Download Schedule California 540 Form

Common Questions

-

What is the Schedule California 540 form?

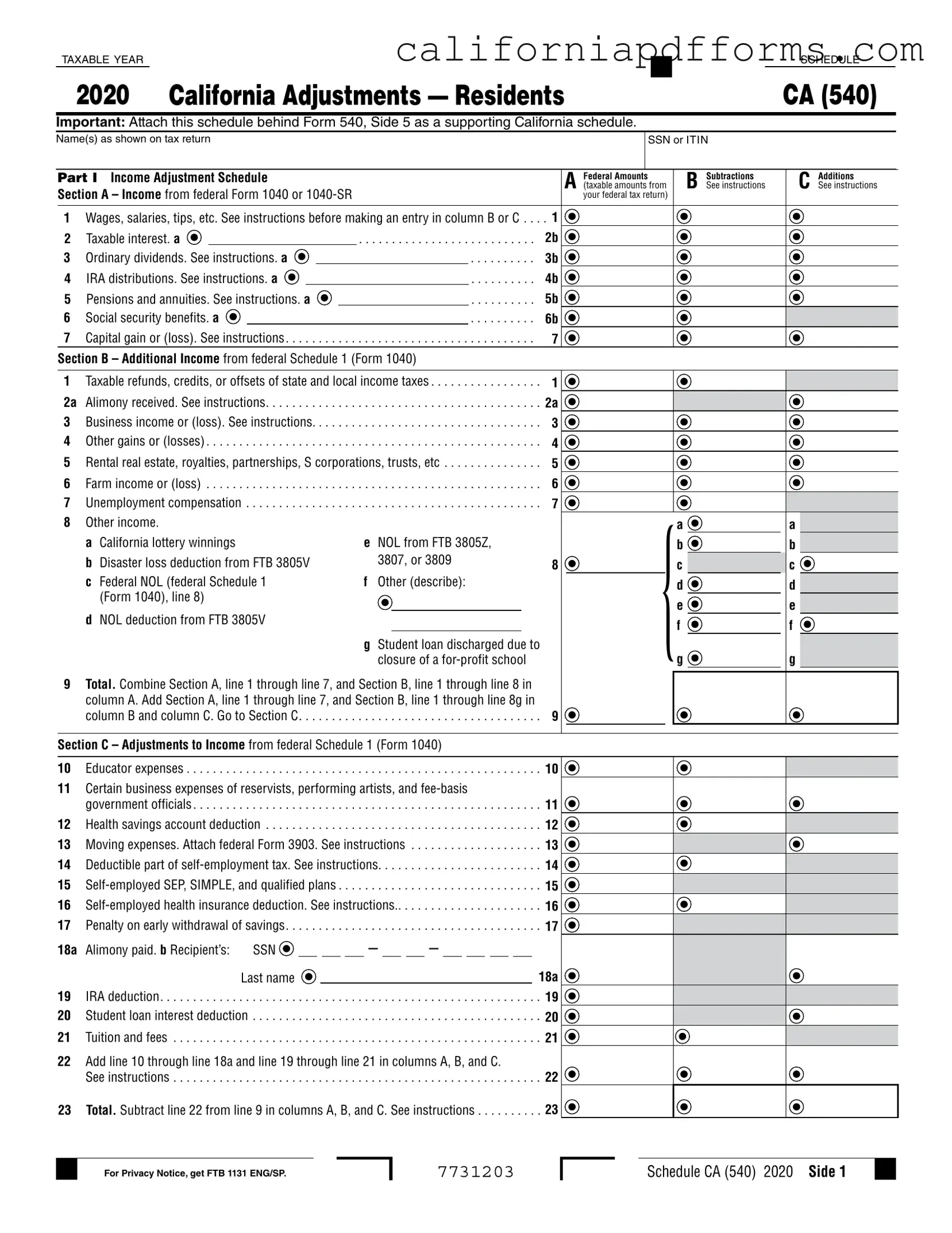

The Schedule California 540 form is used by residents of California to report adjustments to income, itemized deductions, and other tax-related information when filing their state income tax return. It supports the California Form 540 and helps ensure that taxpayers accurately calculate their state tax liability.

-

Who needs to file the Schedule California 540 form?

Residents of California who are filing Form 540 and need to report income adjustments or itemized deductions must complete this schedule. If you have specific deductions or credits that differ from federal calculations, this form is necessary.

-

Where do I attach the Schedule California 540 form?

You should attach the Schedule California 540 behind Form 540, specifically on Side 5. This ensures that the California tax authorities have all necessary documentation to process your return accurately.

-

What types of income adjustments are reported on this form?

The form includes various sections for reporting different types of income adjustments. These include wages, pensions, IRA distributions, and other income sources. Each type has its own line where you can enter the corresponding amounts from your federal tax return.

-

What are the subtractions and additions in the income adjustment section?

Subtractions might include certain types of income that are not taxable in California, while additions could involve income that is taxable in California but not federally. It's crucial to follow the instructions carefully for each line to ensure correct reporting.

-

How do I report itemized deductions on the Schedule California 540?

If you are itemizing deductions for California, you will need to complete the relevant sections on the Schedule California 540. This includes reporting medical expenses, taxes paid, interest, and charitable contributions. Ensure you follow the guidelines for California itemized deductions, which may differ from federal rules.

-

What should I do if I did not itemize deductions on my federal return?

If you did not itemize deductions on your federal return but plan to do so for California, you need to check the appropriate box on the Schedule California 540. This alerts the tax authorities to your intention to itemize for state purposes.

-

What happens if my federal AGI exceeds certain limits?

If your federal Adjusted Gross Income (AGI) exceeds specified thresholds based on your filing status, you will need to complete the Itemized Deductions Worksheet as instructed on the form. This may affect the amount of deductions you can claim.

-

Are there any special instructions for military personnel or reservists?

Yes, there are specific considerations for military personnel, reservists, and certain performing artists regarding their expenses. If applicable, ensure you review the instructions for claiming these unique deductions on the Schedule California 540.

-

Where can I find help if I have questions about the Schedule California 540 form?

If you have questions, you can refer to the instructions provided with the form or visit the California Franchise Tax Board website. Additionally, consider consulting a tax professional for personalized assistance.

Document Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Schedule CA (540) form is used by California residents to report adjustments to income and deductions for state tax purposes. |

| Tax Year | This version of the form is specifically for the 2020 tax year. |

| Attachment Requirement | Taxpayers must attach Schedule CA (540) behind Form 540, Side 5 when filing their California tax return. |

| Income Adjustments | The form allows for both subtractions and additions to federal income, which can affect the taxable income reported to the state. |

| Governing Law | California Revenue and Taxation Code governs the use of Schedule CA (540) for state tax filings. |

| Part I | Part I of the form focuses on income adjustments, including wages, interest, and other taxable amounts. |

| Part II | Part II addresses adjustments to federal itemized deductions, allowing taxpayers to modify these amounts for California tax purposes. |

| Eligibility for Itemization | Taxpayers who did not itemize deductions on their federal return may still choose to itemize for California using this form. |

| Privacy Notice | Taxpayers can find the Privacy Notice by referring to FTB 1131 ENG/SP, which is part of the filing instructions. |

Dos and Don'ts

When filling out the Schedule California 540 form, it is important to follow some guidelines to ensure accuracy and compliance. Here’s a list of things to do and avoid:

- Do read the instructions carefully before starting.

- Do double-check your Social Security Number or ITIN for accuracy.

- Do attach the schedule behind Form 540, Side 5.

- Do ensure that all income adjustments are accurately reported.

- Don't leave any sections blank; provide information as required.

- Don't forget to sign and date your form before submitting.

Misconceptions

Understanding the Schedule California 540 form is essential for California residents filing their state taxes. However, several misconceptions can lead to confusion. Here are six common misunderstandings:

- It's only for high earners: Many people believe that the Schedule CA (540) is only necessary for those with high incomes. In reality, anyone who is a California resident and needs to report adjustments to their federal income must use this form, regardless of their income level.

- It replaces the federal tax return: Some think that the Schedule CA (540) can replace their federal tax return. This is not true. The Schedule CA (540) is an additional form that accompanies the federal Form 540 and is used to make specific adjustments to income for California tax purposes.

- All deductions are automatically accepted: There is a misconception that all deductions claimed on the federal return will be automatically accepted on the California return. California has its own rules and limitations, so some federal deductions may not apply or may need to be adjusted on the Schedule CA (540).

- You can file it separately: Some individuals believe they can file the Schedule CA (540) independently of their federal tax return. This is incorrect. The Schedule CA (540) must be submitted alongside the California Form 540, as it serves to adjust the figures from the federal return.

- It's only for itemizers: There’s a common belief that the Schedule CA (540) is only necessary for those who itemize deductions. In fact, even if you take the standard deduction, you may still need to complete this form to report specific adjustments required by California law.

- It’s a complicated form: Many people think that the Schedule CA (540) is too complex to fill out. While it may seem daunting at first, it is designed to be straightforward, and with careful attention to the instructions, most residents can complete it without excessive difficulty.

By clearing up these misconceptions, individuals can navigate the tax filing process with greater confidence and accuracy. Understanding the requirements and adjustments specific to California is key to ensuring compliance and maximizing potential tax benefits.

Documents used along the form

The Schedule California 540 form is essential for California residents filing their state income tax. In addition to this form, several other documents may be required to provide a complete picture of your financial situation. Here’s a brief overview of these commonly used forms and documents.

- Form 1040: This is the federal income tax return form. It details your total income, deductions, and tax liability at the federal level. Information from this form is often needed to complete your state tax return.

- Schedule A (Form 1040): Used for itemizing deductions, this form allows taxpayers to report various expenses such as medical costs, mortgage interest, and charitable contributions. It can affect your state tax calculations if you itemize on your California return.

- Schedule 1 (Form 1040): This form reports additional income and adjustments to income that are not included directly on the main Form 1040. It includes items like unemployment compensation and alimony received.

- Form 540-ES: This is the estimated tax payment form for California residents. If you expect to owe taxes, you may need to file this form to pay estimated taxes throughout the year.

- Form 3805Z: This form is used to report a Net Operating Loss (NOL) deduction. If you have experienced a loss that can offset future income, this form is necessary for claiming that deduction on your California return.

- Form 3903: If you moved for work, this form allows you to deduct moving expenses. It must be attached if you are claiming these expenses on your California tax return.

Gathering these forms can streamline the filing process and ensure accuracy. Each document plays a role in presenting a complete financial picture to the California tax authorities. Make sure to review each requirement carefully to avoid any issues with your tax return.

Different PDF Templates

California Tax Forms - Legal counsel is often recommended to navigate the complexities represented in this form.

Can You Get a Default Judgement Reversed - Ultimately, this form underlines the possibility of correcting errors and pursuing justice vigorously.

540nr Instructions - The form must be completed with accurate information to avoid penalties and interest.