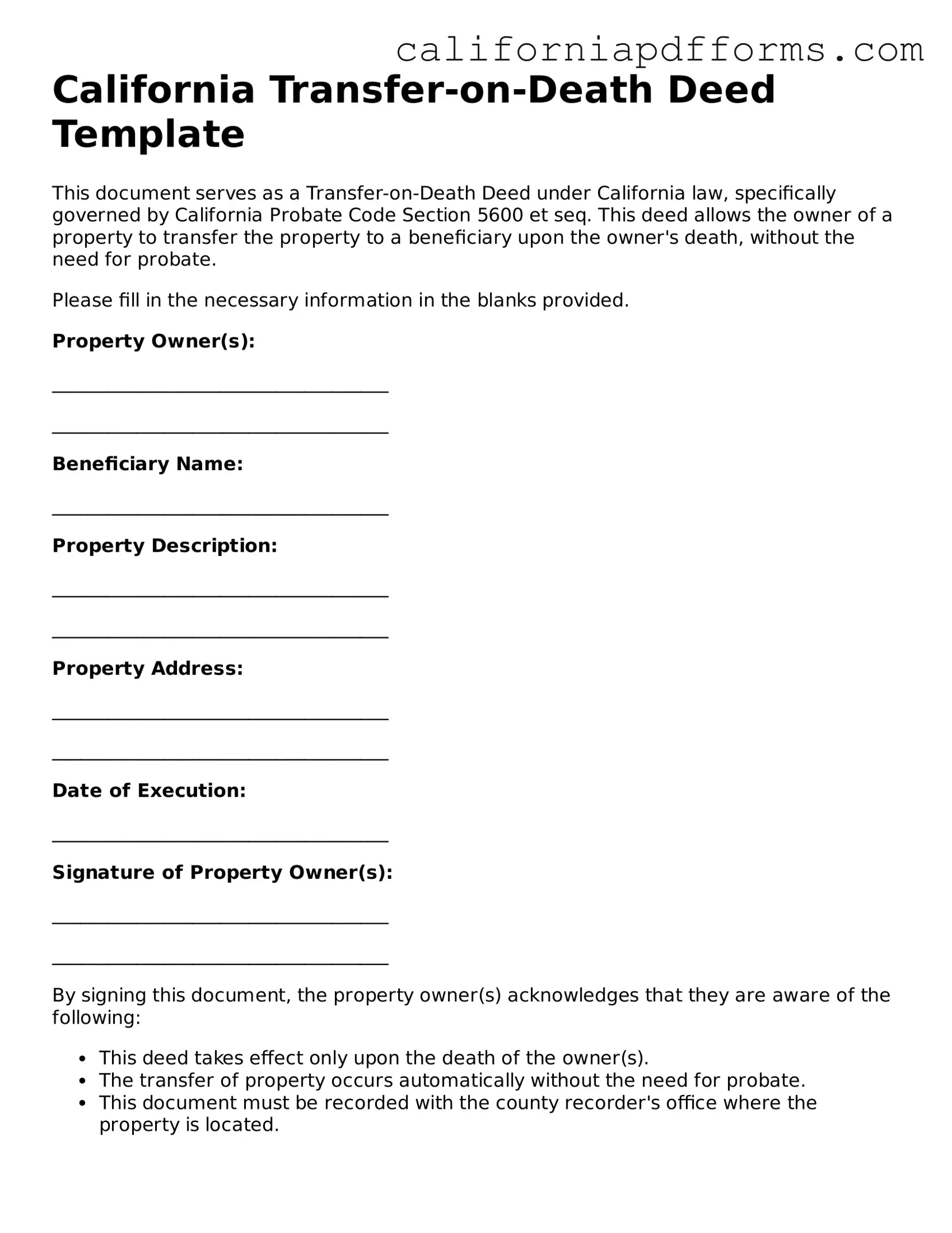

Official Transfer-on-Death Deed Template for the State of California

Common Questions

What is a Transfer-on-Death Deed in California?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows a property owner to transfer their real estate to a beneficiary upon their death. This deed helps avoid probate, making the transfer of property smoother and more efficient for loved ones. The property remains under the owner's control during their lifetime, and they can revoke or change the deed at any time before passing away.

Who can use a Transfer-on-Death Deed?

Any individual who owns real property in California can use a Transfer-on-Death Deed. This includes homeowners and property investors. However, it is important to note that the property must be solely owned by the individual, as joint ownership may complicate the transfer process. Additionally, beneficiaries must be designated clearly in the deed.

How do I create a Transfer-on-Death Deed?

Creating a Transfer-on-Death Deed involves several steps:

- Obtain the appropriate form, which is available online or through legal resources.

- Fill out the form with the necessary information, including the property description and beneficiary details.

- Sign the deed in the presence of a notary public to ensure its validity.

- Record the deed with the county recorder's office where the property is located. This step is crucial for the deed to take effect.

It is advisable to consult with a legal professional to ensure that the deed is completed correctly and meets all legal requirements.

Can I revoke a Transfer-on-Death Deed?

Yes, you can revoke a Transfer-on-Death Deed at any time while you are alive. To do this, you must create a new deed that explicitly states the revocation of the previous deed. Alternatively, you can also revoke the deed by recording a formal revocation document with the county recorder's office. Always ensure that the revocation is executed properly to avoid any confusion later on.

What happens if I do not name a beneficiary?

If you do not name a beneficiary in your Transfer-on-Death Deed, the property will not automatically transfer upon your death. Instead, it will become part of your estate and will be subject to probate. This can lead to delays and additional costs for your heirs. Therefore, it is essential to designate at least one beneficiary to ensure a smooth transfer of property.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, transferring property through a Transfer-on-Death Deed does not trigger immediate tax consequences. The property is transferred to the beneficiary at the owner's death, and they may inherit the property at its fair market value at that time. However, it is important to consult a tax professional to understand any potential tax liabilities or implications that may arise based on individual circumstances.

Can I use a Transfer-on-Death Deed for all types of property?

A Transfer-on-Death Deed can be used for most types of real property, such as residential homes, commercial properties, and vacant land. However, it cannot be used for personal property, such as vehicles or bank accounts. Additionally, properties held in certain types of trusts or properties subject to liens may have specific restrictions. It is wise to consult with a legal expert to determine the best approach for your specific situation.

Form Information

| Fact Name | Details |

|---|---|

| Purpose | The California Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by California Probate Code Section 5600-5696. |

| Revocation | Property owners can revoke the Transfer-on-Death Deed at any time before their death by recording a new deed. |

| Eligibility | Only individuals, not entities, can be named as beneficiaries on the California Transfer-on-Death Deed. |

Dos and Don'ts

When filling out the California Transfer-on-Death Deed form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are four things you should and shouldn't do:

- Do: Clearly identify the property being transferred, including its legal description.

- Do: Provide accurate information about the grantor and the beneficiary.

- Don't: Leave any sections blank; all required fields must be completed.

- Don't: Forget to sign and date the form in the presence of a notary public.

Misconceptions

- Misconception 1: The Transfer-on-Death Deed is only for wealthy individuals.

- Misconception 2: A Transfer-on-Death Deed automatically transfers all assets.

- Misconception 3: You cannot change or revoke a Transfer-on-Death Deed once it is created.

- Misconception 4: The Transfer-on-Death Deed avoids all taxes.

- Misconception 5: You need an attorney to create a Transfer-on-Death Deed.

- Misconception 6: The Transfer-on-Death Deed is the same as a living trust.

- Misconception 7: You cannot use a Transfer-on-Death Deed if you have multiple beneficiaries.

This is not true. The Transfer-on-Death Deed can be beneficial for anyone who owns property in California, regardless of their financial status. It allows for a straightforward transfer of property upon death without the need for probate.

This deed only applies to the specific property it is attached to. Other assets, like bank accounts or personal belongings, will not be affected by this deed.

In fact, you can change or revoke a Transfer-on-Death Deed at any time before your death. This flexibility allows you to adjust your estate plan as needed.

This is misleading. While the deed can help avoid probate, it does not exempt the property from taxes. Beneficiaries may still face property taxes or capital gains taxes upon transfer.

While consulting an attorney can be helpful, it is not required. California provides a simple form that individuals can fill out on their own, making it accessible to many.

These are different legal tools. A living trust can manage assets during your lifetime and after your death, while a Transfer-on-Death Deed only deals with the transfer of real property after death.

This is incorrect. You can name multiple beneficiaries on a Transfer-on-Death Deed. Just be sure to specify how the property will be divided among them.

Documents used along the form

The California Transfer-on-Death Deed form allows individuals to transfer real property to a designated beneficiary upon their death without going through probate. However, several other forms and documents are commonly associated with this deed to ensure a smooth transfer process and to address related legal matters. Below is a list of these documents, each serving a specific purpose.

- Grant Deed: This document transfers ownership of real property from one party to another. It provides a clear title and is often used in conjunction with the Transfer-on-Death Deed to establish ownership before the transfer takes effect.

- Living Trust: A legal arrangement that allows individuals to place their assets into a trust during their lifetime. Upon death, the assets are distributed according to the trust's terms, which can complement the Transfer-on-Death Deed.

- Will: A legal document that outlines how a person's assets will be distributed after their death. While the Transfer-on-Death Deed bypasses probate, a will can still provide guidance for other assets not covered by the deed.

- Affidavit of Death: This document is used to declare the death of an individual. It may be necessary to present this affidavit when transferring property under a Transfer-on-Death Deed.

- Beneficiary Designation Form: Used for financial accounts and insurance policies, this form allows individuals to name beneficiaries who will receive assets upon their death, similar to the Transfer-on-Death Deed for real estate.

- Change of Ownership Statement: This form is filed with the county assessor's office when property ownership changes. It helps ensure that property taxes are correctly assessed after the transfer.

- Power of Attorney: A legal document that allows one person to act on behalf of another in financial or legal matters. It can be useful for managing property during a person’s lifetime before the Transfer-on-Death Deed takes effect.

- Title Insurance Policy: This document protects against losses due to defects in the title of the property. It may be relevant when transferring property to ensure clear ownership.

- Property Tax Exemption Application: This form can be submitted to claim exemptions on property taxes. It may be relevant after the Transfer-on-Death Deed is executed, particularly for certain beneficiaries.

Understanding these documents can help streamline the process of transferring property and ensure that all legal requirements are met. Each form plays a distinct role in managing assets and facilitating a smooth transition of ownership.

Other Popular California Forms

California Prenup Contract - It can help couples plan for unexpected changes in their relationship.

Bill of Sale for Car - Providing a Bill of Sale can enhance buyer confidence in purchasing a pre-owned motorcycle.