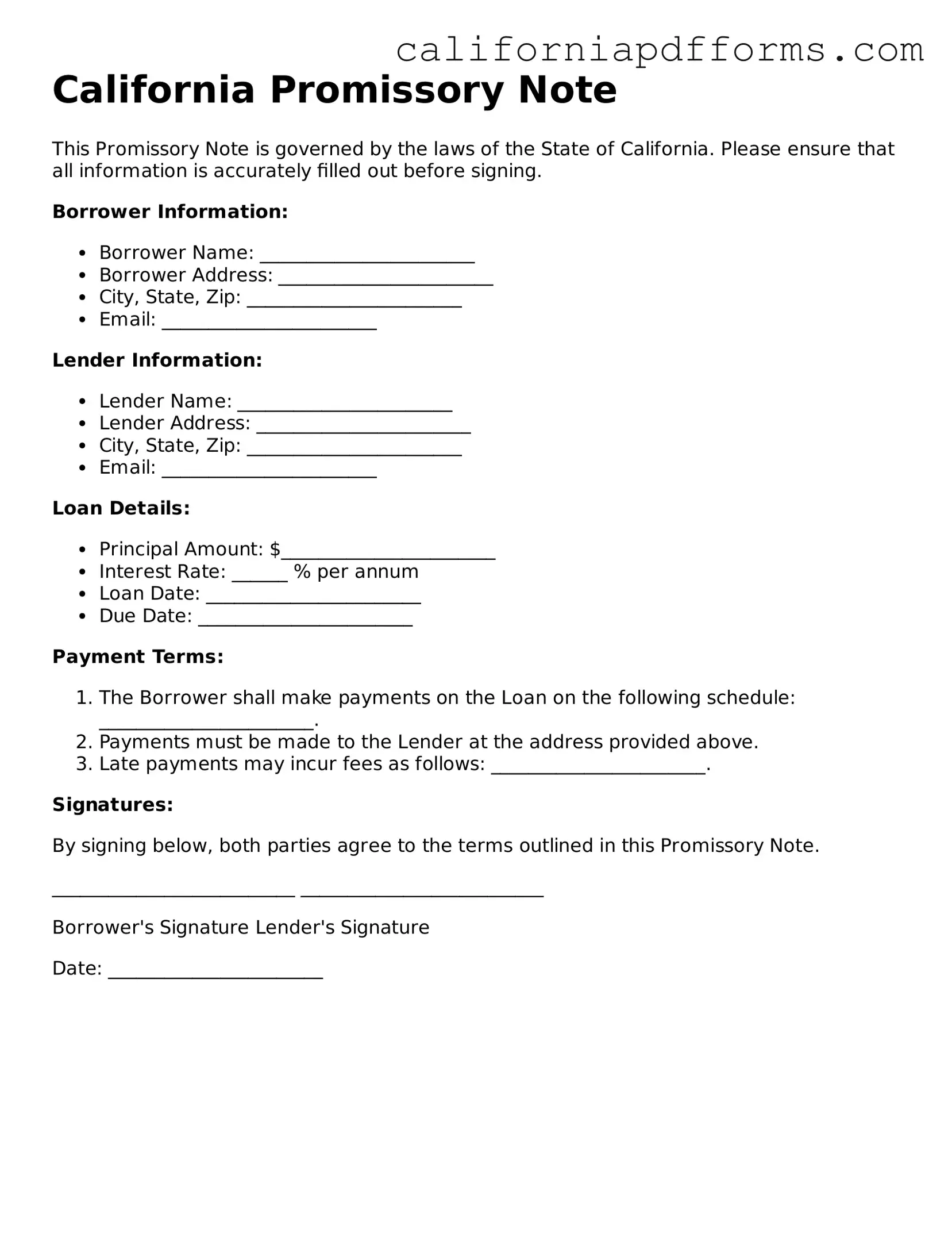

Official Promissory Note Template for the State of California

Common Questions

What is a California Promissory Note?

A California Promissory Note is a legal document that outlines a borrower's promise to repay a loan to a lender. This document details the amount borrowed, interest rates, repayment terms, and any consequences for defaulting on the loan. It serves as a written record of the agreement between the parties involved.

Who typically uses a Promissory Note?

Promissory Notes are commonly used by individuals, businesses, and organizations. They are useful in various situations, including:

- Personal loans between friends or family members.

- Business loans from one entity to another.

- Real estate transactions where financing is involved.

What information is included in a California Promissory Note?

A standard California Promissory Note includes several key pieces of information:

- The names and addresses of the borrower and lender.

- The principal amount of the loan.

- The interest rate and how it is calculated.

- The repayment schedule, including due dates and amounts.

- Any late fees or penalties for missed payments.

- Conditions under which the note can be declared in default.

Is a Promissory Note legally binding?

Yes, a Promissory Note is a legally binding contract. Once both parties sign the document, they are obligated to adhere to the terms outlined. If the borrower fails to repay the loan as agreed, the lender can take legal action to recover the owed amount.

Do I need to have a lawyer to create a Promissory Note?

While it is not mandatory to have a lawyer draft a Promissory Note, it is highly recommended. A legal professional can ensure that the document meets all legal requirements and adequately protects your interests. If you choose to create one yourself, be sure to follow the state laws and include all necessary details.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified after it is signed, but both parties must agree to the changes. It is best to document any modifications in writing and have both parties sign the updated agreement to avoid misunderstandings in the future.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender has several options. They may choose to:

- Contact the borrower to discuss the missed payment.

- Charge late fees as specified in the note.

- Take legal action to recover the owed amount.

It’s important for both parties to communicate openly to resolve any issues before escalating the situation.

Form Information

| Fact Name | Description |

|---|---|

| Definition | A California Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a specified time. |

| Governing Law | The California Promissory Note is governed by the California Civil Code, particularly Sections 3300 to 3400. |

| Parties Involved | The document typically involves two parties: the borrower (maker) and the lender (payee). |

| Interest Rate | The interest rate can be fixed or variable, and it must be clearly stated in the note. |

| Repayment Terms | Repayment terms should specify the due date, payment frequency, and method of payment. |

| Default Clause | The note may include a default clause outlining the consequences if the borrower fails to make payments. |

| Notarization | While notarization is not always required, it is recommended to enhance the note's enforceability. |

Dos and Don'ts

When filling out the California Promissory Note form, it's important to be careful and precise. Here are some guidelines to help you through the process:

- Do read the entire form thoroughly before starting to fill it out.

- Don't leave any required fields blank; all necessary information must be provided.

- Do use clear and legible handwriting or type the information to avoid any misunderstandings.

- Don't make any alterations or corrections on the form without initialing them, as this could lead to confusion.

- Do double-check all figures and dates for accuracy to ensure everything is correct.

- Don't forget to include the names and addresses of both the borrower and the lender.

- Do sign and date the document in the appropriate places to make it legally binding.

Misconceptions

Understanding the California Promissory Note form is essential for anyone involved in lending or borrowing money. However, several misconceptions can lead to confusion. Below is a list of ten common misconceptions along with clarifications.

- All promissory notes must be notarized. Many people believe that notarization is a requirement for all promissory notes. In California, notarization is not mandatory unless specified by the parties involved.

- A promissory note must be in writing. While it is true that a promissory note is typically a written document, oral agreements can also be enforceable under certain circumstances. However, written notes provide clearer evidence of the terms.

- Promissory notes are only for large loans. Some individuals think that promissory notes are only used for significant amounts of money. In reality, they can be used for any amount, regardless of size.

- Interest rates must be included in the note. Although it is common to include interest rates in a promissory note, it is not a legal requirement. The parties can agree to a zero-interest loan.

- Promissory notes are the same as loan agreements. While both documents relate to borrowing money, a promissory note is a simpler document that outlines the borrower's promise to repay, whereas a loan agreement includes more detailed terms.

- All promissory notes are secured. Many assume that all promissory notes are backed by collateral. However, unsecured promissory notes exist and rely solely on the borrower's creditworthiness.

- Once signed, a promissory note cannot be changed. Some believe that changes to a promissory note are impossible after signing. In fact, both parties can agree to modify the terms, but this should be documented in writing.

- Promissory notes are only for personal loans. While often used in personal lending, promissory notes are also common in business transactions and real estate deals.

- There is a standard format for all promissory notes. Many think that there is one universal format for promissory notes. In reality, the format can vary based on the specific needs and agreements of the parties involved.

- Defaulting on a promissory note has no legal consequences. Some individuals underestimate the seriousness of defaulting. In California, failing to repay a promissory note can lead to legal action and damage to credit ratings.

These misconceptions highlight the importance of understanding the nuances of the California Promissory Note form. Accurate knowledge can help prevent disputes and ensure that both lenders and borrowers are protected.

Documents used along the form

The California Promissory Note form is a vital document in financial transactions, particularly when one party lends money to another. This form outlines the terms of the loan, including the amount, interest rate, and repayment schedule. In addition to the Promissory Note, several other forms and documents are commonly utilized to support and clarify the lending process. Below is a list of these documents, each serving a specific purpose.

- Loan Agreement: This document details the terms and conditions of the loan, including the rights and obligations of both the lender and borrower. It often includes provisions regarding default and remedies.

- Security Agreement: If the loan is secured by collateral, this agreement specifies what assets are being used as security for the loan and the rights of the lender in case of default.

- Disclosure Statement: This document provides essential information about the loan, including interest rates, fees, and the total cost of borrowing. It ensures that the borrower is fully informed before signing the Promissory Note.

- Repayment Schedule: This document outlines the timeline for repayment, detailing each payment amount and due date. It serves as a clear reference for both parties throughout the loan term.

- Guaranty Agreement: In some cases, a third party may guarantee the loan. This document outlines the guarantor's commitment to repay the loan if the borrower defaults.

- Amendment Agreement: If any terms of the original Promissory Note or Loan Agreement need to be changed, this document formally amends those terms, ensuring all parties agree to the new conditions.

- Notice of Default: If the borrower fails to make payments, this document serves as a formal notice to the borrower, indicating that they are in default and outlining the potential consequences.

- Release of Liability: Once the loan is repaid, this document releases the borrower from any further obligations under the Promissory Note, providing proof that the debt has been satisfied.

These documents play a crucial role in ensuring clarity and protection for both lenders and borrowers throughout the lending process. Each serves a distinct purpose and contributes to a comprehensive understanding of the financial agreement in question.

Other Popular California Forms

Commercial Lease Contract - Documentation regarding legal authority to sign the lease is sometimes required, ensuring legitimacy.

Death Deed - Communicating your intentions with your beneficiaries can foster transparency and trust.

California Car Bill of Sale - Contains a description of any accessories included in the sale.