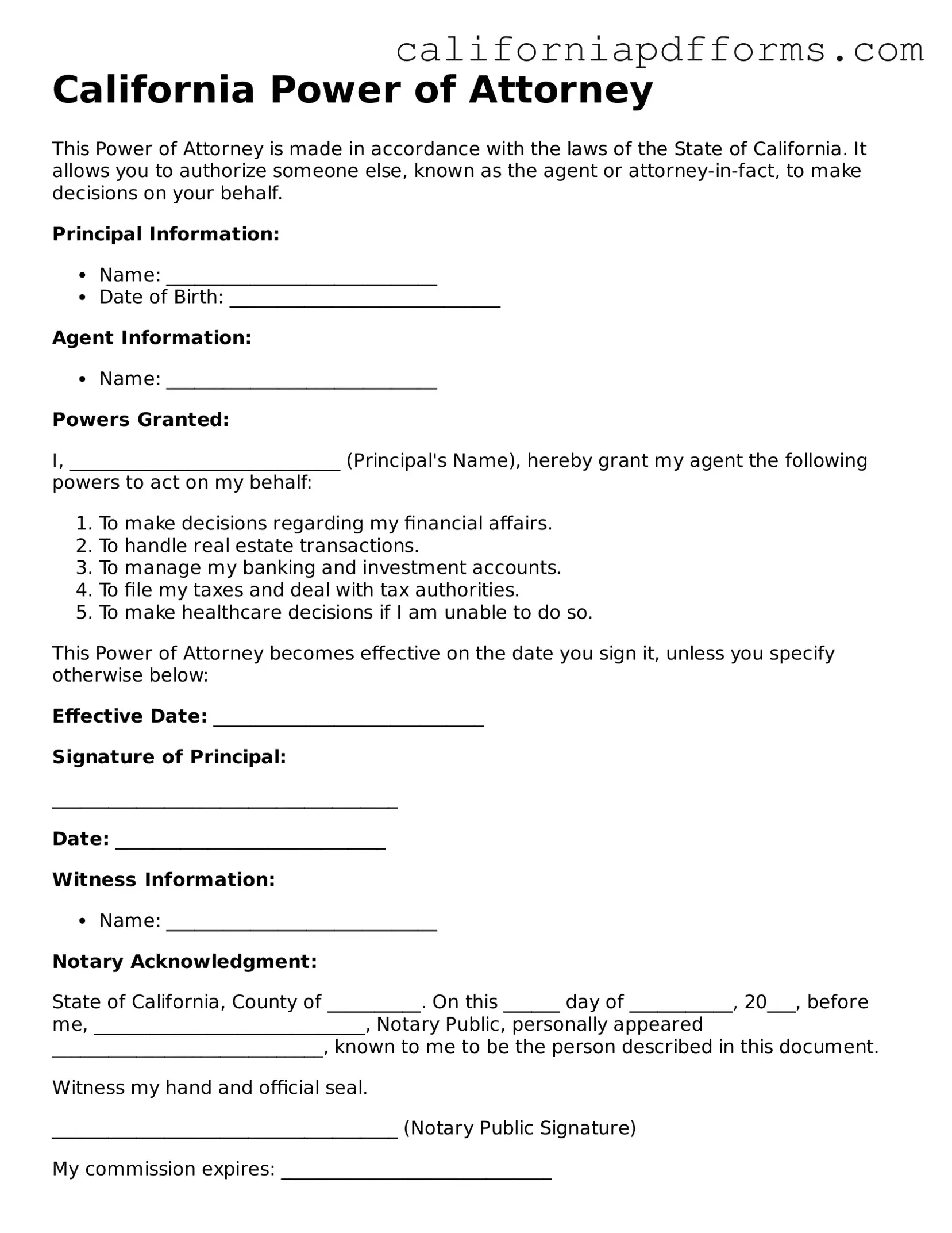

Official Power of Attorney Template for the State of California

Common Questions

- General Power of Attorney: Grants broad powers to the agent to manage various affairs.

- Durable Power of Attorney: Remains effective even if the principal becomes incapacitated.

- Limited Power of Attorney: Grants specific powers for a limited purpose or duration.

- Healthcare Power of Attorney: Allows the agent to make medical decisions on behalf of the principal.

- Decide what type of Power of Attorney you need.

- Select a trustworthy agent.

- Obtain the appropriate form, which can often be found online or through legal resources.

- Complete the form, ensuring all required information is provided.

- Sign the document in the presence of a notary public or witnesses, as required by law.

What is a Power of Attorney in California?

A Power of Attorney (POA) in California is a legal document that allows one person to authorize another person to act on their behalf in financial, medical, or legal matters. This arrangement can be temporary or durable, depending on the needs of the individual granting the authority.

What types of Power of Attorney are available in California?

There are several types of Power of Attorney in California:

Who can be appointed as an agent under a Power of Attorney?

Any competent adult can be appointed as an agent. This can be a family member, friend, or a professional such as an attorney. It is essential to choose someone trustworthy, as they will have significant control over important decisions.

How do I create a Power of Attorney in California?

To create a Power of Attorney in California, follow these steps:

Do I need a lawyer to create a Power of Attorney?

While it is not legally required to have a lawyer to create a Power of Attorney in California, consulting with one is advisable. A lawyer can provide guidance to ensure that the document meets all legal requirements and accurately reflects your wishes.

Can I revoke a Power of Attorney?

Yes, a Power of Attorney can be revoked at any time as long as the principal is mentally competent. To revoke the document, the principal should create a written revocation and notify the agent and any relevant institutions or individuals who were aware of the original Power of Attorney.

What happens if the principal becomes incapacitated?

If the principal becomes incapacitated and has executed a Durable Power of Attorney, the agent can continue to act on their behalf. If a standard Power of Attorney was created, it would become ineffective upon the principal's incapacitation.

Is a Power of Attorney valid if I move to another state?

A Power of Attorney created in California may be valid in another state, but it is essential to check the laws of the new state. Some states may have specific requirements or forms that must be used for the document to be recognized.

What should I do if my agent is not acting in my best interests?

If an agent is not acting in the best interests of the principal, it may be necessary to take legal action. This could involve revoking the Power of Attorney, seeking a court order, or reporting the agent to appropriate authorities if there is evidence of abuse or neglect.

Form Information

| Fact Name | Description |

|---|---|

| Definition | A California Power of Attorney is a legal document that allows one person to grant another person the authority to make decisions on their behalf. |

| Governing Law | This document is governed by the California Probate Code, specifically Sections 4000-4545. |

| Types | There are different types of Power of Attorney forms in California, including Durable, Springing, and Medical. |

| Durability | A Durable Power of Attorney remains effective even if the principal becomes incapacitated. |

| Revocation | The principal can revoke the Power of Attorney at any time, as long as they are competent to do so. |

| Witness Requirement | California law requires the signature of the principal to be witnessed by one person or notarized to ensure validity. |

Dos and Don'ts

When filling out the California Power of Attorney form, it is important to follow specific guidelines to ensure the document is valid and effective. Here are some key dos and don'ts:

- Do read the entire form carefully before filling it out.

- Do ensure that you understand the powers you are granting.

- Do sign the form in front of a notary public or two witnesses, as required.

- Do keep a copy of the completed form for your records.

- Don't leave any sections of the form blank unless specified.

- Don't use outdated versions of the form; always use the latest version.

- Don't sign the form if you feel pressured or unsure about your decision.

- Don't forget to inform your agent about their responsibilities and your wishes.

Misconceptions

Understanding the California Power of Attorney form is essential for anyone considering its use. However, several misconceptions can lead to confusion. Here are eight common misunderstandings:

- Myth 1: A Power of Attorney is only for financial matters.

- Myth 2: A Power of Attorney is permanent and cannot be revoked.

- Myth 3: Only lawyers can create a Power of Attorney.

- Myth 4: A Power of Attorney is only necessary for the elderly.

- Myth 5: The agent must be a family member.

- Myth 6: A Power of Attorney gives the agent unlimited power.

- Myth 7: A Power of Attorney is only effective if the principal is incapacitated.

- Myth 8: Once signed, a Power of Attorney is unchangeable.

This is not true. While many people associate Power of Attorney with financial decisions, it can also cover health care, property management, and other personal affairs.

In reality, a Power of Attorney can be revoked at any time by the principal, as long as they are mentally competent.

Individuals can create their own Power of Attorney using templates, provided they meet the legal requirements. However, consulting a lawyer is advisable for complex situations.

People of all ages can benefit from having a Power of Attorney. Unexpected events, such as accidents or illnesses, can occur at any age.

While many choose family members, the agent can be a trusted friend, colleague, or even a professional, such as an attorney or financial advisor.

The authority granted can be limited to specific tasks or decisions, depending on the principal's wishes. It’s important to clearly outline the agent's powers in the document.

A Power of Attorney can be effective immediately or only when the principal becomes incapacitated, depending on how it is drafted.

Changes can be made to a Power of Attorney as long as the principal is competent. This includes revoking the existing document and creating a new one.

Documents used along the form

A Power of Attorney (POA) is a crucial legal document that allows one person to act on behalf of another in financial or medical matters. In California, individuals often utilize additional forms and documents to complement the POA, ensuring that their intentions are clear and legally binding. Below are some commonly used documents that often accompany a California Power of Attorney.

- Advance Healthcare Directive: This document allows individuals to specify their healthcare preferences in advance. It combines both a living will and a medical power of attorney, detailing what medical treatments one wishes to receive or refuse if they become unable to communicate their wishes.

- Durable Power of Attorney: Unlike a standard Power of Attorney, a durable POA remains effective even if the principal becomes incapacitated. This ensures that the designated agent can continue to make decisions on behalf of the principal during periods of diminished capacity.

- Financial Power of Attorney: This specific type of POA focuses solely on financial matters. It grants the agent authority to manage the principal's financial affairs, including banking, investments, and property transactions, ensuring that financial responsibilities are handled smoothly.

- Revocation of Power of Attorney: Should the principal decide to terminate the authority granted in a Power of Attorney, this document formally revokes the previous POA. It is essential for preventing any misunderstandings regarding the agent's authority.

- Trust Document: A trust can be used in conjunction with a Power of Attorney to manage assets. This document outlines how the principal's assets will be handled during their lifetime and after their death, providing a comprehensive plan for asset management and distribution.

Understanding these documents can help individuals navigate their legal rights and responsibilities more effectively. By having the appropriate forms in place, individuals can ensure that their wishes are honored and that their affairs are managed in accordance with their preferences.

Other Popular California Forms

How to Make Bill of Sale - The document can help expedite the registration process for the buyer after the sale.

Rental Lease Agreement Free - Both parties should keep a copy of the signed lease for their records.