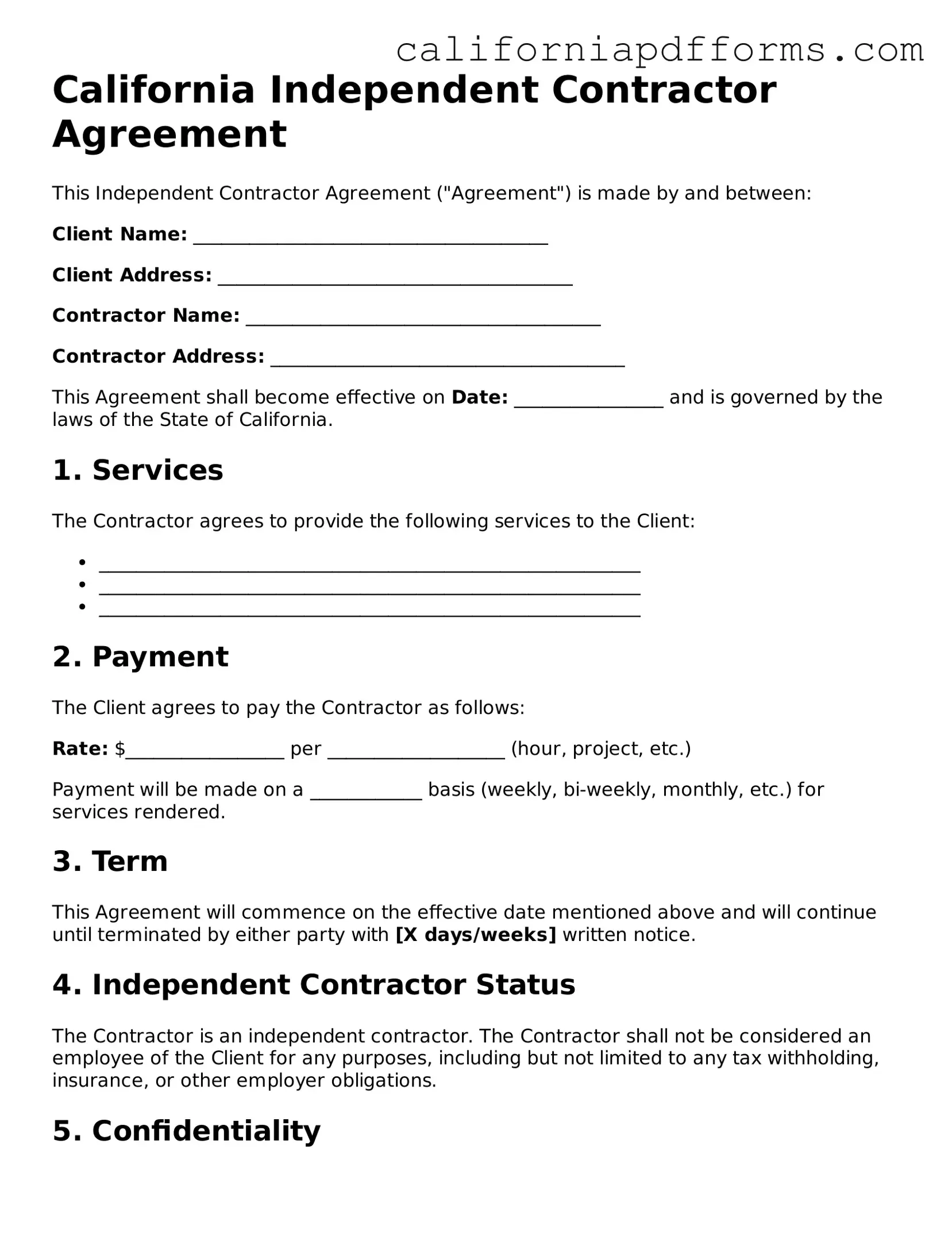

Official Independent Contractor Agreement Template for the State of California

Common Questions

What is a California Independent Contractor Agreement?

A California Independent Contractor Agreement is a legal document that outlines the relationship between a business and an independent contractor. This agreement details the terms of engagement, including the scope of work, payment terms, and the rights and responsibilities of both parties. It is essential for clarifying expectations and protecting the interests of both the contractor and the hiring entity.

Why is an Independent Contractor Agreement important?

Having an Independent Contractor Agreement is crucial for several reasons:

- Clarifies Roles: The agreement clearly defines the roles and responsibilities of both parties, which can help prevent misunderstandings.

- Legal Protection: It provides legal protection for both the contractor and the business, ensuring that both parties understand their rights.

- Tax Implications: It helps clarify the contractor's status, which is important for tax purposes and compliance with California labor laws.

What should be included in the agreement?

An effective Independent Contractor Agreement should include the following key elements:

- Scope of Work: A detailed description of the services to be provided.

- Payment Terms: Information about how and when the contractor will be paid.

- Duration: The length of time the agreement will be in effect.

- Confidentiality: Provisions regarding the handling of confidential information.

- Termination Clause: Conditions under which either party can terminate the agreement.

How does California law define an independent contractor?

In California, the definition of an independent contractor has been shaped by the ABC test, established by the California Supreme Court in 2018. Under this test, a worker is considered an independent contractor if all three of the following conditions are met:

- The worker is free from the control and direction of the hiring entity in connection with the performance of the work.

- The worker performs work that is outside the usual course of the hiring entity’s business.

- The worker is engaged in an independently established trade, occupation, or business.

What happens if the agreement is not followed?

If either party fails to adhere to the terms of the Independent Contractor Agreement, several consequences may arise. The affected party may seek legal remedies, which could include:

- Damages: Compensation for any losses incurred due to the breach.

- Injunctions: Court orders to compel compliance with the agreement.

- Termination: The right to terminate the agreement if terms are violated.

Can the agreement be modified after it has been signed?

Yes, the Independent Contractor Agreement can be modified after it has been signed, but any changes should be documented in writing. Both parties should agree to the modifications, and it is advisable to sign the amended agreement to avoid future disputes. Clear communication and mutual consent are essential to ensure that both parties are on the same page regarding any changes.

Form Information

| Fact Name | Description |

|---|---|

| Purpose | The California Independent Contractor Agreement outlines the terms between a contractor and a client for services rendered. |

| Governing Law | This agreement is governed by California state laws, particularly the California Labor Code. |

| Classification | It is crucial to properly classify workers as independent contractors to comply with California's AB 5 law. |

| Essential Elements | The agreement should include payment terms, scope of work, and duration of the contract. |

| Termination Clause | A clear termination clause helps both parties understand how and when the agreement can be ended. |

| Intellectual Property | It’s important to specify ownership of any intellectual property created during the contract period. |

| Confidentiality | A confidentiality clause can protect sensitive information shared during the course of work. |

| Dispute Resolution | The agreement may include terms for resolving disputes, such as mediation or arbitration. |

| Signature Requirement | Both parties must sign the agreement for it to be legally binding. |

Dos and Don'ts

When filling out the California Independent Contractor Agreement form, it is essential to be thorough and accurate. Here are four things to keep in mind:

- Do: Provide accurate personal information, including your full name and contact details.

- Do: Clearly define the scope of work to avoid misunderstandings later.

- Don't: Leave any sections blank; incomplete forms can lead to delays or rejections.

- Don't: Use vague language; specificity is crucial for clarity and legal compliance.

Misconceptions

-

Misconception 1: The Independent Contractor Agreement is only for freelancers.

Many people believe that this agreement is solely for freelancers. In reality, it can be used by various types of independent contractors, including consultants, service providers, and even temporary workers.

-

Misconception 2: Signing the agreement automatically makes someone an independent contractor.

Simply signing the agreement does not guarantee independent contractor status. The nature of the work relationship and how the work is performed are crucial factors in determining whether someone is truly an independent contractor.

-

Misconception 3: The agreement does not need to be in writing.

While verbal agreements may be legally binding, having a written contract is essential. A written agreement provides clarity and protection for both parties, outlining expectations and responsibilities.

-

Misconception 4: Independent contractors are not entitled to any benefits.

This is not entirely true. While independent contractors typically do not receive the same benefits as employees, they may negotiate certain benefits, such as flexible hours or project bonuses, as part of their agreement.

-

Misconception 5: The California Independent Contractor Agreement is the same as in other states.

Each state has its own laws and regulations regarding independent contractors. California has specific criteria, particularly with the ABC test, that differ from other states. It's important to understand local laws when using this agreement.

Documents used along the form

When engaging an independent contractor in California, several additional forms and documents may accompany the California Independent Contractor Agreement. These documents help clarify the working relationship, outline expectations, and ensure compliance with relevant laws. Below is a list of commonly used forms that can enhance the agreement process.

- W-9 Form: This form is used to collect the contractor's taxpayer identification information. It is essential for reporting payments to the IRS and ensuring that the contractor can provide their correct taxpayer details.

- Confidentiality Agreement: Also known as a Non-Disclosure Agreement (NDA), this document protects sensitive information shared between the contractor and the hiring entity. It helps maintain confidentiality regarding proprietary information, trade secrets, or any other sensitive data.

- Scope of Work Document: This outlines the specific tasks and deliverables expected from the contractor. By detailing the scope, both parties can have a clear understanding of the project requirements and deadlines.

- Invoice Template: An invoice template is often used by contractors to bill for their services. It typically includes details such as the contractor’s name, services provided, payment terms, and due dates, ensuring clarity in financial transactions.

Utilizing these forms and documents alongside the California Independent Contractor Agreement can help establish a clear and professional working relationship. They serve to protect both parties and ensure that expectations are met throughout the duration of the contract.

Other Popular California Forms

Do I Need a Lawyer for a Power of Attorney - Encourages proactive management of personal affairs.

How to Sell a Gun in Ca - Acts as a deterrent against illegal sales by providing a record.

How Much Does a Deed Cost - It is crucial to provide accurate details about the property when completing the form.