Official Quitclaim Deed Template for the State of California

Common Questions

- Transferring property between family members.

- Divorces, where one spouse gives up their interest in the property.

- Transferring property into a trust.

- Clearing up title issues, such as removing an ex-spouse from the title.

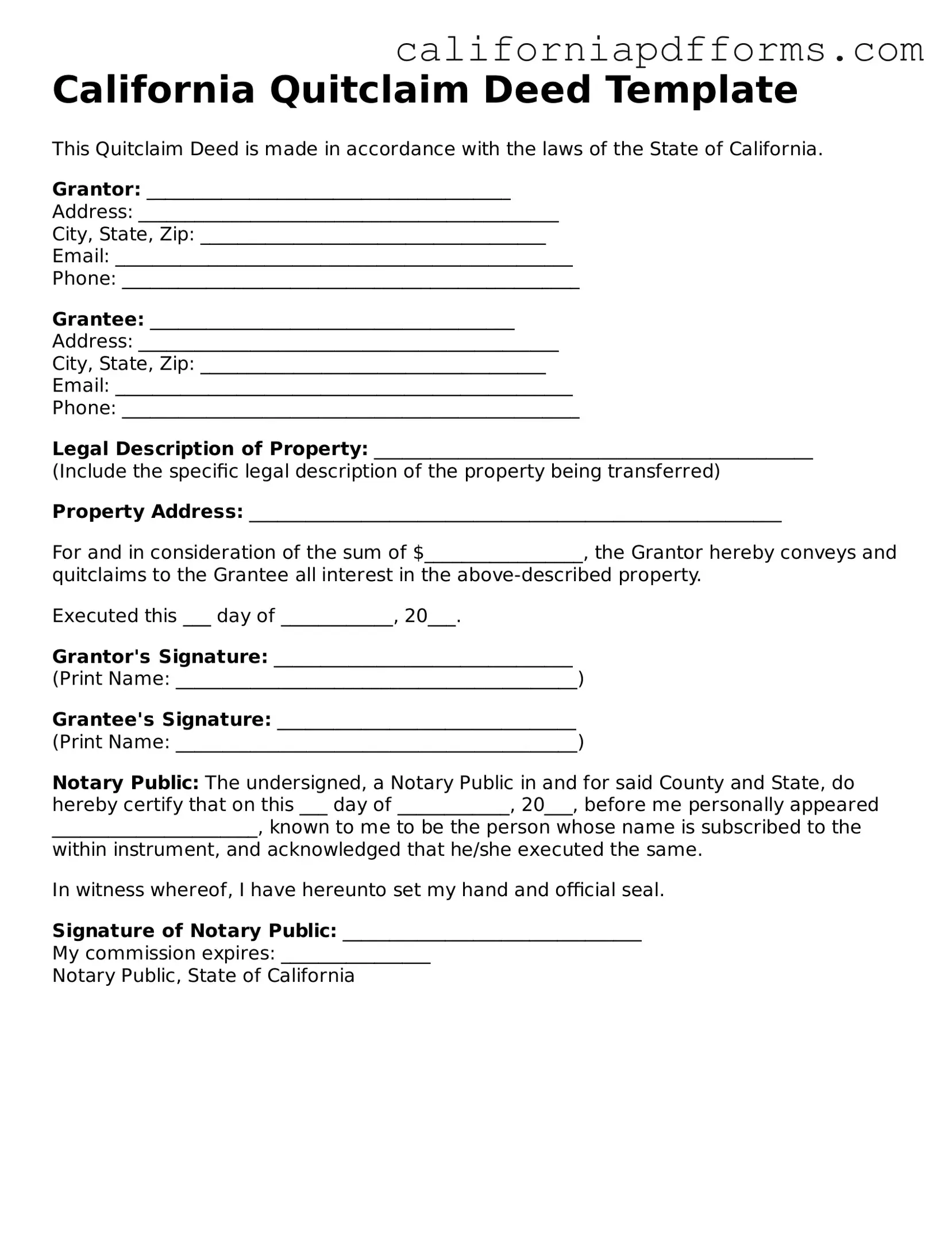

- Obtain a Quitclaim Deed form. These can be found online or at legal stationery stores.

- Fill in the names of the grantor and grantee, along with the property description.

- Sign the document in front of a notary public. Notarization is crucial for the deed to be legally valid.

- Record the deed with the county recorder's office where the property is located. This step is essential to ensure the transfer is public and official.

- The names and addresses of the grantor and grantee.

- A legal description of the property being transferred.

- The date of the transfer.

- The signature of the grantor, notarized.

What is a Quitclaim Deed in California?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without making any guarantees about the title. Essentially, the person transferring the property (the grantor) relinquishes their interest in the property to the recipient (the grantee). This type of deed is often used among family members or in situations where the parties know each other well.

When should I use a Quitclaim Deed?

Quitclaim Deeds are commonly used in various scenarios, including:

However, it’s important to note that a Quitclaim Deed does not guarantee that the property is free from liens or other claims.

How do I complete a Quitclaim Deed in California?

To complete a Quitclaim Deed, follow these steps:

Do I need an attorney to create a Quitclaim Deed?

While it is not legally required to have an attorney prepare a Quitclaim Deed, consulting with one can be beneficial. An attorney can provide guidance on the implications of the transfer and ensure that the deed is filled out correctly. This can help prevent future disputes or complications.

What information is required on a Quitclaim Deed?

A Quitclaim Deed should include the following information:

Additional details, such as the consideration (the value exchanged for the property), may also be included.

Are there any tax implications when using a Quitclaim Deed?

Generally, transferring property via a Quitclaim Deed may not trigger a tax event if it is a gift between family members. However, it’s wise to consult a tax professional to understand any potential implications, especially if the property has significant value or if there are outstanding liens.

Can a Quitclaim Deed be revoked?

Once a Quitclaim Deed is executed and recorded, it cannot be revoked unilaterally. The grantor has given up their interest in the property. If there is a need to reverse the transaction, a new legal document would need to be created, such as a Deed of Reconveyance or a new Quitclaim Deed transferring the property back to the original owner.

What happens if the grantor has outstanding debts?

Transferring property via a Quitclaim Deed does not eliminate the grantor's debts. Creditors may still have claims against the property. If the grantor has significant debts, it may be wise to consult with a financial advisor or attorney before proceeding with the transfer.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed and a Warranty Deed are different. A Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. In contrast, a Quitclaim Deed offers no such guarantees. It simply transfers whatever interest the grantor has, if any.

How can I obtain a copy of a recorded Quitclaim Deed?

To obtain a copy of a recorded Quitclaim Deed, you can visit the county recorder's office where the deed was filed. Many counties also offer online access to property records. You may need to provide specific information about the property, such as the address or the names of the parties involved, to locate the deed.

Form Information

| Fact Name | Description |

|---|---|

| Definition | A California Quitclaim Deed is a legal document used to transfer ownership of real property without any warranties or guarantees regarding the title. |

| Governing Laws | The Quitclaim Deed in California is governed by the California Civil Code, specifically Sections 1091 and 1092. |

| Use Cases | This form is often used in situations such as transferring property between family members, clearing up title issues, or when a property is transferred as part of a divorce settlement. |

| Execution Requirements | The Quitclaim Deed must be signed by the grantor (the person transferring the property) and notarized to be legally effective. |

Dos and Don'ts

When filling out the California Quitclaim Deed form, it’s important to approach the process with care. Here’s a list of things to do and avoid.

- Do ensure you have the correct legal description of the property.

- Do include the names of all parties involved clearly.

- Do sign the form in front of a notary public.

- Do check for any specific county requirements.

- Do provide your contact information for any follow-up.

- Don’t leave any required fields blank.

- Don’t use outdated forms; ensure you have the latest version.

- Don’t forget to include the date of the transfer.

- Don’t rush through the process; take your time to review.

- Don’t assume the deed is recorded automatically; you must submit it to the county.

Misconceptions

Understanding the California Quitclaim Deed form is essential for individuals involved in property transactions. However, several misconceptions can lead to confusion. The following list outlines common misunderstandings associated with this legal document.

- A quitclaim deed transfers ownership of a property without warranty. Many believe that a quitclaim deed guarantees clear title. In reality, it only transfers whatever interest the grantor has, if any, without assuring that the title is free from claims or encumbrances.

- Quitclaim deeds are only used between family members. While these deeds are often utilized in familial transactions, they are not limited to such situations. Any two parties can use a quitclaim deed to transfer property interests.

- A quitclaim deed is the same as a warranty deed. This is a significant misconception. A warranty deed provides guarantees about the title, whereas a quitclaim deed does not offer such protections.

- Using a quitclaim deed is a quick way to resolve disputes. Some individuals think that executing a quitclaim deed can immediately settle ownership disputes. However, it may not resolve underlying legal issues or claims against the property.

- Quitclaim deeds are only valid if notarized. While notarization is a common requirement for validity, it is not the only factor. The deed must also be properly executed and recorded to be effective.

- All property transfers must use a quitclaim deed. This is incorrect. Different types of deeds serve different purposes, and a quitclaim deed is just one option among several available for property transfers.

- Once a quitclaim deed is executed, it cannot be changed. Although a quitclaim deed is generally irrevocable, it can be amended or revoked through a subsequent legal process if all parties agree.

- A quitclaim deed eliminates the need for a title search. Many believe that executing a quitclaim deed negates the necessity for a title search. However, it is advisable to conduct a title search to uncover any potential issues before proceeding with the transfer.

By clarifying these misconceptions, individuals can make more informed decisions regarding property transactions in California.

Documents used along the form

A California Quitclaim Deed is often accompanied by several other forms and documents that facilitate the transfer of property ownership. Understanding these documents can help ensure a smooth transaction. Here’s a list of common forms used alongside a Quitclaim Deed.

- Grant Deed: This document transfers property ownership and guarantees that the seller has not transferred the property to anyone else. It provides more protection to the buyer than a quitclaim deed.

- Title Report: A report that outlines the legal ownership of the property, any liens, or claims against it. This document is crucial for verifying that the seller has the right to transfer ownership.

- Property Transfer Disclosure Statement: This form requires the seller to disclose any known issues with the property, such as structural problems or pest infestations. It helps protect the buyer by ensuring transparency.

- Affidavit of Death: Used when transferring property after the owner has passed away. This document proves the death of the property owner and can help in the transfer process to heirs.

- Preliminary Change of Ownership Report: This form is submitted to the county assessor’s office to report changes in property ownership. It helps assess property taxes accurately.

- Escrow Instructions: A set of written guidelines provided to the escrow company detailing how to handle the transaction. This document ensures that all parties are clear on the terms of the sale.

- Bill of Sale: While not always necessary, this document can be used to transfer personal property associated with real estate, such as appliances or furniture.

- Power of Attorney: If the seller cannot be present for the transaction, this document allows someone else to act on their behalf. It is essential for ensuring the sale can proceed smoothly.

Each of these documents plays a vital role in property transactions. Familiarity with them can help streamline the process and protect the interests of all parties involved.

Other Popular California Forms

Do I Need a Lawyer for a Power of Attorney - Can be tailored to specific needs or left general.

Power of Attorney to Transfer Motor Vehicle - A Motor Vehicle Power of Attorney provides peace of mind when dealing with vehicle transactions.