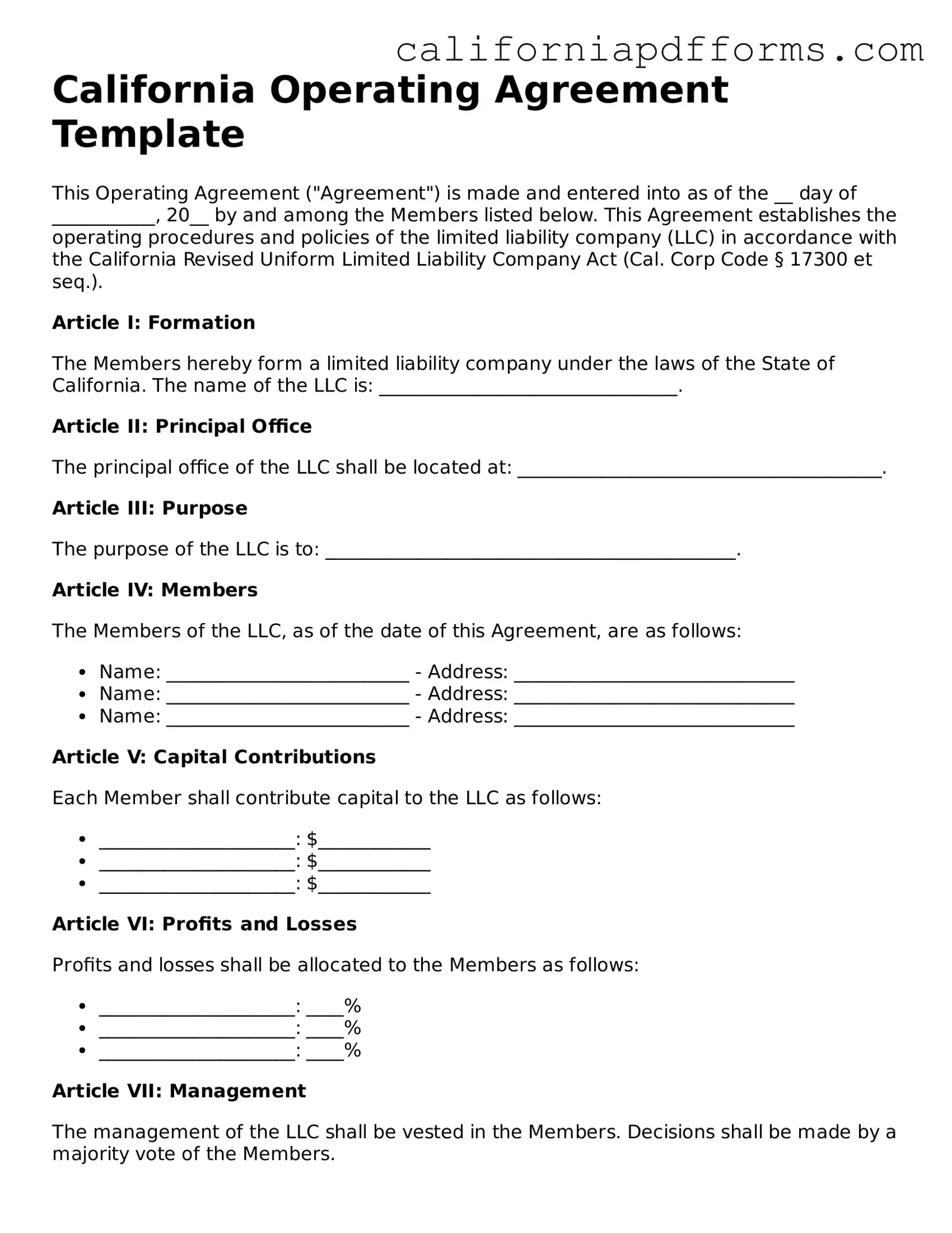

Official Operating Agreement Template for the State of California

Common Questions

What is a California Operating Agreement?

A California Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC) in California. This agreement serves as a foundational document for the LLC, detailing the rights and responsibilities of its members, how profits and losses will be distributed, and the rules for decision-making.

Why is an Operating Agreement important?

Having an Operating Agreement is crucial for several reasons:

- It helps prevent misunderstandings among members by clearly defining roles and expectations.

- It protects the limited liability status of the LLC, ensuring that personal assets are safeguarded from business debts.

- It provides a framework for resolving disputes, which can save time and money in the long run.

Who should create an Operating Agreement?

All members of an LLC should participate in creating the Operating Agreement. Whether the LLC has two members or many, each individual’s input is valuable. This collaborative approach fosters a sense of ownership and commitment among members.

What should be included in the Operating Agreement?

An effective Operating Agreement typically includes the following elements:

- The name and purpose of the LLC

- The names and addresses of the members

- The management structure, specifying whether it will be member-managed or manager-managed

- Details on capital contributions and profit-sharing

- Procedures for adding or removing members

- Guidelines for resolving disputes

Is an Operating Agreement legally required in California?

While California law does not require LLCs to have an Operating Agreement, it is highly recommended. Without it, the LLC may be governed by default rules set by the state, which may not align with the members’ intentions. An Operating Agreement provides clarity and helps avoid potential conflicts.

Can an Operating Agreement be amended?

Yes, an Operating Agreement can be amended. Members may find it necessary to update the agreement as the business evolves. Typically, the amendment process should be outlined within the original Operating Agreement, detailing how changes can be made and what majority is needed for approval.

Where can I find a template for a California Operating Agreement?

Templates for a California Operating Agreement can be found online through various legal websites and resources. However, it is advisable to consult with a legal professional to ensure that the agreement meets the specific needs of your LLC and complies with state laws.

Form Information

| Fact Name | Details |

|---|---|

| Purpose | The California Operating Agreement outlines the management structure and operating procedures of a limited liability company (LLC). |

| Governing Law | This form is governed by the California Corporations Code, specifically sections 17300 to 17360. |

| Member Rights | The agreement specifies the rights and responsibilities of each member, ensuring clarity in decision-making and profit distribution. |

| Customization | Members can customize the agreement to fit their specific needs, allowing for flexibility in management and operations. |

Dos and Don'ts

When filling out the California Operating Agreement form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here are six things you should and shouldn't do:

- Do: Read the entire form carefully before starting.

- Do: Provide accurate information for all members involved.

- Do: Include the date of the agreement at the top of the form.

- Don't: Leave any required fields blank.

- Don't: Use unclear language or abbreviations that might confuse readers.

- Don't: Forget to sign and date the agreement after completion.

Misconceptions

Understanding the California Operating Agreement form can be challenging. Many people hold misconceptions that can lead to confusion. Here are eight common misconceptions and clarifications about the Operating Agreement:

- It is only necessary for large businesses. Many small businesses and startups benefit from an Operating Agreement. It helps define roles and responsibilities, regardless of company size.

- It is the same as Articles of Organization. While both documents are important, the Articles of Organization establish the existence of the LLC, whereas the Operating Agreement outlines the internal workings.

- It does not need to be written down. Although verbal agreements may exist, having a written Operating Agreement is crucial. It provides clarity and can help prevent disputes.

- All members must agree on every detail. While collaboration is key, an Operating Agreement can include provisions for decision-making processes, allowing for majority rules or designated authorities.

- It is a one-time document. An Operating Agreement should be reviewed and updated regularly. Changes in membership or business structure may necessitate revisions.

- It is not legally required. In California, while an Operating Agreement is not mandatory, having one is highly recommended to protect members and outline expectations.

- It only covers financial matters. The Operating Agreement addresses a variety of topics, including management structure, member roles, and procedures for handling disputes.

- It can be ignored once filed. The Operating Agreement is a living document. Members should refer to it often and ensure compliance with its terms.

By addressing these misconceptions, individuals can better understand the importance of the California Operating Agreement and how it serves their business interests.

Documents used along the form

When forming a Limited Liability Company (LLC) in California, the Operating Agreement is a crucial document. However, several other forms and documents are often used in conjunction with it. Understanding these documents can help ensure that your LLC operates smoothly and complies with state regulations.

- Articles of Organization: This is the foundational document filed with the California Secretary of State to legally create your LLC. It includes basic information such as the LLC's name, address, and management structure.

- Statement of Information: This document must be filed within 90 days of forming your LLC and then every two years thereafter. It provides updated information about your LLC, including addresses and names of members and managers.

- Bylaws: While not required for LLCs, bylaws can outline the internal rules and procedures for managing the company. They help clarify the roles and responsibilities of members and managers.

- Membership Certificates: These certificates serve as proof of ownership for members of the LLC. They can be issued to document each member's investment and ownership percentage in the company.

- Initial Meeting Minutes: Documenting the initial meeting of members is important. Minutes should outline decisions made, such as the appointment of officers and the adoption of the Operating Agreement.

- Tax Identification Number (TIN): Obtaining a TIN from the IRS is essential for tax purposes. This number is used for filing taxes, opening bank accounts, and hiring employees.

- Operating Agreement Addendums: These are amendments or additions to the original Operating Agreement. They can be used to address changes in membership, management structure, or other important matters.

- Member Loan Agreements: If members lend money to the LLC, a formal loan agreement should be documented. This protects both the members and the LLC by clearly outlining the terms of the loan.

In summary, while the California Operating Agreement is a vital document for your LLC, several other forms and documents are equally important. Each serves a specific purpose and contributes to the effective management and legal compliance of your business. Taking the time to understand and prepare these documents can help ensure your LLC's success.

Other Popular California Forms

Marital Settlement Agreement California - Allows both parties to agree on terms amicably, reducing stress during a difficult time.

Ca Small Estate Affidavit - The Small Estate Affidavit provides a framework for heirs to identify and claim the assets of a deceased loved one quickly.