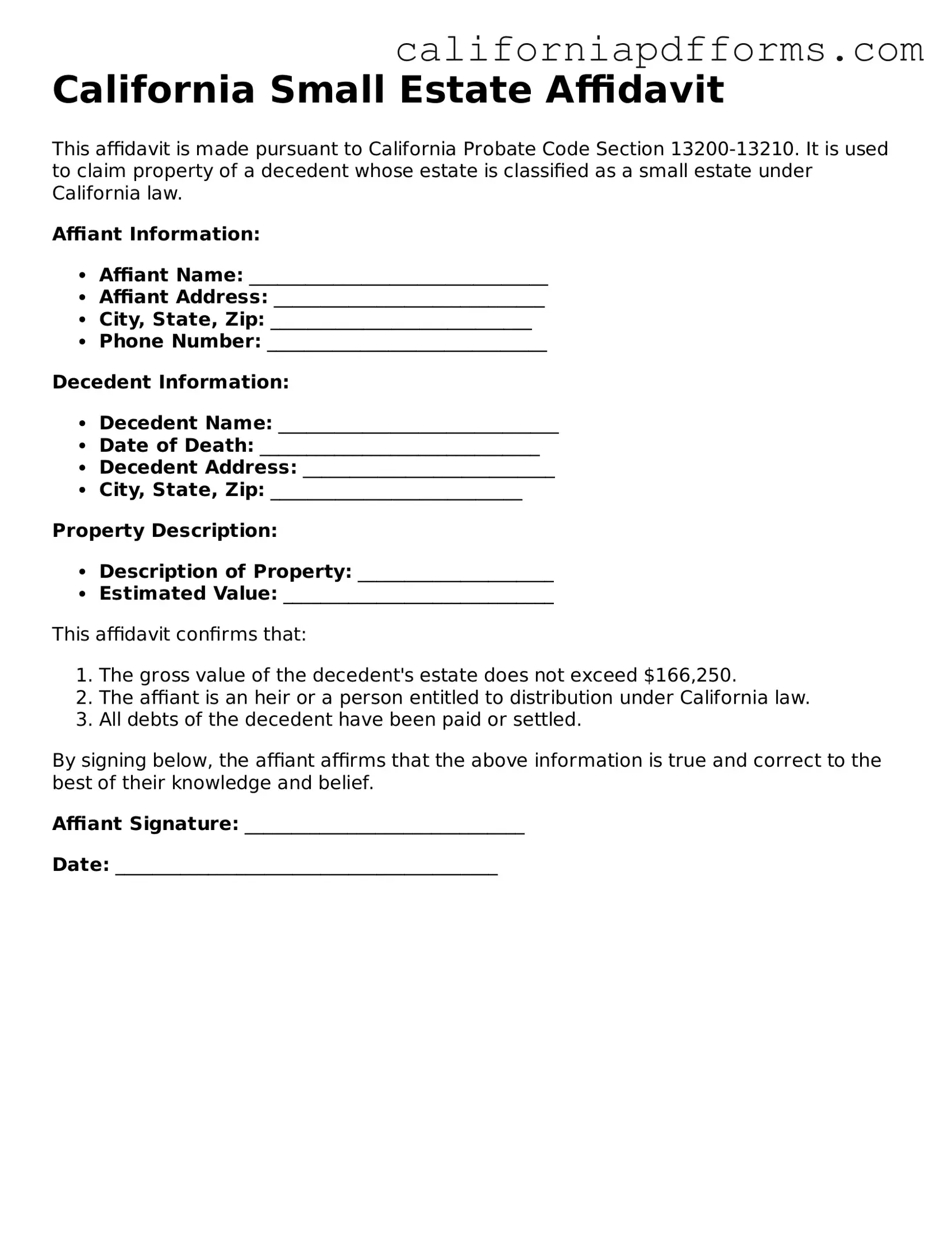

Official Small Estate Affidavit Template for the State of California

Common Questions

What is a California Small Estate Affidavit?

The California Small Estate Affidavit is a legal document that allows individuals to transfer property of a deceased person without going through the formal probate process. This affidavit can be used when the total value of the deceased's assets is below a certain threshold, which is currently set at $166,250. It simplifies the process for heirs and beneficiaries, allowing them to claim assets directly from financial institutions or other entities holding the deceased's property.

Who is eligible to use the Small Estate Affidavit?

Eligibility to use the Small Estate Affidavit is generally limited to the following individuals:

- Heirs or beneficiaries named in the deceased's will.

- Individuals who would inherit under California intestacy laws if there is no will.

- People who are at least 18 years old.

Additionally, the estate must not include real property, or if it does, the total value of the estate must still fall below the specified threshold. It is essential to ensure all criteria are met before proceeding with this affidavit.

How do I complete the Small Estate Affidavit?

Completing the Small Estate Affidavit involves several steps:

- Obtain the appropriate form, which can be found on the California courts website or through legal document providers.

- Fill out the form with accurate information about the deceased, including their name, date of death, and a description of the assets.

- Gather supporting documents, such as a copy of the death certificate and any relevant financial statements.

- Sign the affidavit in front of a notary public to ensure its validity.

Once completed, the affidavit can be presented to banks or other institutions holding the deceased's assets for transfer.

What happens after submitting the Small Estate Affidavit?

After submitting the Small Estate Affidavit, the financial institutions or entities holding the assets will review the document. They may request additional information or documentation. If everything is in order, the institution will transfer the assets to the heirs or beneficiaries as specified in the affidavit. It is important to follow up with these institutions to ensure the process is completed. If there are any disputes or complications, it may be necessary to seek legal assistance to resolve the issues.

Form Information

| Fact Name | Description |

|---|---|

| Purpose | The California Small Estate Affidavit allows individuals to claim property of a deceased person without going through formal probate. |

| Eligibility | The total value of the deceased's assets must not exceed $166,250, excluding certain types of property. |

| Governing Law | The use of the Small Estate Affidavit is governed by California Probate Code Section 13100-13116. |

| Who Can Use It | Heirs, beneficiaries, or individuals entitled to the property can use the affidavit to claim assets. |

| Required Information | The form requires details about the deceased, the relationship to the claimant, and a list of assets. |

| Filing Process | The affidavit is typically filed with the county recorder’s office where the deceased owned property. |

| Signature Requirement | The claimant must sign the affidavit under penalty of perjury, affirming the truth of the information provided. |

| Notarization | While notarization is not required, it is recommended to add credibility to the affidavit. |

| Limitations | This process cannot be used for real estate or assets held in a trust. |

| Timeframe | The affidavit can be presented immediately after the death of the individual, but it is advisable to wait 40 days post-death. |

Dos and Don'ts

When filling out the California Small Estate Affidavit form, it’s important to follow certain guidelines to ensure a smooth process. Here’s a list of things you should and shouldn’t do:

- Do ensure you are eligible to use the Small Estate Affidavit. This typically applies to estates valued at $166,250 or less.

- Do provide accurate information about the deceased and the estate. Double-check names, dates, and asset details.

- Do sign the affidavit in front of a notary public. A notarized signature adds credibility to your document.

- Do keep copies of the completed affidavit for your records and for any institutions that may require it.

- Don't leave any sections blank. Incomplete forms can lead to delays or rejections.

- Don't submit the affidavit without verifying the required supporting documents. These may include death certificates and asset valuations.

- Don't forget to check for any local court requirements. Some counties may have additional rules.

- Don't rush through the process. Take your time to ensure everything is filled out correctly.

Misconceptions

Understanding the California Small Estate Affidavit can be tricky. Here are six common misconceptions about this form that you should be aware of:

-

Anyone can use the Small Estate Affidavit.

This is not true. The Small Estate Affidavit is only available to those whose loved one’s estate is valued at $166,250 or less. If the estate exceeds this amount, a different process is required.

-

The Small Estate Affidavit can be used for any type of asset.

In reality, this affidavit is typically used for personal property, such as bank accounts, vehicles, and personal belongings. Real estate cannot be transferred using this form.

-

The form can be filed at any time.

This is a misconception. The Small Estate Affidavit can only be used after 40 days have passed since the individual’s death. This waiting period is necessary to ensure that all debts and claims against the estate are settled.

-

All heirs must sign the affidavit.

This is not accurate. Only the person who is claiming the property needs to sign the affidavit. However, it’s a good idea to inform other heirs about the process.

-

Using the Small Estate Affidavit avoids all legal processes.

While this affidavit simplifies the transfer of assets, it does not completely eliminate legal processes. Some court involvement may still be necessary to validate the affidavit.

-

The Small Estate Affidavit is a permanent solution.

This is misleading. The affidavit only facilitates the transfer of specific assets. It does not address ongoing estate matters or future claims that may arise.

Being informed about these misconceptions can help you navigate the process more effectively. Always consider consulting with a professional if you have specific questions or concerns regarding the Small Estate Affidavit.

Documents used along the form

The California Small Estate Affidavit is a useful tool for settling the estate of a deceased person when the total value of the estate is below a certain threshold. However, several other forms and documents may be necessary to ensure a smooth process. Below is a list of documents often used in conjunction with the Small Estate Affidavit.

- Death Certificate: This official document verifies the death of the individual and is typically required to initiate the estate settlement process.

- Will: If the deceased left a will, it provides instructions on how their estate should be distributed. It may need to be submitted along with the affidavit.

- Letters of Administration: If no will exists, this document may be needed to appoint an administrator for the estate, allowing them to manage the estate's affairs.

- Inventory of Assets: A detailed list of the deceased's assets, including their estimated values, helps establish the total value of the estate.

- Affidavit of Heirship: This document confirms the rightful heirs of the deceased, especially useful if the deceased did not leave a will.

- Claim of Exemption: This form may be used to claim certain assets that are exempt from probate, ensuring they are distributed according to the law.

- Notice of Death: This document may be filed to formally notify interested parties about the death, which can include creditors and beneficiaries.

- Tax Forms: Depending on the estate's size and nature, certain tax forms may need to be filed with the IRS and state tax authorities.

- Transfer Documents: These are necessary to officially transfer ownership of assets from the deceased to the heirs or beneficiaries.

Having these documents ready can streamline the process of settling an estate. Ensure you gather all necessary paperwork to avoid delays and complications. Each document plays a crucial role in facilitating a smooth transition during a difficult time.

Other Popular California Forms

California House Rental Application - State your Social Security number for background checks.

What Is a Healthcare Power of Attorney - It allows you to select a trusted voice for sensitive healthcare decisions when needed.