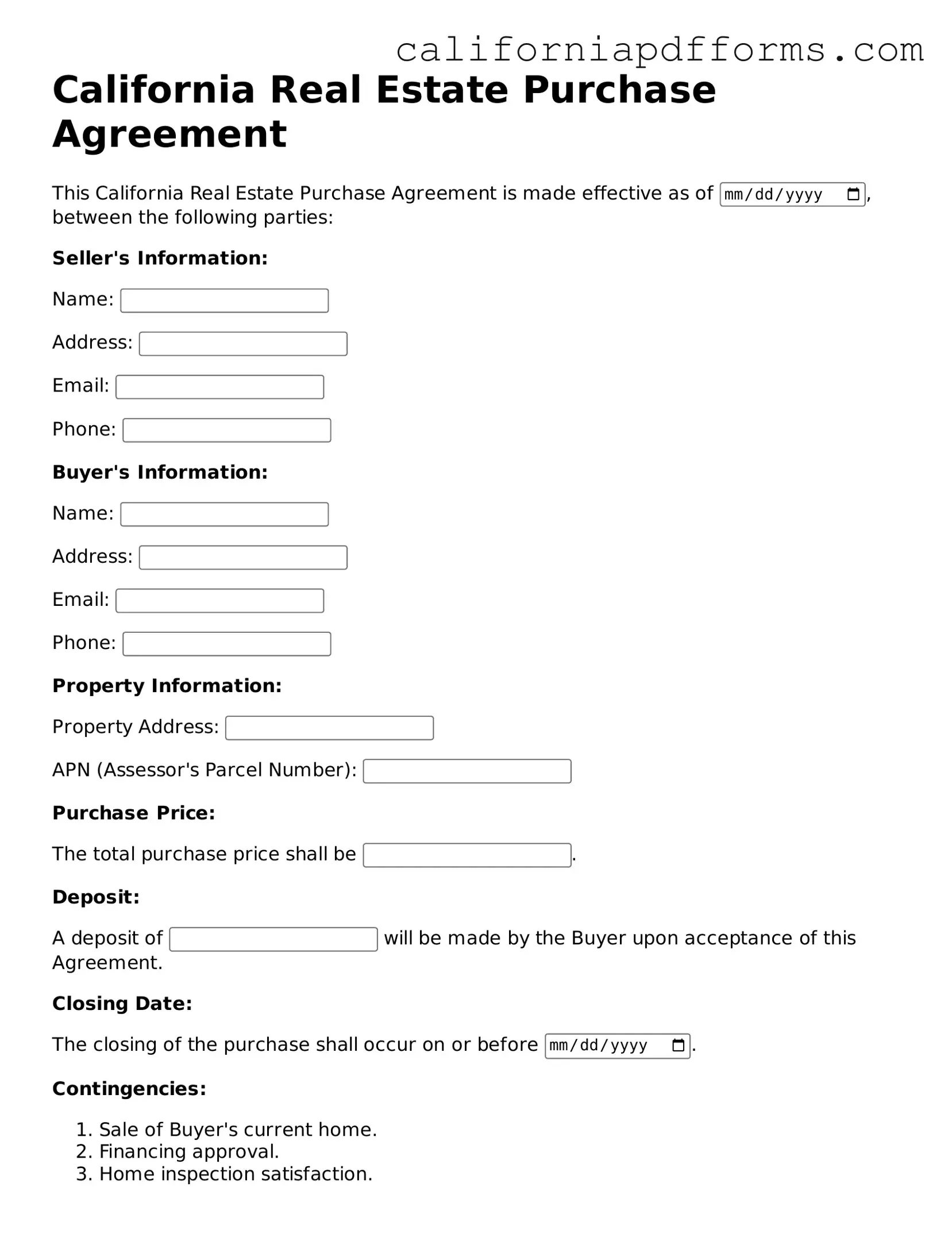

Official Real Estate Purchase Agreement Template for the State of California

Common Questions

What is a California Real Estate Purchase Agreement?

A California Real Estate Purchase Agreement is a legal document that outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This agreement serves as a binding contract once both parties sign it. Key elements typically included are the purchase price, property description, contingencies, and timelines for closing the sale.

What are the key components of this agreement?

The agreement generally includes the following components:

- Purchase Price: The amount the buyer agrees to pay for the property.

- Property Description: A detailed description of the property being sold, including its address and any included fixtures.

- Contingencies: Conditions that must be met for the sale to proceed, such as financing approval or home inspections.

- Closing Date: The date when the transaction will be finalized and ownership is transferred.

- Earnest Money Deposit: A deposit made by the buyer to demonstrate commitment to the purchase.

How do I fill out the form correctly?

To fill out the California Real Estate Purchase Agreement correctly, follow these steps:

- Begin by entering the names of the buyer and seller.

- Provide a complete description of the property, including its address and any relevant details.

- Specify the purchase price and any financing arrangements.

- List any contingencies that must be satisfied before the sale can proceed.

- Include the closing date and any other important deadlines.

- Both parties should sign and date the agreement to make it legally binding.

What happens if one party does not fulfill their obligations?

If one party fails to meet their obligations as outlined in the agreement, the other party may have legal recourse. This could include:

- Seeking damages for any financial losses incurred.

- Requesting specific performance, which means asking the court to enforce the terms of the agreement.

- Negotiating a resolution or amendment to the agreement.

It is advisable to consult with a legal professional if disputes arise.

Form Information

| Fact Name | Description |

|---|---|

| Governing Law | The California Real Estate Purchase Agreement is governed by California state law. |

| Standardization | This form is standardized to ensure consistency in real estate transactions across California. |

| Parties Involved | The agreement identifies the buyer and seller, ensuring clarity about who is involved in the transaction. |

| Property Description | A detailed description of the property is required, including the address and legal description. |

| Purchase Price | The form specifies the purchase price, outlining the financial terms of the transaction. |

| Contingencies | Buyers can include contingencies, such as financing or inspection, to protect their interests. |

| Signatures | Both parties must sign the agreement for it to be legally binding, indicating their acceptance of the terms. |

Dos and Don'ts

When filling out the California Real Estate Purchase Agreement form, it’s important to approach the process with care. Here are six essential do's and don'ts to keep in mind:

- Do read the entire agreement carefully before filling it out.

- Don't leave any sections blank; provide information for all required fields.

- Do consult with a real estate agent or attorney if you have questions.

- Don't use vague language; be specific about terms and conditions.

- Do include all necessary disclosures and attachments as required.

- Don't rush through the process; take your time to ensure accuracy.

Misconceptions

When dealing with the California Real Estate Purchase Agreement form, several misconceptions can lead to confusion. Understanding these can help buyers and sellers navigate the process more smoothly.

- Misconception 1: The agreement is just a standard template.

- Misconception 2: Signing the agreement means the deal is final.

- Misconception 3: Only real estate agents can fill out the form.

- Misconception 4: The agreement is not legally binding.

Many believe that the Real Estate Purchase Agreement is a one-size-fits-all template. In reality, it can be tailored to fit the specific needs of the transaction. Parties can negotiate terms, contingencies, and conditions to suit their unique situation.

Some think that once they sign the agreement, the deal is done. However, the agreement often includes contingencies that must be met before the sale can proceed. These can include inspections, financing, and other conditions that allow either party to back out if necessary.

While real estate agents are commonly involved, anyone can fill out the form. Buyers and sellers can complete it themselves, provided they understand the terms and conditions. However, consulting a professional is advisable to avoid potential pitfalls.

Some individuals mistakenly believe that the Real Estate Purchase Agreement is just a formality and not legally binding. In fact, once signed by both parties, it creates a legally enforceable contract. Failing to adhere to its terms can lead to legal consequences.

Documents used along the form

When engaging in real estate transactions in California, several key documents complement the Real Estate Purchase Agreement. Each of these documents plays a crucial role in ensuring a smooth and legally sound process for all parties involved.

- Disclosure Statement: This document outlines any known issues with the property, such as structural problems or environmental hazards. Sellers are legally required to disclose this information to potential buyers to ensure transparency and protect against future disputes.

- Pre-Approval Letter: A letter from a lender indicating that a buyer has been pre-approved for a mortgage. This document strengthens the buyer's position by demonstrating financial readiness and seriousness to the seller.

- Title Report: This report provides details about the property's ownership history, any liens, and easements. It is essential for ensuring that the buyer receives clear title to the property without any legal encumbrances.

- Escrow Instructions: These instructions outline the terms under which an escrow agent will manage the transaction. They detail how funds and documents will be handled, ensuring that both parties fulfill their obligations before the deal closes.

- Closing Statement: This document summarizes all financial transactions related to the sale, including the purchase price, closing costs, and any credits. It is provided to both the buyer and seller at the closing of the transaction to ensure clarity and agreement on all financial aspects.

Understanding these additional documents can significantly enhance your experience in the real estate market. They provide essential information and protections that help facilitate a successful transaction.

Other Popular California Forms

Pdf Horse Bill of Sale Template - Acts as a receipt for the transaction of the horse.

How to Sell a Gun in Ca - Facilitates compliance with local and state laws regarding firearms.