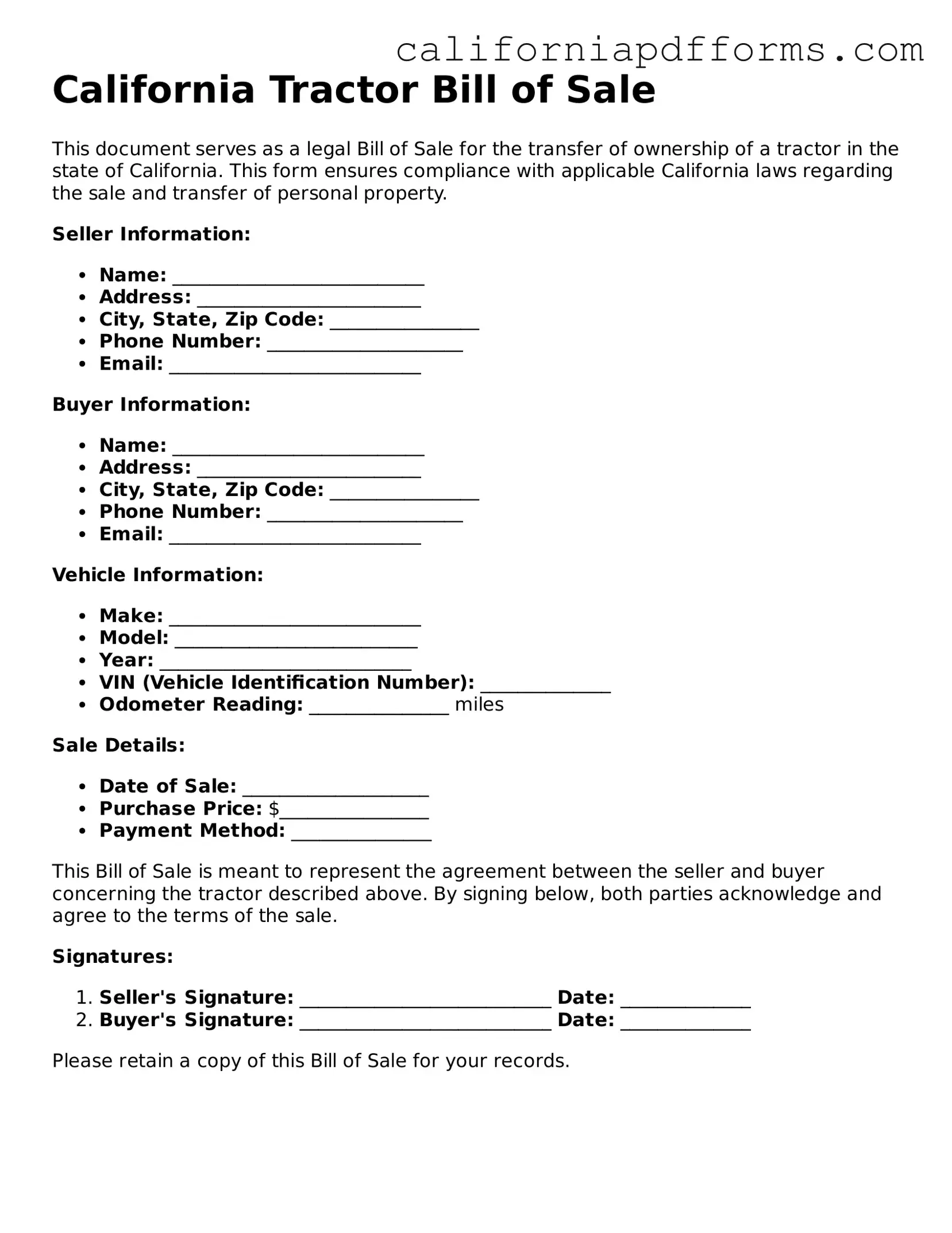

Official Tractor Bill of Sale Template for the State of California

Common Questions

What is a California Tractor Bill of Sale?

A California Tractor Bill of Sale is a legal document that records the sale of a tractor from one party to another. It provides proof of the transaction and details about the tractor, the buyer, and the seller. This document is important for both parties to protect their interests and ensure a smooth transfer of ownership.

Why do I need a Bill of Sale for my tractor?

A Bill of Sale serves several important purposes:

- It acts as a legal record of the transaction.

- It helps establish ownership and can prevent disputes in the future.

- It may be required for registration or titling with the California Department of Motor Vehicles (DMV).

What information should be included in the Bill of Sale?

The Bill of Sale should include the following details:

- The names and addresses of both the seller and the buyer.

- A description of the tractor, including make, model, year, and Vehicle Identification Number (VIN).

- The sale price of the tractor.

- The date of the sale.

- Any warranties or representations made by the seller.

Do I need to have the Bill of Sale notarized?

In California, notarization is not a requirement for a Bill of Sale. However, having the document notarized can add an extra layer of authenticity and may be beneficial in case of any future disputes. It is always a good practice to keep a signed copy for both parties.

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale. It is essential to ensure that all necessary information is included and that the document is clear and understandable. Many templates are available online that can guide you in drafting a comprehensive Bill of Sale.

What should I do after completing the Bill of Sale?

After completing the Bill of Sale, both the seller and the buyer should sign and date the document. Each party should keep a copy for their records. If the tractor needs to be registered with the DMV, the Bill of Sale may need to be submitted along with other required documents.

Is there a fee associated with the Bill of Sale?

Generally, there is no fee for creating a Bill of Sale itself. However, if you choose to have it notarized, there may be a small fee for the notary service. Additionally, there could be fees associated with the registration of the tractor with the DMV.

What if I need to sell a tractor that is financed?

If the tractor is financed, it is important to contact the lender before selling it. The lender may have specific requirements or may need to be paid off before the sale can proceed. The Bill of Sale should reflect any agreements made with the lender regarding the sale.

How do I obtain a copy of the Bill of Sale if I lose mine?

If you lose your copy of the Bill of Sale, you can request a new copy from the other party involved in the transaction. If the document was notarized, the notary may also have a record of the transaction. It’s always advisable to keep multiple copies of important documents to avoid such situations.

Form Information

| Fact Name | Description |

|---|---|

| Purpose | The California Tractor Bill of Sale is used to document the sale of a tractor between a buyer and a seller. |

| Governing Law | This form is governed by California Vehicle Code Section 5600. |

| Required Information | Both parties must provide their names, addresses, and signatures, along with details about the tractor. |

| Transfer of Ownership | The bill of sale serves as proof of ownership transfer once signed by both parties. |

| Notarization | Notarization is not required for the bill of sale in California, but it can add an extra layer of security. |

| Record Keeping | It is advisable for both the buyer and seller to keep a copy of the bill of sale for their records. |

Dos and Don'ts

When filling out the California Tractor Bill of Sale form, it’s important to get it right. Here are ten things you should and shouldn’t do:

- Do provide accurate information about the tractor, including the make, model, and year.

- Don't leave any required fields blank; incomplete forms can cause issues later.

- Do include the Vehicle Identification Number (VIN) for identification purposes.

- Don't use nicknames or informal terms; stick to official names and terms.

- Do ensure both the buyer and seller sign the document.

- Don't forget to date the bill of sale; this is crucial for record-keeping.

- Do keep a copy of the completed form for your records.

- Don't use white-out or make alterations; errors should be corrected with a new form.

- Do check for any local requirements that may apply to your sale.

- Don't underestimate the importance of clear communication between buyer and seller.

Misconceptions

When it comes to the California Tractor Bill of Sale form, many people have misconceptions that can lead to confusion. Here are eight common misunderstandings:

-

It’s only needed for new tractors.

Many believe that a bill of sale is only necessary for new tractor purchases. In reality, it’s essential for both new and used tractors to document the sale and transfer of ownership.

-

It’s a government form that must be filled out in a specific way.

Some think the form is a government document with strict requirements. While it should include specific information, it is not a standardized government form and can be customized as needed.

-

Only the buyer needs a copy of the bill of sale.

There’s a belief that only the buyer should keep the bill of sale. However, both the buyer and seller should retain a copy for their records to avoid disputes in the future.

-

A bill of sale is not legally binding.

Some people think that a bill of sale is just a casual agreement. In fact, it is a legal document that can be used in court to prove ownership and the terms of the sale.

-

It doesn’t need to be notarized.

Many assume that notarization is unnecessary. While it’s not required in California, having the document notarized can add an extra layer of legitimacy and protection for both parties.

-

The form only needs to be filled out when selling.

Some think the form is only relevant during the sale process. In reality, it can also be useful for documenting gifts or trades involving tractors.

-

There’s a specific time frame for completing the bill of sale.

People often believe there’s a strict timeline for when the bill of sale must be completed. While it’s best to complete it at the time of sale, there’s no specific deadline as long as it’s done before registration.

-

All tractors require a bill of sale.

Finally, some think that every single tractor transaction requires a bill of sale. However, for certain small-value transactions or gifts, a bill of sale may not be necessary.

Understanding these misconceptions can help ensure a smoother transaction when buying or selling a tractor in California. Always consider consulting with a legal expert if you have specific questions or concerns.

Documents used along the form

When buying or selling a tractor in California, the Tractor Bill of Sale form is an essential document. However, it is often accompanied by other forms and documents to ensure a smooth transaction. Here’s a brief overview of some commonly used documents that may be required in conjunction with the Tractor Bill of Sale.

- Title Transfer Document: This document is crucial for transferring ownership of the tractor from the seller to the buyer. It includes details such as the tractor’s identification number, make, model, and the names of both parties involved in the transaction.

- Vehicle/Vessel Transfer and Reassignment Form (REG 262): This form is used for transferring ownership and includes sections for odometer disclosure and any liens on the vehicle. It is often required by the California Department of Motor Vehicles (DMV).

- Smog Certification: Depending on the age and type of tractor, a smog certification may be necessary. This document proves that the vehicle meets California’s emissions standards, ensuring it is environmentally compliant.

- Proof of Insurance: Before registering a tractor, buyers must often provide proof of insurance. This document confirms that the tractor is insured, which is a requirement for legal operation on public roads.

- Sales Tax Payment Receipt: When a tractor is sold, sales tax is typically applicable. A receipt showing that the sales tax has been paid may be required for the registration process.

- Odometer Disclosure Statement: This statement is used to verify the tractor's mileage at the time of sale. It helps prevent fraud and ensures transparency in the transaction.

Having these documents ready can facilitate a smoother transaction process and help avoid potential issues down the line. Always ensure that all paperwork is complete and accurate to protect both parties involved in the sale.

Other Popular California Forms

California Grant Deed - A deed ensures that the rights to the property are legally acknowledged.

California Prenup Contract - It can clarify expectations regarding financial contributions during marriage.