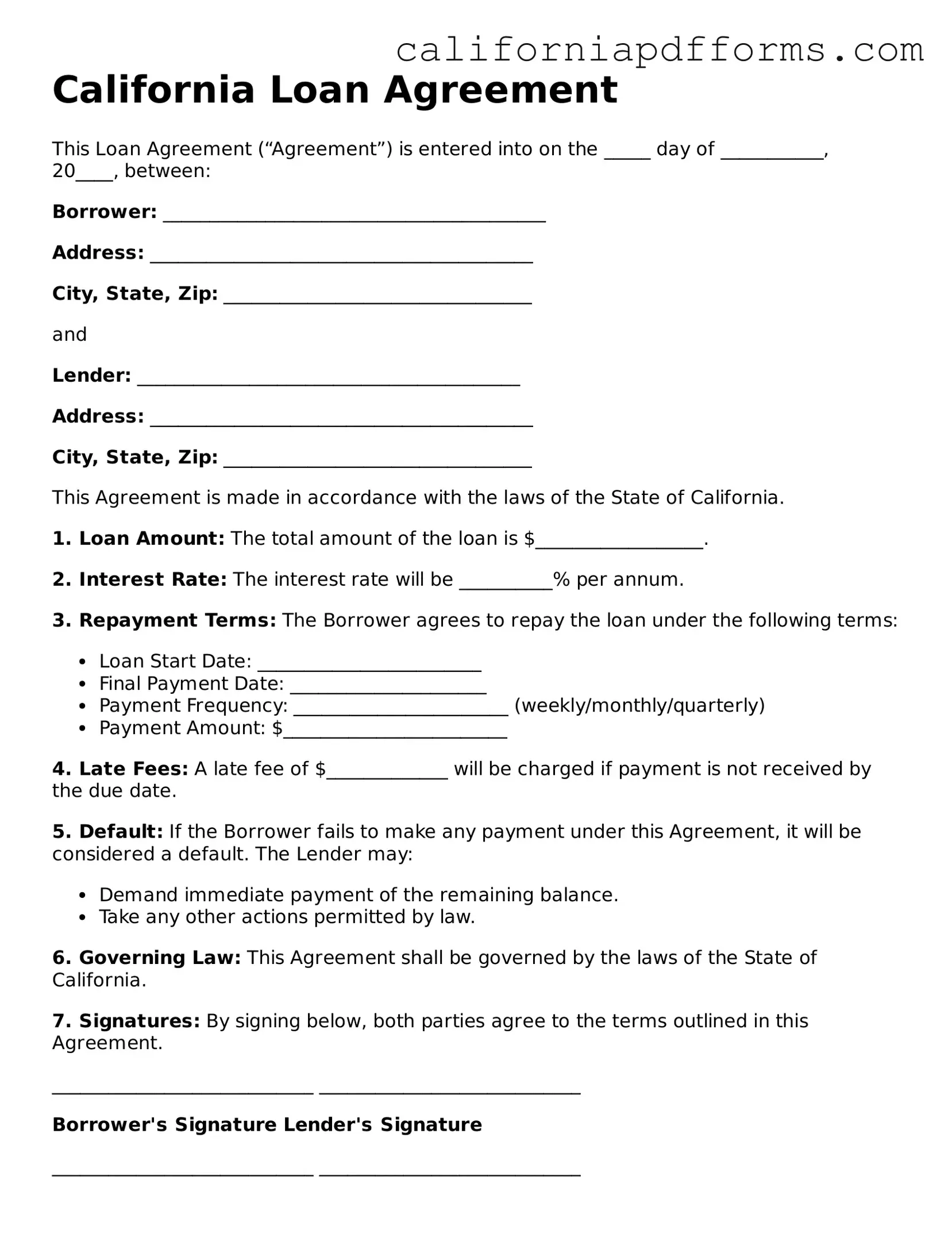

Official Loan Agreement Template for the State of California

Common Questions

What is a California Loan Agreement form?

The California Loan Agreement form is a legal document that outlines the terms and conditions under which one party (the lender) provides a loan to another party (the borrower). This form is essential for ensuring that both parties understand their rights and obligations. It typically includes details such as the loan amount, interest rate, repayment schedule, and any collateral involved. By clearly defining these elements, the agreement helps prevent misunderstandings and disputes in the future.

Who can use the California Loan Agreement form?

This form can be utilized by various individuals and entities, including:

- Individuals borrowing money from friends or family.

- Small businesses seeking funds from private lenders.

- Investors providing loans to other businesses or individuals.

Regardless of the situation, it is crucial that both the lender and borrower fully understand the terms of the agreement to ensure a smooth transaction.

What should be included in a California Loan Agreement?

A comprehensive California Loan Agreement should include several key components:

- Loan Amount: The total sum being borrowed.

- Interest Rate: The percentage charged on the loan amount, which can be fixed or variable.

- Repayment Schedule: Clear terms on how and when the borrower will repay the loan, including due dates.

- Collateral: Any assets pledged as security for the loan, if applicable.

- Default Terms: Conditions under which the lender can claim the collateral or take other actions if the borrower fails to repay.

Including these elements ensures that both parties are on the same page and helps facilitate a successful loan process.

How is the California Loan Agreement form enforced?

The enforcement of a California Loan Agreement relies on the legal principles of contract law. If one party fails to adhere to the terms outlined in the agreement, the other party may seek legal recourse. This could involve filing a lawsuit to recover the owed amount or enforcing the terms of the agreement through the court system. It is advisable for both parties to keep a copy of the signed agreement, as it serves as a crucial piece of evidence in any potential disputes.

Can the California Loan Agreement be modified after it is signed?

Yes, modifications to the California Loan Agreement can be made after it is signed, but both parties must agree to the changes. It is essential to document any amendments in writing and have both parties sign the revised agreement. This practice helps maintain clarity and prevents confusion regarding the terms of the loan. Verbal agreements or informal changes may not be enforceable, so it is always best to formalize any modifications.

Form Information

| Fact Name | Description |

|---|---|

| Purpose | The California Loan Agreement form outlines the terms and conditions under which a borrower receives a loan from a lender. |

| Governing Law | This agreement is governed by California state laws, specifically the California Civil Code. |

| Parties Involved | The form requires the identification of both the lender and the borrower, including their legal names and addresses. |

| Loan Amount | The total amount of money being borrowed must be clearly stated in the agreement. |

| Interest Rate | The form specifies the interest rate applicable to the loan, which can be fixed or variable. |

| Repayment Terms | Details regarding the repayment schedule, including due dates and payment methods, are outlined in the agreement. |

| Default Conditions | The agreement includes clauses that define what constitutes a default and the consequences that follow. |

Dos and Don'ts

When filling out the California Loan Agreement form, it is essential to approach the task with care. Here are five important guidelines to follow and avoid:

- Do: Read the entire form thoroughly before starting to fill it out.

- Do: Provide accurate and complete information to avoid delays.

- Do: Double-check your entries for any typographical errors.

- Do: Sign and date the form in the appropriate sections.

- Do: Keep a copy of the completed form for your records.

- Don't: Rush through the form; take your time to ensure accuracy.

- Don't: Leave any required fields blank; this can lead to rejection.

- Don't: Use abbreviations or unclear language that could confuse the lender.

- Don't: Ignore any instructions provided with the form.

- Don't: Forget to review the terms of the loan agreement before signing.

Misconceptions

Understanding the California Loan Agreement form is crucial for anyone involved in lending or borrowing money. However, several misconceptions can lead to confusion. Here’s a list of common misunderstandings:

- All loan agreements are the same. Many people think that all loan agreements follow the same template. In reality, terms can vary significantly based on the lender, borrower, and type of loan.

- Loan agreements are only necessary for large sums. Some believe that loan agreements are only required for significant amounts of money. However, even small loans should have a written agreement to clarify terms and protect both parties.

- Verbal agreements are sufficient. While verbal agreements can be made, they are often hard to enforce. Written agreements provide clear documentation of the terms and conditions.

- All loan agreements are legally binding. Not every loan agreement holds legal weight. If the agreement lacks essential elements, such as signatures or specific terms, it may not be enforceable.

- Interest rates are fixed. Many assume that interest rates in loan agreements are always fixed. In fact, some loans may have variable rates that can change over time.

- Once signed, the terms cannot be changed. Some people think that once a loan agreement is signed, it cannot be altered. In reality, both parties can negotiate changes, but they should document any modifications in writing.

- Loan agreements are only for personal loans. This misconception overlooks the fact that loan agreements are also essential for business loans, mortgages, and other financial arrangements.

- All lenders require the same information. Different lenders have varying requirements for information and documentation. It’s essential to check with the specific lender to understand what they need.

- Loan agreements are only important at the start. Many borrowers believe that once the loan is secured, the agreement is no longer relevant. In truth, it’s important to refer back to the agreement throughout the loan period.

- You don’t need legal advice. Some individuals feel that they can handle loan agreements without professional help. However, consulting with a legal expert can provide clarity and prevent potential issues.

By debunking these misconceptions, individuals can better navigate the complexities of loan agreements in California. Understanding the nuances can lead to more informed decisions and smoother transactions.

Documents used along the form

When engaging in a loan agreement in California, several other forms and documents may accompany the primary loan agreement to ensure clarity and protection for all parties involved. Each document serves a specific purpose, contributing to a comprehensive understanding of the loan terms and obligations.

- Promissory Note: This document outlines the borrower's promise to repay the loan amount under specified terms, including interest rate and payment schedule. It serves as a legal acknowledgment of the debt.

- Loan Disclosure Statement: This form provides borrowers with essential information about the loan, such as the annual percentage rate (APR), total costs, and any fees associated with the loan, ensuring transparency.

- Security Agreement: If the loan is secured by collateral, this agreement details the collateral being used to secure the loan. It outlines the rights of the lender in the event of default.

- Personal Guarantee: In cases where a business is borrowing, a personal guarantee may be required from business owners, making them personally liable for the loan if the business defaults.

- Credit Application: This form collects information about the borrower’s financial history, creditworthiness, and other relevant details, allowing lenders to assess the risk of lending.

- Loan Modification Agreement: If changes to the original loan terms are necessary, this document outlines the modifications agreed upon by both parties, ensuring that all alterations are legally recognized.

- Amortization Schedule: This schedule breaks down each payment into principal and interest components over the loan term, helping borrowers understand how their payments will affect the loan balance over time.

- Default Notice: In the event of a missed payment, this notice formally informs the borrower of the default and outlines the consequences, including potential legal actions.

- Release of Lien: Once the loan is fully paid, this document confirms that the lender relinquishes any claim to the collateral, providing peace of mind to the borrower.

These documents work together to create a clear framework for the loan process, ensuring that both lenders and borrowers understand their rights and responsibilities. Utilizing these forms can help prevent misunderstandings and protect the interests of all parties involved.

Other Popular California Forms

Temporary Legal Guardianship - The form is a practical way to ensure a child’s needs are met when parents cannot be present.

How to Serve a Cease and Desist Letter - It serves as a warning before taking legal action.