | The General Power of Attorney can be durable, meaning it remains effective even if the principal becomes incapacitated, provided that it is explicitly stated in the document. |

| Revocation | The principal can revoke the General Power of Attorney at any time, as long as they are competent to do so. |

| Agent's Responsibilities | The agent is expected to act in the best interest of the principal and must manage the principal's affairs with care and loyalty. |

Dos and Don'ts

When filling out the California General Power of Attorney form, it's crucial to follow certain guidelines to ensure the document is valid and effective. Here are nine things to consider:

- Do clearly identify the principal and the agent. Make sure their full names and addresses are accurately listed.

- Do specify the powers granted to the agent. Be explicit about what decisions the agent can make on your behalf.

- Do sign the document in front of a notary public. This step is essential for the power of attorney to be legally recognized.

- Do keep copies of the completed form. Distributing copies to your agent and trusted family members can prevent confusion later.

- Do review the document regularly. Changes in circumstances may necessitate updates to the power of attorney.

- Don't leave blank spaces on the form. Fill in all required fields to avoid ambiguity.

- Don't grant powers that you are not comfortable with. Only give authority for decisions you trust the agent to make.

- Don't forget to revoke any previous power of attorney if you are creating a new one. This helps avoid conflicts and confusion.

- Don't underestimate the importance of discussing your wishes with your agent. Clear communication is vital for effective representation.

Misconceptions

- Misconception 1: A General Power of Attorney is only for financial matters.

- Misconception 2: A General Power of Attorney remains effective after the principal becomes incapacitated.

- Misconception 3: A General Power of Attorney can be used to make decisions against the principal's wishes.

- Misconception 4: You need a lawyer to create a General Power of Attorney.

- Misconception 5: Once a General Power of Attorney is signed, it cannot be changed or revoked.

This is not true. While a General Power of Attorney often covers financial decisions, it can also grant authority for healthcare decisions, property management, and other personal matters. The scope of authority can be customized based on the individual's needs.

This is incorrect. A standard General Power of Attorney typically ends when the principal becomes incapacitated. To ensure continued authority in such situations, a Durable Power of Attorney should be used, which remains effective even if the principal is unable to make decisions.

This is a misunderstanding. The agent must act in the best interest of the principal and follow their wishes as outlined in the document. Any actions taken contrary to the principal's wishes can lead to legal consequences for the agent.

While it's advisable to consult a lawyer for guidance, it is not strictly necessary. Individuals can create a General Power of Attorney using templates available online. However, ensuring that the document complies with California law is crucial.

This is false. The principal has the right to revoke or modify the General Power of Attorney at any time, as long as they are mentally competent. Proper procedures should be followed to ensure the revocation is legally effective.

Documents used along the form

When creating a California General Power of Attorney, several other forms and documents may be beneficial to consider. Each of these documents serves a unique purpose and can help ensure that your legal and financial affairs are managed according to your wishes.

- Durable Power of Attorney: This document allows someone to make decisions on your behalf even if you become incapacitated. Unlike a standard power of attorney, it remains effective in such situations.

- Advance Healthcare Directive: This form outlines your healthcare preferences and appoints someone to make medical decisions for you if you are unable to do so.

- Living Will: A living will specifies your wishes regarding end-of-life medical treatment. It guides your healthcare providers and loved ones when difficult decisions must be made.

- Financial Power of Attorney: Similar to a general power of attorney, this document focuses specifically on financial matters, allowing your agent to manage your finances and property.

- Trust Agreement: This document creates a trust to manage your assets during your lifetime and after your death, ensuring they are distributed according to your wishes.

- Will: A will outlines how you want your assets distributed after your death. It names an executor to carry out your wishes and can include guardianship provisions for minor children.

- HIPAA Release Form: This form allows you to designate individuals who can access your medical records and make healthcare decisions on your behalf, ensuring your privacy is maintained.

- Property Transfer Documents: These documents facilitate the transfer of ownership of real estate or other property. They can be crucial if your power of attorney needs to manage or sell your assets.

Understanding these documents can help you create a comprehensive plan for managing your affairs. Each serves a specific role and can work together with the General Power of Attorney to ensure your wishes are honored and your interests are protected.

Other Popular California Forms

How to Sell a Gun in Ca - Validates the authenticity of the transaction for both parties.

California Dmv Bill of Sale - It's essential for documenting the transfer of ownership for various personal or business assets.

Home Schooling in California - It's an essential document that emphasizes the legitimacy of your homeschooling efforts.