Official Self-Proving Affidavit Template for the State of California

Common Questions

What is a California Self-Proving Affidavit?

A California Self-Proving Affidavit is a legal document that allows a will to be validated without requiring the witnesses to testify in court. This affidavit is signed by the testator (the person who made the will) and the witnesses, confirming that they witnessed the signing of the will.

Why is a Self-Proving Affidavit important?

This affidavit simplifies the probate process. It helps to avoid delays and additional costs associated with locating witnesses. When the affidavit is included with the will, it can often be accepted by the court without further proof.

Who can create a Self-Proving Affidavit?

Any person who has created a valid will in California can use a Self-Proving Affidavit. The testator and at least two witnesses must sign the affidavit. All parties must be present when the document is signed.

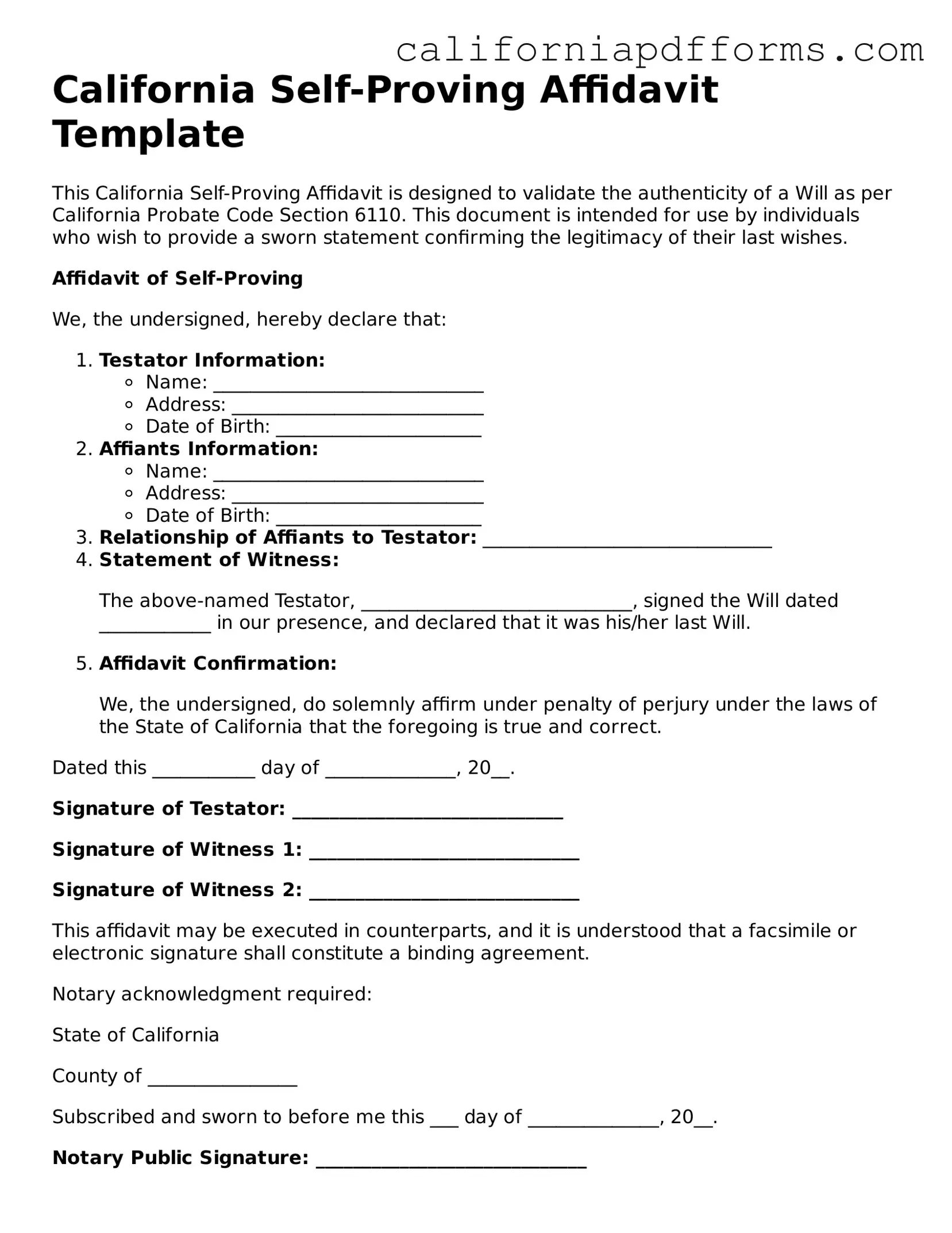

What information is included in a Self-Proving Affidavit?

A Self-Proving Affidavit typically includes:

- The names and addresses of the testator and witnesses.

- A statement confirming that the witnesses observed the testator sign the will.

- A declaration that the testator was of sound mind and under no undue influence.

- The date and location of the signing.

How do I complete a Self-Proving Affidavit?

To complete a Self-Proving Affidavit:

- Ensure the will is properly signed by the testator and witnesses.

- Draft the affidavit, including all required information.

- Have the testator and witnesses sign the affidavit in front of a notary public.

Is a Self-Proving Affidavit mandatory in California?

No, a Self-Proving Affidavit is not mandatory. However, including one can make the probate process smoother and more efficient. Without it, witnesses may need to be located and questioned in court.

Can I use a Self-Proving Affidavit if my will was created in another state?

If your will was created in another state, you may still be able to use a Self-Proving Affidavit in California. However, it’s essential to ensure that the will complies with California laws. Consulting with a legal professional is advisable.

What happens if the Self-Proving Affidavit is not included with the will?

If the Self-Proving Affidavit is not included, the court may require the witnesses to testify about the will's execution. This can prolong the probate process and may involve additional legal costs.

Where can I find a Self-Proving Affidavit form?

You can find a Self-Proving Affidavit form through various legal resources online, at local law libraries, or from legal professionals. Ensure that the form you choose complies with California laws.

Form Information

| Fact Name | Description |

|---|---|

| Purpose | The California Self-Proving Affidavit form is used to simplify the probate process by allowing a will to be accepted without needing witnesses to testify. |

| Governing Law | This form is governed by California Probate Code Section 6110, which outlines the requirements for a valid will. |

| Signature Requirement | The testator must sign the affidavit in the presence of a notary public, ensuring the authenticity of the will. |

| Witnesses | While typically two witnesses are required for a will, the Self-Proving Affidavit allows the will to be validated without their presence during probate. |

| Use in Probate | Using this affidavit can expedite the probate process, making it easier for heirs to access the estate without unnecessary delays. |

Dos and Don'ts

When filling out the California Self-Proving Affidavit form, it is important to adhere to certain guidelines to ensure the document is valid and effective. Below is a list of things you should and shouldn't do.

- Do: Ensure that all required fields are completed accurately.

- Do: Sign the affidavit in the presence of a notary public.

- Do: Include the date of signing to establish the timeline of the document.

- Do: Keep a copy of the signed affidavit for your records.

- Don't: Leave any sections blank, as this may lead to invalidation.

- Don't: Sign the affidavit without the notary present.

- Don't: Alter the language of the affidavit, as this may cause legal complications.

- Don't: Forget to check for any specific requirements that may apply to your situation.

Misconceptions

Understanding the California Self-Proving Affidavit form is essential for anyone involved in estate planning or handling a will. However, several misconceptions can lead to confusion. Here’s a breakdown of ten common misunderstandings about this important legal document.

- The Self-Proving Affidavit is only for wealthy individuals. This form is beneficial for anyone who wants to simplify the probate process, regardless of their estate's size.

- It replaces the need for a will. The Self-Proving Affidavit does not replace a will; it simply enhances the validity of an existing will during probate.

- You must have a lawyer to create a Self-Proving Affidavit. While having legal assistance can be helpful, individuals can complete the form without an attorney, provided they understand the requirements.

- All states have the same rules regarding Self-Proving Affidavits. Each state has its own laws and procedures; California's rules may differ significantly from those in other states.

- Signing the affidavit is the only step required. The affidavit must be signed in the presence of a notary and witnesses to be valid.

- Once created, the Self-Proving Affidavit never needs to be updated. Changes in circumstances, such as new beneficiaries or changes in the estate, may necessitate an updated affidavit.

- The Self-Proving Affidavit guarantees a smooth probate process. While it can simplify matters, complications can still arise during probate, depending on the specific circumstances of the estate.

- It can be created after the testator's death. The Self-Proving Affidavit must be executed while the testator is alive; it cannot be created posthumously.

- All witnesses must be disinterested parties. While it is generally recommended, California law allows for some flexibility regarding the witness requirements.

- It is a one-size-fits-all document. The Self-Proving Affidavit should be tailored to fit the specific will and circumstances of the estate, ensuring it meets all legal requirements.

By addressing these misconceptions, individuals can better navigate the complexities of estate planning and ensure that their wishes are honored. Understanding the Self-Proving Affidavit is a crucial step in the process.

Documents used along the form

The California Self-Proving Affidavit is a useful document that helps validate a will by confirming that it was signed and witnessed properly. When preparing or executing a will, there are several other forms and documents that may be necessary or beneficial. Below is a list of commonly used documents that often accompany the Self-Proving Affidavit.

- Last Will and Testament: This document outlines how a person's assets will be distributed after their death. It typically includes the appointment of an executor and can specify guardianship for minor children.

- Witness Affidavit: This form is used to confirm the identities of the witnesses who observed the signing of the will. It serves as additional proof that the will was executed in accordance with legal requirements.

- Durable Power of Attorney: This document allows an individual to designate someone else to make decisions on their behalf, especially regarding financial or medical matters, should they become incapacitated.

- Advance Healthcare Directive: This legal document specifies an individual's preferences for medical treatment and appoints someone to make healthcare decisions if they are unable to do so themselves.

- Trust Agreement: A trust agreement outlines how assets will be managed during a person's lifetime and after their death. It can help avoid probate and provide for more efficient asset distribution.

- Affidavit of Executor: This document is used to confirm the executor's authority to act on behalf of the estate. It may be required by financial institutions and other entities when managing the deceased's assets.

- Notice of Proposed Action: This notice informs beneficiaries and interested parties about proposed actions related to the estate, such as the sale of property or distribution of assets.

Understanding these documents can help streamline the estate planning process and ensure that all legal requirements are met. Each form plays a vital role in protecting an individual's wishes and facilitating the management of their estate after their passing.

Other Popular California Forms

Dmv Title - The form may stipulate any conditions related to the vehicle's title transfer.

Affidavit of Death California - This affidavit is a testament to the deceased's legal status as a deceased individual.

Temporary Legal Guardianship - Common situations that prompt the use of this form include travel for work or extended vacations.