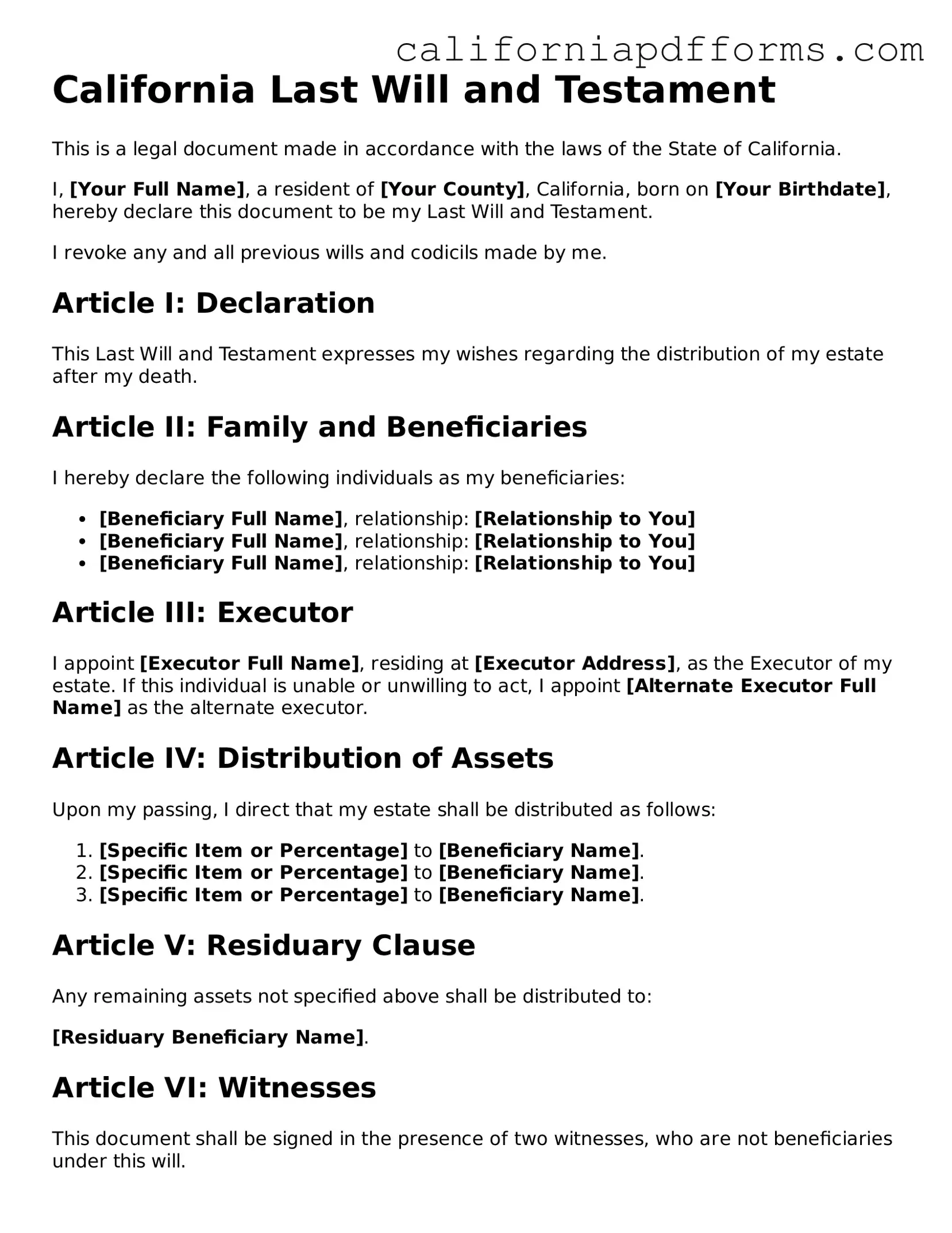

Official Last Will and Testament Template for the State of California

Common Questions

What is a Last Will and Testament in California?

A Last Will and Testament is a legal document that outlines how an individual's assets and affairs will be handled after their death. In California, this document specifies how property will be distributed, names guardians for minor children, and appoints an executor to manage the estate. It serves as a crucial tool for ensuring that your wishes are honored and can help avoid disputes among family members.

Who can create a Last Will and Testament in California?

In California, any person who is at least 18 years old and of sound mind can create a Last Will and Testament. This means that you must understand the nature of your actions and the consequences of creating a will. Additionally, you should be able to express your wishes clearly.

What are the requirements for a valid will in California?

To ensure that a will is valid in California, it must meet several key requirements:

- The will must be in writing.

- The testator (the person making the will) must sign the will or direct someone else to sign it in their presence.

- The will must be witnessed by at least two individuals who are present at the same time. These witnesses must also sign the will.

It is important to note that California allows for handwritten wills, known as holographic wills, which do not require witnesses if the signature and material provisions are in the handwriting of the testator.

Can I change my will after it has been created?

Yes, you can change your will at any time while you are still alive. To do this, you can either create a new will that revokes the previous one or add a codicil, which is an amendment to the existing will. Any changes should be made following the same legal requirements to ensure they are valid.

What happens if I die without a will in California?

If you die without a will, you are considered to have died "intestate." In this situation, California's intestacy laws will determine how your assets are distributed. Generally, your property will go to your closest relatives, such as your spouse, children, or parents. However, this process may not reflect your wishes and can lead to complications and disputes among family members.

Can I disinherit someone in my will?

Yes, you can disinherit someone in your will. However, it is advisable to explicitly state your intention to disinherit that individual to avoid any confusion or potential legal challenges. In California, if you have a spouse or children, they may have certain rights to your estate, so it is essential to be clear about your wishes.

How can I ensure my will is properly executed?

To ensure that your will is properly executed, consider the following steps:

- Consult with an attorney who specializes in estate planning to help draft your will.

- Follow all legal requirements for signing and witnessing your will.

- Store your will in a safe place and inform your executor and loved ones where it can be found.

- Review and update your will regularly, especially after major life events such as marriage, divorce, or the birth of a child.

By taking these steps, you can help ensure that your will is valid and that your wishes are respected after your passing.

Form Information

| Fact Name | Details |

|---|---|

| Legal Basis | The California Last Will and Testament is governed by the California Probate Code, specifically Sections 6100-6320. |

| Requirements | To be valid, a will must be written, signed by the testator, and witnessed by at least two individuals who are not beneficiaries. |

| Revocation | A will can be revoked by the testator at any time, either by creating a new will or by physically destroying the existing one. |

| Holographic Wills | California recognizes holographic wills, which are handwritten and do not require witnesses, as long as they are signed by the testator. |

Dos and Don'ts

When filling out the California Last Will and Testament form, it is important to approach the task with care. Here’s a list of what you should and shouldn’t do:

- Do: Clearly state your full name and address at the beginning of the document.

- Do: Specify the date of your will to avoid confusion with previous versions.

- Do: Name an executor who will be responsible for carrying out your wishes.

- Do: List your assets and beneficiaries clearly, ensuring there are no ambiguities.

- Do: Sign the document in the presence of at least two witnesses who are not beneficiaries.

- Do: Keep the will in a safe place and inform your executor where to find it.

- Do: Review and update your will periodically, especially after major life changes.

- Don't: Use vague language that could lead to misunderstandings.

- Don't: Forget to have your witnesses sign the will at the same time you do.

- Don't: Leave out any assets you want to include, as this could lead to disputes.

- Don't: Write your will in a way that contradicts state laws.

- Don't: Assume your will is final without reviewing it after significant life events.

- Don't: Discuss your will with people who might not respect your wishes.

- Don't: Rely on a verbal agreement; always document your wishes in writing.

Misconceptions

- Only wealthy individuals need a will. Many people believe that wills are only necessary for the rich. In reality, anyone with assets, regardless of their value, can benefit from having a will to ensure their wishes are honored.

- A will can cover all aspects of estate planning. While a will is an important document, it does not address all estate planning needs. Trusts, powers of attorney, and healthcare directives are also crucial components that should be considered.

- Wills are only for older adults. It is a common misconception that only seniors need a will. Young adults, especially those with dependents or assets, should also consider creating a will to protect their loved ones.

- Once a will is created, it cannot be changed. Many people think that a will is a permanent document. In fact, wills can be amended or revoked at any time, allowing individuals to adjust their plans as life circumstances change.

- Having a will avoids probate entirely. Some believe that a will eliminates the probate process. However, a will must go through probate to be validated, although it can simplify the process compared to dying intestate.

- Handwritten wills are not valid. While formalities are important, California does recognize handwritten (holographic) wills under certain conditions. However, it is advisable to follow the standard format to avoid complications.

- All assets will automatically go to my spouse. Many assume that their spouse will inherit everything without a will. In California, the distribution of assets can vary based on the type of property and whether there are children or other heirs involved.

Documents used along the form

When creating a comprehensive estate plan in California, a Last Will and Testament is often accompanied by several other important documents. Each of these documents serves a specific purpose, helping to ensure that an individual's wishes are honored and their affairs are managed according to their preferences. Below are four commonly used forms and documents that work in conjunction with a Last Will and Testament.

- Durable Power of Attorney: This document allows an individual to appoint someone else to make financial and legal decisions on their behalf if they become incapacitated. It remains effective even if the person who created it can no longer make decisions for themselves.

- Advance Healthcare Directive: This form combines a living will and a durable power of attorney for healthcare. It outlines an individual's wishes regarding medical treatment and appoints someone to make healthcare decisions if they are unable to do so.

- Revocable Living Trust: A revocable living trust is a legal entity that holds an individual's assets during their lifetime and specifies how those assets should be distributed after death. This document can help avoid probate and provide more privacy than a will.

- Beneficiary Designations: Certain assets, such as life insurance policies and retirement accounts, allow individuals to name beneficiaries directly. These designations can override the instructions in a will, making it crucial to keep them updated and aligned with one's overall estate plan.

Incorporating these documents into an estate plan can provide clarity and ensure that an individual's wishes are respected. Each document plays a vital role in managing both financial and healthcare decisions, making it essential to consider them alongside a Last Will and Testament.

Other Popular California Forms

Pdf Horse Bill of Sale Template - Helps track the horse's ownership history over time.

Do I Need a Lawyer for a Power of Attorney - Required when the principal is unable to act themselves.

California Grant Deed - Understanding the specifics of a deed can help avoid future disputes.